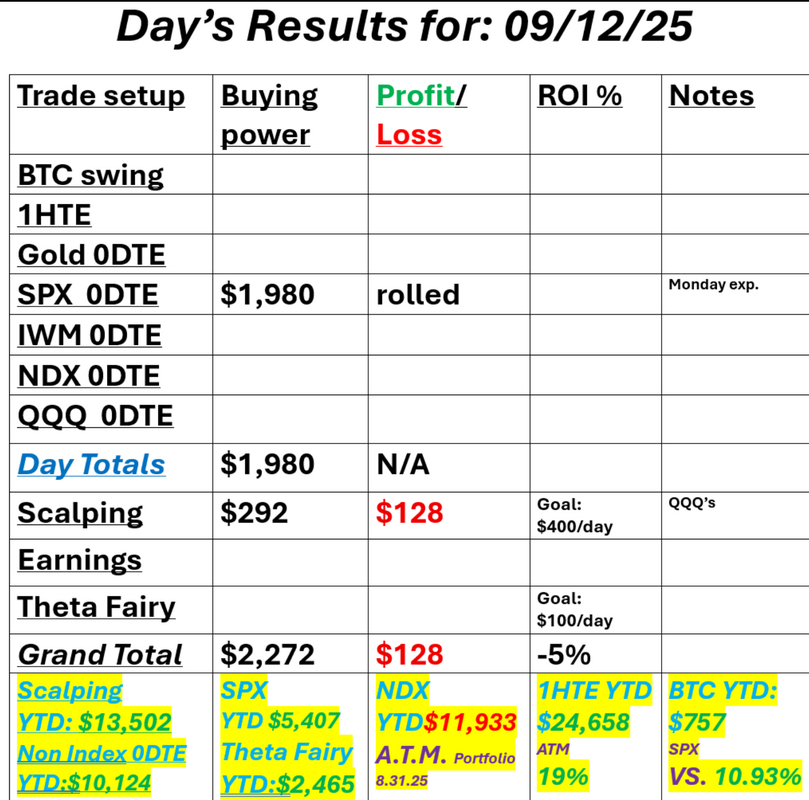

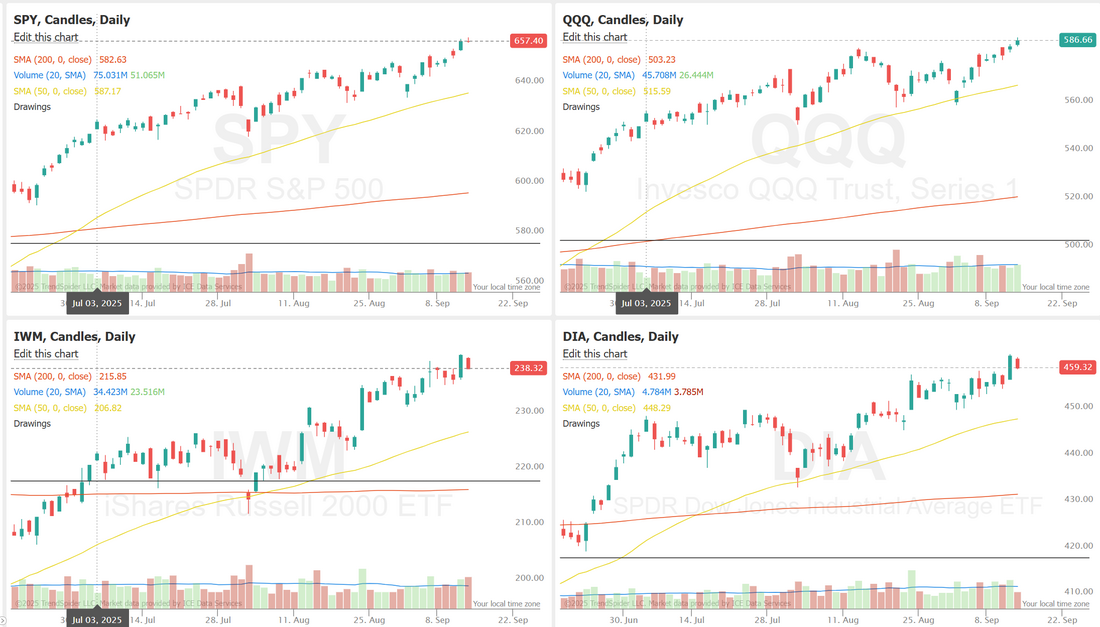

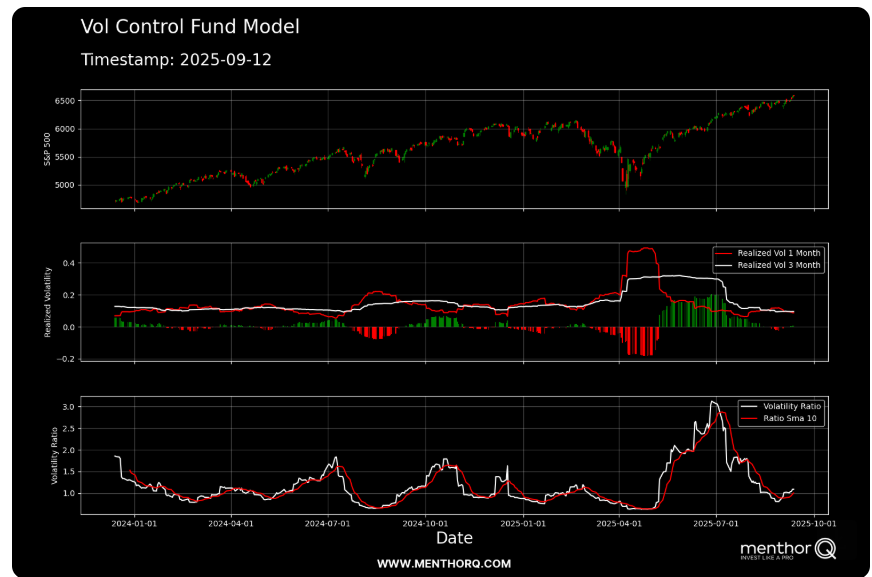

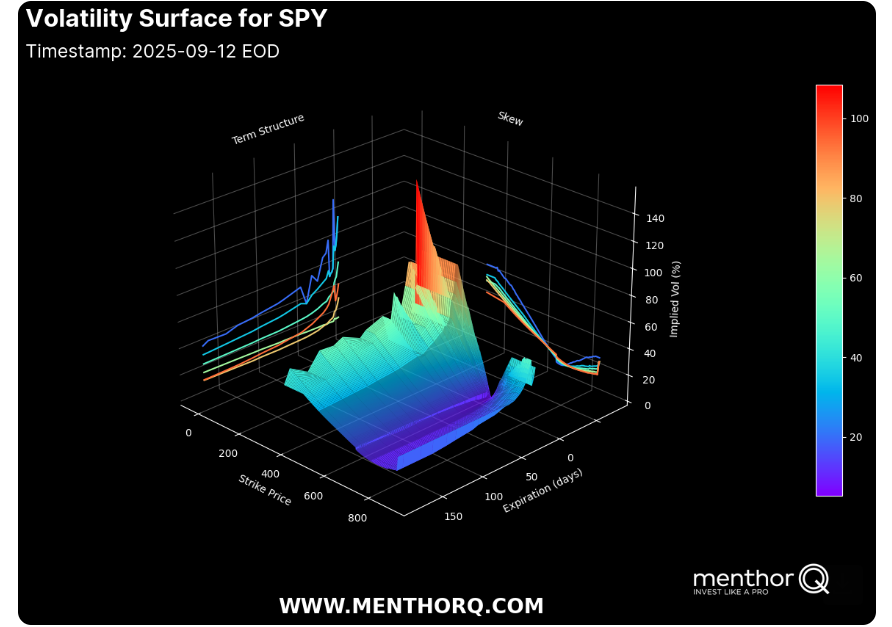

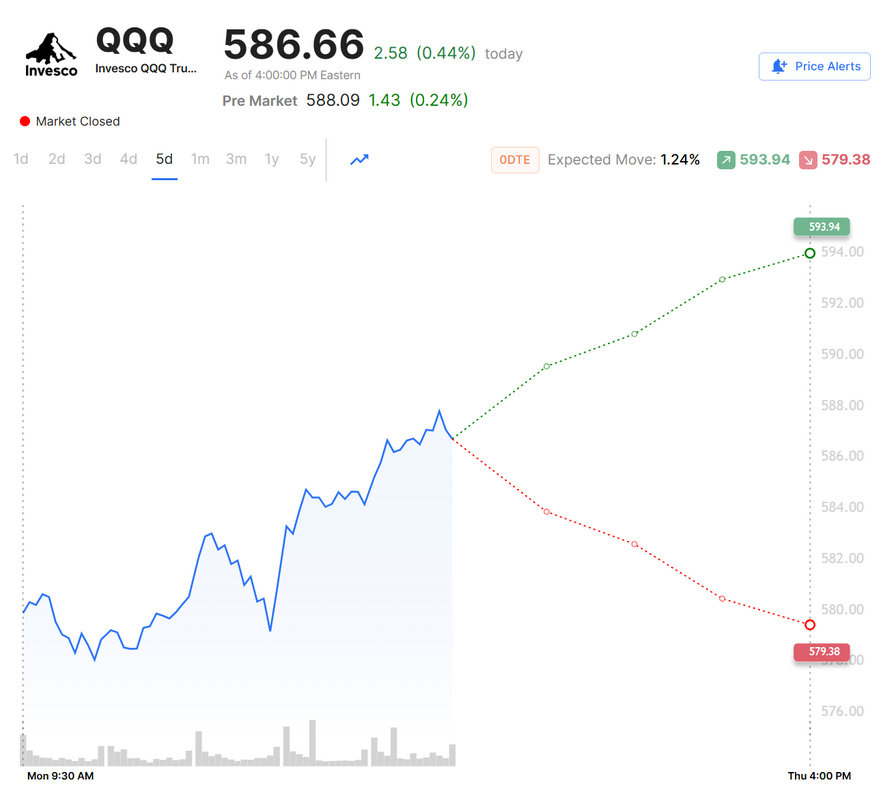

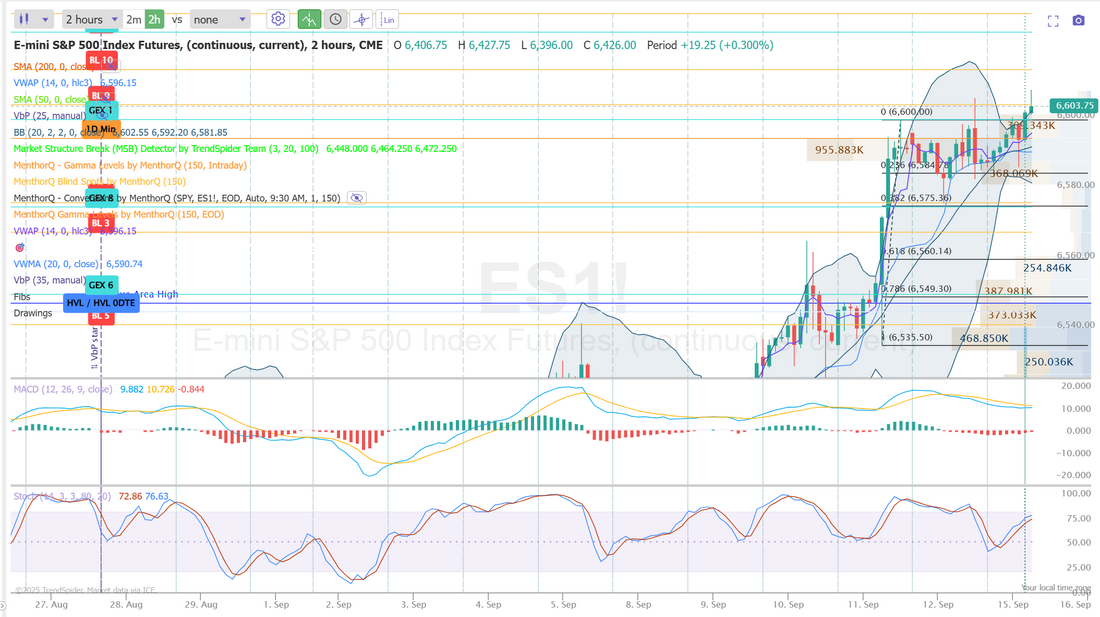

Rate cut incoming this week?Today we'll do a deep dive training of some FED data and market reaction over a big historical period. Will it be a 25bp or 50bp cut and how will the market react both short term and long term? Come join us for a live training session today. Our Friday was pretty quiet. Our SPX position rolled into today (Monday) and a few scalps on QQQ did not deliver. Here's a look at our day. Let's take a look at the market coming into an FOMC week. Markets are mostly sitting right on those ATH's. The SPX continues to press higher, but the volatility framework shows some short-term shifts worth monitoring. One-month realized volatility has eased back toward the three-month measure, reflecting calmer trading after the spring spike. However, the volatility ratio, while well off its peak, has started to curl upward from recent lows suggesting that near-term fluctuations could resurface. In the short term, the index’s ability to hold momentum while this ratio edges higher will be key, as a sustained pickup could challenge the current grind toward new highs. The SPY volatility surface as of September 12, 2025, shows a pronounced spike in implied volatility concentrated around shorter-dated expiries and near-the-money strikes, pointing to elevated hedging demand in the front end. The skew remains tilted, with higher implied vol levels on downside strikes relative to upside, reflecting persistent demand for protective positioning. Term structure analysis highlights a steeper curve, as longer-dated expiries remain more anchored while near-term options trade at a premium. In the short term, this setup suggests markets are pricing in event-driven uncertainty, with positioning clustered around the front-month maturities. Let's take a look at expected range for this week. It's a little surprising with FOMC this week that I.V. is still low. September S&P 500 E-Mini futures (ESU25) are up +0.19%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.08% this morning, pointing to a slightly higher open on Wall Street amid optimism ahead of a widely expected interest rate cut from the Federal Reserve later this week. Futures on the Nasdaq 100 underperformed as Nvidia (NVDA) fell over -2% in pre-market trading after China’s market regulator said in a preliminary probe that the chipmaker had violated the country’s anti-monopoly laws. Also, Texas Instruments (TXN) and Analog Devices (ADI) slid about -3% in pre-market trading after China over the weekend launched an anti-dumping investigation into some U.S.-made analog chips, including those produced by the two companies. Investors also await a fresh batch of U.S. economic data this week, with a particular focus on the retail sales report. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Arista Networks (ANET) slumped over -8% and was the top percentage loser on the S&P 500 after the company’s long-term projections failed to impress investors. Also, shares of vaccine makers retreated after the Washington Post reported that U.S. health officials plan to link Covid shots to the deaths of 25 children, with Moderna (MRNA) and BioNTech SE (BNTX) sliding more than -7%. In addition, RH (RH) fell over -4% after the home furnishings retailer reported downbeat Q2 results and cut its full-year revenue growth guidance. On the bullish side, Warner Bros. Discovery (WBD) surged more than +16% and was the top percentage gainer on the S&P 500 and Nasdaq 100, extending Thursday’s gains after the Wall Street Journal reported that Paramount Skydance was preparing a majority cash bid for the entertainment giant. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly fell to a 4-month low of 55.4 in September, weaker than expectations of 58.2. Also, the University of Michigan’s U.S. September year-ahead inflation expectations were unchanged from August at 4.8%, in line with expectations, while 5-year implied inflation expectations unexpectedly increased to 3.9%, higher than expectations of 3.4%. “The Fed is pulled in opposite directions by rising inflation on the one hand and a weak job market on the other. The Fed can be expected to cut rates further in the coming months; the question is how much, not if,” said Bill Adams at Comerica Bank. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 4.00% to 4.25%. However, there’s also a small chance that a larger 50 basis point cut could occur. Investors will scrutinize remarks from Mr. Powell for any indications on how quickly rates may fall from here. Following recent data painting a picture of a slowing labor market, U.S. money markets have almost fully priced in follow-up rate cuts in October and December. Market watchers will also closely parse the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer key guidance on how policymakers expect the interest-rate path to unfold over the next few years. “Despite inflation running above the Fed’s 2% target, [recent] weaker-than-expected nonfarm payroll figures, coupled with revised data showing 911,000 fewer jobs created in the 12 months to March, have strengthened the likelihood of monetary policy easing,” said Richard Flax, chief investment officer at Moneyfarm. Investors will also keep an eye on U.S. economic data this week. The retail sales report for August will be the main highlight, as it will provide insight into the state of consumer spending. Other noteworthy data releases include U.S. Industrial Production, Manufacturing Production, the Export Price Index, the Import Price Index, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. In addition, several notable companies, including shipping giant FedEx (FDX), homebuilder Lennar (LEN), and cereal maker General Mills (GIS), are scheduled to release their quarterly results this week. Meanwhile, Meta CEO Mark Zuckerberg will open the company’s annual Meta Connect conference on Wednesday evening, where the Facebook parent is expected to highlight product offerings such as its AI glasses. On the trade front, U.S.-China talks on trade, the economy, and the status of ByteDance’s TikTok began on Sunday in Madrid. U.S. Treasury Secretary Scott Bessent said that the U.S. is nearing a deal with China regarding TikTok. The talks resumed on Monday. Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee the September figure coming in at 4.30, compared to 11.90 in August. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.064%, up +0.12%. Let's take a look at the intra-day levels we'll be focusing on today on /ES. 6605, 6614, 6624, 6630 are resistance zones. 660, 6594, 6585, 6577 are support zones. My lean or bias today: Futures are up as I type. The news docket is pretty light. Technicals are all bullish. All that being said, I think we could be flat today, waiting on Weds.results. Trade docket today: We'll focus on getting an exit on our SPX we rolled from Friday as well as scalping. QQQ's may be the preferred method again today. I look forward to seeing you all in our live trading room today and don't forget to tune into zoom for our weekly training session.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |