|

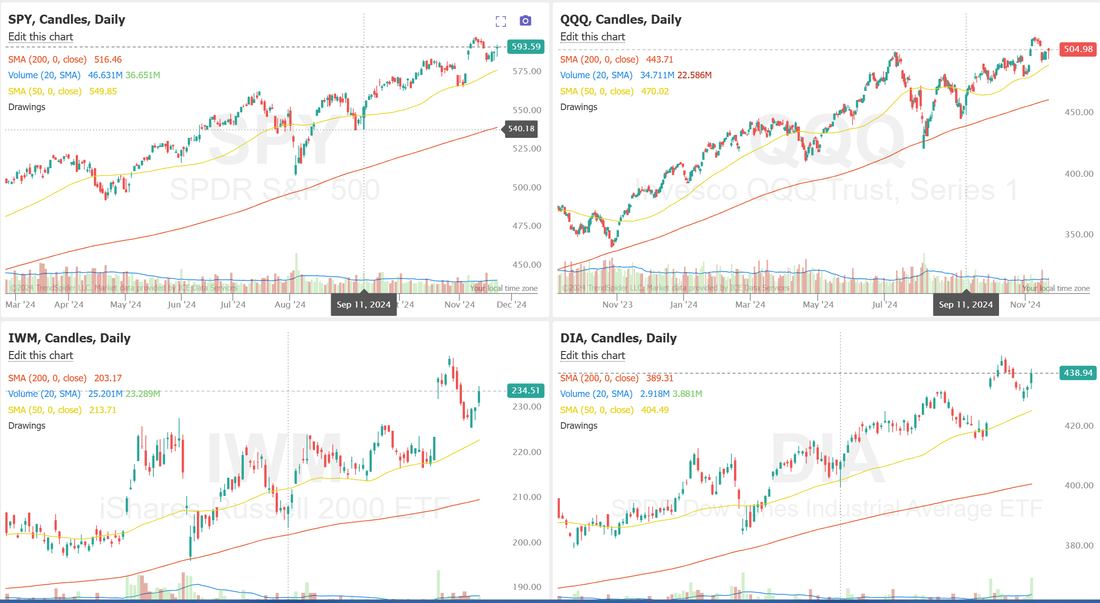

Welcome to Friday! We almost made it. What a crazy week. It's been one of the lowest capital outlays on an average daily basis that we've had in a long time. The price action has been super tough to predict and "get on board" with so my capital commitment has been super small. Our results have been pretty much in line with norms in terms of ROI but in terms of actual dollars its been low. Here's our results from yesterday. For all the frustration it caused we still had a good day and everything we touched worked. See our results below: Let's take a look at the markets: Technicals are still bullish. It seems to me, the market wants to shake off the Geo-political war escalation and continue its march higher, even though the bear have been sporadically pounding the sell orders in at random times during the day. Intra-day its been super choppy but the last three days have been clearly bullish December S&P 500 E-Mini futures (ESZ24) are trending down -0.24% this morning as weak Eurozone PMI data cast doubt on the health of the global economy, while investors braced for U.S. business activity data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. Snowflake (SNOW) jumped over +32% after the cloud data storage and analytics company posted upbeat Q3 results and raised its full-year product revenue guidance. Also, Super Micro Computer (SMCI) surged more than +15% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the server maker submitted a compliance plan to Nasdaq and said it could regain compliance within an extension period to file its 10-K annual report. In addition, Deere (DE) climbed over +8% after the maker of agricultural and construction equipment reported better-than-expected FQ4 results. On the bearish side, Alphabet (GOOGL) slid more than -4% and was the top percentage loser on the S&P 500 after the Justice Department argued to a judge that Google must divest its Chrome browser and implement other measures to end its monopoly on online search. Economic data released on Thursday showed that the U.S. Philadelphia Fed manufacturing index fell to -5.5 in November, weaker than expectations of 7.4. Also, U.S. October existing home sales rose +3.4% m/m to 3.96M, stronger than expectations of 3.95M. In addition, the Conference Board’s leading economic index for the U.S. fell -0.4% m/m in October, weaker than expectations of -0.3% m/m. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -6K to a 6-1/2 month low of 213K, compared with the 220K expected. New York Fed President John Williams said Thursday that U.S. economic growth has been “very good” and “the disinflationary process will continue.” Williams added that he expects “it will be appropriate over time to bring the fed-funds rate down closer to more normal or neutral levels.” Also, Richmond Fed President Tom Barkin said he anticipates inflation will continue to decline across the world’s largest economy. In addition, Chicago Fed President Austan Goolsbee reaffirmed his support for additional interest rate cuts and his willingness to implement them more gradually. Meanwhile, U.S. rate futures have priced in a 62.8% chance of a 25 basis point rate cut and a 37.2% chance of no rate change at December’s monetary policy meeting. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the November Manufacturing PMI will come in at 48.8, compared to last month’s value of 48.5. Also, investors will focus on the U.S. S&P Global Services PMI, which arrived at 55.0 in October. Economists foresee the preliminary November figure to be 55.2. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure to arrive at 74.0 in November, compared to 70.5 in October. In addition, market participants will be looking toward a speech from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.388%, down -1.04%. Our trade docket for today: /MNQ. We've had fairly good luck scalping this week just sticking to the /MNQ. /NG. We'll lock in the gain on the remaining put side to free up buying power.GAP, INTU earnings trades. IWM roll. MRNA extra cash flow. Potential 0DTE setups on MSTR, SMCI, TSLA. SPY book profit. FDX roll. 0DTE new setups. We closed our bearish debit setups yesterday so we'll be working a potential new setup today for 0DTE. This is an exampe of how the bullish setup could look. My bias or lean today: Bullish. I think the rebound continues. Let's take a look at the markets intra-day levels that I'll be watching today. /ES: We've had four updays this week, even though it doesn't feel like it intra-day as we've gotten some decent spikes down. Technicals are bullish but it sure seems like today could be a chop day with resistance at 5983 and support at 5935. /NQ: The range is a bit bigger on Nasdaq with 20901 working as resistance and 20647 as support. BTC: We haven't put a single Bitcoin trade on this week. As it keeps pushing to new ATH's, I'm waiting for a sign of a retrace. I can't go long here and yet there is no sign of stopping or turning either. So I sit and wait. I look forward to seeing you all in the trading room today. With today being options expiration we have a shot at some 0DTE's on some big I.V. equites today, namely MSTR, TSLA, SMCI so we should have plenty to work today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |