|

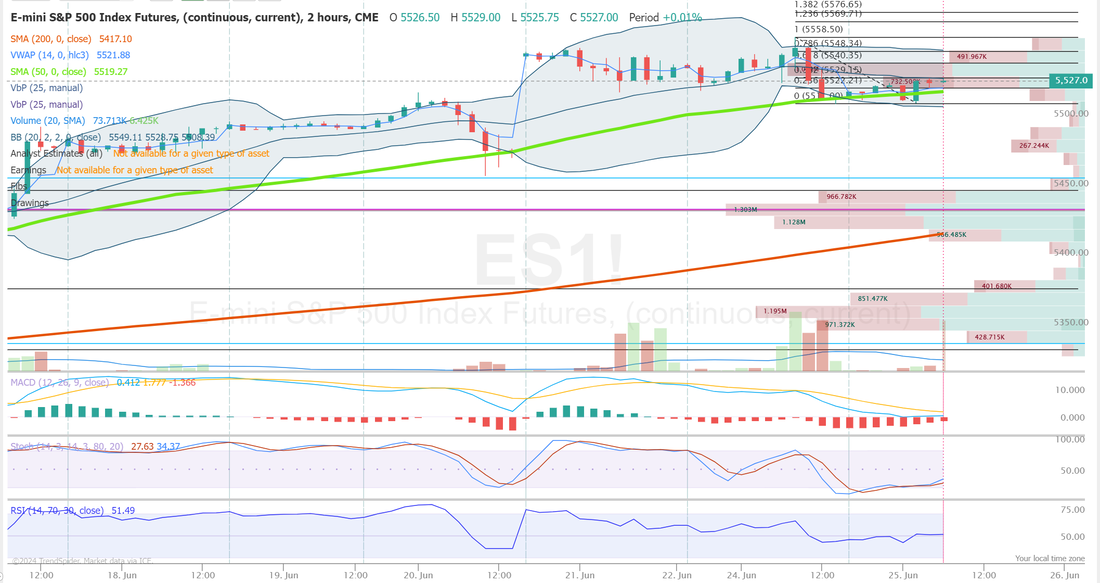

Yesterday was one of those days I should have just stayed in bed. I gave back almost 10 days of profits in the last 30 mins. of the day with the selloff. Here's my results. BTC missed a full profit by $7 dollars! SPX went perfect but I didn't have enough leverage in that to offset the selloff in NDX. Scalping helped but again, not enough. My lean yesterday was bearish as I mentioned but I didn't anticipate a selloff like that going into the close. I'll try to get quicker exits today to avoid the power hour all together. Lets look at the markets: We did see some slight rotation with weakness in the SPY and QQQ and strength in the IWM and DIA. This is a reversal from previous sessions. We continue to look for a sell confirmation in the VTI. The market enters today with another neutral rating. That makes it tough to find proper levels when the market is trying to make up its mind. My lean today is more neutral. The strenght in the laggards (IWM, DIA) should help outweight the weakness from the SPY, QQQ. Trade docket for today: /HG, CCL, 0DTE's, NVDA, PFE, FDX, PAYX, GIS. Dovish comments Monday from Chicago Fed President Goolsbee knocked T-note yields lower and supported stocks when he said it might be appropriate for the Fed to start thinking about whether restrictive policy is putting too much pressure on the economy. San Francisco Fed President Daly said if inflation falls more slowly than expected, it would be appropriate for the Fed to hold interest rates higher for longer, but if inflation falls quickly or the labor market cools more than expected, cutting rates would be necessary. The US Jun Dallas Fed manufacturing outlook survey rose +4.3 to -15.1, slightly weaker than expectations of -15.0. The markets are awaiting Friday’s release of the US May core PCE deflator, the Fed’s preferred inflation gauge, to see if price pressures are abating, which could pave the way for the Fed to begin cutting interest rates. The consensus is that the May core PCE deflator eased to +2.6% y/y from +2.8% y/y in April. The markets are discounting the chances for a -25 bp rate cut at 10% for the next FOMC meeting on July 30-31 and 65% for the following meeting on September 17-18. Generally positive Q1 earnings results are supportive of stocks. Q1 earnings are expected to climb +7.1% y/y, well above the pre-earnings season estimate of +3.8%. According to data compiled by Bloomberg Intelligence, about 81% of reporting S&P 500 companies have beaten Q1 earnings estimates. Overseas stock markets Monday settled mixed. The Euro Stoxx 50 rose to a 1-week high and closed up +0.89%. China's Shanghai Composite fell to a 3-3/4 month low and closed down -1.17%. Japan's Nikkei Stock 225 Index climbed to a 1-week high and closed up +0.54%. My intra-day levels: /ES; 5540/5558/5570/5581 to the upside. 5522/5510/5490/5474 to the downside. /NQ; 19861/19949/20009/20085 to the upside. 19809/19724/19685/19638 to the downside. Bitcoin; The weakness continues with support levels tenuous. We are working on a 13 day slide at this point. 65,888 is resistance and 56,782 is new support. Let's see if I can snag some green today after yesterdays red!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |