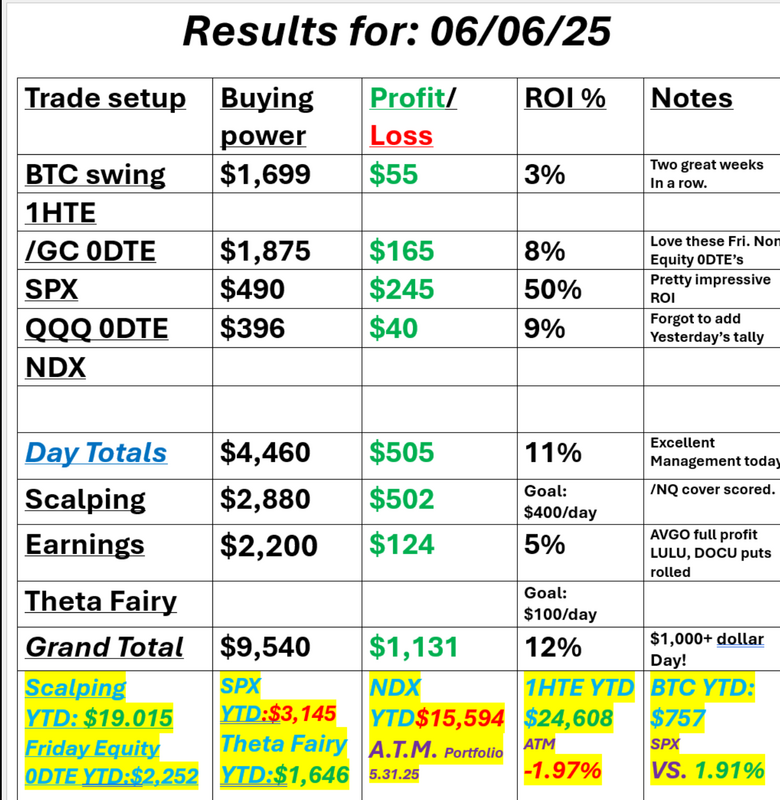

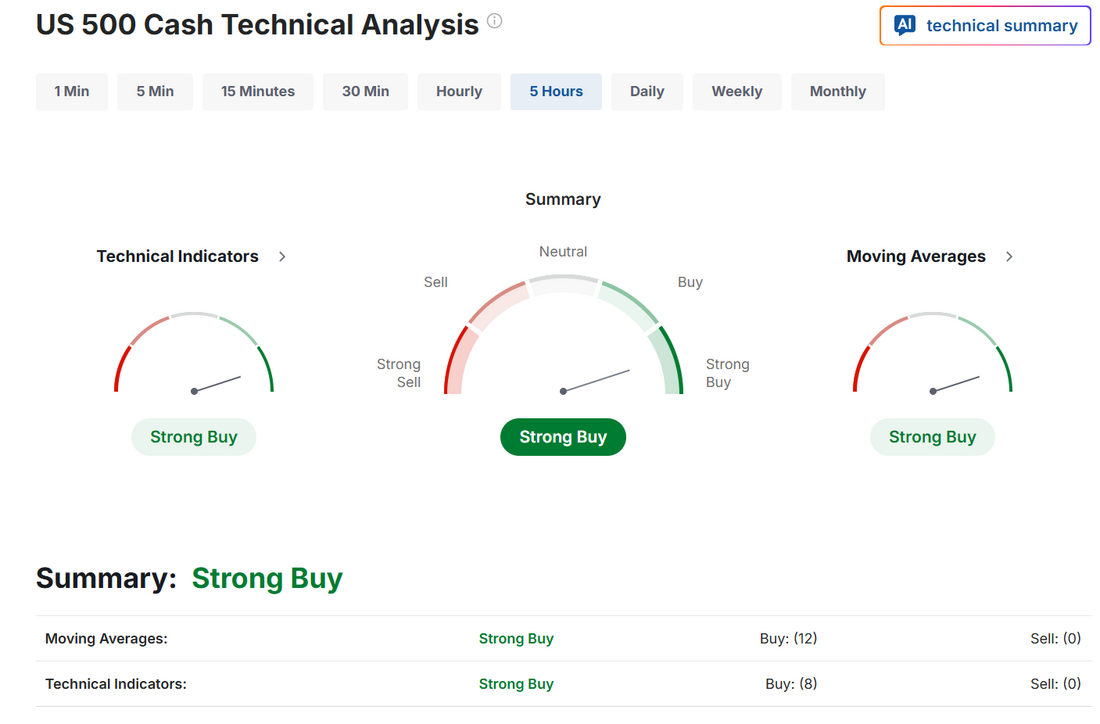

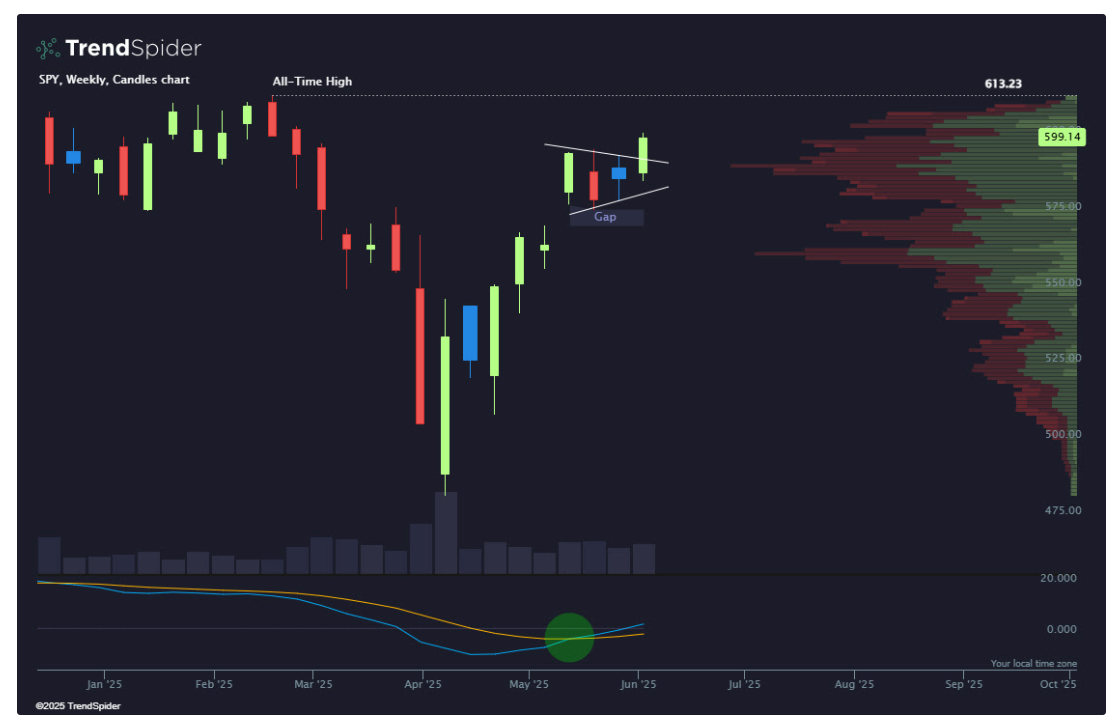

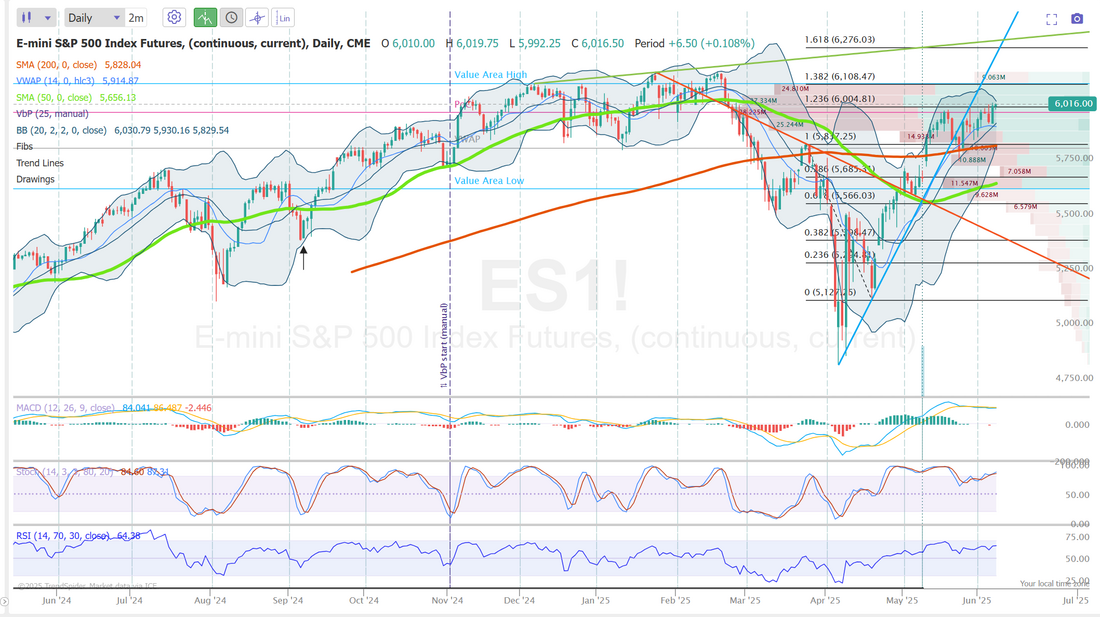

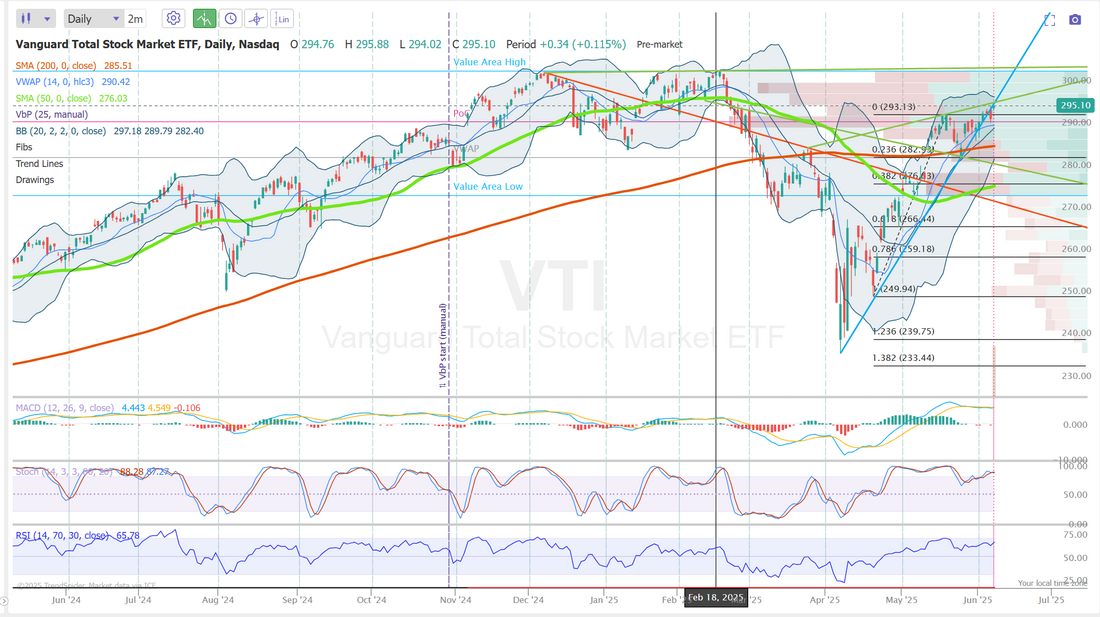

One big deal is all we need.Welcome back traders to a new week. China/USA talks are in focus today. We'll also get CPI and PPI later this week. I feel like one "real" deal. An agreement with China would , of course, be huge. We had a solid day on Friday. Nothing really hit big but it all added up at the end of the day for a $1,000+ profit result. Here's a look at our results below: Let's take a look at the markets to start the week. Fridays push higher was enough to get our technicals back into bullish mode. Futures are flat to slightly up this morning. The indices are stretching for some fresh air up above this level. Can it stretch it out today? We keep waiting for a breakout. June S&P 500 E-Mini futures (ESM25) are up +0.08%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.01% this morning, pointing to a muted open on Wall Street as investors turn their attention to talks between the U.S. and China in London, and also await the release of key U.S. inflation data later in the week. Top officials from the U.S. and China meet in London today for talks that investors hope will signal progress toward easing trade tensions between the world’s two largest economies. The talks come after a call between U.S. President Donald Trump and Chinese leader Xi Jinping last week, in which the two agreed to resume discussions on tariffs following a temporary truce reached in mid-May. “The meeting should go very well,” Trump wrote on Truth Social on Saturday. The U.S. president told reporters on Friday that negotiations with Beijing were “very far advanced.” In Friday’s trading session, Wall Street’s major equity averages ended in the green, with the benchmark S&P 500 notching a 3-1/2 month high and the blue-chip Dow posting a 3-month high. The Magnificent Seven stocks advanced, with Alphabet (GOOGL) rising over +3% and Amazon.com (AMZN) gaining more than +2%. Also, chip stocks gained ground, with Marvell Technology (MRVL) climbing nearly +5% and Micron Technology (MU) rising over +2%. In addition, Tesla (TSLA) gained more than +3% after CEO Elon Musk indicated he would ease tensions with President Trump following Thursday’s heated spat. On the bearish side, Lululemon Athletica (LULU) tumbled over -19% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the retailer cut its full-year EPS guidance. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 139K in May, stronger than expectations of 126K. Also, U.S. May average hourly earnings rose +0.4% m/m and +3.9% y/y, stronger than expectations of +0.3% m/m and +3.7% y/y. In addition, the U.S. unemployment rate was unchanged at 4.2% in May, in line with expectations. Finally, U.S. consumer credit rose $17.87B in April, stronger than expectations of $11.30B. “While [the labor market] may not be firing on all cylinders, it’s far from showing signs of a major breakdown. [Friday’s] solid labor report buys the Fed more time, but Chair Jerome Powell may have a hard time justifying a restrictive rate policy should inflation continue lower,” said Bret Kenwell at eToro. Philadelphia Fed President Patrick Harker said on Friday that there may be a path to cutting rates in the second half of the year, but reiterated that officials should hold steady for now and wait for uncertainty to subside. “For now, I am strongly of the belief we sit here, let some of this uncertainty resolve itself,” he said. U.S. rate futures have priced in a 99.9% probability of no rate change at next week’s monetary policy meeting. The U.S. consumer inflation report for May will be the main highlight this week. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Barclays economists said in a note that they anticipate the inflation data will show “the first signs of tariff-related price pressures.” They expect upward price pressures on “a wide range of core goods categories,” such as apparel, household furnishings, new vehicles, and other goods. Also, investors will be keeping an eye on other economic data releases, including the U.S. PPI, the Core PPI, Initial Jobless Claims, Crude Oil Inventories, and the University of Michigan’s Consumer Sentiment Index (preliminary). Market participants will also focus on earnings reports from several notable companies, with Adobe (ADBE), Oracle (ORCL), Chewy (CHWY), and GameStop (GME) scheduled to release their quarterly results this week. U.S. central bankers are in a media blackout period before the June 17-18 policy meeting, so they are prohibited from making public comments this week. Despite President Trump’s push to pressure central bankers into swiftly cutting interest rates, Fed Chair Jerome Powell and his colleagues have signaled they have time to evaluate the effects of trade policy on the economy, inflation, and employment. Meanwhile, Apple (AAPL) kicks off its annual Worldwide Developers Conference today in Cupertino, California. The event is expected to feature the company’s new products, services, and partnerships. Today, investors will also focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final April figure to be unchanged m/m, compared to +0.4% m/m in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.483%, down -0.69%. SPY closed the week at $599.14 (+1.66%), with bulls firmly in control above the bullish gap and continuing to press through resistance. The index managed to push through last week’s inside candle and close above a high-volume node, which had previously acted as resistance. With that area of high activity now below the current price, downside conviction from bears looks increasingly limited. The tech-heavy QQQ ETF closed the week at $529.92 (+2.08%), shrugging off the Tesla and Trump drama. While it lacked the inside weekly candle breakout, it was fueled by a bullish weekly MACD cross and managed to fly right through resistance at its high-volume node. As it breaks through an ascending triangle, QQQ now sits within 2% of a new all-time high. The IWM small-cap ETF outpaced the large-caps for a change, ending the week at $211.90 (+3.32%). The index broke out of a weekly inside candle and is now driving into a low-volume node, where price tends to move quickly through. With the high-volume node resistance cleared, the next key target appears to be the year-to-date high. Let's take a look at the expected ranges for the week. Once again, we see that the delta between SPY and QQQ is just not enough to merit adding the NDX to our 0DTE mix. My lean or bias today is bullish. Friday was a solid bullish day and the charts look closer and closer to lifting off. Premium is not horrible but also not great so a combination of debit and credits legs could work well today. Today we'll work the call sides of our DOCU and LULU trades. JACK and GNE pairs trade work. Adding another QQQ 0DTE cover to our 4DTE . We have started our day scalping with a long /MNQ. SPX 0DTE. Earnings this week will focus on GME, PLAY, GTLB, CHWY, ADBE, ORCL. BITO may be skipped today. We should be able to get some 1HTE BTC trades on this morning. Let's take a look at some intra-day levels. Looking at the daily chart, this market really wants to go higher but it's just not got a lot of gas in the tank. It's trying. With trade talk and CPI/PPI this week, maybe everything falls into place for a bull push? VTI is getting tantalizingly close to getting back above its upward trend line. Looking at the /ES intra-day levels. We've got some new levels for today! Finally. 6025 is our new resistance and above would be very bullish for me. 5989 is support and while falling below it wouldn't trigger some massive bearishness, for me. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |