|

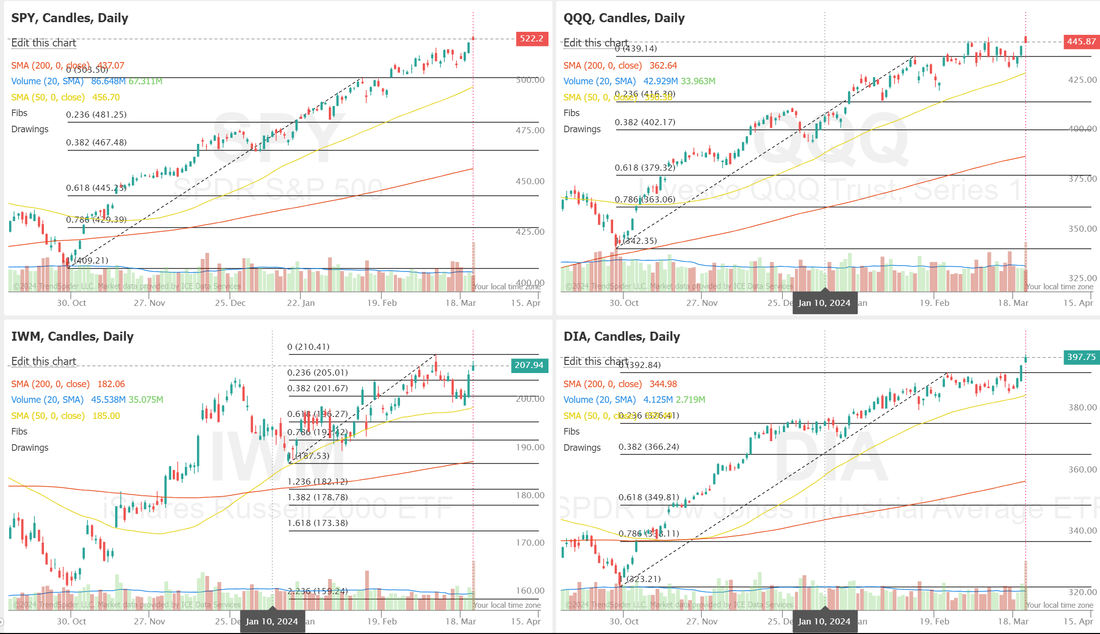

Good morning traders! Welcome to the "gateway to the weekend". We've had a great week so far so it was probably expected that yesterday I would struggle. My net liq was down $7,900 at the close. We have a couple trades that have pretty large leverage in them. MSTR, DIA, NVDA. MSTR continues to work for us and while its volatile we continue to bring in a nice cash flow. DIA just continues to push. We've added a couple long calls and thats helped a bunch but we are back to chasing it again. NVDA gave us a great week but yesterday it was $5,600 of my $7,900 drawdown on net liq. We have been successful in booking profits on the Iron Condor portion of that trade so our buying power continues to drop, which is helpful. 0DTE's were also a mixed bag. NDX scored a $790 profit on $4,200 of capital. Event contract 0DTE scored a 4% ROI but again, I was only filled on $1,000 worth. We have found a ton of value in these contracts. Our SPX was close to a big score. How close? Pretty close. We rolled a small put side to today so we have a decent chance of redeeming ourselves today. These 0DTE's have been built with lower risk but also lower probability. Our NVDA continues to hold the most extrinsic. That trade looks wonderful where its at but as I.V. increases, it affects both side of the trade. We have three earnings trades to exit this morning. NKE, FDX, LULU. That should give us some nice buying power back headed into the weekend. Markets continue their bullish push DIA is the big break out story. Market concentration hasn't been this grouped up since the 1930's. The saying now is, "its different. It's A.I." Maybe, but we continue to see a few big cap companies shouldering most of the work to push us higher. A big part of the 2000 tech bubble crash was the large concentration to tech. When that let loose so did everything else. I don't think A.I. is a fad or going away but valuation may come down and the implication is bearish for the overall market. One interesting new ETF that we've incorporated into our ATM asset allocation model is ticker XDTE. This is the SPY with 0DTE covered calls written on it. Pretty inovative. You can see the white paper here. www.roundhillinvestments.com/assets/pdfs/xdte_etf_fact_sheet.pdf Tim Maloney, the founder of Roundhill Investments is a great guy. They have a bunch of inovative ETF's. Check them out when you have time. My bias is bearish today. I belive we are due a retrace. Intra-day levels for me:

/ES; 5301/5322/5343/5352 to the upside. 5288/5267/5251/5233 to the downside. /NQ; 18610/18705/18800/18869 to the upside. 18445/18397/18333/18265 to the downside. Trade docket for today is a usual Friday. Primarily we look to lock in profits and derisk the portfolio. Free up our buying power in preparation for Monday when we all start it over. BA, FDX, LULU, NVDA, QQQ, SMCI, SPX/NDX/Event contract 0DTE's, AAPL

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |