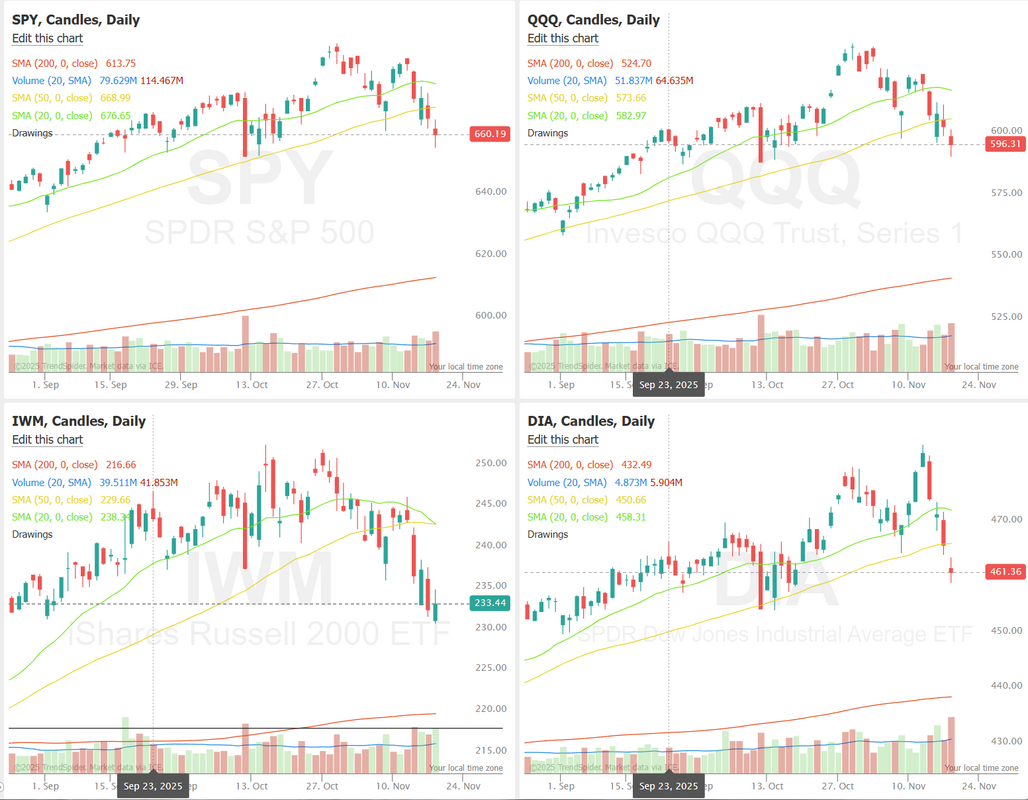

Nivida earnings incomingNVDA earnings are coming in after the close today. The numbers should be awesome. It's not like AI chip and GPU demand has waned. The real question is, how will the market react? Chances are high we get a selloff. Regardless, it will be a driver for futures after hours and likely into tomorrow morning. We'll be looking to add another Theta fairy tonight once we see the reaction. Yesterday was a loss for me but I'd still take the same approach. All our day trades worked out well, even though the SPX needed an adjustment to work. I went bigger than normal on scalping because the movement (or so I thought) was going to be great. It ended up chopping me up most of the day and the internet outage in the early hours hurt. Trading without our tick strike audible order flow was tough and put me in a hole right out of the gate. Here's a look at my day. Let's take a look at the markets: Sell mode is still in place technically. We are now FIRMLY below the 50DMA on all our indices Theta fairy's seem to be back! Premium is rich now. They still need to be modified as a pure strangle is still too low of premium but they seem to be working. We've got another one on this morning that is already above our normal take profit level. We'll look to add another one this late afternoon after we see what NVDA earnings do to the futures. Today is part II of our training on the next four books in our master list. Join in on our live zoom feed. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.44% this morning, signaling a modest rebound from a bruising stretch of losses, while investors look ahead to an earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Home Depot (HD) slid over -6% and was the top percentage loser on the S&P 500 and Dow after the world’s largest home-improvement retailer reported weaker-than-expected Q3 comparable sales and cut its full-year earnings guidance. Also, chip stocks slumped, with Marvell Technology (MRVL) and Micron Technology (MU) falling more than -5%. In addition, Amazon.com (AMZN) sank more than -4% after Rothschild & Co. Redburn downgraded the stock to Neutral from Buy. On the bullish side, Medtronic Plc (MDT) climbed over +4% and was the top percentage gainer on the S&P 500 after the medical device maker posted upbeat FQ2 results and raised its full-year guidance. Economic data released on Tuesday showed that U.S. factory orders rose +1.4% m/m in August, in line with expectations. Also, data from ADP Research showed that U.S. companies shed an average of 2,500 jobs per week in the four weeks ending November 1st. Richmond Fed President Tom Barkin on Tuesday offered an upbeat outlook on inflation, while indicating the labor market may be softer than the available data suggest. Still, he did not indicate whether he will back another rate cut next month. Meanwhile, U.S. rate futures have priced in a 53.4% chance of no rate change and a 46.6% chance of a 25 basis point rate cut at the December FOMC meeting. Investors are eagerly awaiting Nvidia’s third-quarter earnings report, scheduled for release after the market close. The chipmaker’s earnings reports have been market-moving since May 2023, when it delivered the revenue growth forecast that reverberated globally. Skepticism toward the AI trade is now at its highest level since before Nvidia’s 2023 forecast, putting pressure on the company to deliver with its report. “We expect Nvidia to exceed estimates and provide future earnings and revenue guidance that is higher than investors expect. It’s unlikely that Nvidia has seen any slowdown in demand for its products, even with increased competition, given how early we are in the AI cycle,” said James Demmert at Main Street Research. Retailers such as TJX Companies (TJX), Lowe’s (LOW), and Target (TGT), along with cybersecurity firm Palo Alto Networks (PANW), are also set to report their quarterly figures today. Market watchers will also pay close attention to the publication of the Fed’s minutes from the October 28-29 meeting. The FOMC lowered its benchmark rate last month for the second time this year, though Chair Jerome Powell cautioned that a December reduction is far from a “foregone conclusion.” Since then, a faction of Fed officials has intensified warnings that progress on inflation could slow or stall, casting doubt on the prospects for another rate cut next month and underscoring a widening divide within the central bank. “We expect the minutes to show a deeply divided Fed with concerns over weaker employment picture but sticky inflation,” according to Mohit Kumar, chief economist and strategist for Europe at Jefferies. In addition, market participants will be anticipating speeches from Fed Governor Stephen Miran, Richmond Fed President Tom Barkin, and New York Fed President John Williams. On the economic data front, investors will focus on the August Trade Balance data, set to be released in a couple of hours. The data was originally scheduled for release on October 7th, but was delayed due to the government shutdown. Economists anticipate that the trade deficit will narrow to -$61.3 billion from -$78.3 billion in July. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.9 million barrels, compared to last week’s value of 6.4 million barrels. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.126%, up +0.10%. The SPX has been sliding in recent sessions, and the Volatility Risk Premium has jumped back into elevated territory, sitting near the upper end of its 3-month range. With IV marked as overvalued and VRP pushing above 5%, the options market is pricing in more short-term uncertainty than recent realized volatility supports. In the near term, this kind of setup often coincides with choppier price action as traders recalibrate to the richer volatility environment. The key focus now is whether VRP continues to rise—signal of persistent hedging demand, or quickly mean-reverts, which would hint that the recent volatility spike may be settling. The QQQ 5-day Swing Model is entering a more tactical zone, with price pulling back toward the model’s risk trigger near 575.96, a level that has historically acted as a short-term pivot. The lower band remains well below current pricing, but the recent drop toward mid-range suggests momentum has cooled. With the swing model showing a high historical success rate and the upper band sitting far above at 616.66, the next few sessions may hinge on whether QQQ stabilizes above the risk trigger or continues sliding toward the lower band that has captured most successful rebounds. Short-term traders often watch these inflection zones closely, as moves into or away from risk triggers tend to shape near-term directional bias. Wednesday

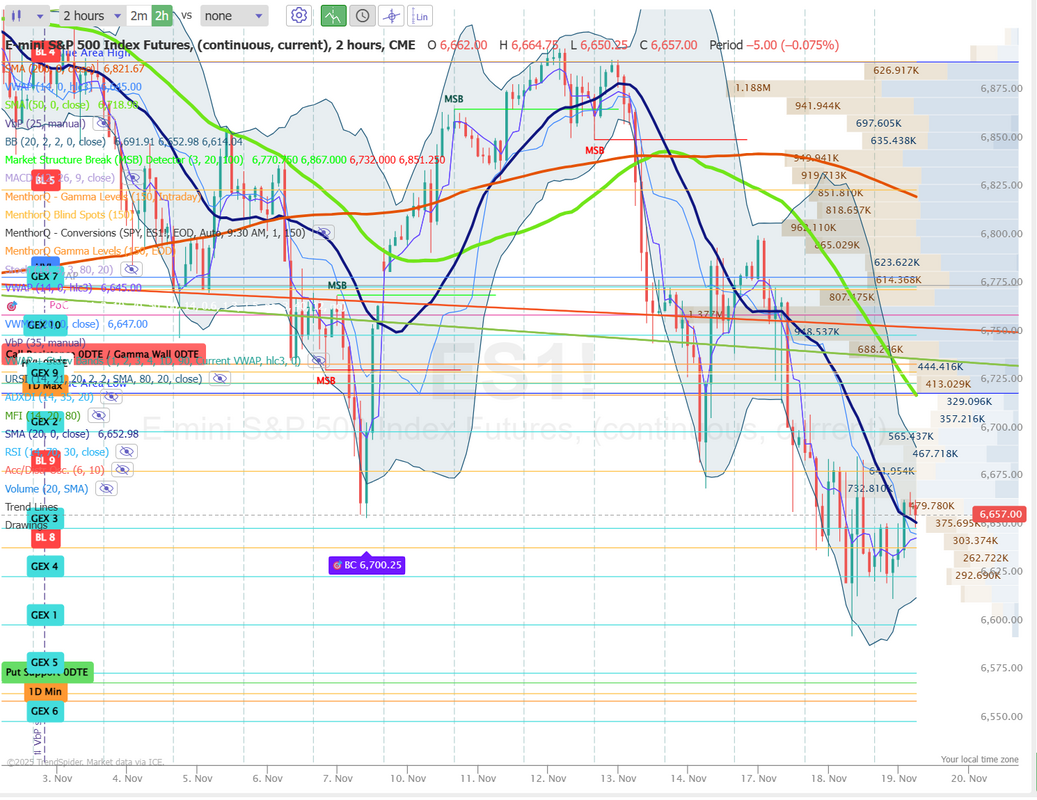

My lean or bias this morning is bearish once again. Much like yesterday, we may be a relief rally and futures are up as I type but technicals are bearish and being below the 50DMA you kind of have to go with the flow. Let's take a look at the intraday /ES levels for 0DTE's today. 6679, 6700, 6719 6735* (big gamma wall) are all resistance levels. 6650, 6640* (key support level yesterday), 6625, 6599* (key buying level) are all support levels. I look forward to seeing you all in the live trading room shortly. Our part II training should be another good one.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |