|

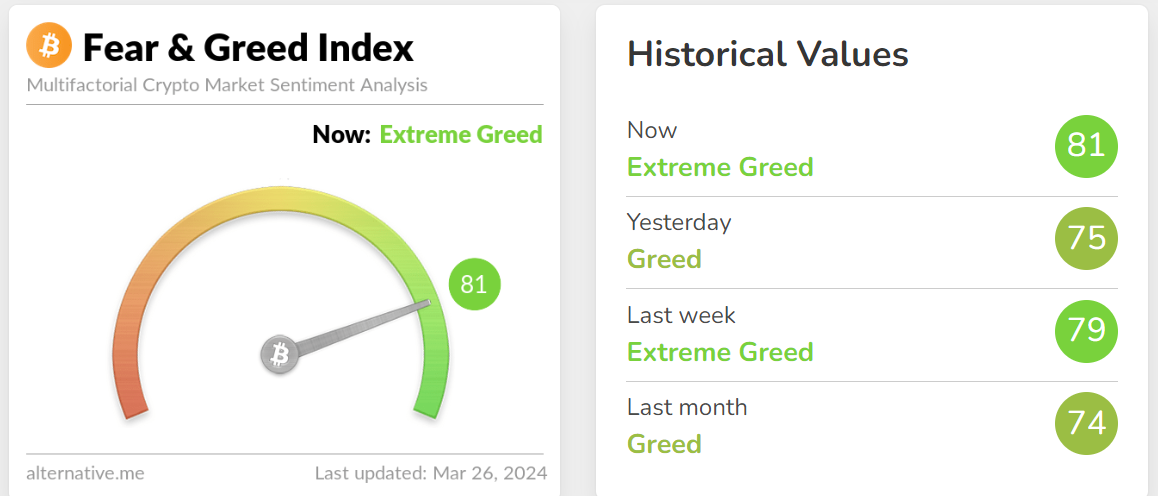

Good morning traders! I missed Mondays update with some technical issues but I'm back today. Friday was another solid day for us and I finished the week up 9k total on net liq. We went 15 for 15 with wins on our 0DTE's last week. Thats a tough goal to repeat but yesterday we went 4 for 4 for $1,300 proft on about 12k of buying power. As we talked about in our live zoom yesterday, I.V. is incredibly low this week with the absence of major pre-planned news items and the short holiday trading schedule. Our trade docket for today is as follows: BA, IWM?, MKC, MSTR, PFE, SBUX, SMCI, SPX/NDX/Event contract 0DTE, XBI, GME, CCL?, PAYX, /ZW, /HE, 2DTE butterfly on SPX. Markets are back to buy signal again. However, its not that strong. Most of the major indices we trade look a little tired here. Point in fact. We re-initiated our monthly VTI swing trade (which is one of my favorites and on track this year for our 36%-50% ROI target) with a bearish slant for the first time this year. We look for three indicators to cross and give us a directional bias. Its bearish right now. If you look at the expected move for SPY, even taking into account the shortened trading week, its pretty pitiful. Hence the 2DTE Butterfly we'll put on today. Fear and Greed index is still stuck in the Greed area. What's possibly more interesting is the fear and greed index on crypto. Bitcoin is pushing back to ATH and it doesn't look like it wants to stop. As I've said before. I've never been a big "Crypto guy" but I have thrown $400-$500 dollars a month into crypto over the last few years. I stopped when my balance reached $4,000 dollars. Its spread across BTC, ETH, DOT. Its now at $17,000 value. Who knows where crypo will end up but its certainly been bullish lately. All one has to do it look at the fear and greed index on crypto to know what people are thinking. 5300 seems to be the volume profile target for today on /ES My lean for today, and probably for the rest of this week (unless we get some sort of catalyst) is neutral to slightly bullish. My intra day levels:

/ES; 5303/5312/5325/5339 to the upside. 5292/5281/5263/5249 to the downside. /NQ; 18704/18792/18868/18911 to the upside. 18570/18505/18445/18417 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |