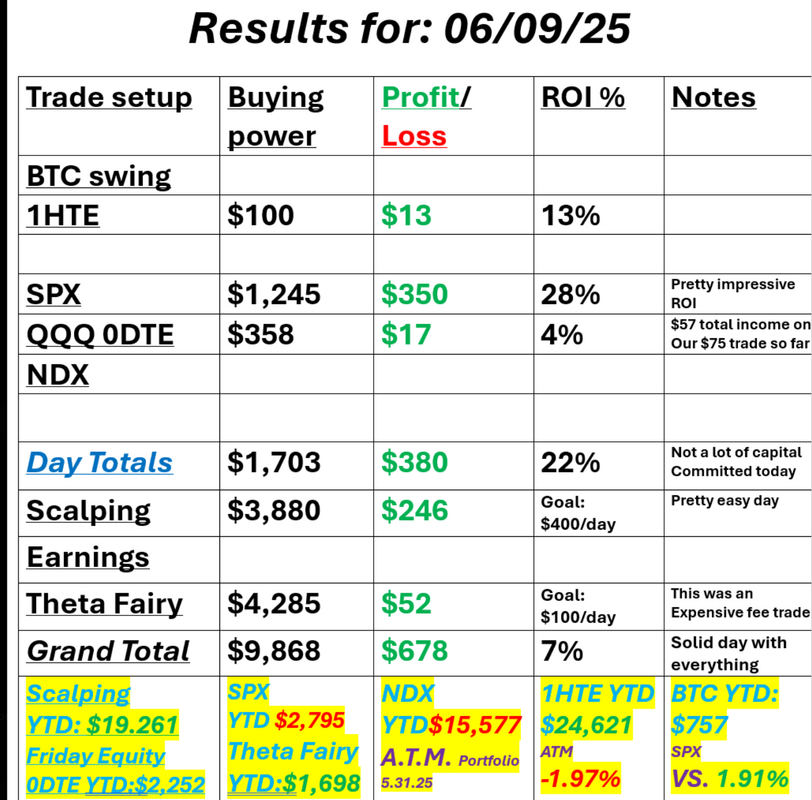

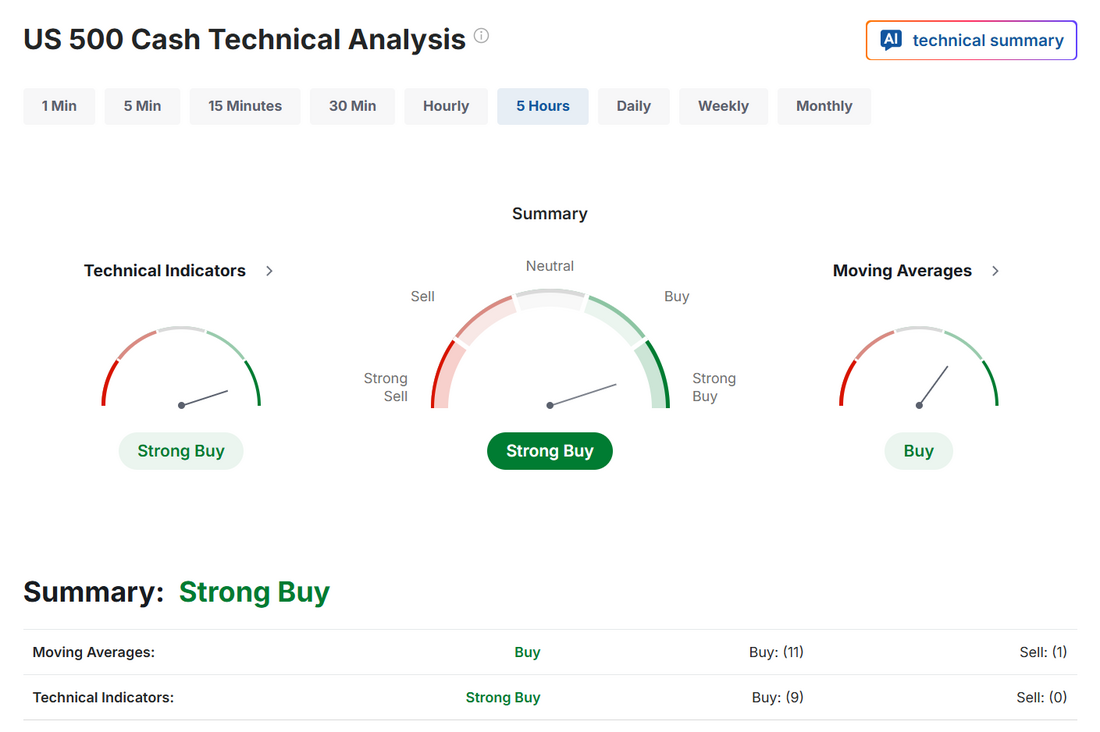

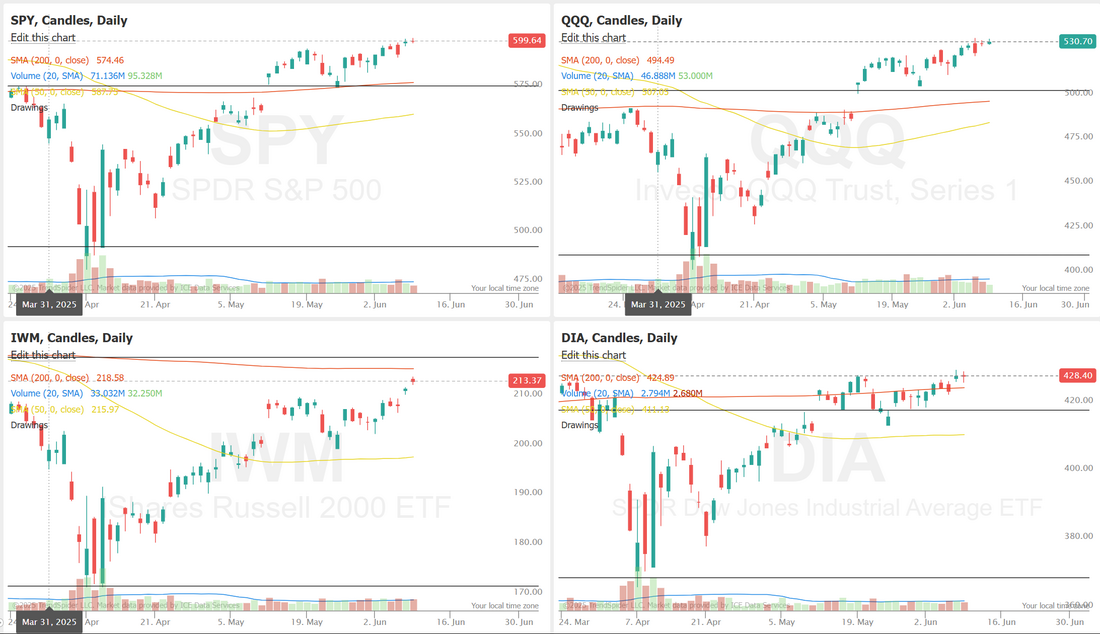

Earnings dayWe've got some of our favorite earnings plays coming up today with GME, PLAY, GTLB and CHWY. We'll be working those today. We had a really solid day yesterday. We didn't quite make our $1,000/day profit goal on our day trades but with our ATM portfolio addition it was a monster day. All these little trades add up. Here's a look at our day: Speaking of our ATM portfolio, I want to review it again. It's a "hidden gem" of our program. We don't talk about it much. It just sits in the background and churns out results. ATM stands for Asymmetric trade management. It has a dual-fold mandate to #1. Beat the unmanaged SP500 results, because if you can't do that then you might as well put your money in the SPY and call it a day. #2. Do it with less volatility. We endeavor to accomplish both of these lofty goals with a "hedge fund like" approach. We always have bullish AND bearish trades working simultaneously. Generally we carry an overall negative delta on the portfolio so as to benefit if markets drop. We carry long and short positions to balance volatility. Cash flow makes up about 70% of our returns. When markets go sideways or down it's great for our model. The results speak for themselves: 2021 54.50% return vs. 26.89% for SP500. 2022 22.6% return vs. -18.1% loss for SP500. (Our portfolio outperforms best when the markets are down) 2023 1.42% return vs. 22.57% for SP500 (Our last month through away a very good year. We made changes and learned from that mistake) 2024 10.36% return vs. 20.18% SP500 (A good year but it's hard to beat the index when you are attempting to take LESS risk and the market just goes up and up) 2025. So far this year we are neck and neck with the market. Both our portfolio and the SP500 are essentially flat, however, we had 20% expected return built up in extrinsic that has a high probability of coming in over the next three months. The market is currently up 2%. We have 20% return we should collect in the next three months. That's 10X of 1000% more than the market. I think we have a good shot at a 40% ROI year in 2025! Our four year average return has been 26% with no down years and we are on pace to TRIPLE our money in 5 years. That's not too shabby. If you'd like to see how we structure our portfolio and participate or simply want to protect your money against another 2022 crash, you can check it out for free below: My lean or bias yesterday was bullish and that's how we played it. It took a bit but that's eventually how the day worked out. My lean today is bullish as well. That's how all the technicals are set up and we are above some key support zones on /ES. June S&P 500 E-Mini futures (ESM25) are up +0.03%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.05% this morning as trade talks between the U.S. and China extended into a second day, with investors cautiously awaiting the outcome. While the first day of trade negotiations on Monday yielded no breakthrough, U.S. officials had expressed optimism that the two sides could ease tensions over shipments of technology and rare earth elements. U.S. Commerce Secretary Howard Lutnick said talks between Washington and Beijing were “fruitful,” and Treasury Secretary Scott Bessent described them as a “good meeting.” “We are doing well with China. China’s not easy,” U.S. President Donald Trump told reporters at the White House on Monday. “I’m only getting good reports.” In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Chip stocks gained ground, with Advanced Micro Devices (AMD) and Arm Holdings (ARM) climbing over +4%. Also, Tesla (TSLA) advanced more than +4% after U.S. President Trump reaffirmed his intention to end the spat with CEO Elon Musk, stating he would keep Starlink internet service at the White House and wished his billionaire backer “very well.” In addition, Goodyear Tire & Rubber (GT) surged over +10% after BNP Paribas Exane upgraded the stock to Outperform from Neutral with a price target of $15. On the bearish side, Intuitive Surgical (ISRG) slumped more than -5% after Deutsche Bank downgraded the stock to Sell from Hold with a price target of $440. Economic data released on Monday showed that U.S. Wholesale Inventories rose +0.2% m/m in April, compared with the flat preliminary reading and +0.4% m/m in March. “Markets have moved higher on tariff postponement and the perception that they will be more moderate than initially announced. We expect markets to remain headline-sensitive, as trade deals take time to negotiate and unsettling tariff news is likely to cause noticeable volatility,” said Richard Saperstein at Treasury Partners. Meanwhile, market watchers are keenly awaiting the U.S. consumer inflation report for May, scheduled for release on Wednesday. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Barclays economists said in a note that they anticipate the inflation data will show “the first signs of tariff-related price pressures.” The CPI is expected to increase to +2.5% y/y from +2.3% y/y in April, while the core CPI, which excludes volatile food and fuel prices, is expected to increase to +2.9% y/y from +2.8% y/y in April. U.S. rate futures have priced in a 99.9% chance of no rate change at next week’s FOMC meeting. Despite President Trump’s push to pressure U.S. central bankers into swiftly lowering interest rates, Fed Chair Jerome Powell and his colleagues have signaled they have time to evaluate the impact of trade policy on the economy, inflation, and employment. Today, investors will likely focus on an earnings report from GameStop (GME) as the video-game retailer ventures into the cryptocurrency space. The company, which ignited the meme stock craze in 2021 with its meteoric rise, announced in late May that it had purchased $500 million in bitcoin. As its retail video game business struggles, GameStop is looking to follow the playbook of Strategy (MSTR) and other firms shifting their business models toward bitcoin accumulation. The U.S. economic data slate is empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.453%, down -0.67%. Trade docket for today is fairly busy. We have a Theta fairy that already logged a take profit this morning. Our modified versions (switching from a strangle to credit spreads) has worked in this new market environment but they are very expensive. My take profit hit at $120 dollars and I only netted $52 after fees and commissions. We'll continue to work on this setup to improve costs. DOCU may get an addition or possible take profit today. GNE pair trade DCA. QQQ 0DTE trade. I'll likely stick with /MNQ for scalping. That's been working well for us lately. GME, PLAY, GTLB and CHWY earnings trades. We'll give another 1HTE BTC trade a go this morning. SPX 0DTE focus. Let's take a look at the markets. Technicals are solidly bullish. However, the break out is not really breaking out! I'm sure CPI and PPI may give us more clarity in the next couple days. Let's take a look at our intra-day /ES levels. Levels are slightly different from yesterday. 6041 is now resistance with 5997 working as support. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |