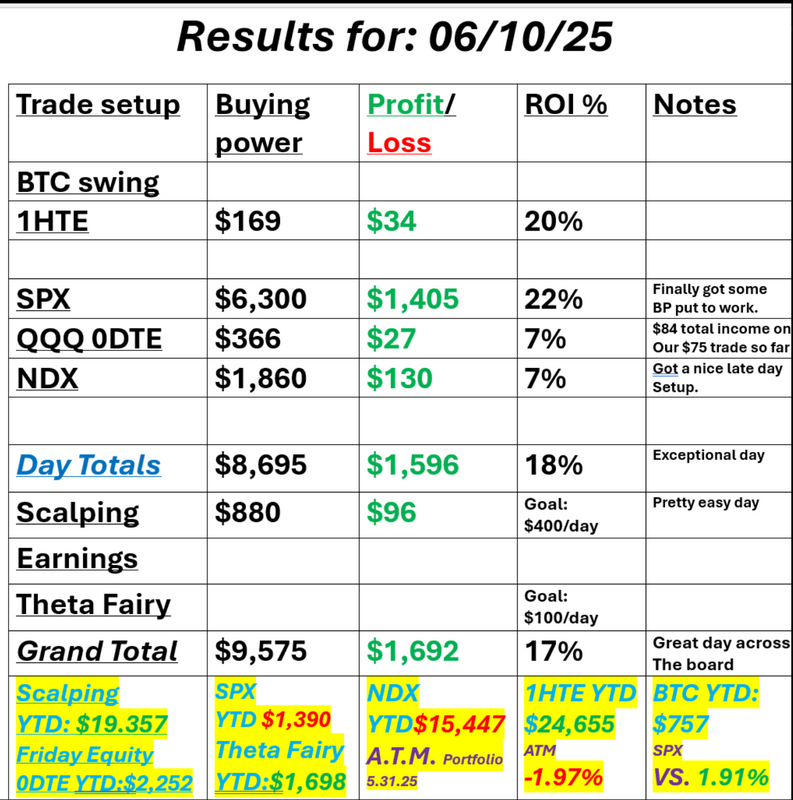

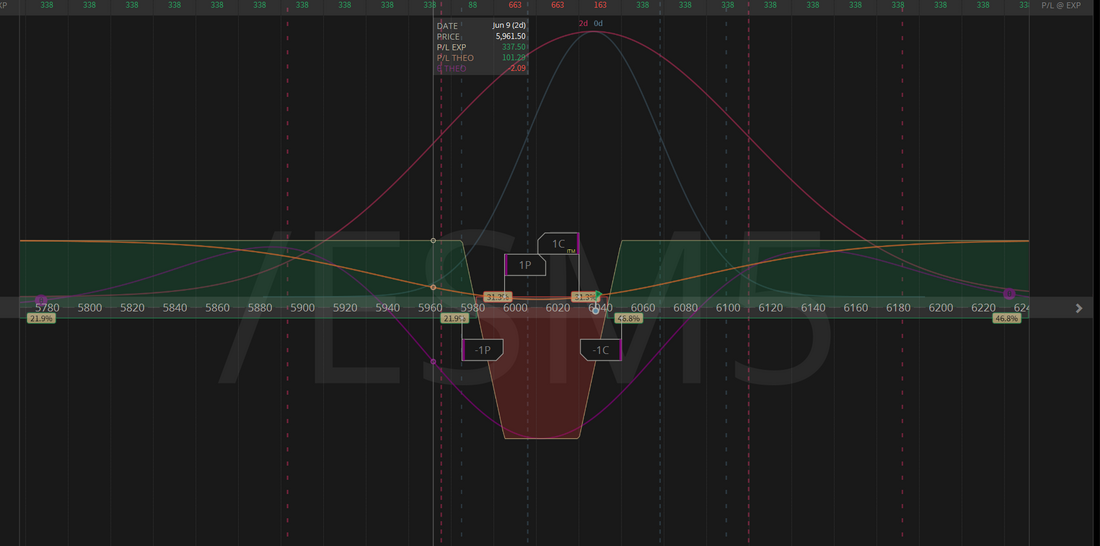

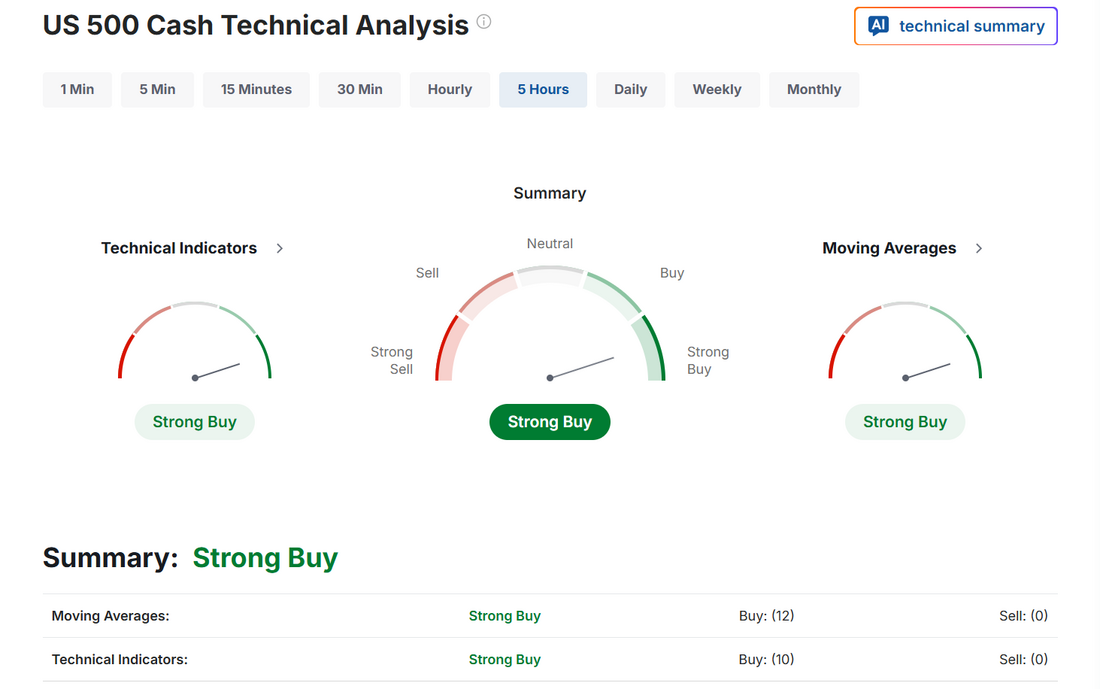

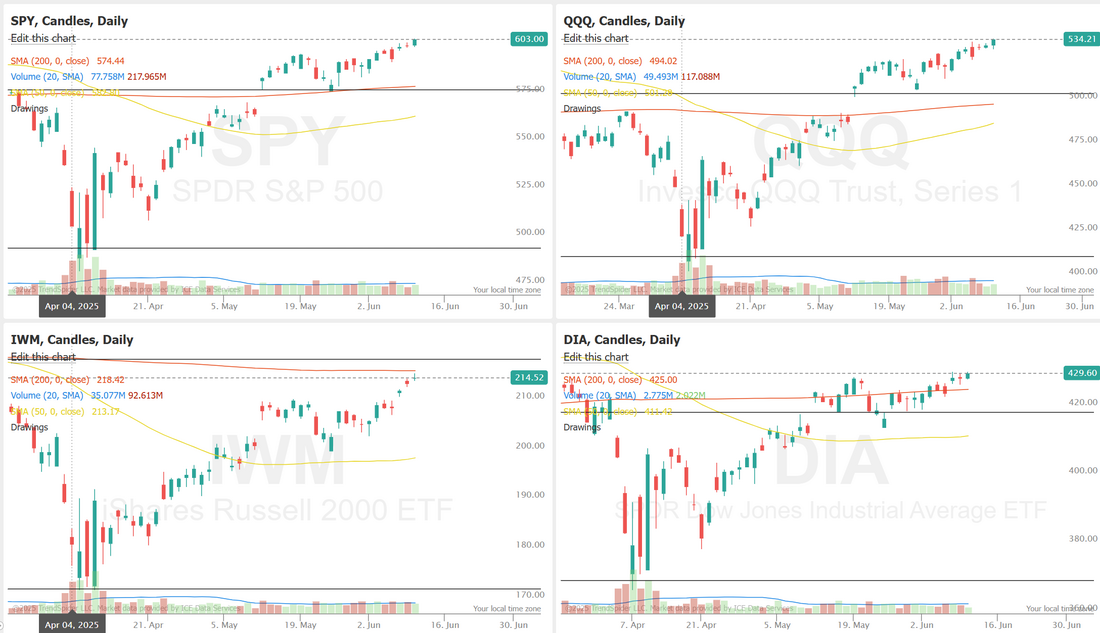

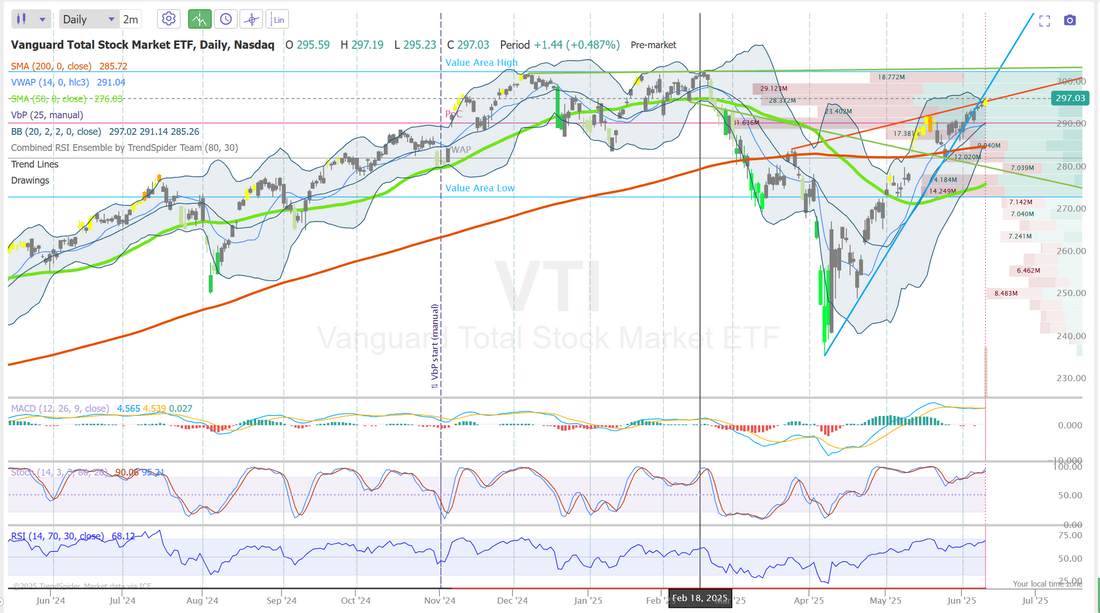

B.P. + Risk/Reward = Dollar profitThere are so many components that interact to produce a good, bad or indifferent result with each trade. While there is plenty of discussion on building good risk/reward ratios, it can ultimately be the B.P. (buying power) you use (or don't use) that makes you happy at the end of the day. I was enthralled by a trader I only knew through another trader friend of mine who would consistently put up $100,000+ profit months, trading his own money. I was less impressed when I found out he was trading 5.4 million dollars! What does all this mean? Well...if you have been keeping track of our daily performance over that last few weeks, you've noticed that every single day has been profitable. Almost every single trade we were doing worked but...They were small trades BP wise. Some days our max BP used was less than 3K. It's tough to meet our daily income goal of $1,000 dollars on that small amount of BP. We were finally able to get so good BP usage yesterday and it resulted in a great day. See our results below: ADTV (Avg. daily trading volume) is speaking....volumes.As you know, I've been suspect of this last months rally. There's several macro reasons why I have doubts but the low daily volume speaks...volumes, I believe. We have techs only that have really carried us higher. Little overall participation and, as I said, super low volume. Do I thing we are going to roll over and start a new downtrend? No. That's too early to call but it is concerning. CPI today and PPI tomorrow, as well as China developments should be our drivers. We still carry a negative Delta in our ATM portfolio. June S&P 500 E-Mini futures (ESM25) are trending down -0.14% this morning after the U.S. and China agreed on a framework to ease trade tensions, but investors were left disappointed by the lack of details, with the focus now shifting to the release of key U.S. inflation data. Representatives from the countries said the framework would effectively reinstate a pact they reached in Switzerland last month, a deal in which both sides reduced tariffs and which was partly based on Beijing’s pledge to speed up critical mineral-export licenses while the negotiations continue. Little detail from the talks was disclosed, but U.S. negotiators said they “absolutely expect” that issues concerning shipments of rare earth minerals and magnets will be resolved through the framework’s implementation. “The two largest economies in the world have reached a handshake for a framework,” U.S. Commerce Secretary Howard Lutnick said Tuesday after two days of talks in London. “We’re going to start to implement that framework upon the approval of President Trump, and the Chinese will get their President Xi’s approval, and that’s the process.” Lutnick later told The Wall Street Journal that he anticipates Trump will approve the agreement as early as Wednesday or Thursday. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Chip stocks advanced, with Intel (INTC) climbing over +7% to lead gainers in the S&P 500 and Nasdaq 100, and KLA Corp. (KLAC) gaining more than +3%. Also, Tesla (TSLA) rose over +5% after executives, including CEO Elon Musk, shared a video of one of its vehicles driving in Austin without anyone behind the wheel, suggesting the company is nearing the launch of its robotaxi service in the Texas capital. In addition, Insmed (INSM) soared more than +28% after the company announced positive top-line results from a Phase 2 trial evaluating the efficacy and safety of treprostinil palmitil inhalation powder. On the bearish side, JM Smucker (SJM) plunged over -15% and was the top percentage loser on the S&P 500 after the maker of Jif peanut butter and Folger’s coffee issued below-consensus FY26 adjusted EPS guidance. Meanwhile, a federal appeals court on Tuesday approved the Trump administration’s request to keep sweeping tariffs in effect but agreed to expedite its review of the case this summer. In other tariff news, Bloomberg reported that the U.S. and Mexico are nearing an agreement that would eliminate President Trump’s 50% tariffs on steel imports up to a specified volume. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Economists, on average, forecast that the U.S. May CPI will come in at +0.2% m/m and +2.5% y/y, compared to the previous numbers of +0.2% m/m and +2.3% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +2.9% y/y in May, compared to the April figures of +0.2% m/m and +2.8% y/y. A survey conducted by 22V Research revealed that 42% of investors expect the market reaction to the CPI report to be “risk-on,” 33% said “mixed,” and 25% said “risk-off.” This marks the first time the reaction has favored risk-on since August 2024, according to 22V. “The combination of the May inflation figures and upcoming Treasury supply will provide investors tradable events and add to the market’s collective understanding of the early fallout from the trade war as well as demand for U.S. debt in the current environment,” said Ian Lyngen at BMO Capital Markets. U.S. rate futures have priced in a 99.9% probability of no rate change at next week’s policy meeting. On the earnings front, cloud services giant Oracle (ORCL) is set to report its FQ4 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.495%, up +0.49%. I've got no lean or bias today. CPI should guide us into the trading day. We've got one of our favorite setups already working this morning. The long Iron condor. It's always nice to be in a position to profit from big, wild, unpredictable swings. We'll likely add to this trade today to work out the "valley of death" component. It's another fairly heavy trading day. ADBE and ORCL are new earnings setups. We have our /ES 0DTE. A gold (/GC) 0DTE and will have an SPX 0DTE all working today. CHWY, GME and GTLB should all be take profit trades for us today. A possible add to our LULU trade. PLAY should be a take profit as well. Will continue to work the 0DTE part of our QQQ trade. Scalping continues to work best with the /MNQ futures. Once we get a breakout move we can get back to the QQQ's. Let's look at the markets: Bullish bias is holding into the CPI release. We continue to edge higher. We are really due a breakout. Up or down, I don't know but these tight candles and low volume mean somethings coming. I won't publish intra-day levels today or tomorrow with CPI and PPI likely leading the way. We'll trade off pivot points today which have been amazingly accurate for us. I've added a new indicator to our technical analysis today which is a blended RSI. It uses four different RSI timeframes, all combined to give a pretty darn accurate signal of when the market s in a buy, sell or caution zone. Note the Green, Red and yellow highlights. Just one more tool in our tool box. What is the new tool telling us about the broad market? Well, remember, it's only one tool. As always, we will use it in combination with all our other tools but looking at the VTI we start to get some caution signs. We are stuck below the current uptrend line. MACD is rolling over. Stoc is way overbought. RSI is in overbought zone and the combined RSI signal is yellow. CPI and PPI tomorrow will give us more guidance but don't be surprised if all this...including the super low volume, triggers a reversal. Busy day again today. We should be booking profits on our earnings trades from yesterday right out of the gate this morning. I've also got some training to share with you all this morning on predicting the future and the travails that come with that. I look forward to seeing you all in the live trading room. Yesterday was a blow out success. Let's see if we can get close to our $1,000 profit goal again today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |