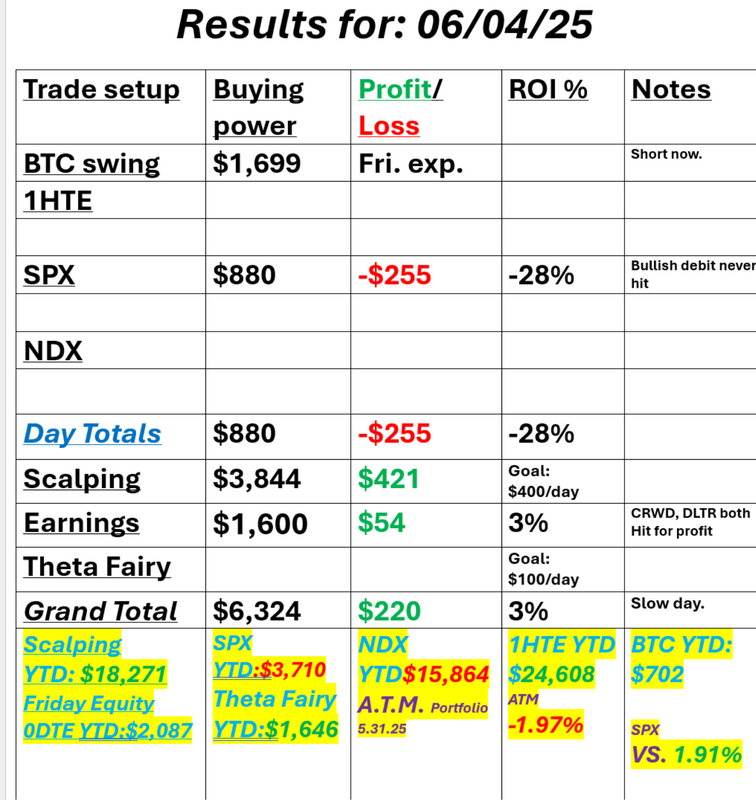

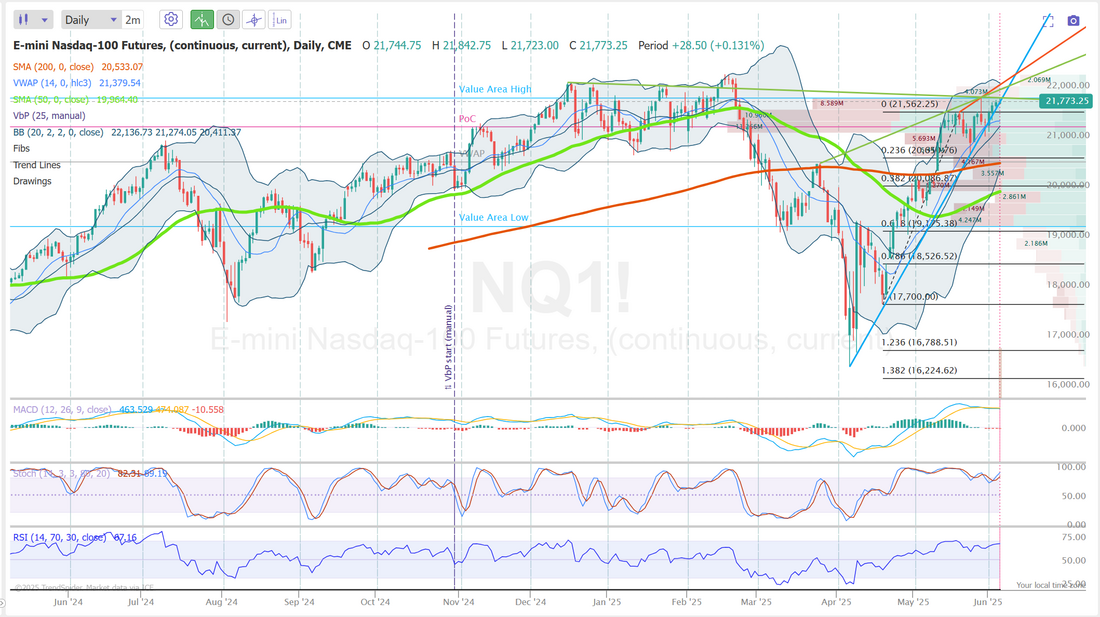

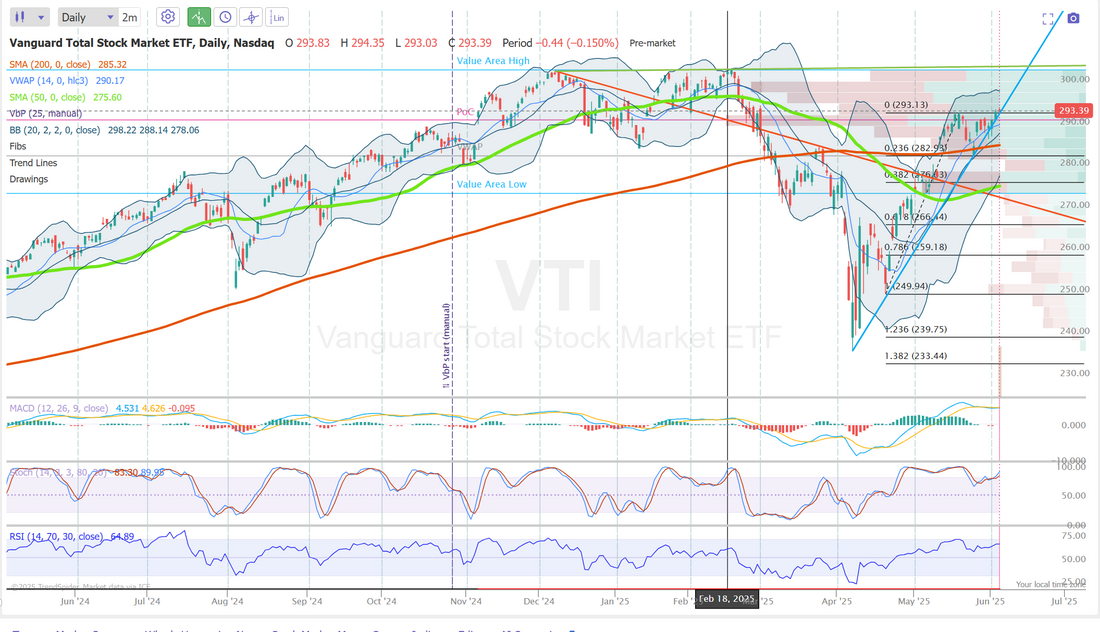

Well...nevermind.Yesterday I said that I was a reluctant bull. All our technicals were bullish. The current trend is up. It looked (especially on the /NQ) that we were finally ready to break out of this nearly three week consolidation and push higher. I wasn't really feeling it BUT you need to trade with a system and not your gut. I tried a couple bullish debit spreads on SPX. One worked a bit and one didn't so I really just treaded water yesterday. It was a green day when all was said and done but not by much. With the flat day yesterday our levels and technicals are EXACTLY the same today as they were yesterday. Can the bulls break out today? We've got US trade balance and Jobless claim numbers out early and they may give us some guidance but I'm not holding my breath. I'll likely start today with a tight Iron fly, chicken Iron condor or some small, asymmetric setup. Here's my results from yesterday. June S&P 500 E-Mini futures (ESM25) are up +0.02%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.10% this morning, pointing to a muted open on Wall Street, while investors await a fresh batch of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from semiconductor and software giant Broadcom. Some positive corporate news is supporting stock index futures, with MongoDB (MDB) surging over +14% in pre-market trading after the database company posted upbeat Q1 results, raised its full-year guidance, and boosted its share buyback program. Also, Five Below (FIVE) climbed more than +5% in pre-market trading after the specialty discount retailer reported forecast-beating Q1 results and issued solid Q2 guidance. However, gains in U.S. equity futures are limited amid investor caution ahead of Friday’s payrolls data. Also, trade uncertainty persists as the Trump administration’s deadline for countries to submit their “best offers” for trade deals has passed without any notable developments. In yesterday’s trading session, Wall Street’s major indexes ended mixed. ON Semiconductor (ON) climbed over +6% and was the top percentage gainer on the S&P 500, extending Tuesday’s gains after the semiconductor firm’s CEO Hassan El-Khoury said he sees early signs of a broad-based recovery in demand. Also, homebuilder stocks advanced after the benchmark 10-year T-note yield slumped, with DR Horton (DHI) rising more than +4% and Lennar (LEN) gaining over +3%. In addition, Guidewire Software (GWRE) surged over +16% after the insurance-software provider posted upbeat FQ3 results and raised its full-year revenue guidance. On the bearish side, Dollar Tree (DLTR) slid more than -8% and was the top percentage loser on the S&P 500 after the discount retailer warned that new U.S. tariffs could slash its Q2 profit by 45% to 50%. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 37K in May, weaker than expectations of 111K and the smallest increase in more than two years. Also, the U.S. ISM services index unexpectedly fell to 49.9 in May, weaker than expectations of 52.0. “Markets are likely to view this through the lens of disappointment on the real growth side,” said Florian Ielpo at Lombard Odier Investment Managers. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity declined slightly in recent weeks, signaling that tariffs and heightened uncertainty are hurting the economy. “All districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions,” according to the Beige Book. The report stated that consumer spending either declined slightly or showed no change across most districts, while prices rose at a “moderate” pace. Most regions described employment as “flat,” while wages continued to grow at a “modest” pace. The report said the outlook remained “slightly pessimistic and uncertain, on balance.” U.S. rate futures have priced in a 95.6% probability of no rate change and a 4.4% chance of a 25 basis point rate cut at June’s monetary policy meeting. Today, investors will monitor earnings reports from several high-profile companies, with Broadcom (AVGO), Lululemon Athletica (LULU), and Samsara (IOT) slated to release their quarterly results. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 236K, compared to last week’s number of 240K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast Q1 Unit Labor Costs to be +5.7% q/q and Nonfarm Productivity to be -0.8% q/q, compared to the fourth-quarter numbers of +2.0% q/q and +1.7% q/q, respectively. U.S. Trade Balance data will be released today as well. Economists expect the trade deficit to narrow to -$67.60B in April from -$140.50B in March. In addition, market participants will parse comments today from Fed Governor Adriana Kugler, Kansas City Fed President Jeff Schmid, and Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.343%, down -0.44%. I won't bother to repost the technicals for today because they are exactly the same as yesterday! Just scroll down. The /ES seems trapped between 6003 and 5966. Trade docket for today: AVGO, LULU, DOCU earnings plays. These are usually pretty good tickers for us. FIVE was our earnings trade from yesterday. It's a 15DTE so we'll likely continue to work it today. SPX 0DTE focus. /MNQ scalping. We'll also look at a week long spec trade using the QQQ's. I don't have a bias or lean today. Until we can definitively break out of this 5966/6003 /ES range it looks like a dead market. There are some differences in the outlook, depending on what index you use. The /ES is now down below the upper trend line (blue line). Seems to be topping out. Technicals are mixed. The /NQ is stronger. It continues to hug the upward moving trend line. Technicals are all bullish. It's really close to breaking out. VTI seems like it wants to break out as well but just can't build enough momentum. Where we go today is anybody's guess. We'll see what everyone thinks in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |