|

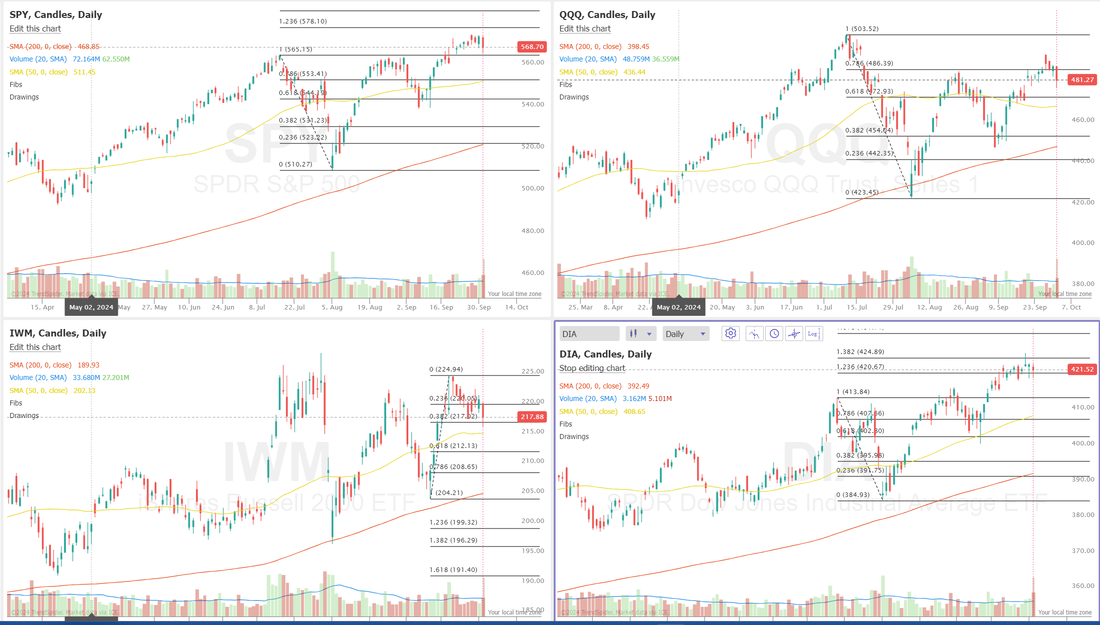

Welcome back taraders. Yesterday was a "traders market". It's easy to go long something in a bull market, make money and feel like your a genius but it's markets like we had yesterday that test the true metal of a trader. Can you be patient enough, nimble enough, and confident enough to commit capital on a day that? I don't like bragging and I don't like braggards. If you want to set yourself up for failure, just bragg about your results. The karma Gods will surely make you look like a fool the next day. That being said, I'm super proud of our day yesterday. It was an absolute home run! More important, it illustrated how important it is to have multiple strategies working at the same time. It was a scalping mania day! We were also very patient on our 0DTE entries. See our results below: Again...braggards ALWAYS, eventually get what's coming to them but gosh darn it if yesterday wasn't amazing for us. Let's take a look at what yesterdays crazyness did to the market structure. We have flipped to a sell signal but will it last? The last time Iran did this the markets shrugged it off. Or...it this a definative change of direction? Those new ATH's will have to wait, for now. You'll notice though, very little damage was done to the SPY or DIA. December S&P 500 E-Mini futures (ESZ24) are trending down -0.37% this morning as flaring tensions in the Middle East dampened sentiment, while investors braced for the ADP National Employment numbers due later in the day. Nike (NKE) slumped over -5% in pre-market trading after the world’s largest sportswear company reported weaker-than-expected Q1 revenue and withdrew its full-year sales guidance. Market participants continue to keep a close watch on developments in the Middle East. Iran launched approximately 200 ballistic missiles at Israel on Tuesday in response to Israeli strikes on Hezbollah in Lebanon, marking a sharp but brief escalation between Middle Eastern adversaries, which risked sparking a new wave of attacks as Prime Minister Benjamin Netanyahu pledged to retaliate. Tehran warned that any retaliation would result in “vast destruction,” heightening fears of a broader regional conflict. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Humana (HUM) plunged over -11% and was the top percentage loser on the S&P 500 after releasing its Medicare Advantage plan for 2025. Also, chip stocks lost ground, with Arm (ARM) slumping more than -4% to lead losers in the Nasdaq 100 and Intel (INTC) sliding over -3% to lead losers in the Dow. In addition, Apple (AAPL) fell nearly -3% after Barclays said that the availability of the iPhone 16 suggests “softer demand” compared to last year. On the bullish side, Paychex (PAYX) climbed about +5% and was the top percentage gainer on the S&P 500 after the payroll processing firm reported better-than-expected Q1 results. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings unexpectedly climbed to a 3-month high of 8.040M in August, stronger than expectations of 7.640M. Also, the U.S. September ISM manufacturing index remained steady from August at 47.2, below the consensus of 47.6 and marking the sixth consecutive month of contraction. In addition, the U.S. S&P Global manufacturing PMI was revised upward to 47.3 in September, though it still declined from 47.9 in August. Finally, U.S. August construction spending unexpectedly fell -0.1% m/m, weaker than expectations of +0.2% m/m. Meanwhile, U.S. rate futures have priced in a 63.2% chance of a 25 basis point rate cut and a 36.8% chance of a 50 basis point rate cut at the next FOMC meeting in November. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the September ADP Nonfarm Employment Change will stand at 124K, compared to the previous number of 99K. U.S. Crude Oil Inventories data will also be released today. Economists estimate this figure to be -1.500M, compared to last week’s value of -4.471M. In addition, market participants will be anticipating speeches from Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.767%, up +0.59%. My bias or lean today is...bullish! We've seen this movie before. I think we shake off yesterday and push higher today. I've also put my money where my mouth is in our scalping room. We have two bullish setups to key off today. Trade docket for today: STZ, LEVI, /MCL, /MNQ,QQQ scalping, /ZC, LW, NKE, 0DTE's Let's take a look at the intra-day levels. /ES; I've got a couple key levels I'm watching today. 5767 is the first big resistance. 5788 is the important one. That's not only the PoC, it's also the 50 period M.A. on the 2hr. chart. Above that we are back to full on bullishness. 5732 is the one key support I'm watching today. Below that we have some big potential downside. /NQ: The Nasdaq got beat up the most yesterday. It's got the most work to do. 20019 is the first resistance with 20130 next. 19892 is first support then comes 19820. If we lose 19820 it could be "look out below" I would lay on the shorts pretty heavily there. BTC: Bitcoin got beat up yesterday along with equities. It's sitting right now on its 200 period M.A. on the 2hr. chart. Thats the only level I'm watching today. If it holds through the morning we'll play it long. If it can't hold it, we go short. One final comment on having lot of "tools in the tool chest". Sometimes there are 5-7 day stretches that our scalping program doesn't find setups or worse, does find setups that just don't produce. You may think it's not a strategy you want to continue with. Then, you get a day like yesterday. It proved invaluable. The same can be said about the Theta fairy. Sometimes we go a month without getting a set up. Sometimes we get yesterday. I'm starting off the day with $300 profit already in my pocket. It's an amazing trade setup IF...you are disciplined enough to use the built in stop loss and know when NOT to trade it. Long live the Theta fairy. I'll see you all in the live trading room shortly. Let's do it again!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |