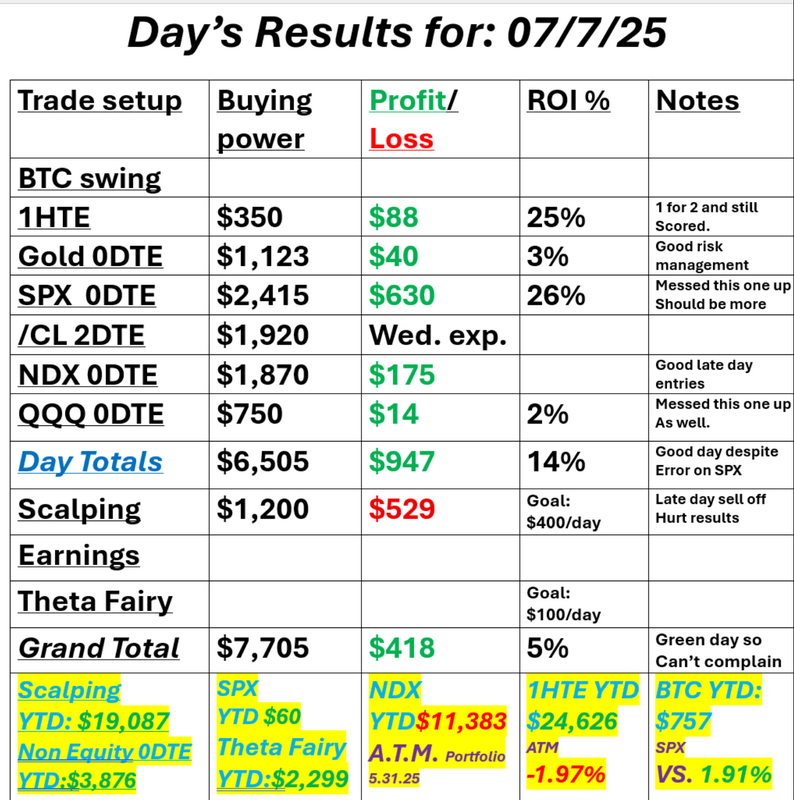

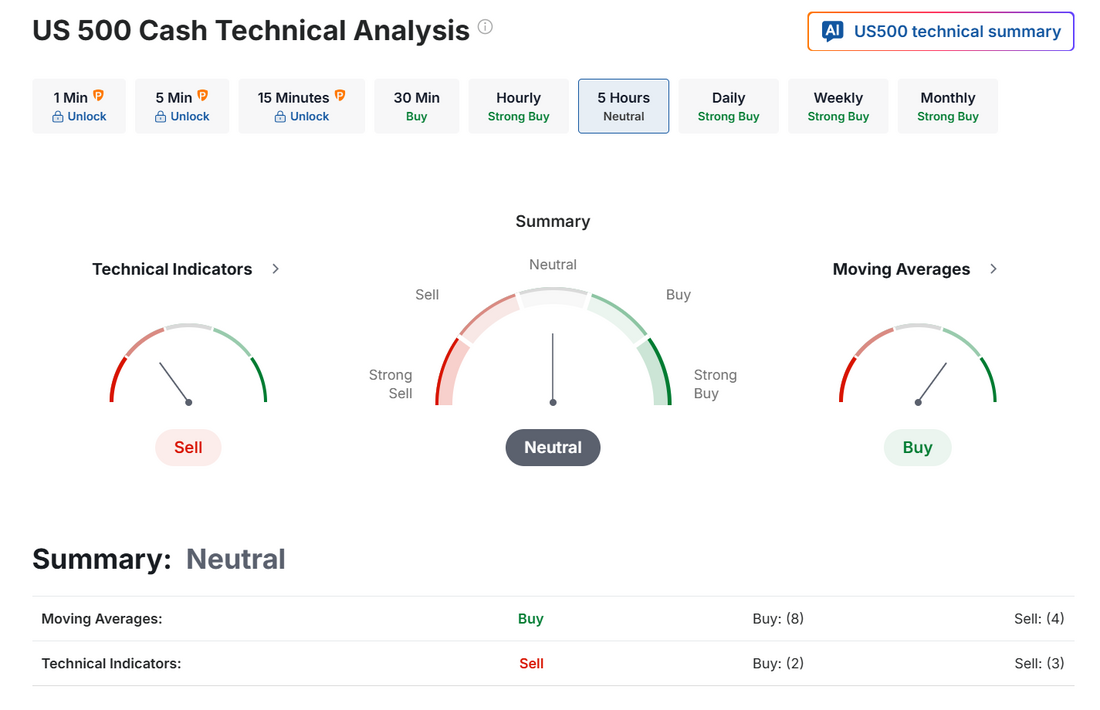

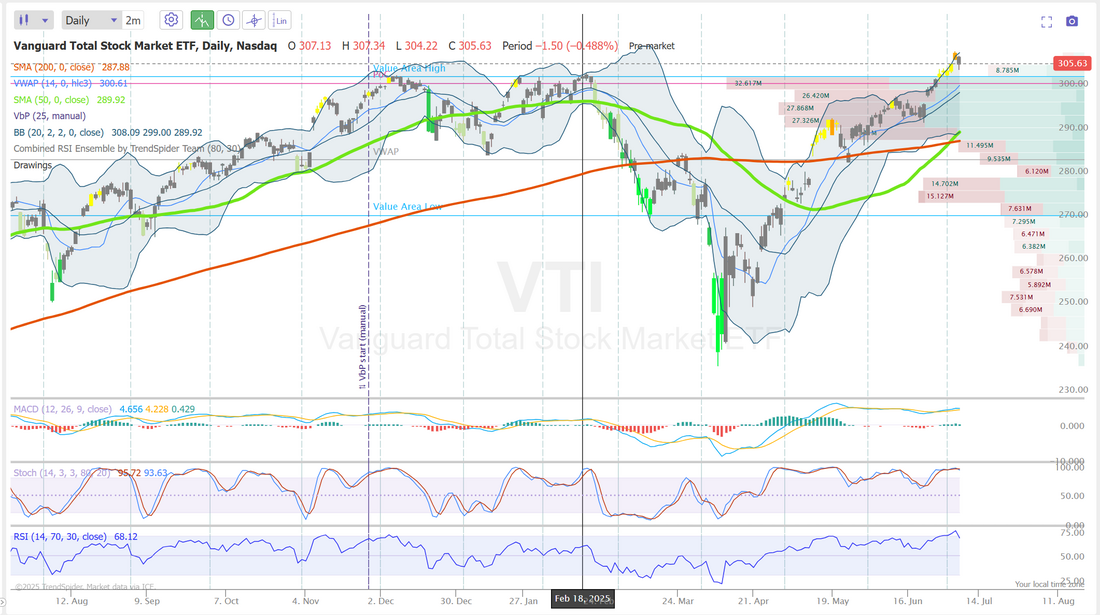

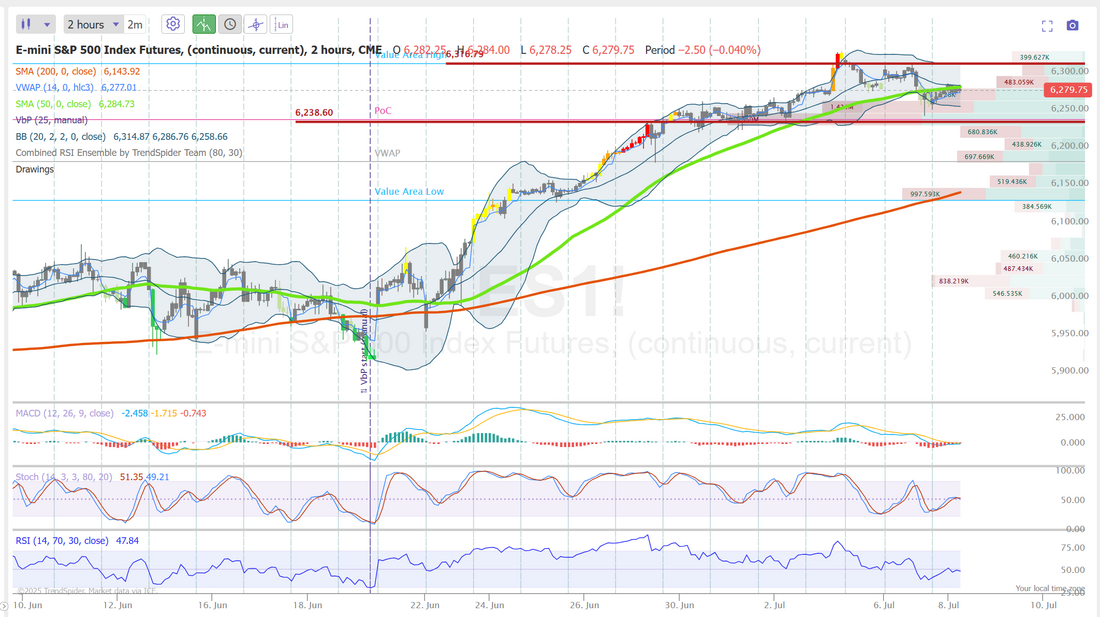

Retail investors driving the marketIt's always interesting to see who an what drives market moves. This current push higher is almost all retail. That's not tremendously comforting if you want the bull market to keep going. Mom-and-pop investors bought ~$4 BILLION of US equities on Tuesday, the biggest daily amount since mid-April. Over the 5 trading days ending, retail purchased $15B of stocks, according to Goldman. We had a profitable day yesterday despite two unforced errors on my part. That probably cost us $320 of potential profit. I'll work to do better today. Here's a look at our day: Let's take a look at the market. Technicals have flipped neutral to start us off. SPX has now hit 7 new ATH's this year. Is the highly anticipated rollover finally starting? Taking a look at the VTI again. Yesterday brought very faint sell signals all across the board. Today may very well be the day that we get a confirmation one way of the other. Any weakness or red today will confirm the weak sell signals we currently have. Any strength may be enough to put the bulls back on track. I'm looking for a neutral day today. Futures are higher, as I type but we'll need some catalyst today if the bulls want to continue any higher. Trade docket today: AFRM week long trade. /MNQ, /NQ scalp, Gold 1DTE, LULU, QTTB, SPX 0DTE and NDX 0DTE. Let's take a look at the intra-day levels on /ES. My two key levels for today as the same as yesterday. 6316 is the resistance zone and Value area high. 6238 is support and also PoC on the 2 hr. chart. I look forward to another day of trading together in the live trading room! See you shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |