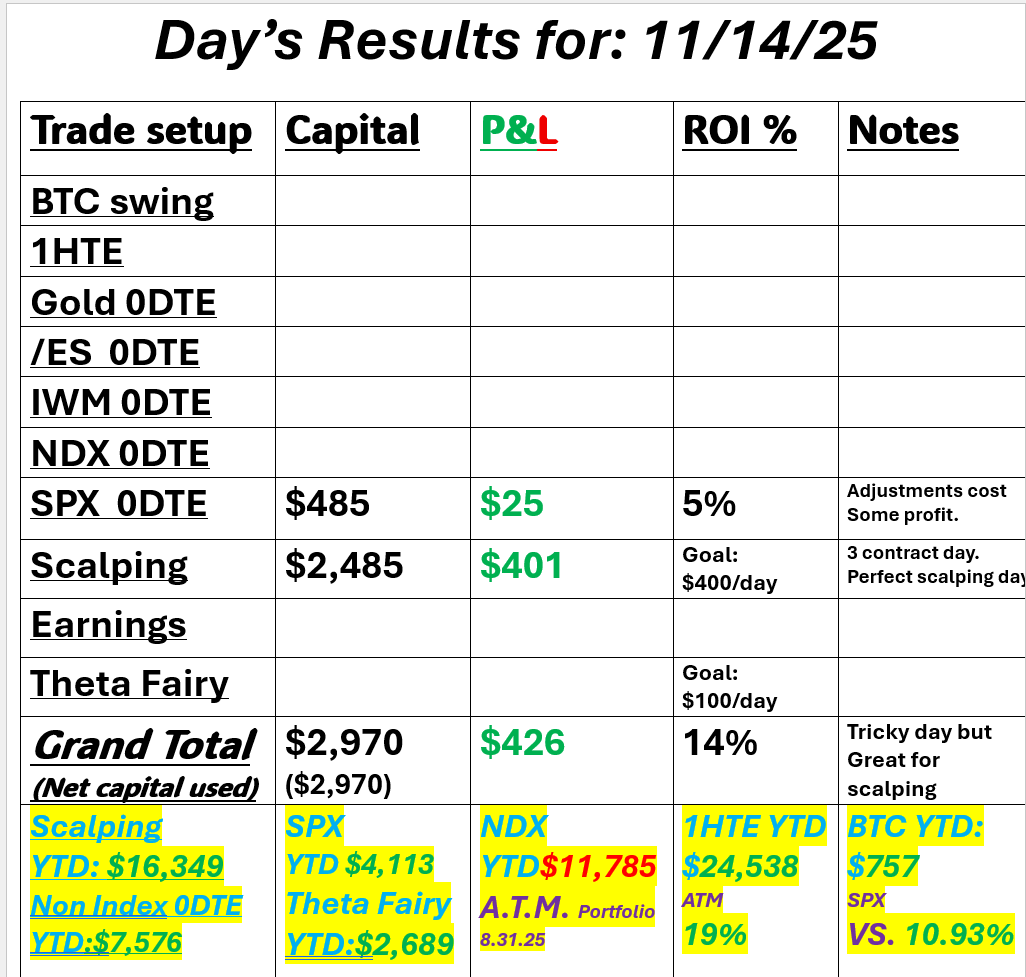

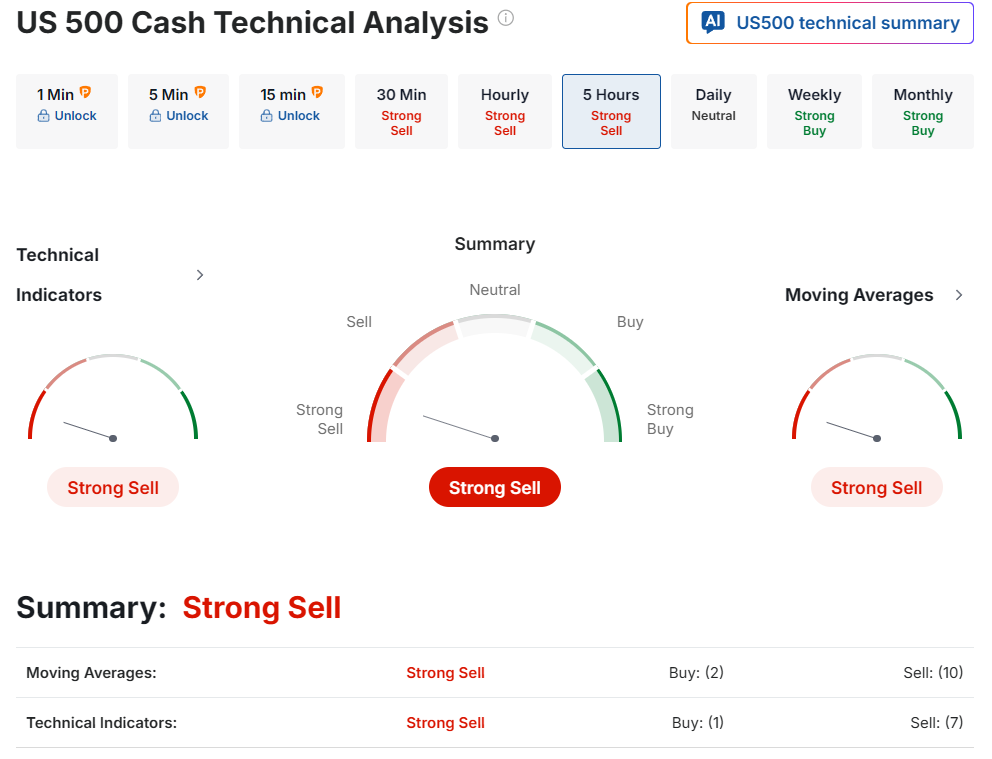

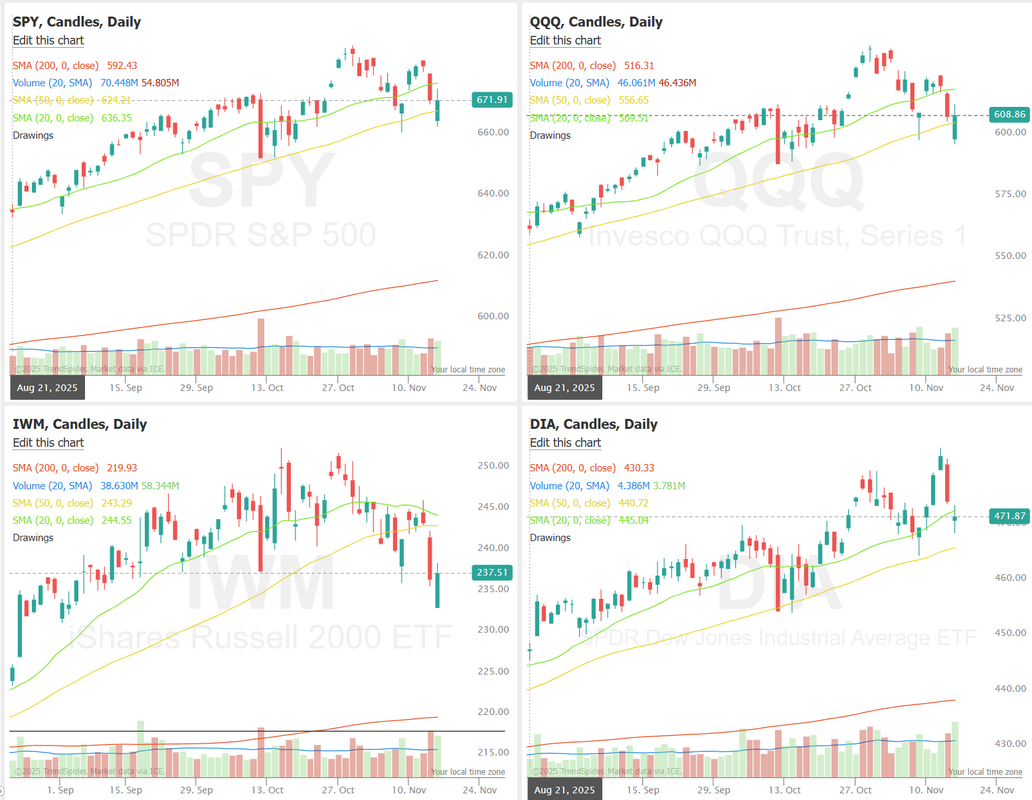

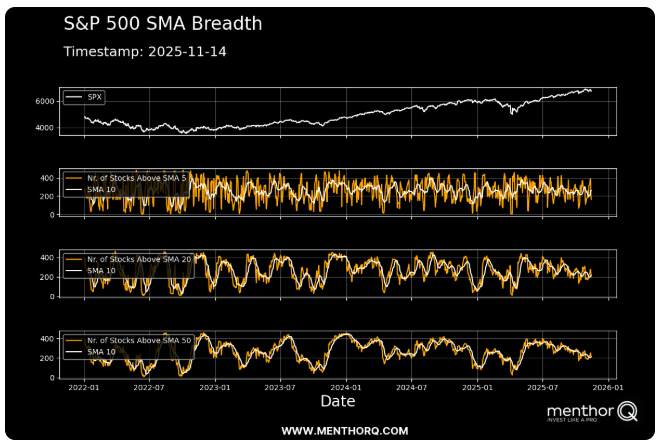

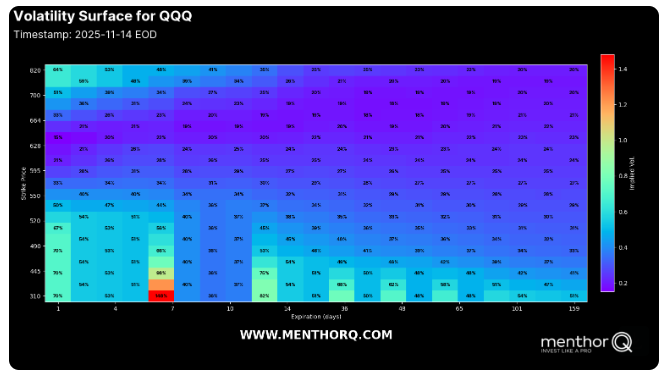

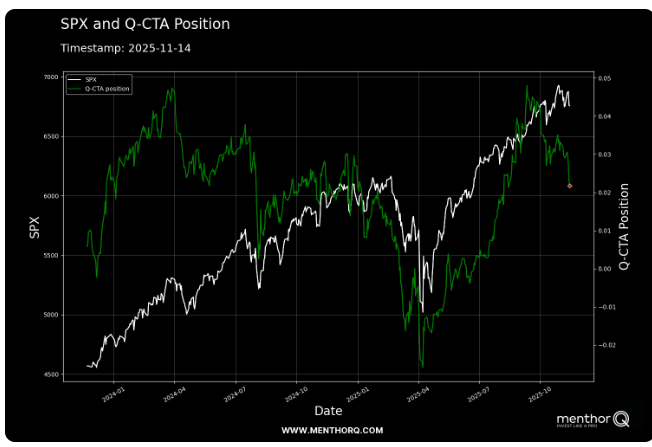

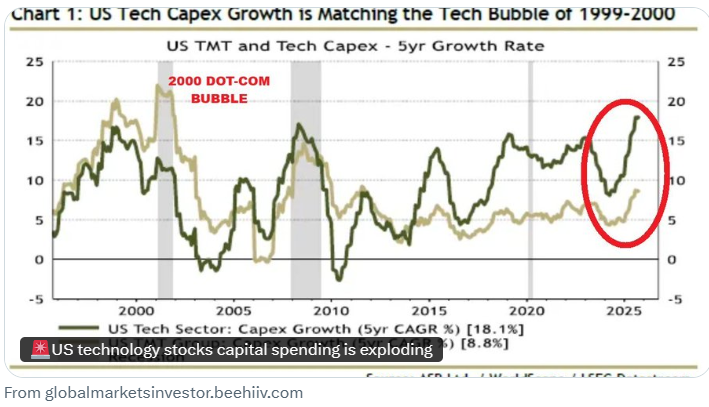

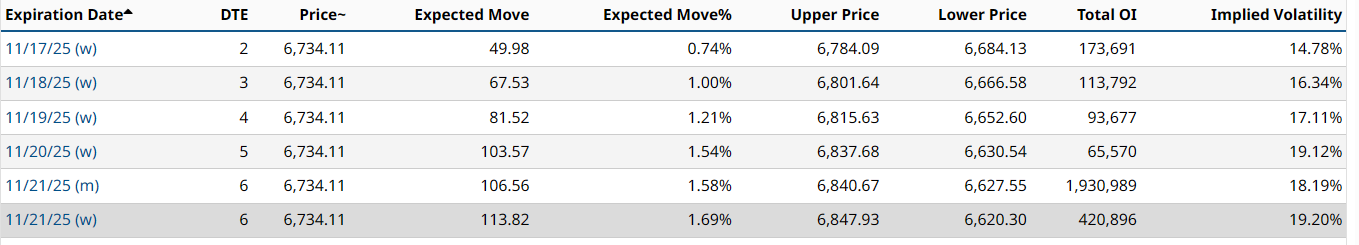

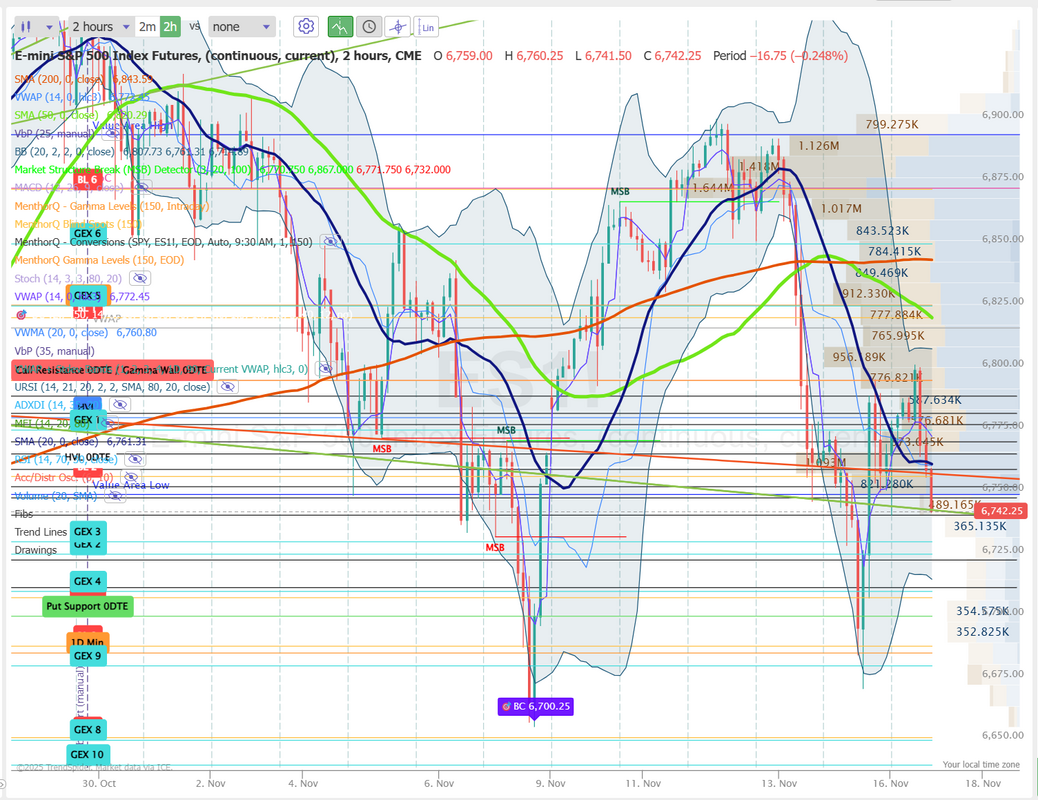

The data flow is back on.Finally, after more than a month without any economic data the spigot gets turned back on. It appears some of the data will be truncated but it's a step in the right direction. We've got NVDA earnings this week which may be even more important but it's looking less and less likely we get a rate cut next month. What a tricky day Friday. Bearish action in the morning with a big reversal later in the day. The market is in the throws of trying to divine a direction. We had to adjust our SPX which cut most of our profit potential there however it was a great day for scalping...again. Also, our ATM portfolio continues to hold up well to all this movement. We are not quite back to a new ATH there yet but we are close. Here's a look at our trades for Friday. Today may be an interesting day for an NDX 0DTE. Premium is rich. Let's take a look at the markets. We start the day off with a sell signal technically. Really interesting candles from Friday. They are green because futures started low and we finished higher by end of day but it was still a down day. The trend still continues to look bearish to me. The latest SPX breadth readings across the 5-, 20-, and 50-day SMAs show a short-term improvement in participation, with the number of stocks trading above their respective moving averages stabilizing after a recent pullback. The 5-day breadth is especially choppy but has begun to turn higher, suggesting a pickup in very near-term buying pressure. The 20- and 50-day breadth measures remain in mid-range territory, indicating that while broader momentum hasn’t fully shifted, selling pressure has eased. In the short term, traders may watch whether these breadth lines continue pushing above their 10-day smoothers, continued follow-through would signal strengthening internal support for the index’s recent bounce, while a quick rollover would hint at fragility beneath the surface. The QQQ volatility surface shows a clear skew toward elevated implied volatility at the very short-dated expirations, especially for deep out-of-the-money puts, where IV spikes above 70% and even over 100% in isolated strikes. This indicates strong demand for near-term downside protection, often a sign that traders are bracing for short-horizon catalysts or increased index movement. As expirations extend beyond two weeks, the surface flattens considerably, suggesting expectations for volatility to normalize over time. In the short term, the contrast between high front-end IV and relatively steady longer-dated levels highlights a market leaning defensive in the immediate window but not committing to a sustained volatility regime shift. The SPX continues to hold near recent highs, but the Q-CTA positioning line has rolled over sharply, showing a clear reduction in systematic long exposure. This type of divergence price holding up while trend-following models begin to pare risk, often reflects fading momentum beneath the surface. In the short term, systematic flows may be less supportive than in previous weeks, which could leave the index more sensitive to volatility spikes or macro headlines. While not predictive on its own, the shift in Q-CTA positioning suggests a more cautious posture from rules-based strategies as the market navigates this elevated zone. Monday news catalysts. US tech CAPEX is EXPLODING: Tech capital expenditure has grown more over the last 5 years than during the 2000 dot-com bubble. Is this sustainable and will it pay off? Is this AI CapEx bubble and will burst? This week we'll have a three part training on the top 12 books traders should read. We'll hit four each training session, Mon. Weds. Thurs. on our live zoom feed. Make sure to join in. These are always beneficial. Expected move for the SPX this week is 1.69%. That's some good premium. Credit trades may make more sense this week. December S&P 500 E-Mini futures (ESZ25) are up +0.02%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.09% this morning, pointing to a muted open on Wall Street as cautious sentiment prevailed at the start of a busy week. Investor focus this week is on an earnings report from AI bellwether Nvidia, the minutes of the Federal Reserve’s latest policy meeting, and the release of long-delayed U.S. jobs data. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Most semiconductor stocks fell, with Lam Research (LRCX) sliding over -3% and ON Semiconductor (ON) dropping more than -2%. Also, Stubhub Holdings (STUB) tumbled about -21% after the company did not provide guidance for the current quarter. In addition, Bristol-Myers Squibb (BMY) slipped more than -4% after ending a trial of its experimental drug milvexian for stroke and blood-clot prevention due to disappointing data. On the bullish side, DoorDash (DASH) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Needham called the stock’s recent pullback a buying opportunity and reiterated its Buy rating with a $275 price target. “The general trend has been to buy the dip, which could provide a respite. Retail investors may be spooked temporarily, but are likely to come back in if they believe the long-term story driving many of the names that have been gutted remains intact,” said Melissa Brown at SimCorp. Kansas City Fed President Jeff Schmid said on Friday that further interest rate cuts could do more to entrench higher inflation than to support the labor market. Also, Dallas Fed President Lorie Logan said, “I think it would be hard to support another rate cut unless we were to get convincing evidence that inflation is really coming down faster than my expectations or that we were seeing more than the gradual cooling that we’ve been seeing in the labor market.” In addition, Atlanta Fed President Raphael Bostic indicated that although he backed the most recent two rate cuts, he wasn’t yet persuaded about another move next month. Meanwhile, U.S. rate futures have priced in a 55.4% chance of no rate change and a 44.6% chance of a 25 basis point rate cut at the next FOMC meeting in December. In tariff news, the White House removed duties on imported coffee, bananas, and beef on Friday amid surging prices for some grocery staples. All eyes will be on Nvidia (NVDA) this week, dubbed “the most important stock on Earth” by Goldman Sachs, as the semiconductor giant reports its quarterly earnings on Wednesday. Nvidia’s earnings reports have been market-moving since May 2023, when the company delivered the revenue growth forecast that reverberated globally. Skepticism toward the AI trade is now at its highest level since before Nvidia’s 2023 forecast, putting pressure on the company to deliver with its upcoming report. Retailers such as Walmart (WMT), Home Depot (HD), TJX Companies (TJX), Lowe’s (LOW), and Target (TGT), along with notable companies like Palo Alto Networks (PANW), Intuit (INTU), and Copart (CPRT), are also set to release their quarterly results this week. Market participants continue to await further updates to economic data calendars from official statistics agencies. The Bureau of Labor Statistics said it will publish the September jobs report on Thursday, and the Census Bureau announced it will proceed with releasing reports on August construction spending, factory orders, and the trade balance. The data will gradually help clarify the state of the U.S. economy, though they’ll be more backward-looking than usual. Investors will also monitor private-sector data this week, including preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity, the National Association of Realtors’ existing home sales data, and the University of Michigan’s Consumer Sentiment Index. In addition, market watchers will parse the Fed’s minutes from the October 28-29 meeting, set for release on Wednesday, amid growing concerns over the central bank’s ability to cut interest rates next month. The FOMC lowered its benchmark rate last month for the second time this year, though Chair Jerome Powell cautioned that a December reduction is far from a “foregone conclusion.” Since then, a slew of Fed officials have voiced skepticism about the need for a rate cut next month, citing lingering uncertainty about inflation. Investors will hear perspectives from Fed officials Jefferson, Waller, Williams, Barr, Hammack, Cook, Goolsbee, Paulson, and Logan throughout the week. Today, investors will focus on the New York Fed-compiled Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists expect the November figure to come in at 6.10, compared to 10.70 in October. The construction spending report for August will also be released today. Economists forecast this figure to be -0.2% m/m, compared to -0.1% m/m in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.127%, down -0.53%. My lean or bias today is bearish. I think the bulls are starting to take center stage here. Let's see if they can run with it. We can only hope! Let's take a look at the intraday /ES levels: Lots of tight levels this morning. 6752, 6759, 6765, 6770, 6777, 6781 are resistance levels. 6741, 6732, 6730, 6725, 6722, 6711 are support. Let's make it happen today folks. I look forward to seeing you shortly in the live trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |