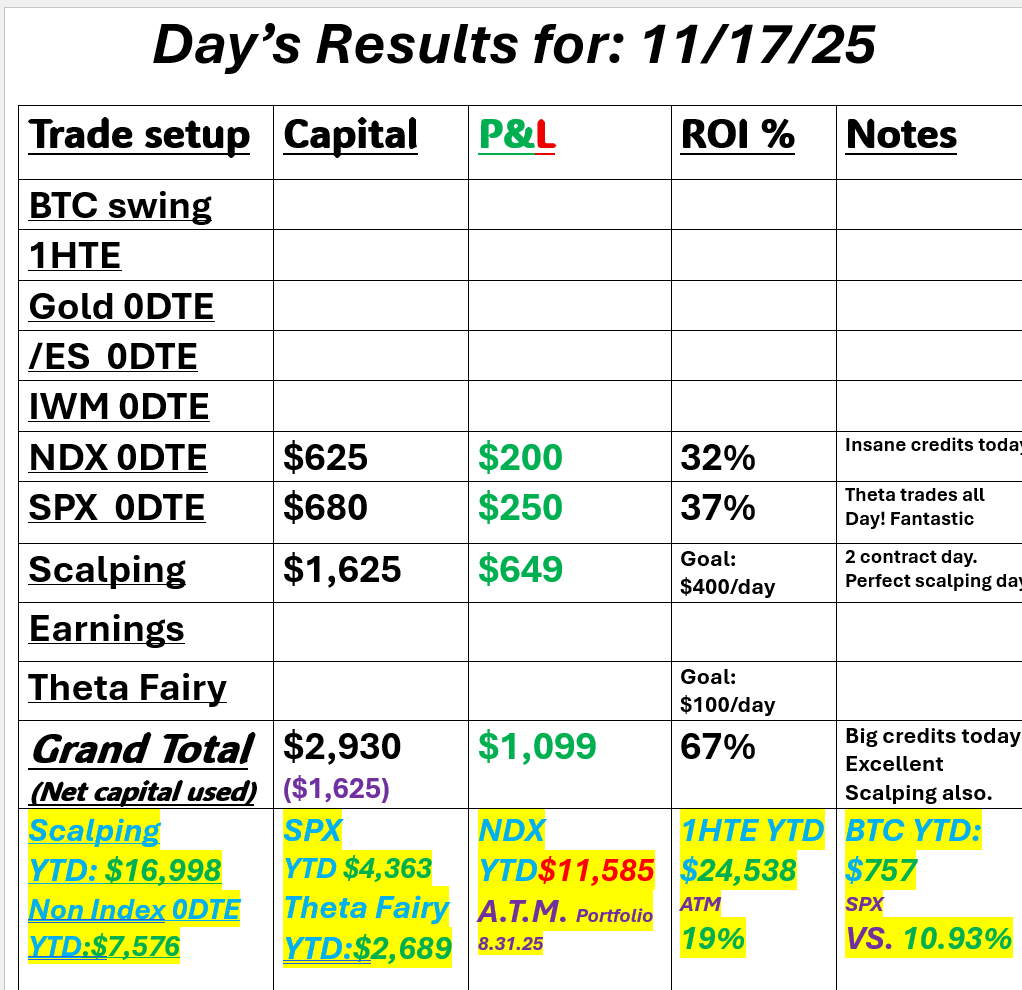

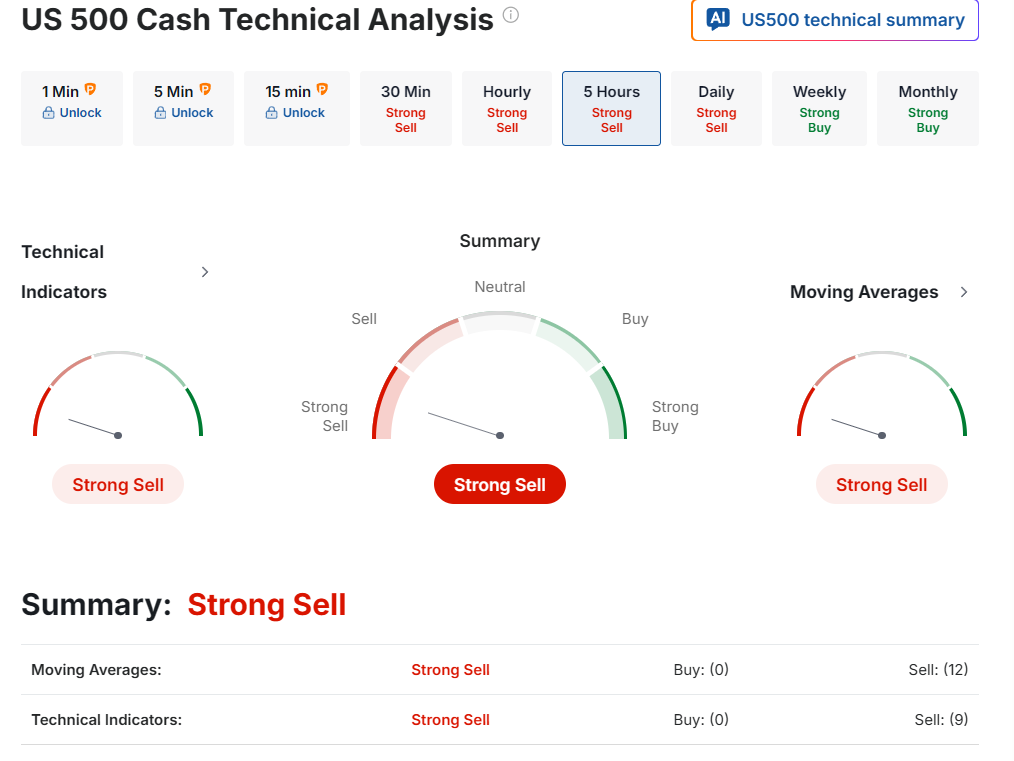

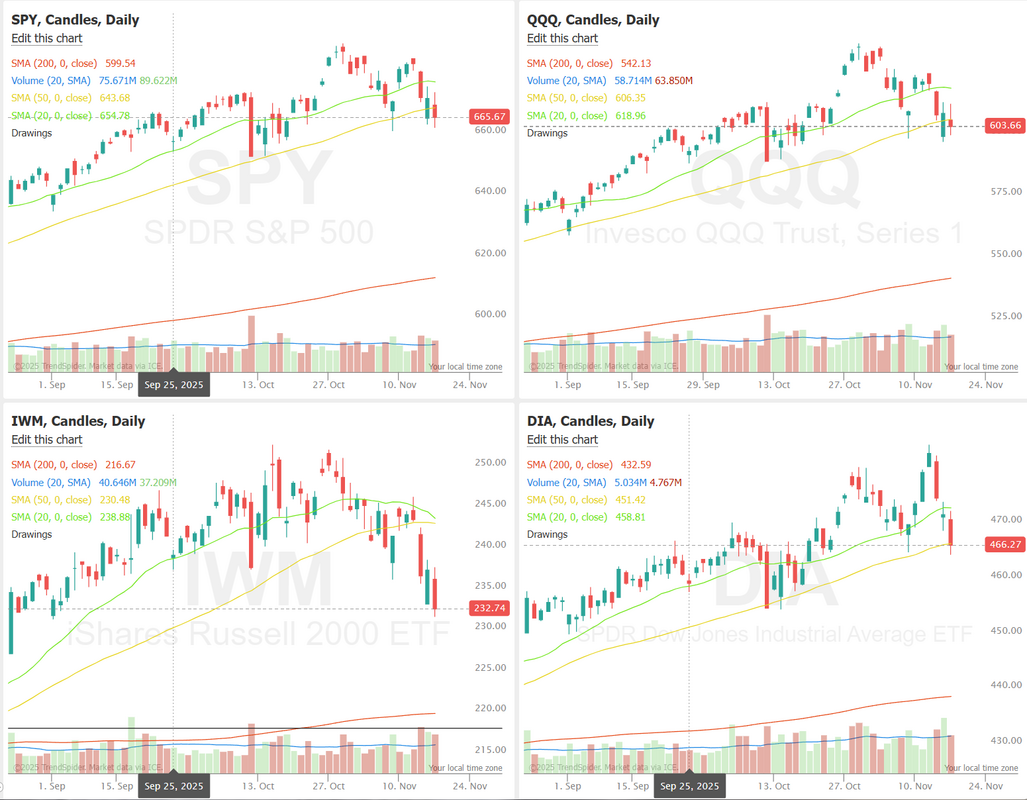

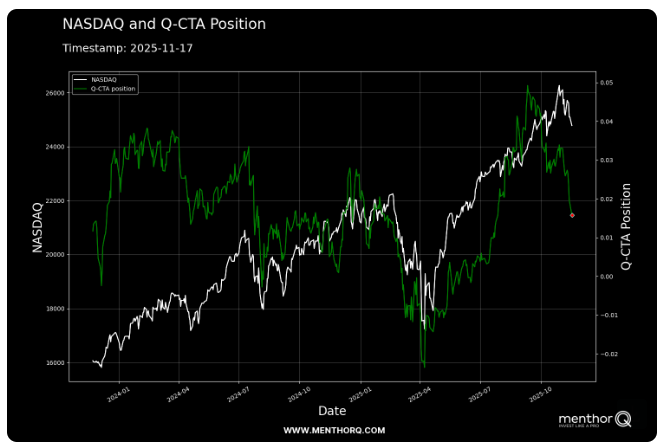

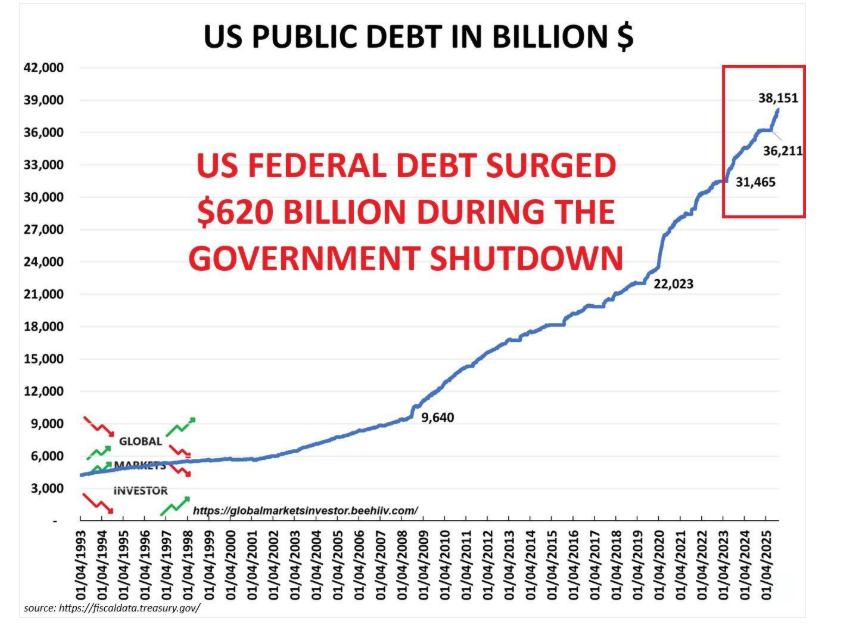

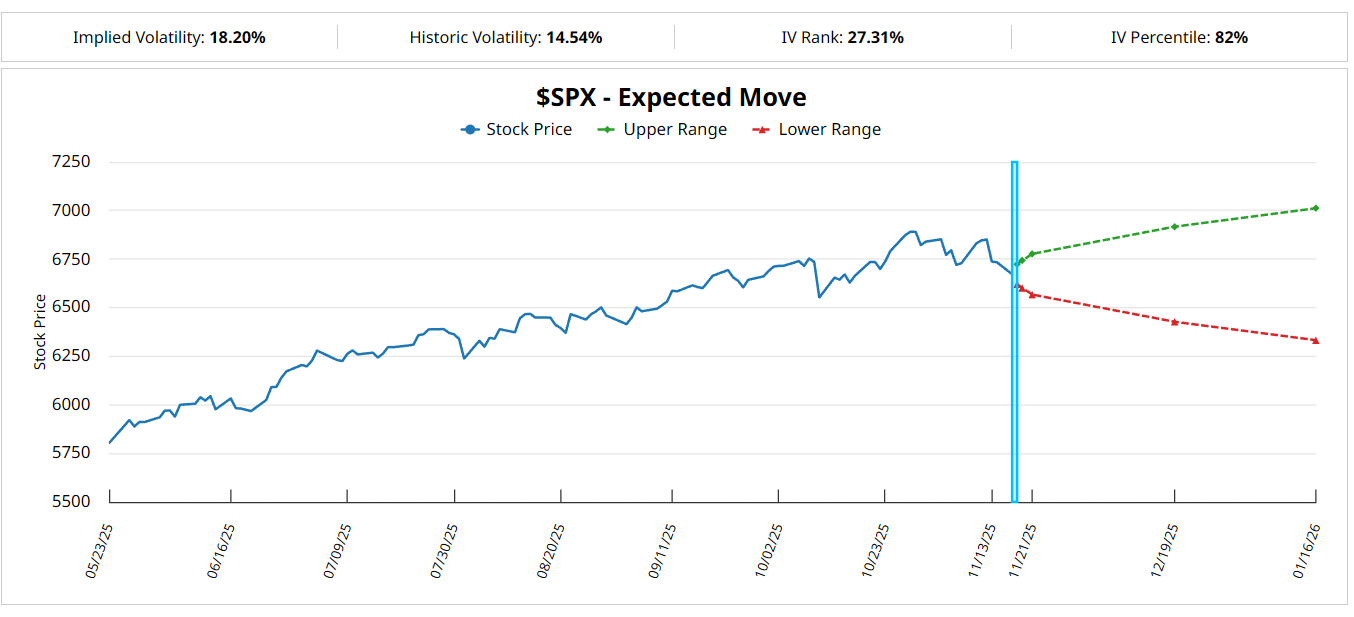

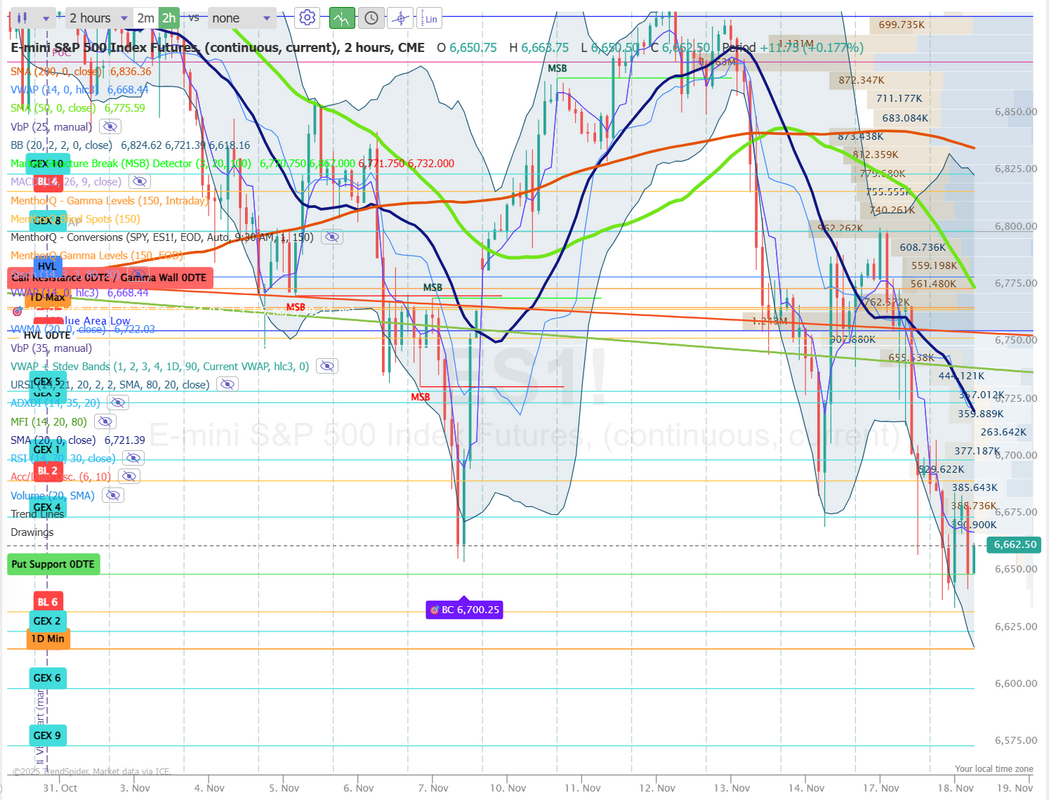

Ugly looking market=Beautiful profitsHow good was yesterday? Down markets are simply the best! It's everything we ask for, but it's more importantly, everything we are prepared for and set up to benefit from. Don't fear the reaper...be the reaper. Sorry, couldn't resist. Premium was just absolutely stellar. This is why we love down markets. It's been a long time since pure Theta trades made this much sense. We also had a solid day yesterday in our Asset allocation portfolio. It's built for days like this. Here's a look at our day yesterday. ATM portfolio was great. It was a scalpers paradise and 0DTE premium was rich. A 67% ROI on our used capital is extremely high without the help of debit trades. Let's take a look at the markets. It's not surprising, that the technicals are pointing bearish. Something very big happened yesterday. We broke below the 50DMA on all the indices we track and trade. This hasn't happened in months and can be viewed as very bearish. The SPX is pulling back from its recent highs, and the option score has slipped toward the lower end of its range, reflecting a cooling in short-term bullish appetite. Price action shows a series of lower highs forming over the past several sessions, hinting at a shift in momentum as sellers become more active on bounces. In the near term, the index appears to be consolidating between roughly 6,650 and 6,750, with repeated failures to reclaim the upper end of that zone. A continued low option score suggests hedging demand may be elevated, which can keep intraday swings choppy. Traders watching the short term may focus on whether SPX can stabilize above recent support or if another dip in the option score precedes a retest of last week’s lower levels. Systematic flows in the Nasdaq appear to be rolling over, with the Q-CTA position trending lower just as the index itself shows signs of losing momentum after its recent peak. The sharp pullback in model-driven exposure suggests that trend-following programs are reducing risk as upside conviction softens. In the short term, this reduction in systematic demand could leave the index more sensitive to broader market volatility, especially if price continues to drift away from recent highs. Traders may watch whether Q-CTA positioning stabilizes or continues to unwind, as that shift often influences short-term liquidity and directional pressure. December S&P 500 E-Mini futures (ESZ25) are trending down -0.31% this morning as investors continue to unload risk assets while awaiting Nvidia’s earnings and a pivotal U.S. jobs report. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Dell Technologies (DELL) plunged over -8% and was the top percentage loser on the S&P 500 after Morgan Stanley double-downgraded the stock to Underweight from Overweight with a price target of $110. Also, most chip stocks slumped, with Qualcomm (QCOM) sliding more than -4% and Marvell Technology (MRVL) falling over -3%. In addition, Hewlett Packard Enterprise (HPE) dropped more than -7% after Morgan Stanley downgraded the stock to Equal Weight from Overweight. On the bullish side, Alphabet (GOOGL) rose over +3% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Berkshire Hathaway disclosed a $4.9 billion stake in Google’s parent. Economic data released on Monday showed that the Empire State manufacturing index unexpectedly rose to a 1-year high of 18.70 in November, stronger than expectations of 6.10. Also, U.S. construction spending unexpectedly rose +0.2% m/m in August, stronger than expectations of -0.2% m/m. Fed Vice Chair Philip Jefferson said on Monday that risks to the labor market appear tilted to the downside, while reiterating that policymakers should move cautiously as interest rates approach neutral. At the same time, Fed Governor Christopher Waller reiterated his view that the central bank should lower interest rates again in December, pointing to a weak labor market. Meanwhile, initial jobless claims came in at 232K for the week ending October 18th, according to the Labor Department’s website. Data for the prior three weeks were not available. U.S. rate futures have priced in a 53.6% probability of no rate change and a 46.4% chance of a 25 basis point rate cut at the conclusion of the Fed’s December meeting. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. The report was originally scheduled for release on October 2nd, but was delayed due to the government shutdown. Economists expect this figure to rise +1.4% m/m in August, following a -1.3% m/m drop in July. Market participants will also parse comments today from Fed Governor Michael Barr and Richmond Fed President Tom Barkin. On the earnings front, home improvement chain Home Depot (HD) is slated to release its Q3 results today. Earnings reports from big retailers throughout the week will provide additional insight into the health of the economy. Investor attention for the remainder of the week is squarely focused on Nvidia’s earnings report and the delayed September jobs report, with both events set to play a key role in shaping the outlook for markets throughout the rest of 2025. “The monthly jobs report would normally dominate this week’s economic calendar, but with the AI trade struggling the past couple of weeks, Nvidia’s earnings are once again looking like a key piece of the market’s momentum puzzle,” said Chris Larkin at E*Trade from Morgan Stanley. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.108%, down -0.56%. The US federal debt surged +$620 billion during the 43-day government shutdown, to a record $38.151 trillion. This marks a +$14.4 billion increase per day. The break in directional correlation between $SPX & $BTC quite profound. Happens rarely. Considering the depth of the sell off in crypto $SPX actually holding up quite well. So far. Risk is it spreads of course, flip side: Once $BTC bottoms markets could rip higher with it. TBD. This is absolutely WILD: Retail investors have BOUGHT THE DIP every single week in 2025 whenever the S&P 500 fell over -1%, the 6th consecutive year their dip-buying rate stayed above 50. Meanwhile, institutional investors became dip buyers for the first time since 2019. Guess what? Premium is back! Did I mention that? That means our vaunted Theta Fairy trade is back in play! We've got a modified version working for us today and likely will be able to get another one working this evening so keep your alerts on in discord for the working timestamp post. Yesterday we had a solid (and long) training session on part I of the top 12 books every trader should read. Tomorrow we start part II. Make sure to tune in. Implied I.V. is up in the 82% percentile. Should be another good day for premium collection. My lean or bias today is bearish. It kind of has to be. We've had a lot of selling the past few days, so a rebound could be in the cards, but technicals are ugly, and we are below the 50DMA. Plus, who doesn't love a down market? Let's look at the intraday /ES levels for 0DTE setups today. 6675, 6691, 6700, 6725,6731 are resistance levels. 6650, 6633, 6625, 6618, 660, 6574 are support. I look forward to seeing you all today in the live trading room. The market looks like it's shaping up to give us an ample opportunity to make a nice profit again today. Now it's up to us to capitalize on that opportunity.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |