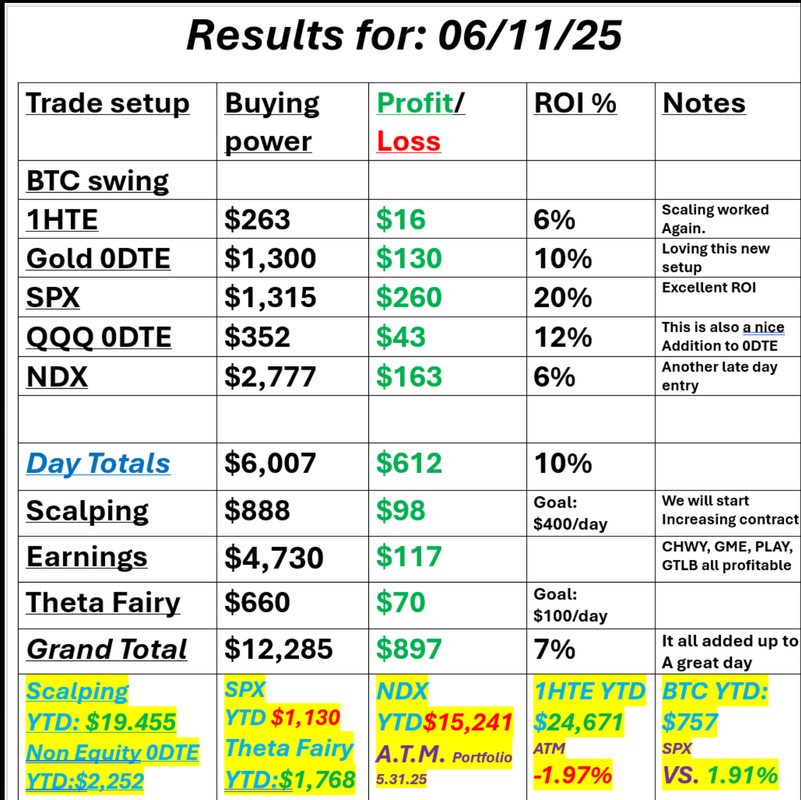

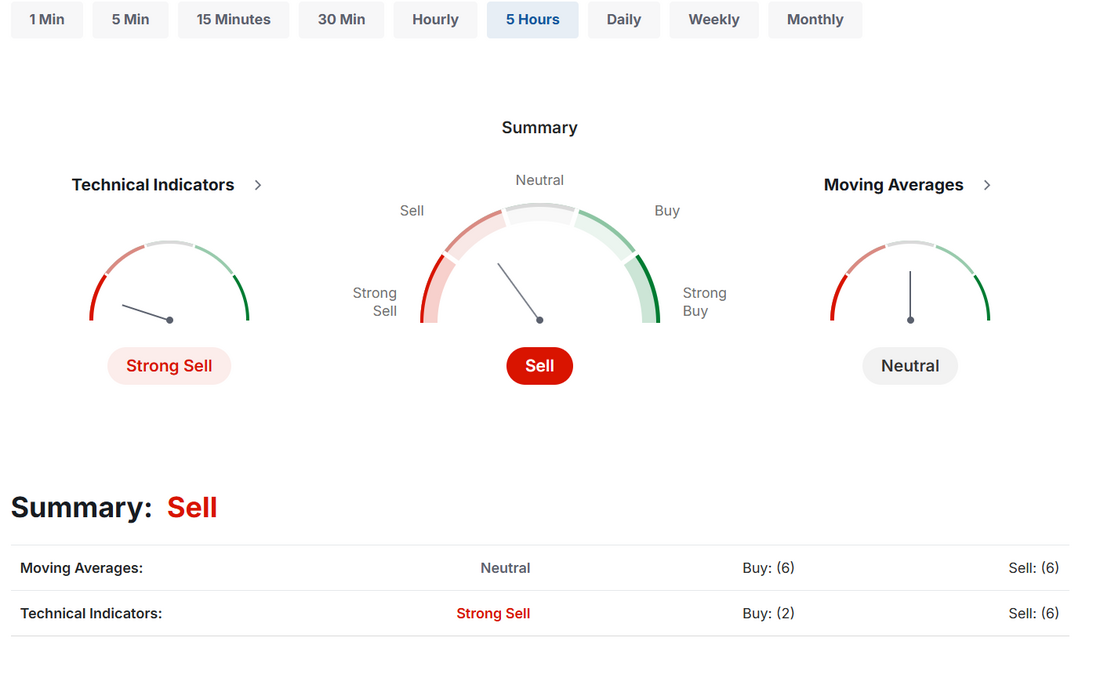

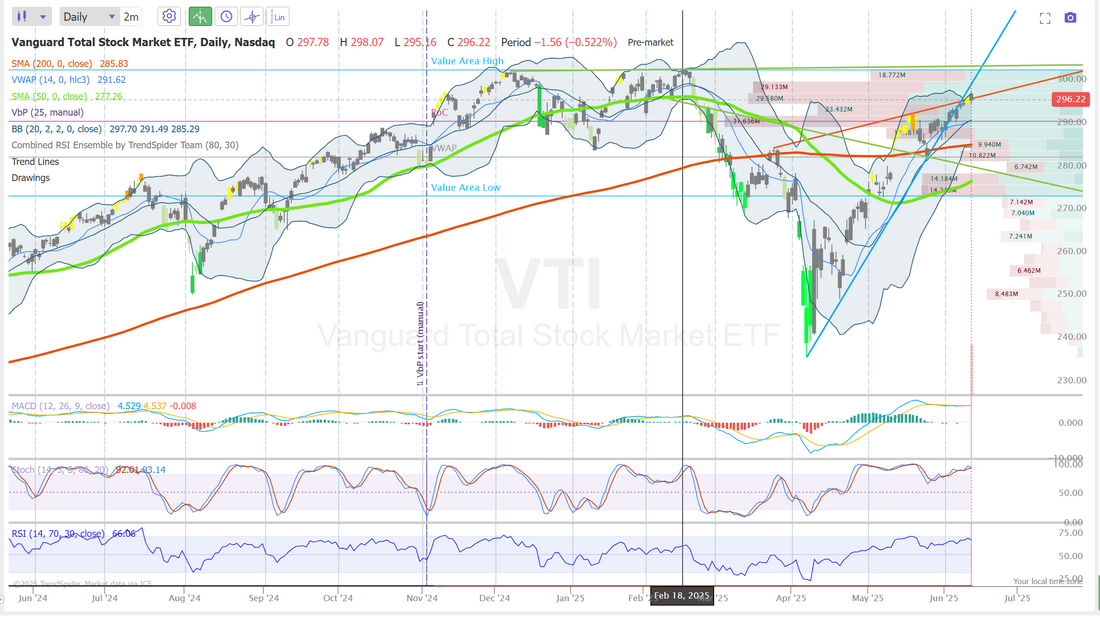

I feel better bearishThe market sold off a bit yesterday and futures are down this morning pre-PPI release. That's flipped our technical picture to a bit of a sell signal and you know what? That's great! I've talked a lot about epiphanies you get as you learn to trade. The concept of shorting is a big one. The idea that you can make money when stuff falls. From a traders perspective we always prefer down markets. The moves are generally bigger (stairs up elevator down anyone?) It's way easier to find overpriced stocks to short than it is to find the next "Ten bagger". Premium is better for option sellers. The key is to have the bulk of our Assets in a hedge fund environment like our ATM asset allocation model. PPI will lead the way today. I don't imagine it will be much different than CPI yesterday. The main question is, do we roll over today. The key 6003 level on /ES is back in play. We had an incredible day yesterday. It never really seemed like it! We just chipped away and chipped away and at the end of the day we had 13 trades under our belt and it all added up to a great result. Every trade matters. See our results below: une S&P 500 E-Mini futures (ESM25) are down -0.35%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.30% this morning as concerns around U.S. trade policy and escalating geopolitical tensions weighed on sentiment, while investors awaited the release of crucial producer inflation data. U.S. President Donald Trump heightened trade uncertainty with comments that he plans to impose unilateral tariffs on dozens of U.S. trading partners within two weeks. “We’re going to be sending letters out in about a week and a half, two weeks, to countries telling them what the deal is, like I did with the EU,” Trump said late Wednesday. An escalation of tensions in the Middle East also weighed on investors’ risk appetite. CBS reported that U.S. officials have been told Israel is fully prepared to launch an operation into Iran, prompting the U.S. to evacuate non-essential embassy staff from Iraq. Iran threatened to strike not only Israeli targets but also U.S. bases in the region if attacked. In yesterday’s trading session, Wall Street’s major indices closed lower. Most of the Magnificent Seven stocks retreated, with Amazon.com (AMZN) falling more than -2% and Apple (AAPL) dropping over -1%. Also, U.S. steel stocks slumped after the U.S. and Mexico closed in on a deal to remove tariffs on some steel imports, with Cleveland-Cliffs (CLF) sliding more than -8% and Nucor (NUE) dropping over -6%. In addition, Lockheed Martin (LMT) fell more than -4% after the U.S. Air Force reduced its F-35 aircraft request to Congress by half. On the bullish side, Warner Bros. Discovery (WBD) climbed +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after it said it may repurchase more of its bonds than the $14.6 billion announced for buyback on Monday. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices rose +0.1% m/m in May, weaker than expectations of +0.2% m/m. On an annual basis, headline inflation picked up to +2.4% in May from +2.3% in April, weaker than expectations of +2.5%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.1% m/m and +2.8% y/y in May, weaker than expectations of +0.3% m/m and +2.9% y/y. “The tariffs aren’t filtering through to Main Street as feared. This is good news for the White House, Wall Street, and Jerome Powell. The Fed’s tone could soften next week because we’ve probably seen peak hawkishness, especially with other central banks cutting,” said David Russell at TradeStation. Meanwhile, U.S. rate futures have priced in a 100% chance of no rate change at next week’s FOMC meeting. Money markets are currently pricing in roughly two Fed rate cuts by the end of 2025, with the first anticipated in October. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. May PPI will stand at +0.2% m/m and +2.6% y/y, compared to the previous figures of -0.5% m/m and +2.4% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect May figures to be +0.3% m/m and +3.1% y/y, compared to April’s numbers of -0.4% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 242K, compared to 247K last week. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ2 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.402%, down -0.20%. As I mentioned, technicals are rolling over a bit here. It's now a full blown sell signal...yet, but we can hope! Taking a look at VTI there are a couple key areas of focus for me. #1 We are back down below the upward trend line. #2. We are also sitting right on the current resistance line. #3. Stoch and RSI are looking overbought. It's too early to call for a rollover but it's looking more and more likely. Another busy day today: We are working a /ES trade that has about $447 risk for a $1,100 potential profit. We'll keep working it today. DOCU possible call side. LULU additional work. ORCL take profit. ADBE earnings play. QQQ 0DTE as well as a potential SPX 0DTE, depending on the outcome of the /ES trade. I'll continue scalping with /MNQ futures contracts. 1HTE BTC trade. With PPI this morning we'll not start with any lean or bias and we'll trade off pivot points again.

I'll see you all in the live trading room soon!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |