|

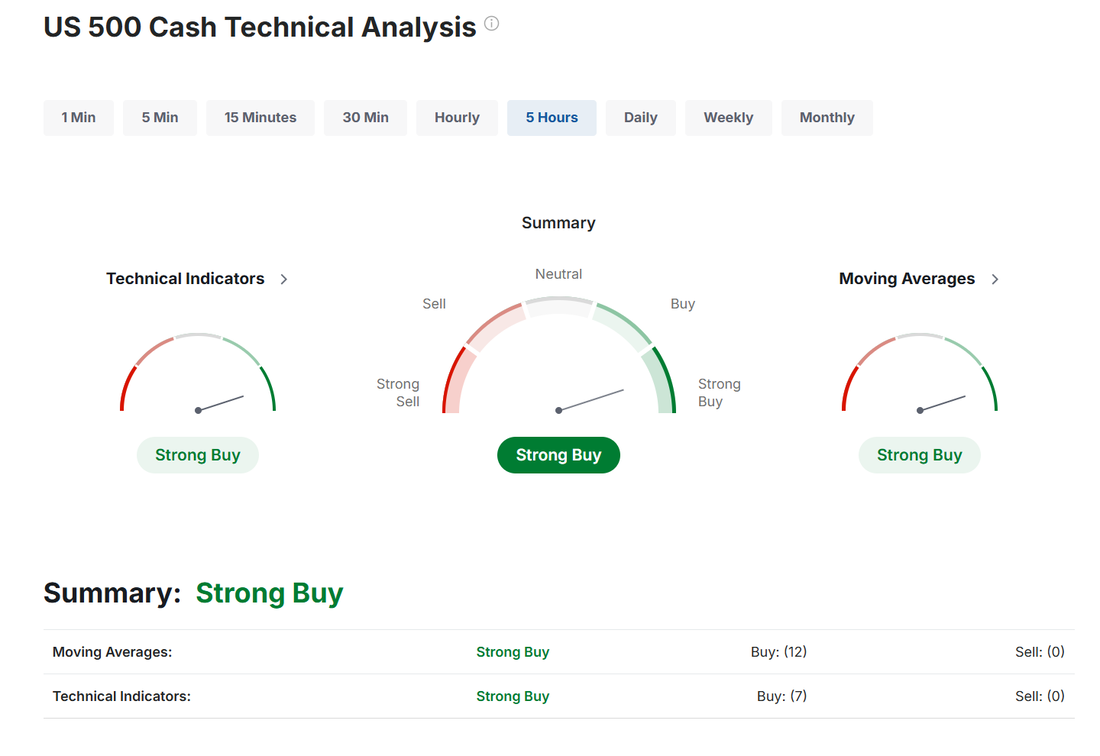

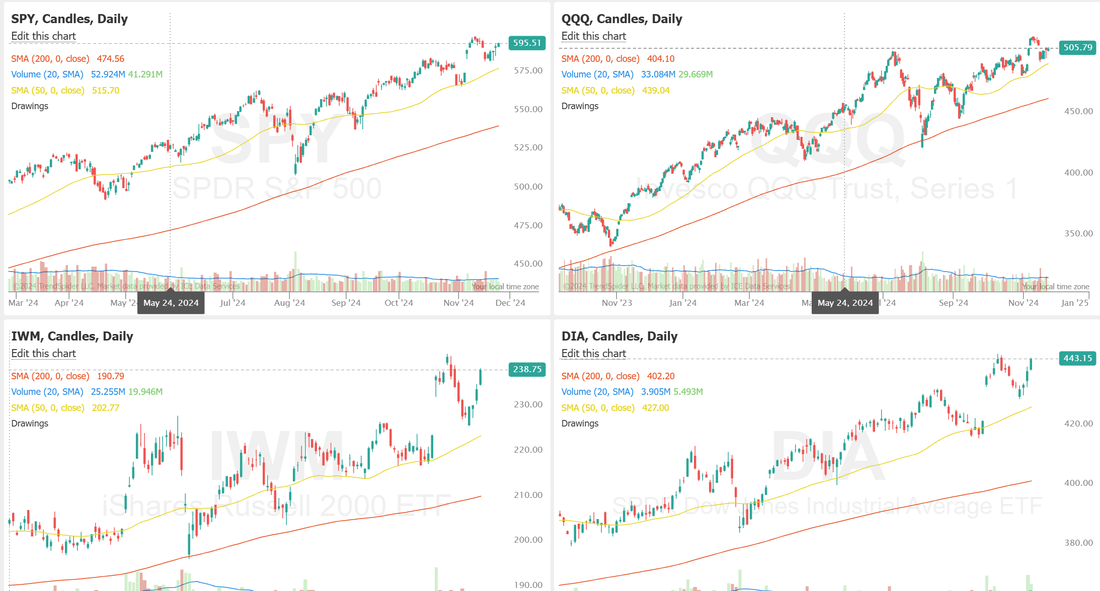

Welcome back to a new, shortened trading week! The markets will take off Thursday and have a shotened session Friday so that will damper our ability to do most of our normal weekly setups. We did have a wonderful day last Friday. Check our results below: Let's take a look at the markets Technicals looks strong coming into the week. Fridays strength continued to push us higher. For the first time in a while, the SPY is showing some slight relative weakness, trailing behind the other major indexes in percentage gain terms and closing the week at $595.51 (+1.66%). However, the technical setup remains clear: a textbook support/resistance flip, with the 21-EMA providing added support. The QQQ ended the week at $505.79 (+1.87%), finding support exactly where expected, at the October high. However, the lack of follow-through raises some concerns. Despite a constructive consolidation above the 21-EMA throughout the week, it failed to close last Friday’s gap down, so bulls will want to see a decisive move higher in the near term, especially with NVIDIA’s earnings report in the rear view. The IWM started the week on uncertain footing but staged an impressive turnaround on Tuesday, gaining momentum through Friday to close strongly at $238.77 (+4.48%). Supported by the 21-EMA and October highs, it showcased a picture-perfect support/resistance flip and seems poised to capitalize on the seasonal tailwinds typical for this time of year, particularly in election cycles. December S&P 500 E-Mini futures (ESZ24) are up +0.45%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.57% this morning as investors welcomed Scott Bessent’s nomination as U.S. Treasury Secretary, while also awaiting the publication of the minutes of the Federal Reserve’s latest policy meeting as well as the release of the Fed’s favorite inflation gauge and other key economic data later in the week. Market participants viewed Donald Trump’s selection of Scott Bessent as Treasury Secretary as a prudent choice that could bring greater stability to the U.S. economy and financial markets. Bessent, the head of macro hedge fund Key Square Group, has signaled support for Trump’s tariff and tax cut plans, but investors anticipate he will prioritize economic and market stability over pursuing political gains. In Friday’s trading session, Wall Street’s major equity averages ended higher. Super Micro Computer (SMCI) climbed over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing that it expects to file its delayed 10-K and 10-Q reports in the period available under Nasdaq rules. Also, Copart (CPRT) advanced more than +10% after reporting better-than-expected FQ1 revenue. In addition, Elastic N.V. (ESTC) surged over +14% after the AI enterprise search company posted upbeat FQ2 results and raised its full-year guidance. On the bearish side, Intuit (INTU) slumped more than -5% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the tax and accounting software company issued below-consensus FQ2 guidance. Economic data released on Friday showed that the U.S. S&P Global manufacturing PMI rose to a 4-month high of 48.8 in November, in line with expectations. Also, the U.S. November S&P Global services PMI climbed to a 2-1/2 year high of 57.0, better than expectations of 55.2. At the same time, the University of Michigan’s U.S. November consumer sentiment index was revised lower to 71.8 from the preliminary reading of 73.0, weaker than expectations of 73.7. “The U.S. flash PMIs for November were bullish in aggregate thanks to strength in services,” stated Vital Knowledge’s Adam Crisafulli, noting that the details indicated a goldilocks scenario, “with favorable growth developments and cooling price pressures.” Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Thanksgiving Day Holiday. Also, the stock markets will close early on Black Friday, with trading ending at 1 p.m. Eastern Time. The highlight of this holiday-shortened week will be the October reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge. Also, investors will be monitoring a spate of other economic data releases, including U.S. GDP (second estimate), the CB Consumer Confidence Index, Building Permits, the S&P/CS HPI Composite - 20 n.s.a., New Home Sales, the Richmond Manufacturing Index, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Wholesale Inventories (preliminary), the Chicago PMI, Pending Home Sales, Personal Income, Personal Spending, and Crude Oil Inventories. Market participants will also focus on earnings reports from several high-profile companies. Prominent tech firms such as Dell Technologies (DELL), HP Inc. (HPQ), Analog Devices (ADI), Workday (WDAY), and CrowdStrike (CRWD), along with retailers like Best Buy (BBY), Dick’s Sporting Goods (DKS), and Macy’s (M), are scheduled to release their quarterly results this week. In addition, investors will closely monitor the release of the Federal Reserve’s minutes from the November 6-7 meeting on Tuesday. The report will offer details on the policymakers’ discussion during the November meeting, where they decided to lower interest rates by a quarter percentage point, and may shed light on the central bank’s future rate-cut plans. U.S. rate futures have priced in a 56.2% chance of a 25 basis point rate cut and a 43.8% chance of no rate change at December’s policy meeting. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.343%, down -1.52%. The one day VIX is buried and not giving much hope for credit trades to start the week. While the last few days have been bullish and our technicals and chart patterns are all flashing bullish, I'm not carryng a high conviction either way coming into this shortened week. This is a week that a lot of traders take off. Trade docket for today: /MNQ, ZM, /NG, BBY, DKS,M, SPY/QQQ, CAVA, IWM,DLTR,UAL, 0DTE's. Let's take a look at the intra-day critical levels. /ES: 6039 is nearest resistance with 6001 acting as support. /NQ: 20980 is nearest resistance with 2107 next. 20909 is first support with 20873 next.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |