Does Crisis = Opportunity?Good Friday to you all! I've got two big topics I want to discuss this morning. What is your personal view of crisis moments and who are you aligned with for trading? #1. What is your view of crisis? Is it, like the Chinese symbol implies, an opportunity? Or is it just something that freaks you out? We got an amazing undercut and rally pattern last night (more on that pattern in a min.) That set us up for a great overnight trade on our patented Theta fairy and a long /MNQ options scalp to the upside. I was so excited. It was a once in about 8 month opportunity that we rarely get. It would have been awesome if it wasn't for the fact that I spent 4 hours (yes four full hours) talking one of our trading members off the ledge. He was literally out of his mind with fear. He was convinced that Iran was going to retaliate with nukes (not in the future but last night). That gold was going to $5000/oz. and that WWIII was starting. I told him that scenario was physically impossible. (I'm pretty sure you need to possess nukes before you can fire them, right?) He then said it was. I said it wasn't and this 7 yr. old conversation continued. Yes they can. No they can't. He was literally out of his mind. I couldn't help but wonder, what is it that can make two people look at the same situation and one sees' opportunity and the other sees the end of existence? How you view things really does affect what results you get. #2. I also want to talk about who you are aligned with for trading purposes. Firstly, you absolutely should and can align yourself with a team of traders. Please don't trade alone. There are too many advantages to trading as a team and having that support. When you do align with a team ask yourself this. Do you show you real, live trades or is it just education? Do they provide 24/7 hand holding? Do they have a professional trader to can talk to at any time? I see a lot of education out there. I also see some trade alert services that give no support and just text out trade ideas that you are supposed to just blindly follow. I don't know of many services that started building you trade ideas before the open and continued to trade through the night last night. We did and it's put money in our members pockets that otherwise wouldn't be there. I'm not excited about spending four hours with you individually each day to keep you from taking a ride on the crazy train but I will and clearly do! I don't think you'll find a more valuable trading room that what we've built right here. Undercut & Rally Patterns — Weaponizing the Shakeout What Is an Undercut & Rally? At its core, an undercut and rally (U&R) is a shakeout reversal. Price undercuts a key prior low or major moving average, triggering stops and panic selling, only to reverse higher, trapping shorts and reenergizing bulls. It’s a setup rooted in deception and asymmetric psychology:

The U&R is your chance to buy fear — with a defined stop and explosive upside. Why U&Rs Work

3 Types of Undercut & Rallies 1. Key Low U&R

2. Moving Average U&R

3. Double U&R

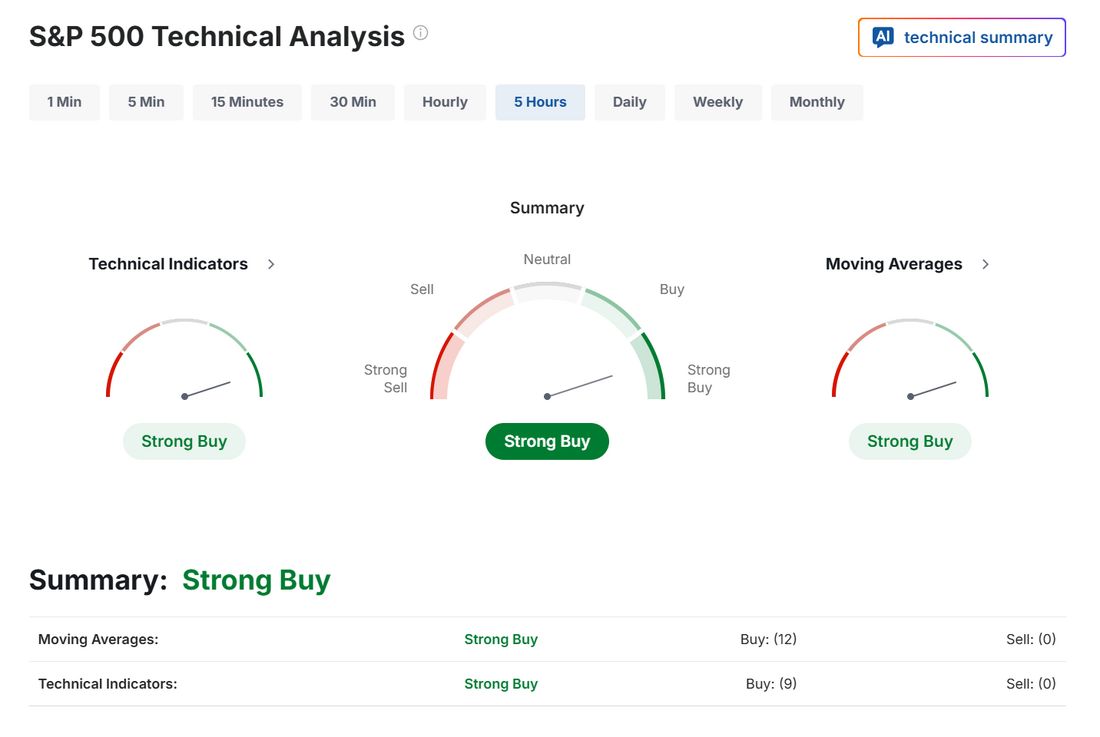

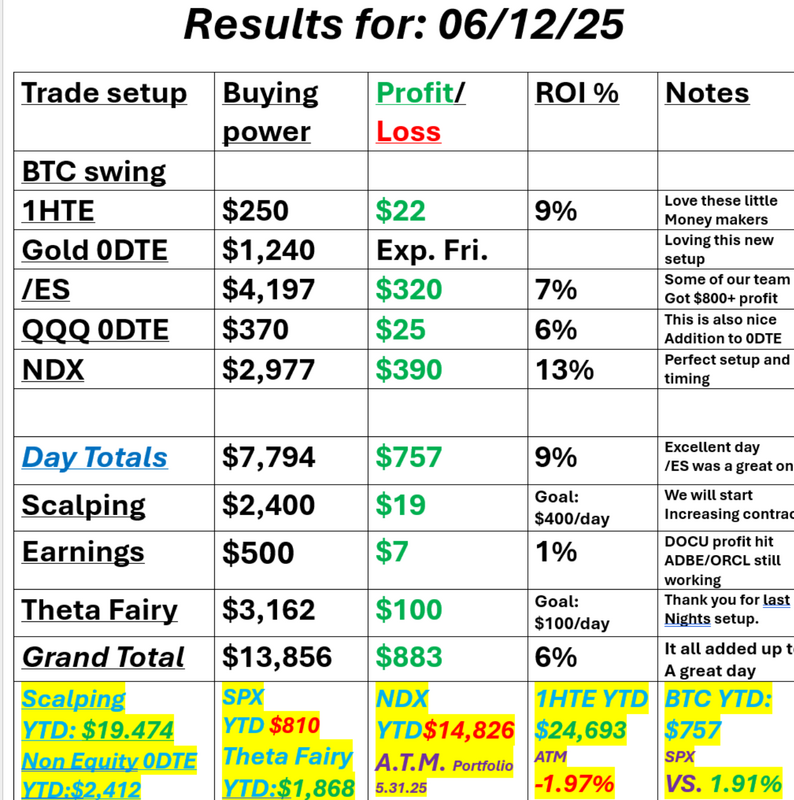

une S&P 500 E-Mini futures (ESM25) are down -1.18%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.46% this morning, pointing to a sharply lower open on Wall Street as sentiment took a hit following Israel’s attack on Iran’s nuclear and military facilities. Israel carried out a broad attack on Iran’s nuclear facilities, ballistic-missile sites, and military leadership on Friday. Israel reportedly killed the head of the Islamic Revolutionary Guard Corps and hit dozens of targets in a major escalation that could ignite a wider conflict in the Middle East. The strikes came after Iran announced Thursday that it would soon open a third uranium-enrichment site. The United States said it played no role in the operation. The attack unsettled markets and drove investors toward safe-haven assets. Israeli Prime Minister Benjamin Netanyahu confirmed that a military operation against Iran had started and would continue “as many days as it takes.” Iran pledged to retaliate against Israel and potentially U.S. assets in the Middle East. At the same time, U.S. President Donald Trump urged Iran to strike a deal “before it is too late.” In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Oracle (ORCL) jumped over +13% and was the top percentage gainer on the S&P 500 after the IT giant posted better-than-expected FQ4 results and said it expects its cloud infrastructure growth rate to surge to more than 70% in FY26. Also, Datadog (DDOG) rose more than +3% and was the top percentage gainer on the Nasdaq 100 after Wolfe Research upgraded the stock to Outperform from Peer Perform with a $150 price target. In addition, Cardinal Health (CAH) gained over +4% after the medical distributor raised its full-year adjusted EPS guidance. On the bearish side, Boeing (BA) slid more than -4% and was the top percentage loser on the S&P 500 and Dow after an Air India-operated Boeing 787 Dreamliner carrying more than 200 people crashed near the airport in Ahmedabad, a city in western India. Economic data released on Thursday showed that the U.S. producer price index for final demand came in at +0.1% m/m and +2.6% y/y in May, compared to expectations of +0.2% m/m and +2.6% y/y. Also, the core PPI, which excludes volatile food and energy costs, arrived at +0.1% m/m and +3.0% y/y in May, better than expectations of +0.3% m/m and +3.1% y/y. In addition, the number of Americans filing for initial jobless claims remained at an 8-month high of 248K last week, compared with the 242K expected. “For the second day in a row, inflation data came in lower than expected, and this gives the Fed room to sit on their hands,” said Chris Zaccarelli at Northlight Asset Management. “As long as inflation isn’t increasing – or even better, is decreasing – the Fed can be patient and wait for more information on how the new tariffs and trade negotiations are going to impact the price stability part of their dual mandate later this year.” Meanwhile, U.S. rate futures have priced in a 97.2% chance of no rate change at next week’s FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary June figure will stand at 53.5, compared to 52.2 in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.340%, down -0.37%. All that worry. All that concern and it's barely moved our technicals. Trade docket today: We've already booked our profit on our Theta fairy! Looking for a possible BA 0DTE. /GC (Gold) 0DTE, /MNQ scalp continues from last night. Looking for more upside. ADBE, LULU, ORCL all are expiring today. QQQ 0DTE and SPX 0DTE. I'll try another 1HTE BTC trade this morning as well. Level's today are easy. Above 6003 is bullish. Boom! There you go. Let's keep the party from last night going! See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |