|

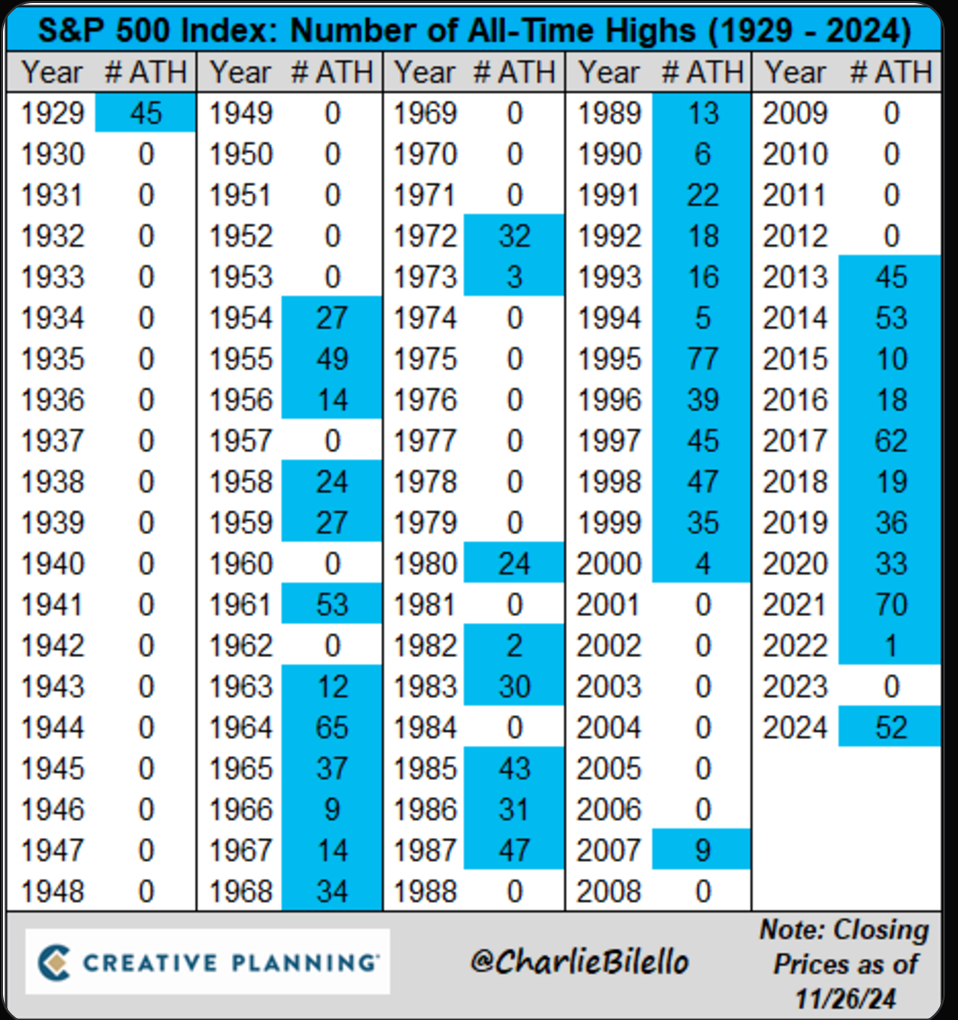

Welcome back traders. The week is almost done! We've had some solid days so far. I didn't get the blog up yesterday with some uploading issues so here's a look at our last two days results. Nothing really to complain about. I.V. is super low this week so we've worked some debit trades into the mix and that has helped. We are starting today with another one and this will likely be the "go to" setup for us the rest of this week. Let's take a look at the markets: Buy mode is still holding tight. We are now back to being pinned to the ATH zone. Check out the number of new ATH's this year. The S&P 500 closed at an all-time high today for the 52nd time this year. $SPX The only years with more all-time highs: 1995 (77) 2021 (70) 1964 (65) 2017 (62) 2014 (53) 1961 (53) December S&P 500 E-Mini futures (ESZ24) are down -0.18%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.33% this morning as investors digested Donald Trump’s latest cabinet appointments and awaited a flurry of pre-Thanksgiving holiday U.S. economic data. Trump appointed Jamieson Greer as the U.S. Trade Representative and Kevin Hassett as director of the National Economic Council. Greer had been involved in shaping Trump’s trade policy decisions during his first term. The minutes of the Federal Open Market Committee’s November 6-7 meeting, released Tuesday, revealed that officials broadly supported a careful approach to future interest rate cuts as the economy remains robust and inflation gradually eases. “Participants anticipated that if the data came in about as expected, with inflation continuing to move down sustainably to 2% and the economy remaining near maximum employment, it would likely be appropriate to move gradually toward a more neutral stance of policy over time,” according to the FOMC minutes. Also, the minutes showed that some participants suggested the Fed could pause rate cuts if inflation remains elevated, while others advocated for quicker rate reductions should the economy or labor market deteriorate. In addition, policymakers noted uncertainty around the so-called neutral rate, a level of policy that neither restricts nor stimulates economic growth, as a reason for caution. This uncertainty “complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually.” In yesterday’s trading session, Wall Street’s three main equity benchmarks ended higher. NRG Energy (NRG) climbed over +10% and was the top percentage gainer on the S&P 500 after Jeffries upgraded the stock to Buy from Hold with a price target of $113. Also, Eli Lilly (LLY) gained more than +4% after the Biden administration proposed a rule that would require the U.S. government to cover weight-loss drugs through the Medicare and Medicaid systems. In addition, Semtech (SMTC) surged over +18% after the company posted upbeat Q3 results and issued above-consensus Q4 guidance. On the bearish side, Amgen (AMGN) fell more than -4% and was the top percentage loser on the Dow after highly anticipated Phase 2 data on its experimental obesity drug, MariTide, showed that it failed to significantly outperform competitors. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index jumped to a 16-month high of 111.7, compared with the 111.8 consensus. Also, the U.S. September S&P/CS HPI Composite - 20 n.s.a. eased to +4.6% y/y from +5.2% y/y in August, weaker than expectations of +4.7% y/y and the smallest annual increase in a year. At the same time, U.S. new home sales plunged -17.3% m/m to a nearly 2-year low of 610K in October, weaker than expectations of 725K. San Francisco Fed President Mary Daly stated on Tuesday that “inflation is still printing above our 2% target, so we need to continue to work to bring that down.” U.S. rate futures have priced in a 66.3% probability of a 25 basis point rate cut and a 33.7% chance of no rate change at the next FOMC meeting in December. Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Thanksgiving Day holiday. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.8% y/y in October, compared to the previous figures of +0.3% m/m and +2.7% y/y. Also, investors will focus on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to expand at an annual rate of 2.8% in the third quarter, in line with initial estimates. U.S. Personal Spending and Personal Income data will be closely monitored today. Economists anticipate October Personal Spending to be +0.4% m/m and Personal Income to be +0.3% m/m, compared to September’s figures of +0.5% m/m and +0.3% m/m, respectively. U.S. Durable Goods Orders and Core Durable Goods Orders data will be released today. Economists forecast October Durable Goods Orders at -0.8% m/m and Core Durable Goods Orders at +0.2% m/m, compared to the prior figures of 0.0% m/m and +0.5% m/m, respectively. U.S. Pending Home Sales data will come in today. Economists expect the October figure to be -2.1% m/m, compared to the previous figure of +7.4% m/m. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 215K, compared to last week’s number of 213K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.262%, down -1.00%. Trade docket for today: /MNQ scalping, /ES debit as the basis for our 0DTE today. BBY, CAVA?, CRWD, DELL, IWM, WDAY, /BTC, 0DTE's. My bias or lean for today is more neutral. We do have Jobless claims, GDP estimates and Durable goods coming out this morning but other than that is should be a low vol day. Let's take a look at our intra-day levels for 0DTE's. /ES: Once again, I'm not expecting much out of the markets today. 6047 is resistance and 6017 is support. That's also PoC on the 2hr. chart. A break above or below these levels could get things moving however. /NQ: The Nasdaq is a little different. Talk about a pinching wedge formation! This market is coiled and ready for a move. 21026 is resistance and 20853 is support. A break above of below these levels could trigger some big, outsized moves. BTC: Bitcoin finally get a little retrace. We were able to get a nice trade in yesterday on both BTC and ETH. The setup doesn't look quite as easy today but I'm going to try hard to get another BTC and ETH trade on today. 95,769 is current resistnance with 92,000 working as support. Let's have a great day today! See you all in the trading room. I hope you all have a nice Thanksgiving. I'm a big believer in gratitude and I'm super grateful for all our members of our trading community. I appreciate you all.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |