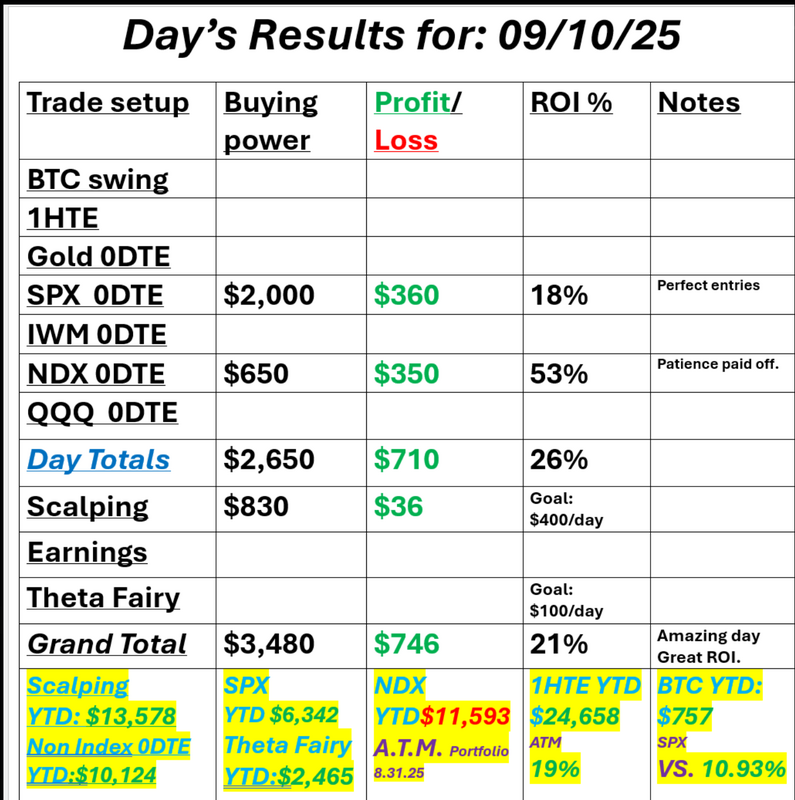

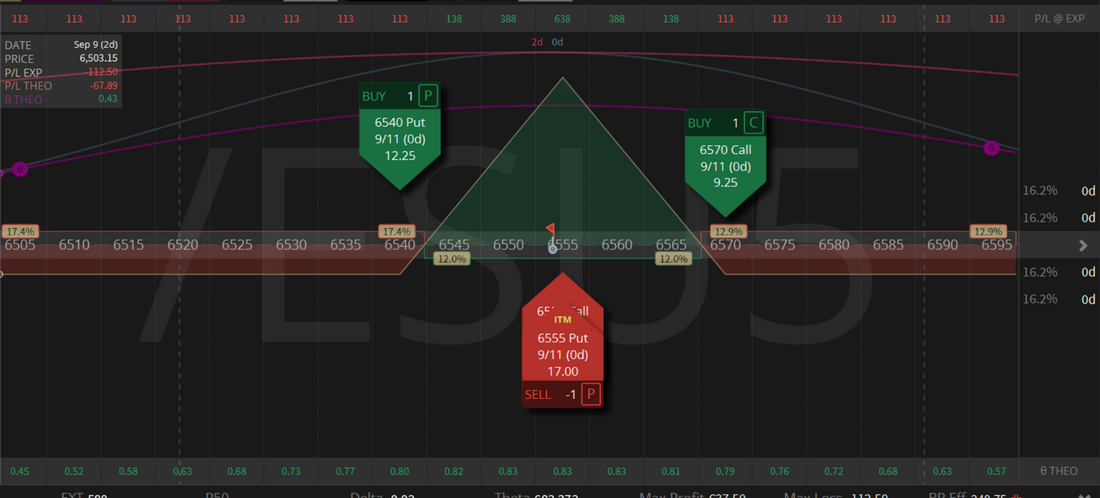

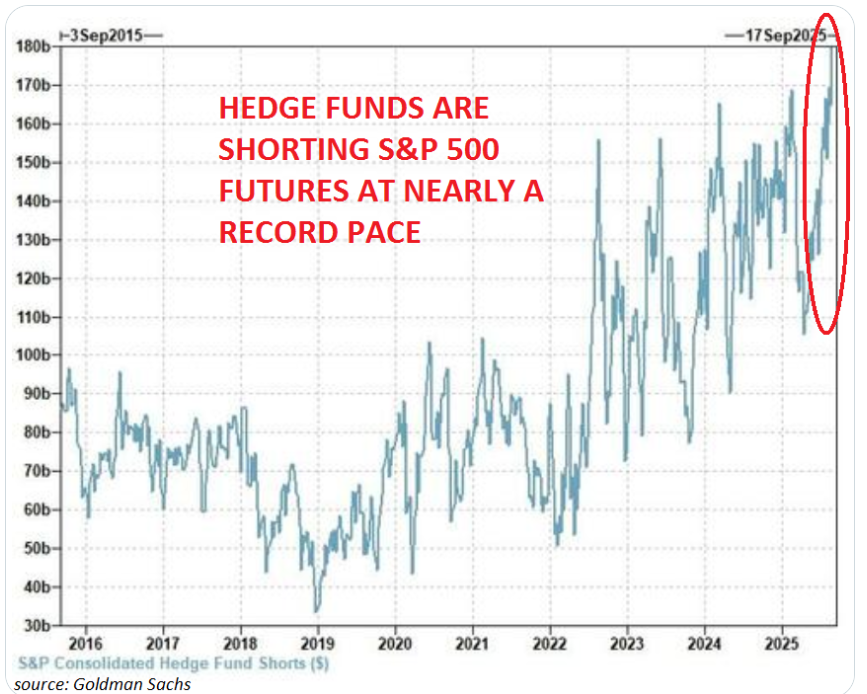

CPI dayWe had a good day yesterday but it was a slow burn and a "full work day". Sometimes our workdays are only an hour and sometimes we need the full 6.5 hrs. to make it happen. Have you ever noticed that the things in life that are hard are usually the things that are most important? Going to the gym is hard but the benefits are amazing. Sitting our our hands. Waiting for trades to materialize. Begging for the market to hit one of our levels so we can start hitting that enter button on our computers. These are all hard things, but we know that with discipline we usually get rewarded. We had a solid day yesterday but our last NDX trade came down to the last 30 min. of the day. Here's a look at our results. Today is a copy/paste from yesterday. We move on from PPI to CPI today. Just like yesterday, we'll forgo looking at levels and creating bias until we get into our zoom session and see how the market reacts. September S&P 500 E-Mini futures (ESU25) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.15% this morning as investors refrain from making any big bets ahead of key U.S. inflation data that is expected to shape expectations for the Federal Reserve’s interest rate path this year. In yesterday’s trading session, Wall Street’s major indices ended mixed, with the S&P 500 notching a new record high. Oracle (ORCL) jumped over +35% and was the top percentage gainer on the S&P 500 after the enterprise software giant gave an aggressive forecast for its cloud business. Also, stocks tied to AI computing infrastructure soared on Oracle’s upbeat outlook, with CoreWeave (CRWV) surging more than +16% and Broadcom (AVGO) climbing over +9% to lead gainers in the Nasdaq 100. In addition, GameStop (GME) rose over +3% after the videogame retailer reported stronger-than-expected Q2 results. On the bearish side, Synopsys (SNPS) plummeted more than -35% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chip design software company reported downbeat FQ3 results and issued below-consensus FQ4 guidance. Economic data released on Wednesday showed that the U.S. producer price index for final demand fell -0.1% m/m and rose +2.6% y/y in August, weaker than expectations of +0.3% m/m and +3.3% y/y. Also, the core PPI, which excludes volatile food and energy costs, fell -0.1% m/m and rose +2.8% y/y in August, weaker than expectations of +0.3% m/m and +3.5% y/y. “The worst-case scenario on inflation isn’t playing out,” said David Russell at TradeStation. “The doves will be happy to see the year-over-year number back below 3%. Combined with the weak jobs data recently, this keeps us on track for rate cuts. However, the speed and intensity might depend more on the big consumer index.” Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and an 8.0% chance of a 50 basis point rate cut at next week’s monetary policy meeting. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Market watchers will assess the extent to which hefty U.S. tariffs are passing through to consumers. Slower price growth could reinforce expectations for a series of rate cuts after a likely move next week, while hotter-than-expected inflation may lead investors to price in a more cautious pace of easing. Economists, on average, forecast that the U.S. August CPI will come in at +0.3% m/m and +2.9% y/y, compared to the previous numbers of +0.2% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.1% y/y in August, unchanged from July’s figures of +0.3% m/m and +3.1% y/y. A survey conducted by 22V Research revealed that investors anticipate an in-line inflation report, with most respondents saying that the core CPI is on a Fed-friendly glide path. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 235K, compared to last week’s number of 237K. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ3 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.042%, up +0.35%. We've got a modified Theta fairy working with an Iron fly going into CPI release. We'll be looking to pull it after the vol crush after CPI release. Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace: Hedge funds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. CPI prepThe Consumer Price Index (CPI), released monthly by the Bureau of Labor Statistics (BLS), measures the change in prices paid by consumers for a representative basket of goods and services. Key components include: Headline CPI: Includes all items—food, energy, and others. Core CPI: Excludes volatile categories like food and energy, offering a clearer view of underlying inflation trends. YoY – Forecast: 2.9% | Prior: 2.7% | Range: 3% / 2.7% MoM – Forecast: 0.3% | Prior: 0.2% | Range: 0.5% / 0.1% Core YoY – Forecast: 3.1% | Prior: 3.1% | Range: 3.1% / 3% Core MoM – Forecast: 0.3% | Prior: 0.3% | Range: 0.4% ./ 0.2% Our levels were pretty spot on yesterday. 6560 and 6535 are the main resistance/support levels coming into CPI. We'll drill down on all the levels in our zoom session. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |