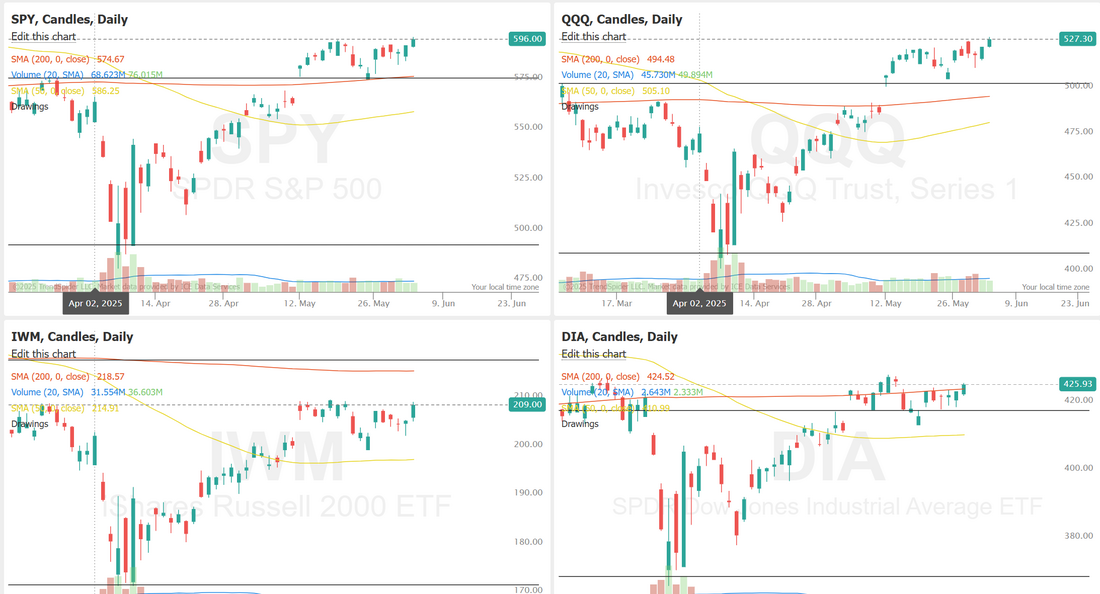

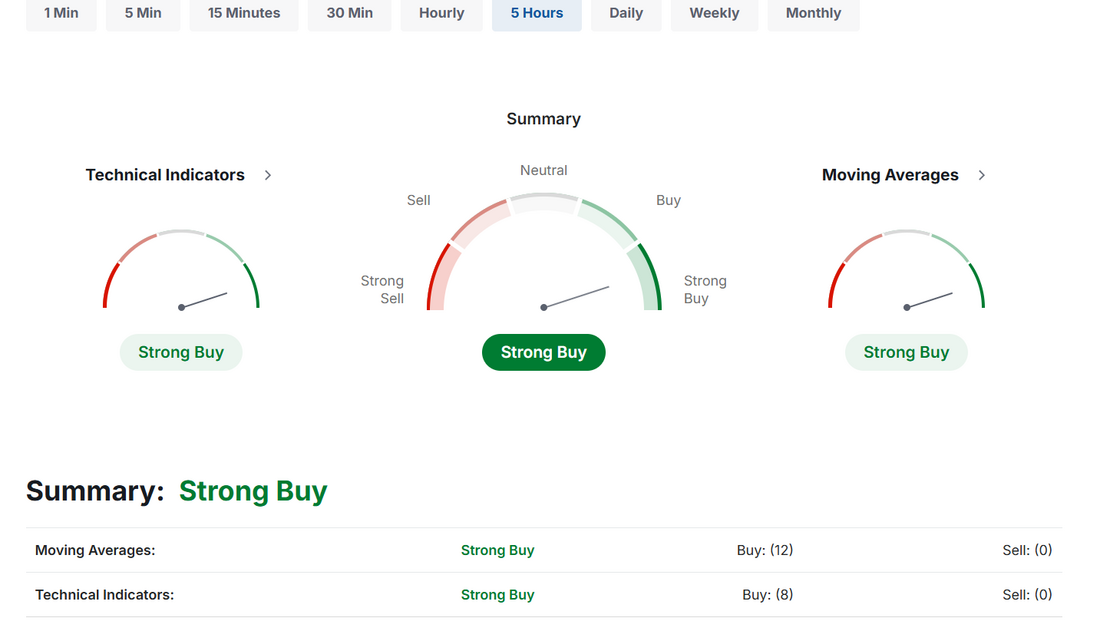

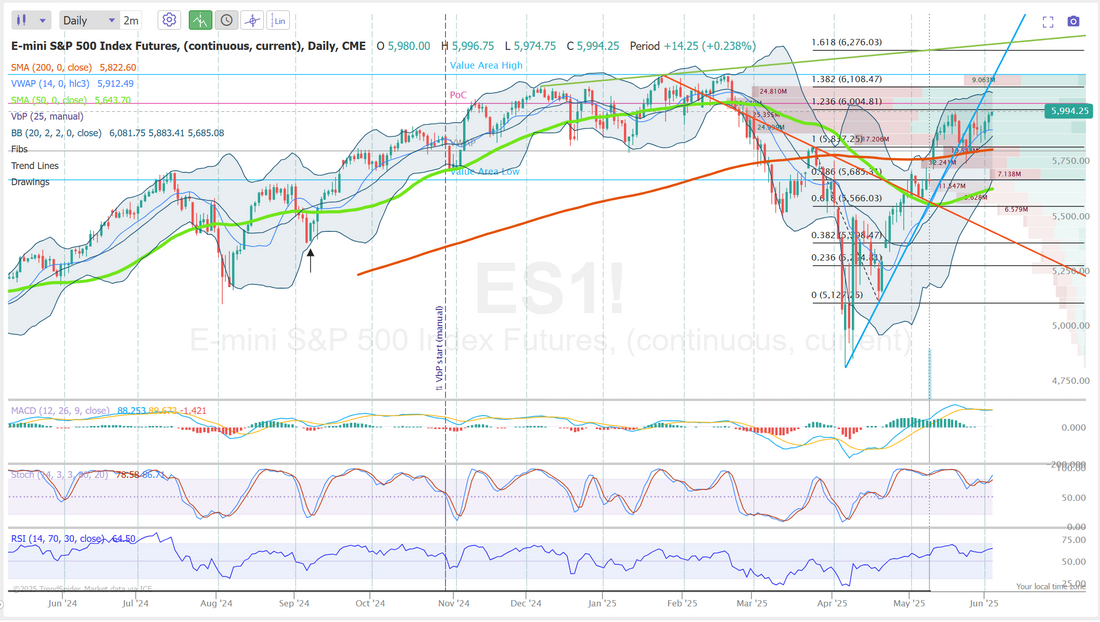

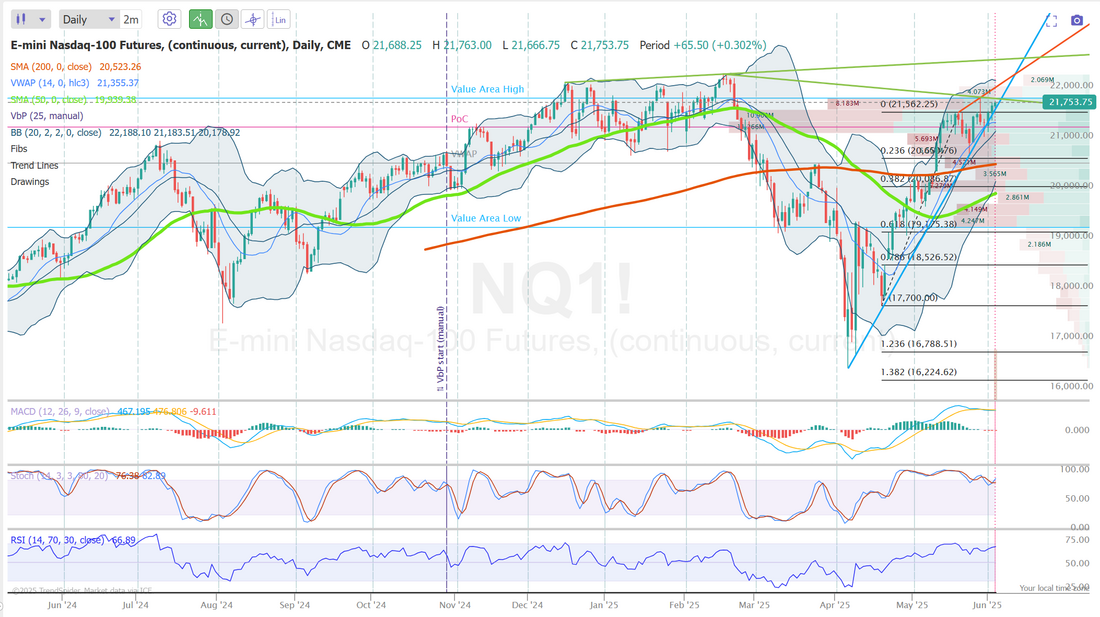

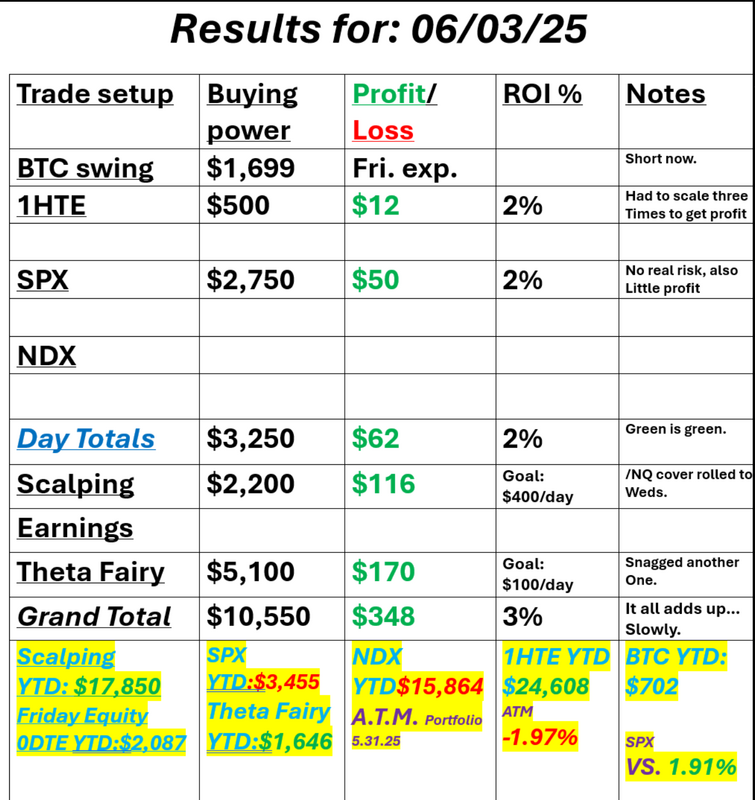

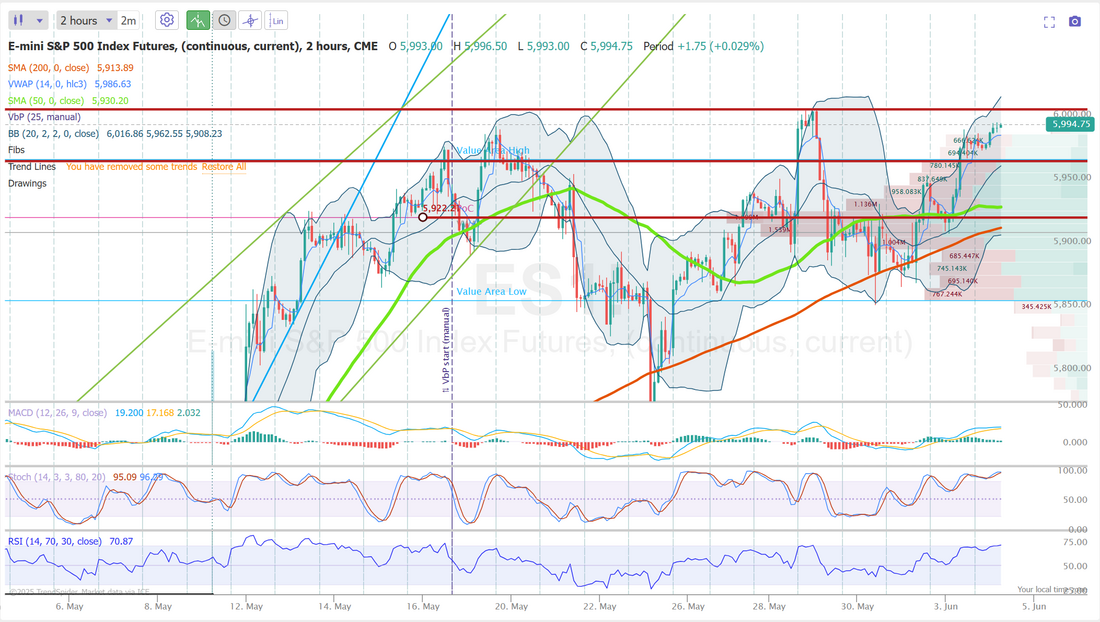

Is today the day?It today the day that we finally break out of our consolidation zone and push up to new levels? It sure looks like it. All of our indices are sitting primed at recent highs. Technicals are bullish. The /ES is below the upward trend line (blue) but still looks bullish The /NQ is stronger. Holding firm above the upper leaning trendline. There's resistance overhead, to be sure so It's hard to tell if bulls will have enough strength to power through those levels but I think you need to be bullish to start off the day today. We had another winning day yesterday. If wasn't mind blowing but everything we touched worked and it all adds up. One key I've noticed is, if you are going to start with a directional (debit) type setup. It's usually best to just let it work. They are asymmetric enough that if it loses it's within an acceptable loss range and if it works the profit level is also acceptable based on our income goals. Although my gut doesn't feel tremendously bullish this morning, that's the way all our indicators are leaning so that's how I'll start out my day. Here's a look at our day yesterday. Trade docket today: Skipping the 1HTE's. The risk/reward is still about 20% away from where I'd like to see it. We have a /NQ scalp on and I'll ride that as long as I can today. CRWD and DLTR earnings trades so be in the take profit zone for us this morning. QTTB may be getting into a take profit zone as well. FIVE is our new earnings potential trade for today and SPX will be our focus again for 0DTE. June S&P 500 E-Mini futures (ESM25) are trending up +0.22% this morning, extending yesterday’s gains, while investors await comments from Federal Reserve officials and further data on the labor market, which has thus far remained resilient despite the Trump administration’s trade war. Investors also await a potential call between U.S. President Donald Trump and Chinese President Xi Jinping this week in hopes of easing tensions. Still, President Trump said Wednesday that his Chinese counterpart was “extremely hard” to strike a deal with. Also, President Trump doubled steel and aluminum tariffs to 50%, delivering on a promise to raise U.S. import duties in support of domestic manufacturers. Trump framed the move, which took effect at 12:01 a.m. Washington time on Wednesday, as essential to safeguard national security. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Dollar General (DG) surged over +15% and was the top percentage gainer on the S&P 500 after the retailer posted upbeat Q1 results and raised its full-year sales growth guidance. Also, chip stocks advanced, with ON Semiconductor (ON) climbing more than +11% to lead gainers in the Nasdaq 100 and Microchip Technology (MCHP) rising over +6%. In addition, MoonLake Immunotherapeutics (MLTX) soared more than +17% after the Financial Times reported that Merck held talks to acquire the biotechnology company. On the bearish side, Kenvue (KVUE) slumped over -6% and was the top percentage loser on the S&P 500 after CEO Thibaut Mongon cautioned that seasonal demand was lagging both last year and the company’s expectations. A Labor Department report released on Tuesday showed that U.S. JOLTs job openings unexpectedly rose to 7.391M in April, stronger than expectations of 7.110M. At the same time, U.S. April factory orders fell -3.7% m/m, weaker than expectations of -3.1% m/m and the biggest decline in 15 months. “The higher-than-expected job openings number is a good sign for the economy, as many were worried that the tariff uncertainty was weighing too heavily on businesses,” said Chris Zaccarelli at Northlight Asset Management. Atlanta Fed President Raphael Bostic said on Tuesday that he is in no hurry to lower interest rates, noting he wants to see “a lot” more progress on inflation. “There’s still a ways to go in terms of the progress that we’re going to need to see,” Bostic said. Also, Chicago Fed President Austan Goolsbee said that higher inflation from U.S. tariffs could show up quickly, though it would take more time to observe a tariff-driven economic slowdown. In addition, Fed Governor Lisa Cook said she views tariffs as potentially fueling inflation and weakening employment, while emphasizing the importance of price stability in guiding future rate adjustments. Meanwhile, U.S. rate futures have priced in a 98.7% chance of no rate change and a 1.3% chance of a 25 basis point rate cut at the June FOMC meeting. Today, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the May ADP Nonfarm Employment Change will stand at 111K, compared to the April figure of 62K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the May ISM services index to be 52.0 and the S&P Global services PMI to be 52.3, compared to the previous values of 51.6 and 50.8, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -2.900M, compared to last week’s value of -2.795M. In addition, market participants will hear perspectives from Fed Governor Lisa Cook and Atlanta Fed President Raphael Bostic throughout the day. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. On the earnings front, notable companies like Dollar Tree (DLTR), MongoDB (MDB), and Five Below (FIVE) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.467%, up +0.11%. Let's take a look at our intra-day levels on /ES: There are a couple levels today that I've been watching for the last two weeks. The biggest one for me today is the 6003 level. If bulls can clear that level today I think the rocket ship can really take off to the upside. 5966 is the main support level with 5922 being the next level down. Once again, I think there is more downside potential than upside but the trend is clearly up right now. I look forward to seeing you all in the live trading room shortly. We'll be talking about the progress (or lack thereof) I'm making on implementing pairs trades in the ATM portfolio. See you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |