|

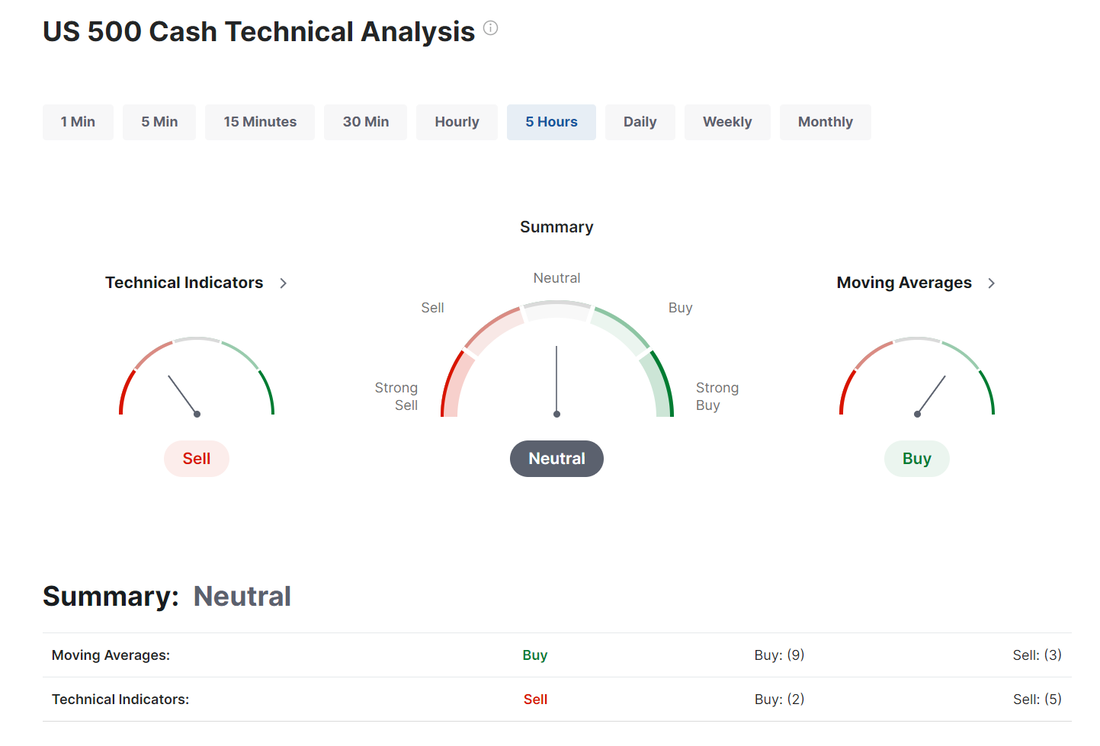

Welcome back to a new week of trading! Friday ended up a pretty solid week for us. All told we brought in over $13,000 of profits from our 0DTE's with our event contracts contributing $1,400 and our standard SPX/NDX combos bringing in the rest. We also had some nice success with our SPY/QQQ combo even though it was put on much later in the week than normal. Today is a big day for our NDX as we have $5,000 of extrinsic set for expiration today. Let's take a look at the markets. The SPY made little headway this week, giving back much of its early-week gains and closing at $544.51 (+0.32%). Cautious traders are pointing to a clear overextension away from the 200-day SMA and an overbought RSI reading as reasons to tread lightly. In fact, the last time this index was this far above its 200-day SMA was in May of 2021! This week, QQQ made history, with a daily close above an 80 RSI level for only the 13th time ever. Despite this strength, the week ended on a down note, closing at $480.18 (+0.19%). This index has been running hot and is currently farther away from its 200-day moving average than it’s been in nearly a year, suggesting the possibility for some cooling in the weeks to come. It’s hard to believe, but the small caps were the top gainer this week, closing at $200.35 (+0.82%). That said, is history about to repeat itself? In August of last year, a clear head and shoulders pattern led the way to a break below the 100-day SMA, and a very similar-looking setup appears to be forming now. NVDA, which is a big weekly trade for us, turned lower this week following a large bearish engulfing candle, resembling the March market top that front ran a 22% correction. With weak S&P seasonality on the horizon, prices may stay suppressed. At the same time, CEO Jensen Huang has cashed out over $90M worth of shares since June 15th. Let's take a look at I.V. and potential moves for the week. The 1 day VIX is still dreadfully low in the 8 dollar range. A reading above 15 is the sweet spot for getting Theta fairy setups and also gives us the best risk/reward ratio for our 0DTE's. Expected moves in the market this week: In other words...nothing new or exciting happening on the I.V. front. Not much to work with...again. Economic data on Friday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to 51.7 in June, stronger than expectations of 51.0. Also, the U.S. June S&P Global services PMI unexpectedly rose to a 2-year high of 55.1, stronger than expectations of 53.4. At the same time, U.S. existing home sales fell -0.7% m/m to a 4-month low of 4.11M in May, compared with the 4.08M consensus. In addition, the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in May, weaker than the expected -0.4% m/m. “Investors should brace for drama. The second half of 2024 is shaping up to be a time of transition and volatility. The decisions that investors make now will be key to navigating this period effectively,” said Solita Marcelli at UBS Global Wealth Management. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 60.3% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. In the coming week, the May reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred measure of inflation, will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (third estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Building Permits, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, Chicago PMI, and Michigan Consumer Sentiment Index. Several notable companies like Nike (NKE), FedEx (FDX), Micron Technology (MU), Walgreens Boots Alliance (WBA), General Mills (GIS), and Carnival (CCL) are slated to release their quarterly results this week. Investors will also gain further insights into the artificial intelligence landscape this week as investor favorite Nvidia hosts its annual shareholder meeting on Wednesday. In addition, several Fed officials will be making appearances throughout the week, including Daly, Cook, Bowman, and Barkin. Meanwhile, investors will be closely watching the first U.K. prime ministerial and U.S. presidential debates scheduled for this week, alongside the first round of voting in the French legislative election scheduled for this weekend. The U.S. economic data slate is mainly empty on Monday. With the pause in the markets Friday we are closer to sell signals than buys as we start the week. One ominous sign that I don't think is getting enough airplay is the huge divergence in the markets. With the SPY and QQQ bouncing around ATH's the overall market is seeing more and more selling. Take a look at the SPY vs. the equal weighted RSP. It's largely been tech and semi's and A.I. driven stocks holding this market up. The rest of the market is struggling. If TSLA and NVDA continue to be weak it could be the catalyst to pull the broader markets down. Our VTI swing trade is flashing a short signal. Add to that the fact that the technicals have swung back to the dreaded neutral rating today. Today could be key for the bulls if they want to hold on to any momentum. We are back to a full week of potential earnings trades with FDX, CCL, MU, PAYX, GIS, LEVI, NKE, WBA all on our potentals list. Our trade docket for today: /NG, /HG, /ZN, CCL, DELL, DIA, ODTE's, GLD, PLTR, IWM, CRM, NVDA, PYPL, SHOP, WYNN, UPST, SPY/QQQ 4DTE, VTI, NVDA. My lean today is bearish. With finishing last week with a week close and the neutral rating technically today as well as the VTI flashing sell I'm leaning to the downside today. Intra-day levels for me: /ES; 5539/5545/5550/5556 to the upside. 5529/5519/5513/5509 to the downside. As you can see, the range is very tight today as is normal on a neutral rated day but there is an open air pocket below support if we start to drop. /NQ; 20009/20091/20188/20248 to the upside. 19990* (key support) 19849/19787/19694 to the downside. Bitcoin: Is back to a critical support level it established in early May. 65,908 is now resistance and 60,694 is critical support. A break below that and there could be some downside potential. Let's have a great day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |