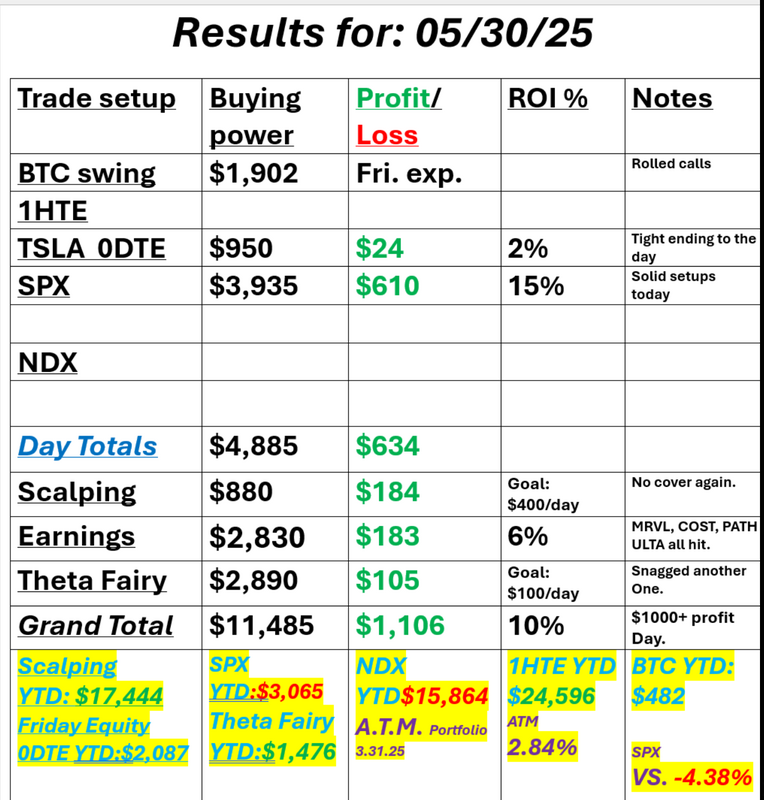

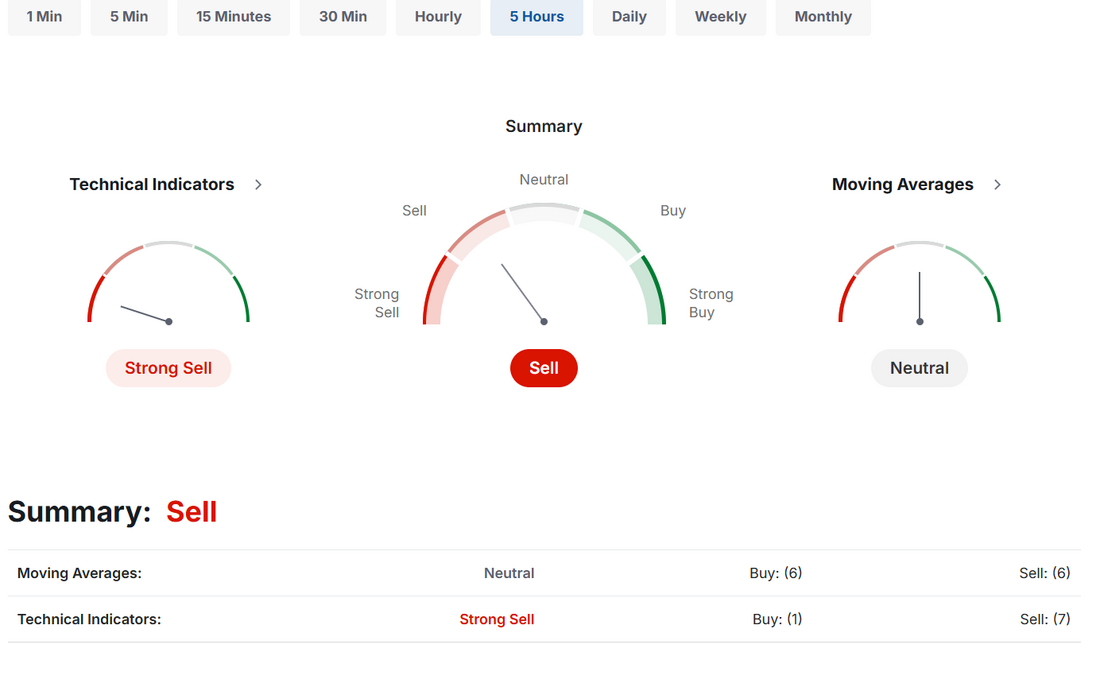

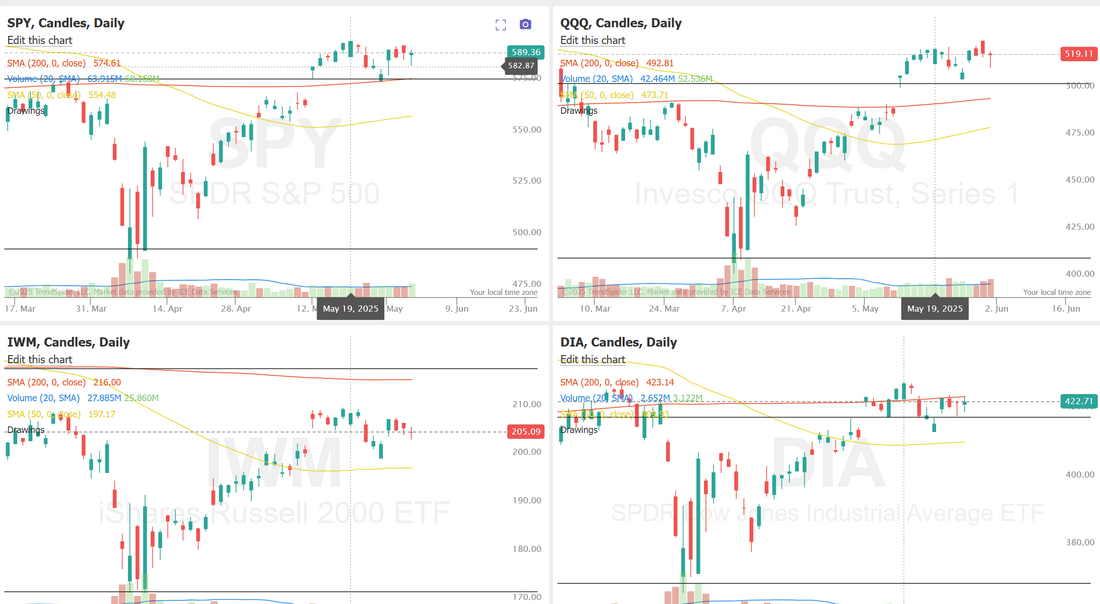

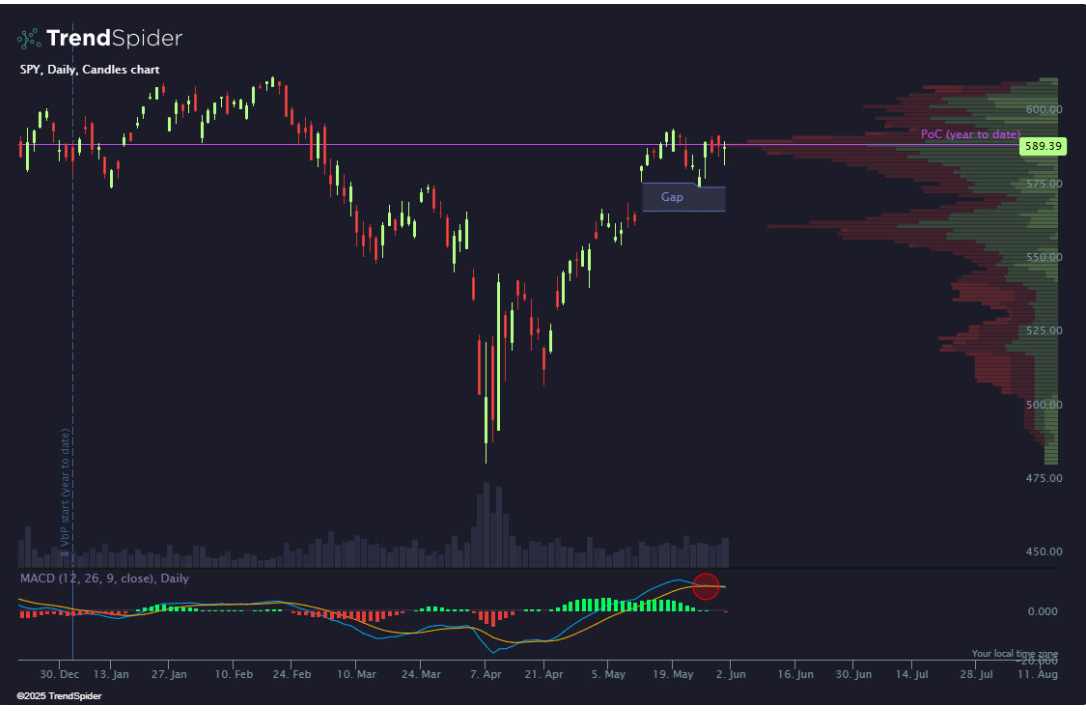

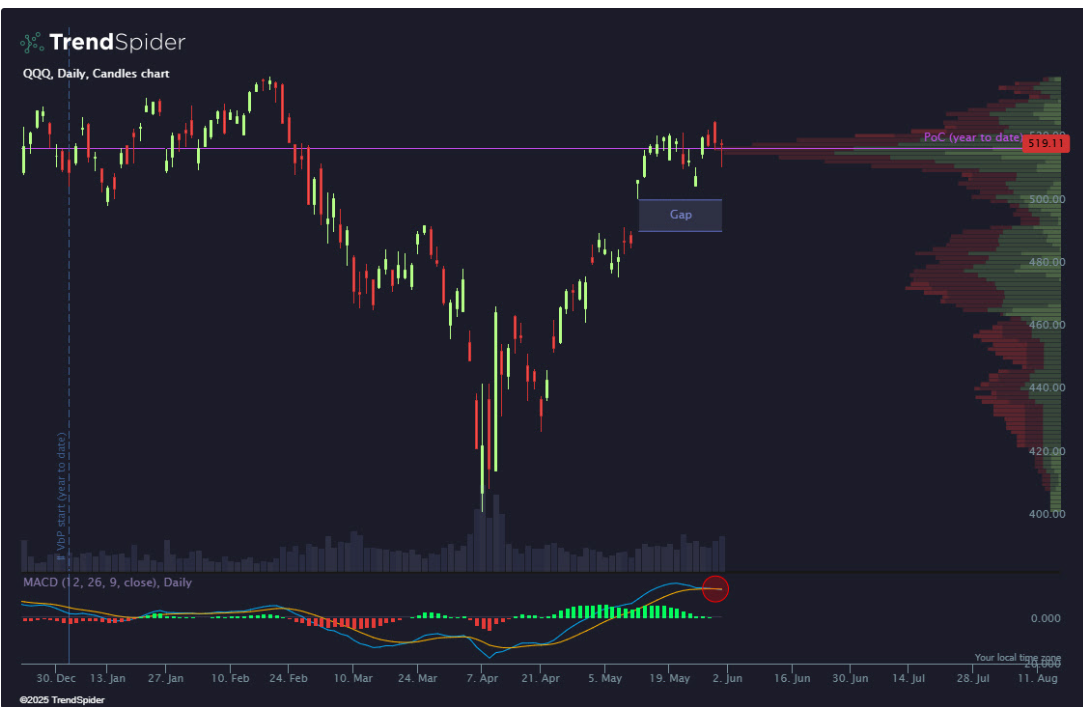

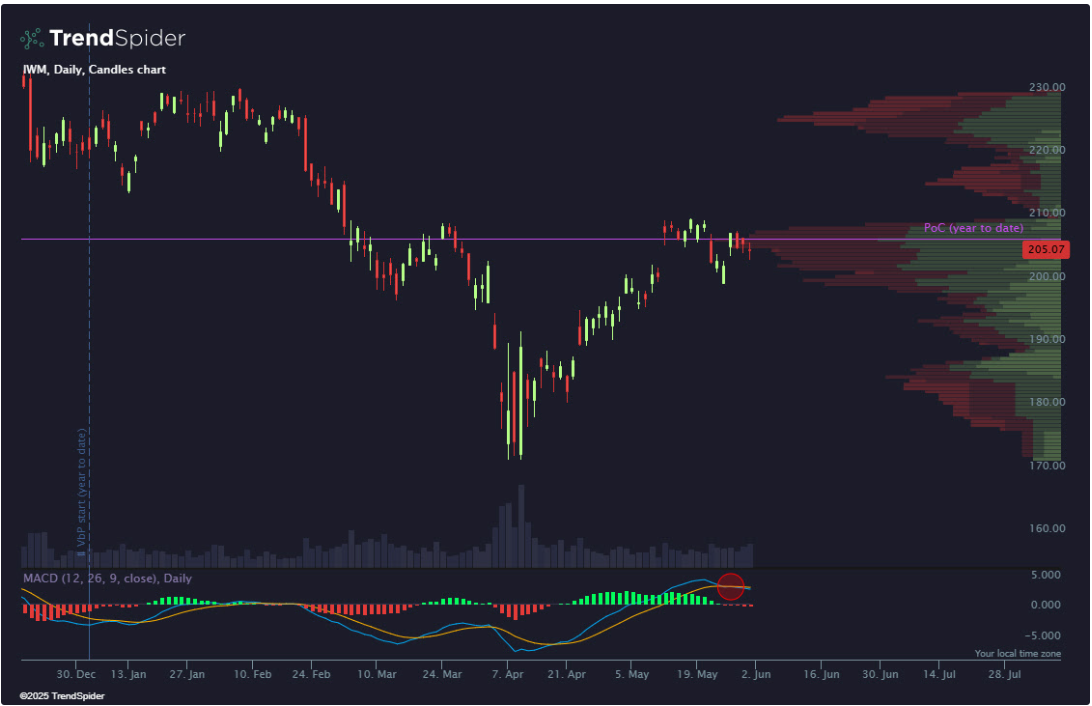

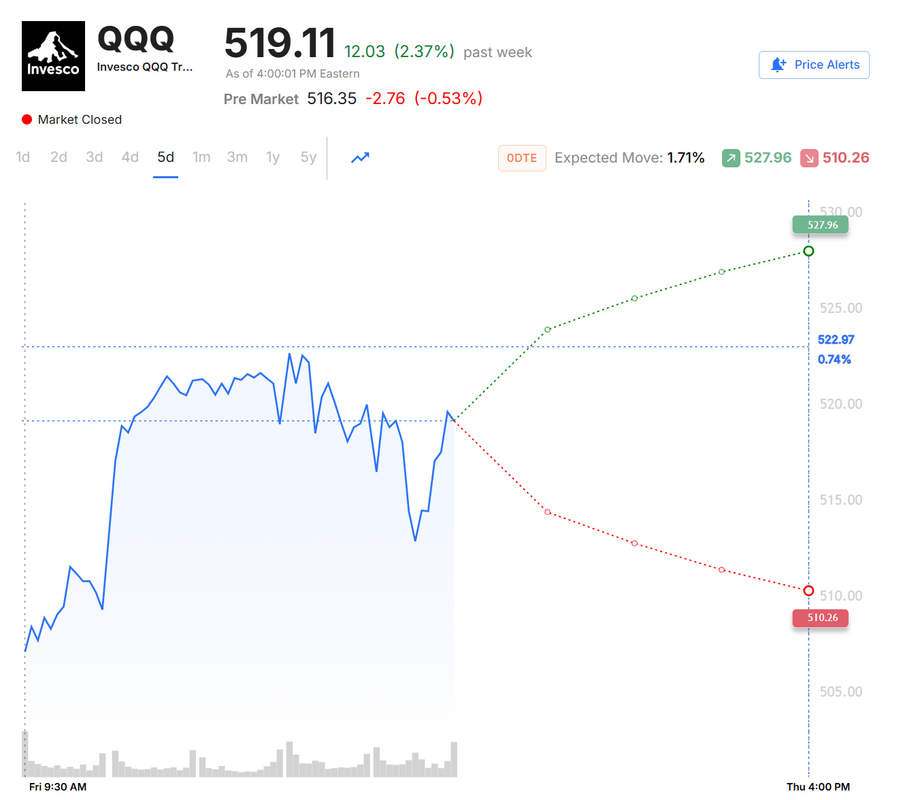

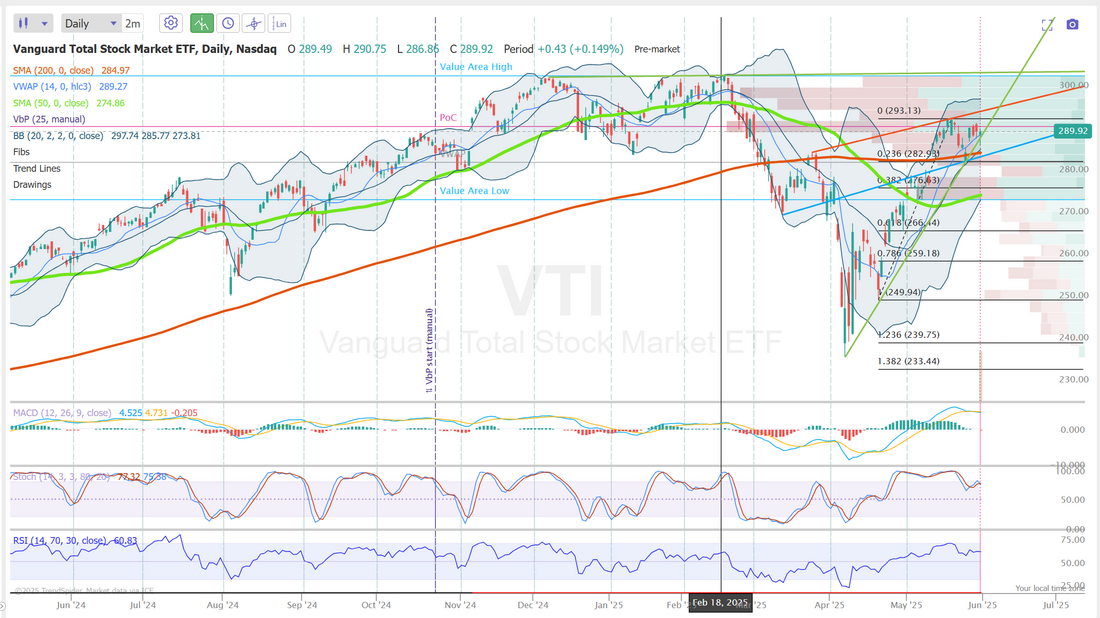

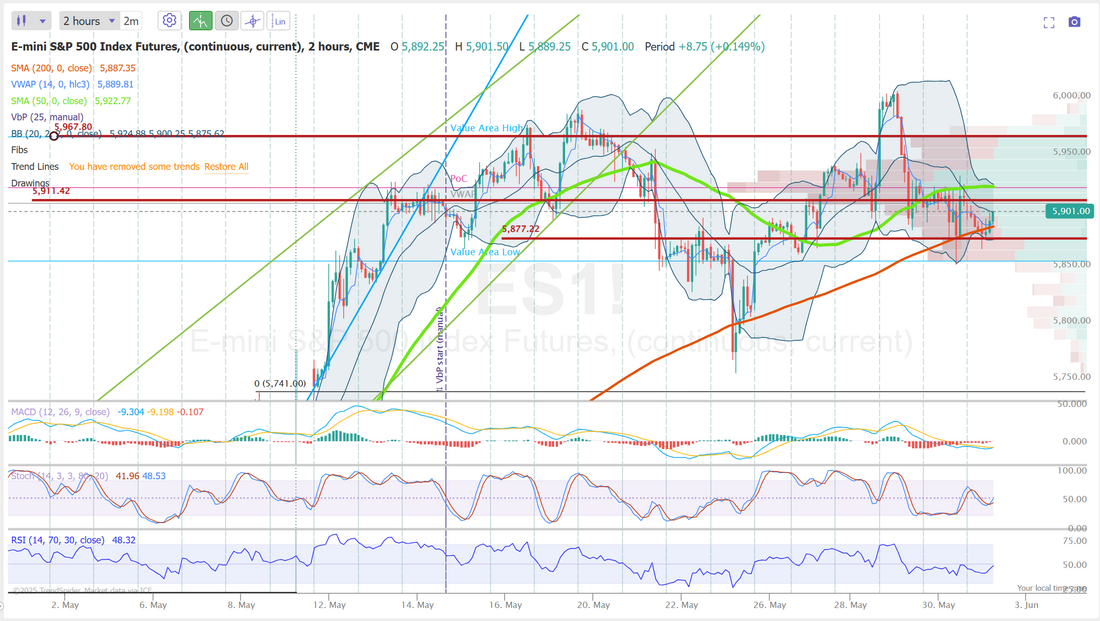

Headline driven marketsThis was the statement from Clark Bellin at Bellwether Wealth and I couldn't agree more. “We expect the markets to remain headline-driven, especially headlines related to tariffs. As we start to see more clarity on trade, we expect more traditional drivers of markets, like earnings and fundamentals, to lead the way and drive sentiment,” The markets always working off of something. Big technical levels, Fundaments, Corporate earnings, etc. Right now its all about headlines. The challenge with that is that we never know when these headlines will appear. It makes it tough. We had a great day Friday. We had a well diversified amount of setups and they all worked. It gave us our goal of a $1,000+ profit day. Our results are below: June S&P 500 E-Mini futures (ESM25) are down -0.57%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.69% this morning, starting the new month on a downbeat note as escalating global trade tensions weighed on investors’ risk appetite. Late Friday, U.S. President Donald Trump said he would double tariffs on steel and aluminum imports to 50%, starting Wednesday. President Trump also alleged that China violated the trade truce agreed in mid-May, a claim that China has denied. The Chinese Ministry of Commerce issued a statement on Monday rejecting the U.S. president’s claim and said that it is the U.S. side that has “seriously undermined” the consensus reached in Geneva. U.S. Treasury Secretary Scott Bessent said over the weekend that President Trump and Chinese President Xi Jinping will speak soon to resolve trade issues, including a dispute over critical minerals. This week, investors look ahead to comments from Federal Reserve Chair Jerome Powell and other Fed officials, earnings reports from several high-profile companies, as well as a slew of U.S. economic data, with a particular focus on Friday’s nonfarm payrolls report. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Ulta Beauty (ULTA) surged over +11% and was the top percentage gainer on the S&P 500 after the beauty retailer posted upbeat Q1 results and raised its full-year guidance. Also, Zscaler (ZS) climbed more than +9% and was the top percentage gainer on the Nasdaq 100 after the cybersecurity company reported stronger-than-expected FQ3 results and boosted its annual guidance. In addition, Palantir Technologies (PLTR) gained over +7% after the New York Times reported that the Trump administration had expanded the company’s work across the federal government in recent months. On the bearish side, Regeneron Pharmaceuticals (REGN) plummeted more than -19% and was the top percentage loser on the S&P 500 and Nasdaq 100 after a late-stage trial of its experimental chronic obstructive pulmonary disease treatment for former smokers, itepekimab, failed to meet its primary endpoint. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.1% m/m and +2.5% y/y in April, in line with expectations. Also, U.S. April personal spending rose +0.2% m/m, in line with expectations, while personal income grew +0.8% m/m, stronger than expectations of +0.3% m/m. In addition, the University of Michigan’s U.S. consumer sentiment index was revised higher to 52.2 in May, stronger than expectations of 51.1. At the same time, the U.S. May Chicago PMI unexpectedly fell to 40.5, weaker than expectations of 45.1. Fed Governor Christopher Waller said on Monday he still sees a path to interest rate cuts later this year, given his expectations that tariffs will raise unemployment and temporarily push up inflation. “Assuming that the effective tariff rate settles close to my lower tariff scenario, that underlying inflation continues to make progress to our 2% goal, and that the labor market remains solid, I would be supporting ‘good news’ rate cuts later this year,” Waller said. Meanwhile, U.S. rate futures currently price in about two interest rate cuts this year, with the first reduction not expected until October, according to LSEG data. The U.S. May Nonfarm Payrolls report will be the main highlight this week, as investors assess the extent to which tariffs are affecting jobs and what implications that may have for interest rates. Another key data set for gauging the impact of tariff uncertainty on business activity and confidence will be the latest ISM figures on manufacturing and services sector activity. Other noteworthy data releases include the U.S. JOLTs Job Openings, Factory Orders, ADP Nonfarm Employment Change, Crude Oil Inventories, Initial Jobless Claims, Trade Balance, Nonfarm Productivity, Unit Labor Costs, Average Hourly Earnings, the Unemployment Rate, and Consumer Credit. “With so many soft indicators pointing to a slump, modest confirmation of a slowdown from hard data should be enough to put cuts on the table,” Steve Englander said in a note, global head of G-10 FX research at Standard Chartered. Market watchers will also monitor earnings reports from several high-profile companies, with Broadcom (AVGO), CrowdStrike (CRWD), Hewlett Packard Enterprise (HPE), Lululemon Athletica (LULU), and Dollar Tree (DLTR) scheduled to report their quarterly results this week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Fiscal legislation in Washington will draw attention this week as well. The Senate will begin deliberations on a tax-and-spending bill that was passed by the House of Representatives last month. Today, investors will focus on remarks from Fed Chair Jerome Powell, who is scheduled to speak at the Federal Reserve Board’s International Finance Division 75th anniversary conference. Market participants will also parse comments from other Fed officials, including Logan, Goolsbee, Cook, Bostic, Kugler, and Harker, throughout the week. On the economic data front, all eyes are on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the May ISM manufacturing PMI will be 49.3, compared to the April figure of 48.7. The U.S. S&P Global Manufacturing PMI will also be reported today. Economists expect the final May figure to be unrevised at 52.3. U.S. Construction Spending data will be released today as well. Economists foresee this figure coming in at +0.4% m/m in April, compared to -0.5% m/m in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.445%, up +0.68%. Let's take a look at the markets: We have a very slight sell signal to start off the week. Take a close look at the candles from Fridays price action. Those sure look a lot like Doji's!. Nothing was solidified on Friday as far as directional bias. We have been stuck in consolidation zone for two weeks now. Looking ahead, all eyes turn to Fed Chair Powell’s upcoming remarks and Friday’s unemployment report, both of which come on the heels of a cooler PCE reading that hinted at potential disinflation. However, with tariffs once again emerging as the market’s wildcard, traders should brace for headline-driven swings as June kicks off. Let’s see how the charts are setting up. SPY closed the week at $589.39 (+1.79%), hovering near the year-to-date volume point of control, a key resistance zone. Bulls successfully defended the open gap near the 200-day SMA, showing underlying support. However, a bearish MACD curl and a lower high suggest momentum is fading. With signals pulling in both directions, traders are now watching for a decisive move, whether it’s a breakdown toward the $565 high-volume node or a push to new highs. Fueled by Nvidia’s earnings, tech-heavy QQQ closed at $519.11 (+1.94%), essentially flat over the past two weeks. Although it briefly broke to new highs, the move failed to hold as tariff headlines and fading post-earnings momentum from Nvidia weighed on sentiment. With the MACD starting to curl lower and a fresh gap now sitting below, traders are watching closely to see how QQQ reacts to its year-to-date volume point of control. IWM closed the week at $205.07 (+1.26%), finishing green but still lagging its large-cap counterparts as it remains below the 200-day SMA. While it’s a positive sign that the recent gap has been filled, momentum is fading, with the MACD curling lower and the year-to-date volume point of control just overhead acting as resistance. While Friday’s cool PCE print offered some relief, small-cap investors will be watching Powell’s Monday remarks for clearer direction. I.V. is back to a more normal 1.2% Expected move for SPY this week. With 1.7% expected on QQQ. Once again, there doesn't seem to be enough of a delta between the two to merit an NDX 0DTE focus. Trade docket today: No 1HTE's again today. Setups have just not been there the last few trading days so we'll be patient. It's tough to beat the risk/reward on these when the setups appear. I got assigned 200 short shares of BITO over the weekend so we'll now start cash flowing that with covered puts (which are already in place). My focus today is SPX 0DTE and /MNQ for scalping. We'll have a pairs trade training refresher today and then tomorrow we'll add some new pairs. We also have another full week of earnings setups. AVGO, CRWD, LULU, DLTR, DOCU, FIVE, DG all report this week and we'll look to trade them all. Let's take a look at the technical levels. Using the VTI on the daily chart you can see so many things. #1. The trend line is bullish. #2. We are stuck in a consolidation zone for the last two weeks. #3. We've got the 200DMA working as support. In other words, the bulls really have everything they need to push higher. The question is, can the "headline drivers" stay away long enough to allow that to happen? On an intra-day basis with the /ES I've got two key areas...again. Same as Friday. Above 5911 is bullish. Below 5877 is bearish. My bias or lean today is just a crap shoot. I'll lean bullish out of the gate but until this two week long churn can work itself out we are just directionally challenged. I look forward to seeing you all in zoom shortly. Pairs trades training later in the day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |