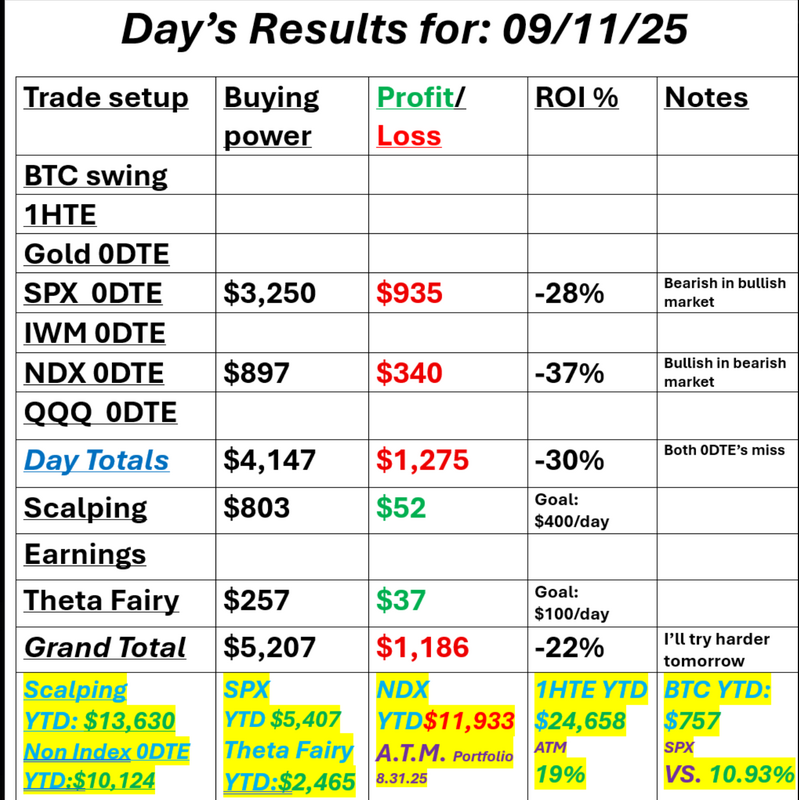

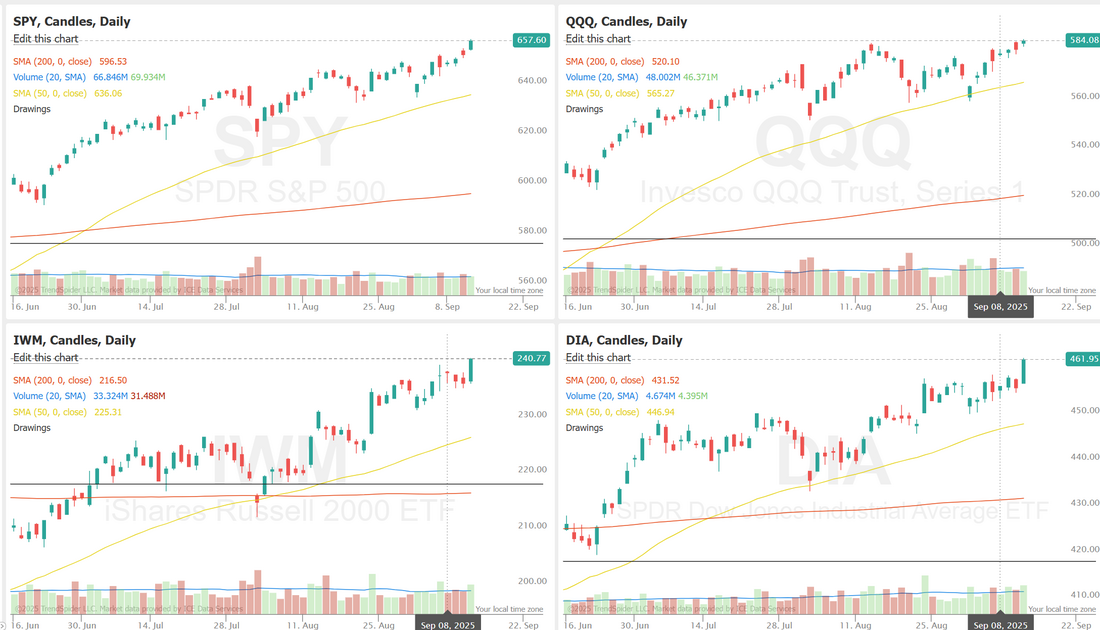

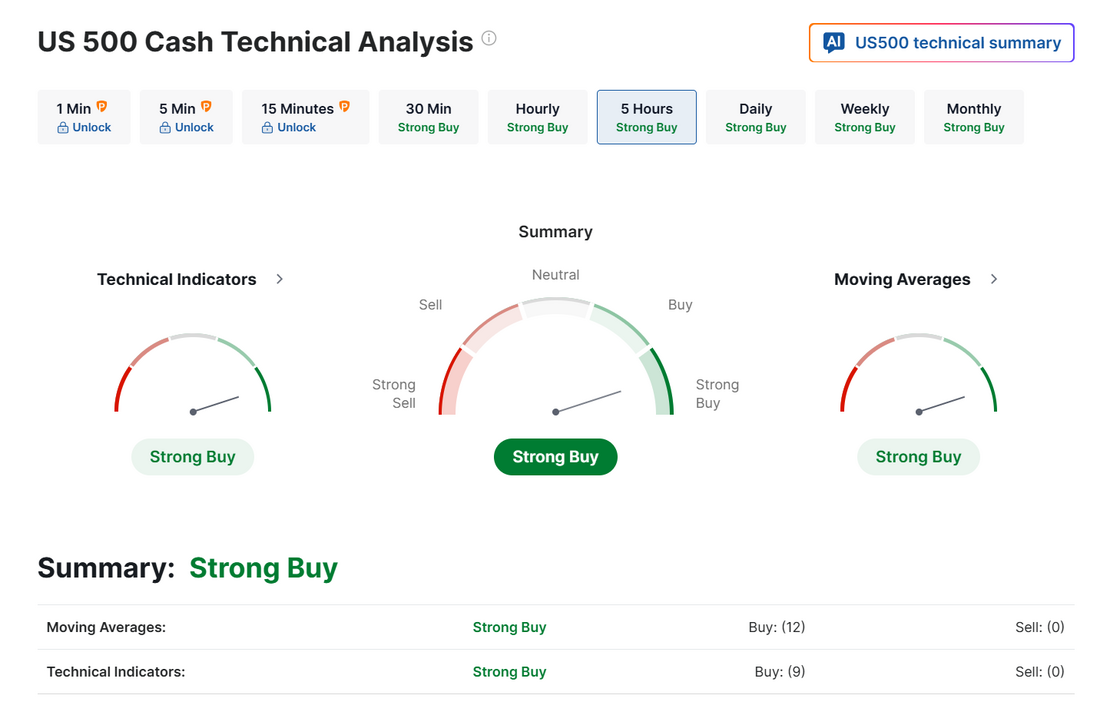

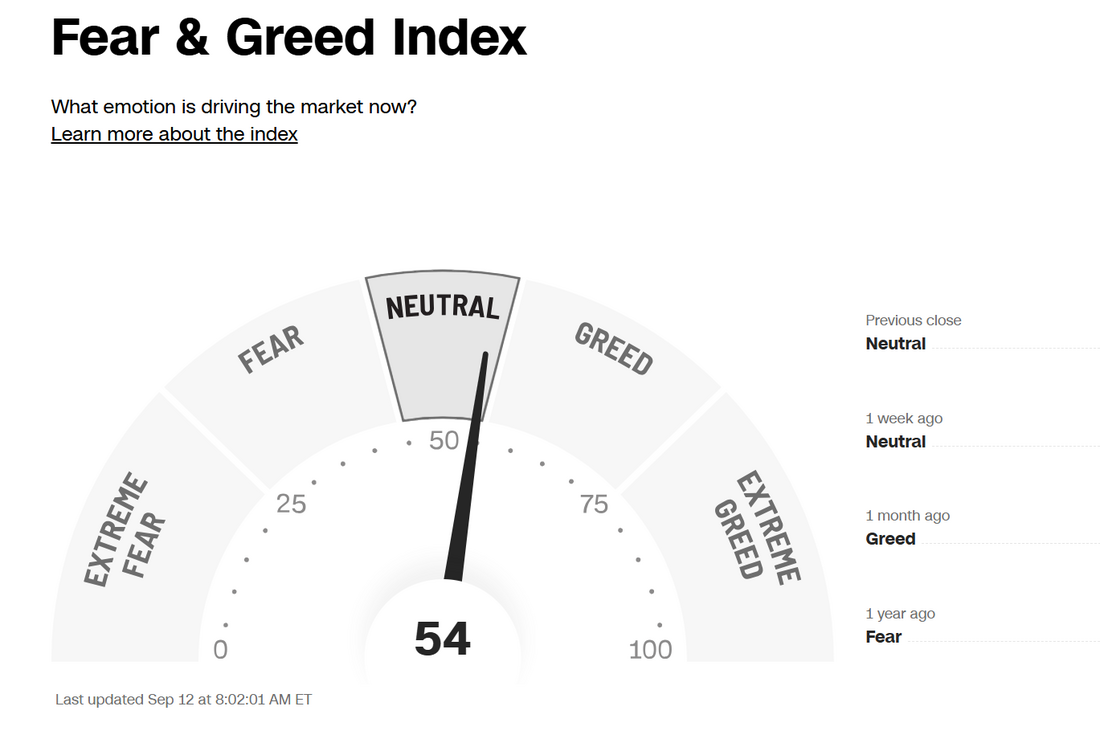

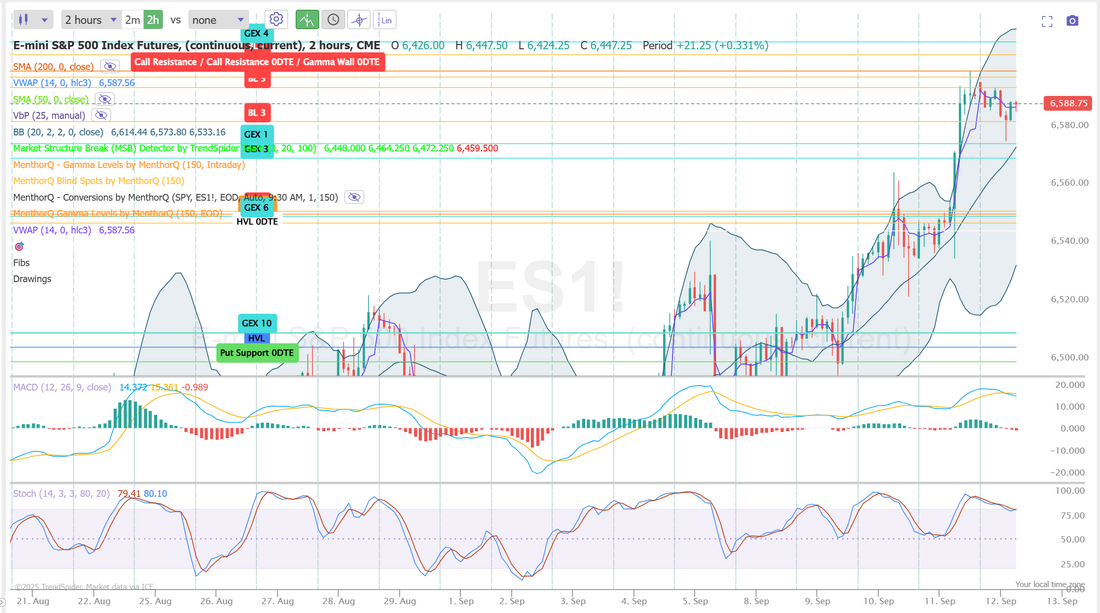

New ATH's reachedMarkets are holding at incremental new highs. We had two days of solid inflation numbers and it all seems like a lock that we'll get a rate cut. The question is, will it be a "buy the rumor, sell the news" situation? The market sure seems stretched to me. We'll see soon enough. I had a bad day yesterday with both my 0DTE's missing. Our Thetafairy and scalping made money but not enough to offset. Here's a look at my day. Let's look at the markets. That's a pretty solid up trend. New ATH's. Is there any resistance in sight? Not yet. Technicals are bullish as you'd think they should be with a trend like we currently have. The fear and greed index is not overly optimistic here, which is a bit surprising. September S&P 500 E-Mini futures (ESU25) are down -0.11%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.04% this morning, taking a breather as investors assess how much further the record rally fueled by expectations of Federal Reserve rate cuts can continue. Higher bond yields today are also weighing on stock index futures. Investors now await the University of Michigan’s preliminary reading on U.S. consumer sentiment due later in the day. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green, with the S&P 500, Dow, and Nasdaq 100 notching new record highs. Warner Bros. Discovery (WBD) jumped over +28% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the Wall Street Journal reported that Paramount Skydance was preparing a majority cash bid for the entertainment giant. Also, Centene (CNC) surged about +9% after the healthcare company reiterated its full-year adjusted EPS guidance. In addition, Micron Technology (MU) climbed over +7% after Citi raised its price target on the stock to $175 from $150. On the bearish side, Netflix (NFLX) slid more than -3% and was the top percentage loser on the Nasdaq 100 after Chief Product Officer Eunice Kim announced her departure from the company. The U.S. Bureau of Labor Statistics report released on Thursday showed that consumer prices rose +0.4% m/m in August, stronger than expectations of +0.3% m/m. On an annual basis, headline inflation picked up to +2.9% in August from +2.7% in July, in line with expectations. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +3.1% y/y in August, in line with expectations. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly rose by +27K to a 3-3/4-year high of 263K, compared with the 235K expected. “[Thursday’s] CPI report has been trumped by the jobless claims report,” said Seema Shah at Principal Asset Management. “If anything, the jump in jobless claims will inject a bit more urgency in the Fed’s decision-making, with Powell likely signaling a sequence of rate cuts is on the way.” Meanwhile, U.S. rate futures have priced in a 100% probability of a 25 basis point rate cut and a 7.5% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. In tariff news, the Financial Times reported on Thursday that the U.S. will push G7 countries to impose higher tariffs on India and China over their purchases of Russian oil. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary September figure will stand at 58.2, the same as in August. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.044%, up +0.82%. We've got a new training module for you coming up on our next Monday zoom session. Mark your calendar for that. I don't have a lean or bias today. The trend is bullish so I lean that direction but a pause or even a retrace today could make sense. Let's let the morning develop. Let's take a look at the intra-day levels I'll be watching today. 6595, 6600, 6606, 6610 are resistance levels. 6583, 6575, 6569, 6552 are support zones. I look forward to seeing you all in the live trading room shortly. Let's see f we can finish the week strong!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |