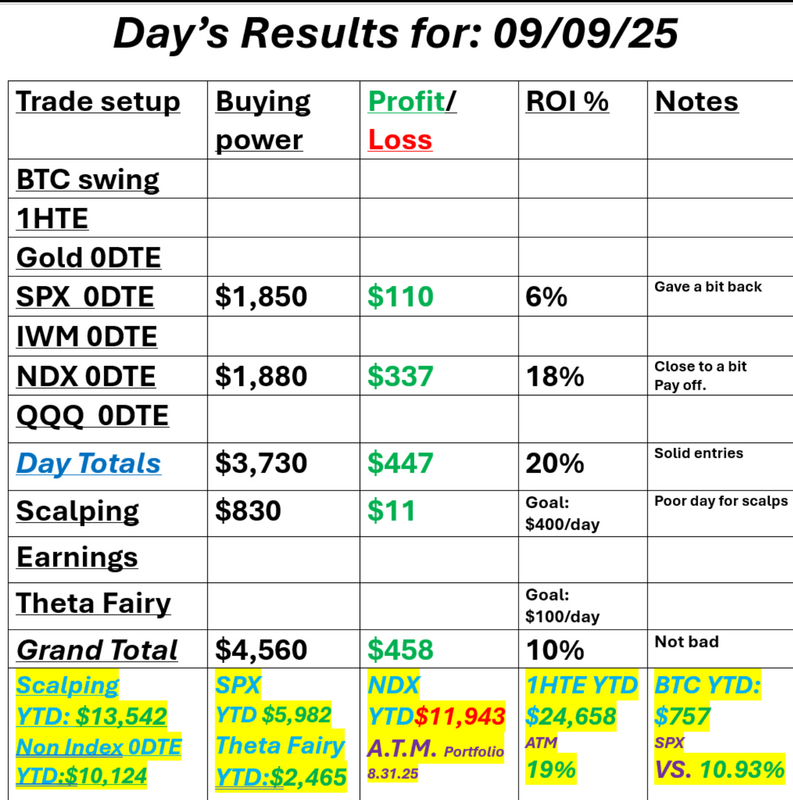

PPI numbers incomingWe are entering a couple potential big days with PPI release this morning and CPI tomorrow. Inflation official numbers are running around 3.3% annually. Quite a bit higher than the FED's goal of 2% but that isn't stopping the CME futures from predicting a 100% probability of a rate cut next week. Markets should react today so we'll be prepared for movement. Yesterday was another absolutely perfect, or near perfect day for us, execution wise. We really did everything right...again but, with such little movement over the last couple of days our profits are smaller than we'd like. I know I'm repetitive here but our challenge remains the same. Low I.V. make credit trades poor risk/reward and lack of directional movement makes debit trades ineffective. As I said, I'm sure that will change today and tomorrow. Here's a look at our "perfect" day yesterday. September S&P 500 E-Mini futures (ESU25) are up +0.25%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.15% this morning as a blowout outlook from Oracle buoyed sentiment, while investors geared up for crucial U.S. producer inflation data. Oracle (ORCL) surged over +29% in pre-market trading after the enterprise software giant projected that booked revenue from its core cloud business would surpass half a trillion dollars in the coming months, stunning Wall Street and boosting optimism that the AI infrastructure rollout is accelerating. Chip stocks also climbed in pre-market trading on Oracle’s upbeat outlook, with Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) up more than +2%. In yesterday’s trading session, Wall Street’s major indexes closed higher. UnitedHealth Group (UNH) surged over +8% and was the top percentage gainer on the S&P 500 and Dow after the insurer said it expects about 78% of its Medicare Advantage members to be enrolled in top-rated Medicare plans next year. Also, Atlassian Corp. (TEAM) climbed more than +5% and was the top percentage gainer on the Nasdaq 100 after announcing plans to end its data center product over the next three years and move customers to its cloud platform. In addition, Nebius (NBIS) jumped over +49% after securing a deal worth up to $19.4 billion to provide Microsoft with AI infrastructure through 2031. On the bearish side, Albemarle (ALB) slumped more than -11% following a report that China’s CATL would soon restart its Yichun lithium mine. A preliminary report from the Bureau of Labor Statistics on Tuesday showed that employers added 911,000 fewer jobs in the year through March than previously indicated in the monthly payroll data. The final figures will be released early next year. “The labor market appears weaker than originally reported,” said Jeff Roach at LPL Financial. “A deteriorating labor market will allow the Fed to highlight the need to ease rates. Investors should expect the Fed to officially start the rate-cutting campaign at the next meeting.” JPMorgan CEO Jamie Dimon told CNBC in an interview on Tuesday that the record revision to U.S. payrolls data underscores that the U.S. economy is contending with a slowdown. “The economy is weakening,” Dimon said. “Whether that is on the way to recession or just weakening, I don’t know.” U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and a 10.2% chance of a 50 basis point rate cut at the Fed’s monetary policy committee meeting next week. Meanwhile, a federal judge on Tuesday night blocked U.S. President Donald Trump from removing Lisa Cook from the Federal Reserve Board of Governors while a lawsuit challenging her dismissal proceeds. In tariff news, the U.S. Supreme Court agreed on Tuesday to review the legality of President Trump’s sweeping global tariffs. The court placed the case on a fast track, setting oral arguments for the first week of November. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. August PPI will stand at +0.3% m/m and +3.3% y/y, compared to the previous figures of +0.9% m/m and +3.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect August figures to be +0.3% m/m and +3.5% y/y, compared to July’s numbers of +0.9% m/m and +3.7% y/y. U.S. Wholesale Inventories data will be released today. Economists anticipate that the final July figure will be unrevised at +0.2% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.900M, compared to last week’s value of 2.415M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.082%, up +0.25%. No bias or levels today or tomorrow with PPI and CPI. They should be the drivers and we'll look at the levels as they develop intra-day inside our trading room.

I look forward to seeing you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |