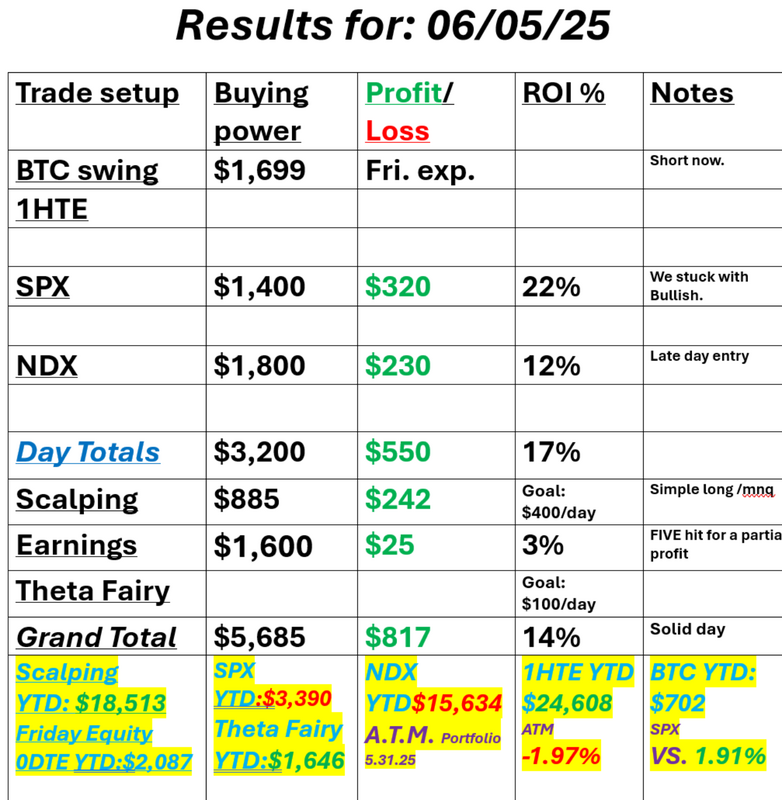

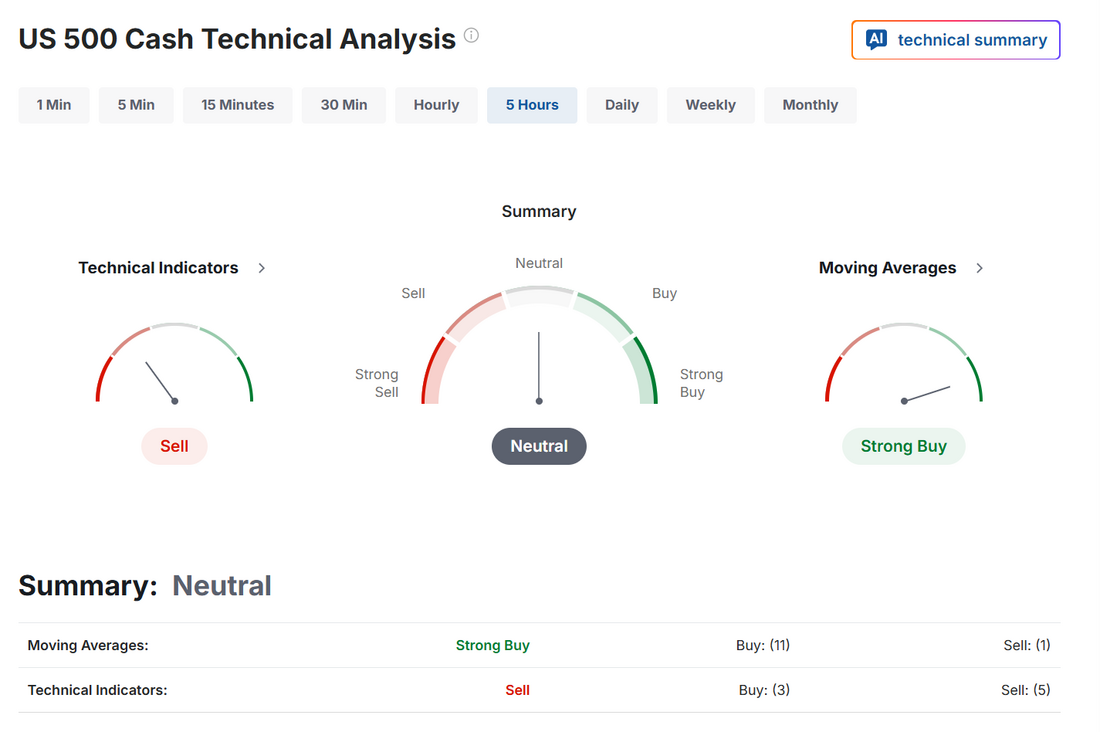

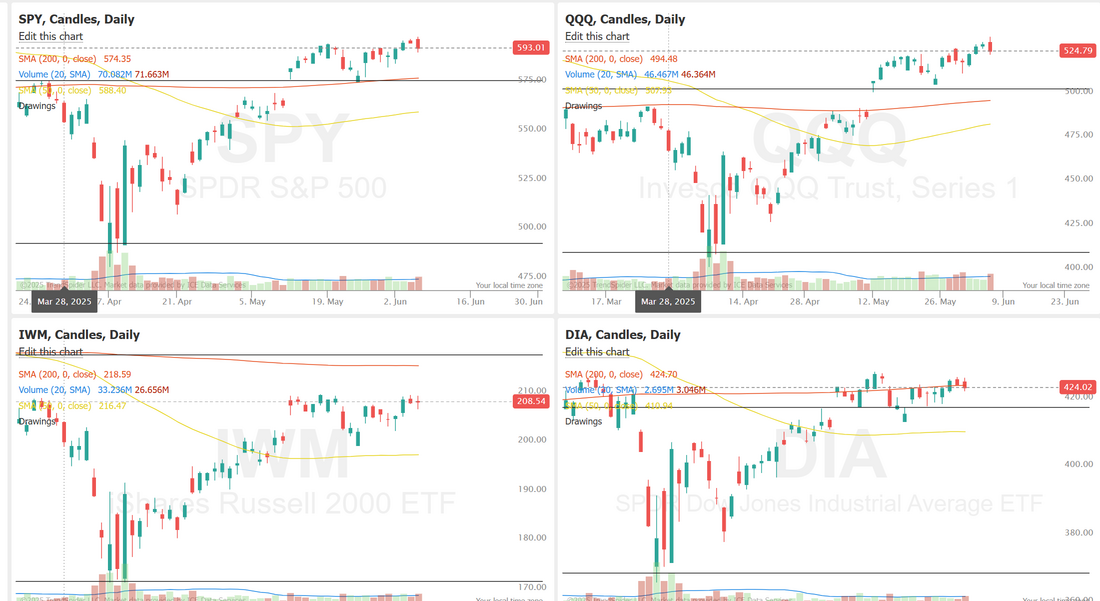

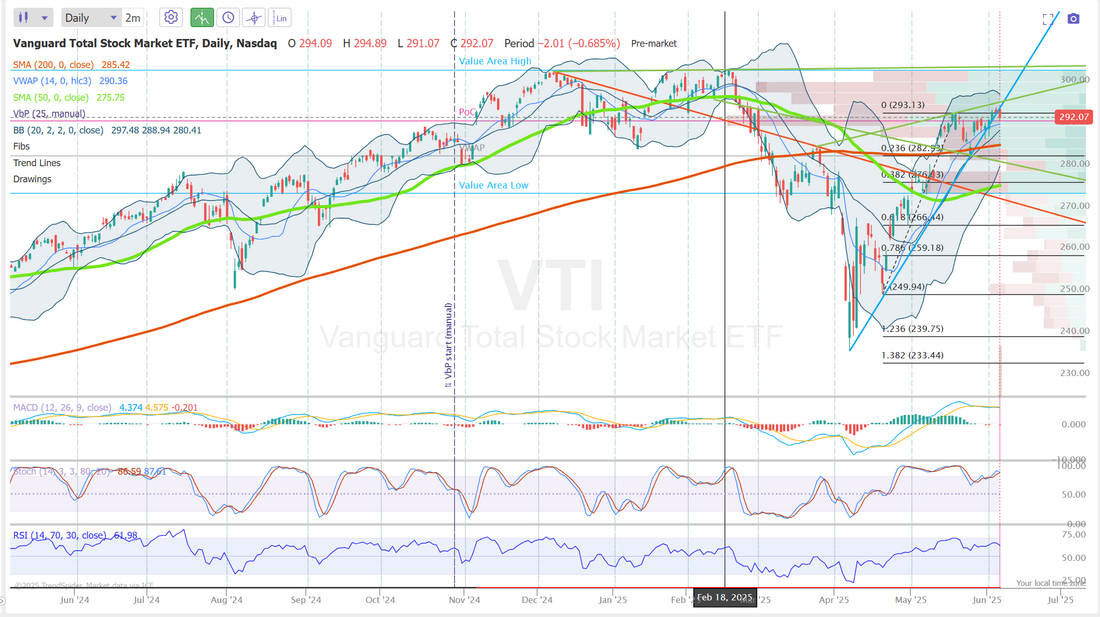

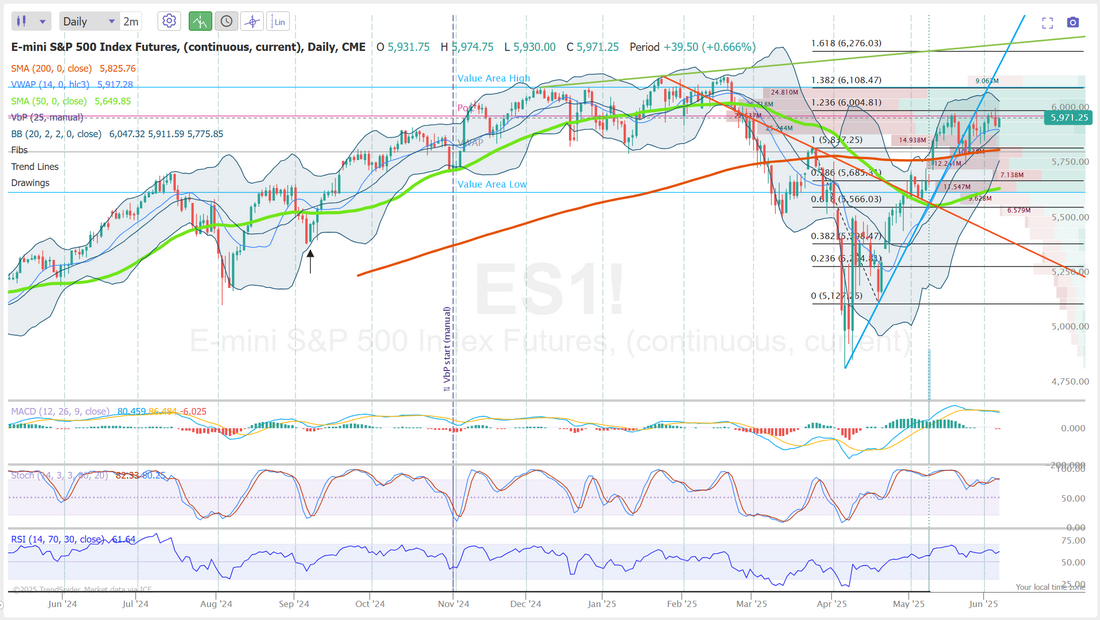

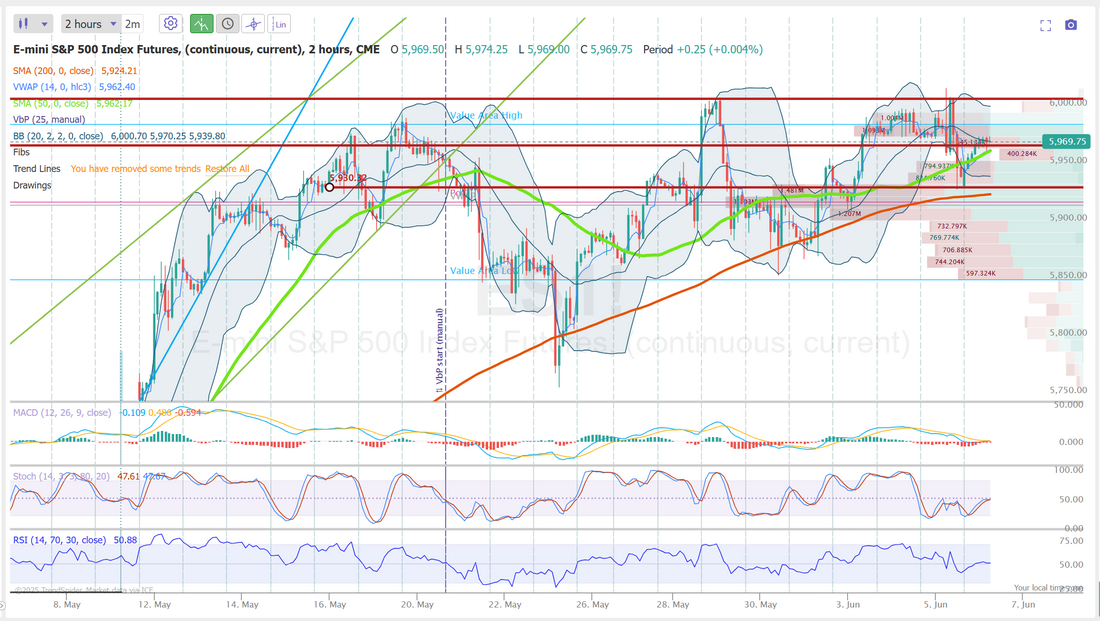

The inevitable inevitably happenedWell, who say this coming? Everyone? Two Alphas with hard charging styles. The blowup seems like a guarantee but oh my, this is insane. If these two were my brothers my dad would be putting both of them over a knee! I have to say that I was really looking forward to seeing both Trump and Elon work some magic. Who doesn't want secure boarders and lower deficits? How about lower pharma costs? Who doesn't want to see Government spending slashed? It doesn't look like were getting any of it. This doesn't mean we can't profit for this melee. We've been shorting (selling calls) on TSLA for a while because, well...the company is in trouble. Profits are dropping. Market share is waning. Sales are plummeting. None of those fundamentals seemed to matter. Elon's talk of getting back to work and robo taxis pushed the stock continually higher. We've had to roll the calls out and up several times. Now we have the same (non-fundamental) reasons to trigger a big selloff. (50 point drop as I type this). Now we will be rolling puts out and down to eventually match our very profitable call side. Crazy times for sure but it doesn't mean we can't profit. Our day yesterday worked for us. We started the day with a begrudgingly bullish stance because that's what our system said to do. It worked out and our key for success yesterday was pulling profits early. Let's take a look at the "new" market. Finally some movement. With the selloff late yesterday we move back to a neutral rating and I feel a lot more comfortable with that. It's harder to trade, for sure but I just wasn't buying the bullish breakout thesis. The "stall" continues. We haven't rolled over enough to get a real sell signal and we just can't break out above this current level to get a new bullish trend. The VTI is a perfect example of what a neutral rating day looks like. No real sell or buy signal here. My bias or lean today is bullish. Futures are up and yesterdays selloff was just a silly, knee jerk reaction. Trade docket is a bit busy today for a Friday: /GC (Gold) 0DTE. We'll work the put side of this today. AVGO, DOCU, LULU are all earnings trades we'll finish working today. The DOCU and LULU were tight trades with lower probabilities so we planned to work them a bit more today. That may or may not take up our buying power for an SPX 0DTE. BITO will need to either be rolled for more income of let it go at a full profit. We'll decide on that as the day progresses. Our QQQ trade will get a 0DTE cash flow component again today. We'll look to stick with the /MNQ for scalping. That's been working well for us lately. Let's take a look at the /ES intra-day levels. On the daily chart you can see it's trying to roll over. We are below the uptrend line. Technicals are not hooking to sell side yet but are close. Essentially we are still stuck in the same zone we've been in for three weeks now. On an intra-day basis using the 2 hr. chart we are right back to our old stomping grounds. 6003 is resistance and that is what I think would be the launching pad for the bulls. They almost cleared it yesterday before all the drama unfolded. 5967 is a key support. We are just up above it now as I type. Below that comes 5929. NFP is out in a few min. and that should give us more guidance on how the day starts. I'm very happy with our day yesterday because we did things that didn't feel comfortable, I.E. starting bullish because that's what our system said to do even though I wasn't feeling it. Pulling our trades early to lock in gains. In hindsight it would have been ugly if we had continued to hold. Let's see what we can accomplish today.

I look forward to seeing you all in the live trading room shortly!

1 Comment

Darryl

6/6/2025 09:16:49 am

I made a nice little profit on Kalshi on a trade of when would Musk leave DOGE and the Whitehouse. I traded yes on before the end of year.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |