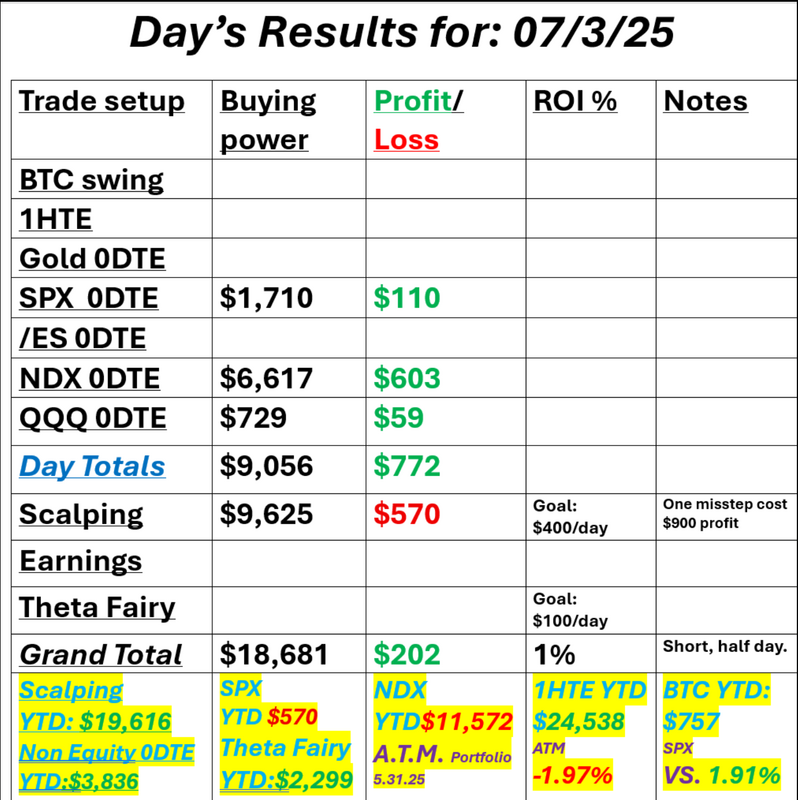

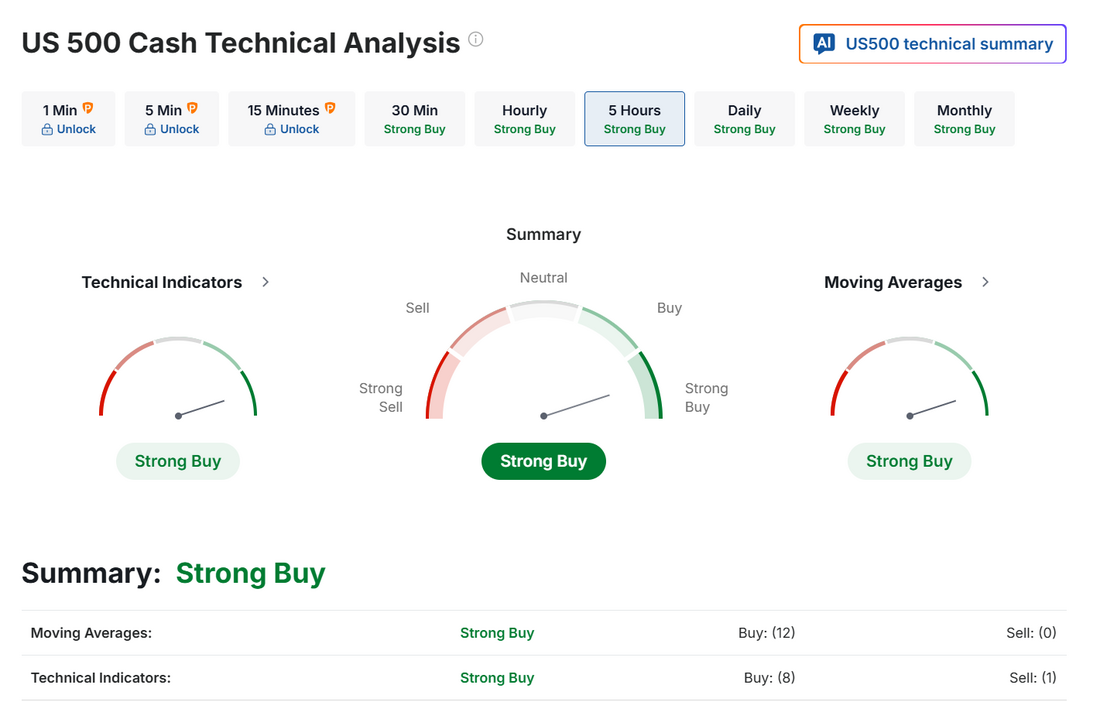

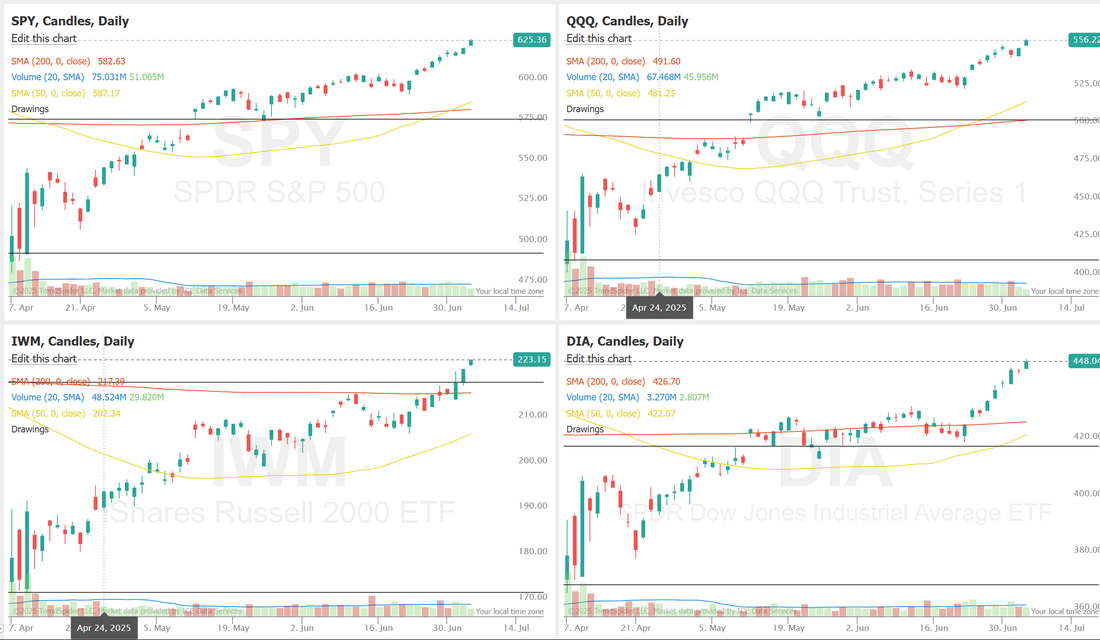

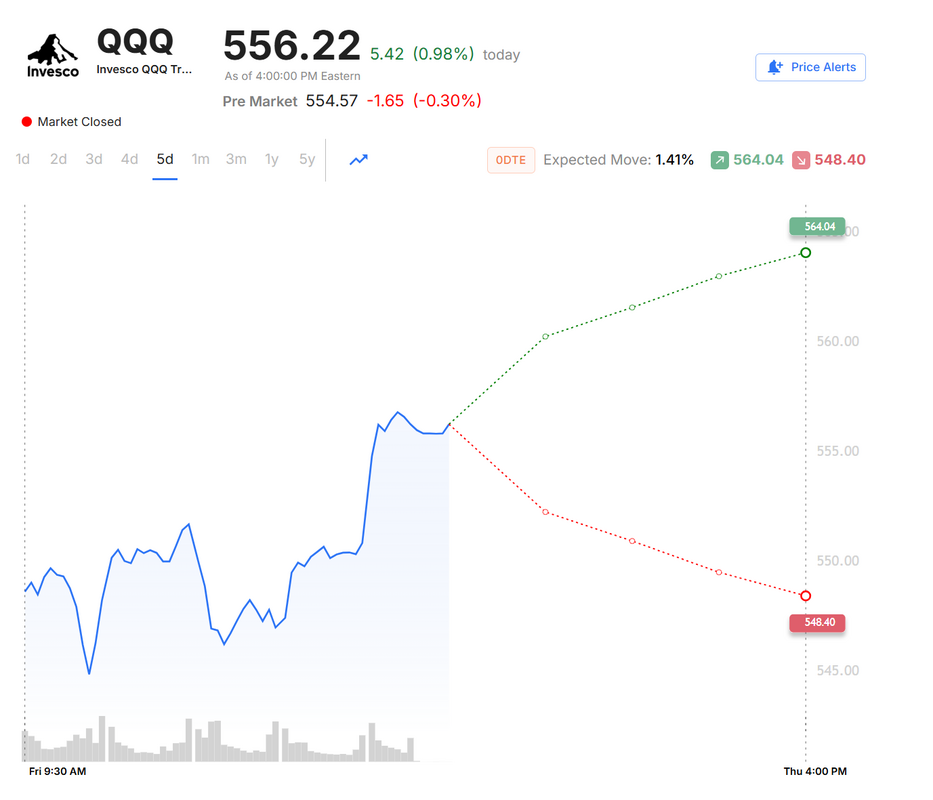

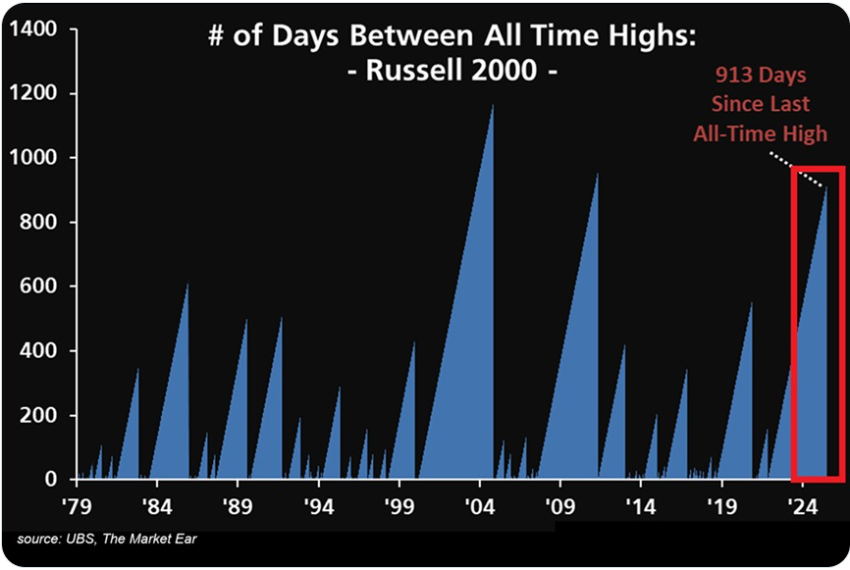

July 9th trade deadline loomsI hope everyone had a great 4Th of July. It's always good to get a break for the screens and market and take some personal time. We are back at it today with a full week ahead of us. Their are no real earnings trades to watch this week and economic news is tampered down from last weeks deluge. We do have the trade deadline looming and I'm sure we'll get some announcements of deals and no deals in the next couple days. Markets continue to trend bullish and continue to look overstretched (to me at least). Here's a look at our shortened days results from last Thurs. I gave up an additional $900 profit by not rolling our calendar 0DTE portion of our QQQ scalp out but that's hindsight for you. Let's take a look at the market. Buy mode is still hanging in there. All the major indices continue to sit at ATH'S. This is the 7th ATH for SPX this year. VTI is always my go to for total market view and it sure looks stretched and poised for a downturn here. We will be building cash for a bearish zebra setup in our ATM portfolio this week. September S&P 500 E-Mini futures (ESU25) are down -0.34%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.53% this morning, starting the week on a downbeat note as uncertainty surrounding U.S. tariffs remains elevated ahead of the July 9th deadline to complete trade negotiations. U.S. President Donald Trump announced on his Truth Social platform that “tariff letters and/or deals” would be delivered to global trading partners starting at 12 p.m. Eastern Time on Monday. President Trump has stated that new tariff rates could span from 10% to 70%. U.S. officials have signaled August 1st as the effective date for higher tariffs. Trump also threatened an additional 10% levy on nations aligned with BRICS, which includes Brazil, Russia, India, and China. “Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy,” he said. In Thursday’s trading session, Wall Street’s major equity averages ended higher. Most members of the Magnificent Seven stocks advanced, with Microsoft (MSFT) and Nvidia (NVDA) rising over +1%. Also, Datadog (DDOG) surged more than +14% and was the top percentage gainer on the Nasdaq 100 after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on July 9th. In addition, Cadence Design Systems (CDNS) climbed over +5%, and Synopsys (SNPS) gained more than +4% after the U.S. lifted export restrictions on chip design software to China. On the bearish side, homebuilder stocks slumped after the benchmark 10-year T-note yield jumped, with Lennar (LEN) sliding over -4% to lead losers in the S&P 500 and DR Horton (DHI) falling more than -2%. The U.S. Labor Department’s report on Thursday showed that nonfarm payrolls rose 147K in June, stronger than expectations of 111K. Also, U.S. June average hourly earnings rose +0.2% m/m and +3.7% y/y, weaker than expectations of +0.3% m/m and +3.9% y/y. In addition, the U.S. unemployment rate unexpectedly fell to 4.1% in June, stronger than expectations of 4.3%. Finally, the U.S. ISM services index rose to 50.8 in June, in line with expectations. “The solid June jobs report confirms that the labor market remains resolute and slams the door shut on a July rate cut,” said Jeff Schulze at ClearBridge Investments. Atlanta Fed President Raphael Bostic on Thursday urged patience amid economic policy uncertainty and said that a wait-and-see stance could help avoid the need to reverse course on interest rates. “I believe a period characterized by such widespread uncertainty is no time for significant shifts in monetary policy,” Bostic said. U.S. rate futures have priced in a 93.6% chance of no rate change and a 6.4% chance of a 25 basis point rate cut at the July FOMC meeting. Meanwhile, the U.S. House of Representatives passed President Trump’s “One Big, Beautiful Bill” on Thursday with a 218-214 vote, and Trump signed it into law on the White House South Lawn on Friday afternoon. The highlight of this week is the July 9th deadline, when the 90-day reprieve from President Trump’s so-called “reciprocal” tariffs ends. Trump is anticipated to announce a slew of trade agreements ahead of the tariff deadline. “We’re going to be very busy over the next 72 hours,” Treasury Secretary Scott Bessent said Sunday on CNN’s State of the Union, referencing the time remaining before the deadline. Bessent also indicated that certain nations without finalized deals could be granted a three-week extension to negotiate, with the tariffs set to take effect on August 1st. The U.S. economic calendar lightens up considerably following last week’s wave of economic data releases. Investors will monitor U.S. Consumer Credit, Crude Oil Inventories, and Initial Jobless Claims data this week. Also, market watchers will parse the Fed’s minutes from the June 17-18 meeting, scheduled for release on Wednesday, for any additional clues on potential interest rate cuts. While there have been recent signs of divisions leaning toward a more dovish stance, PMI and jobs data have indicated economic resilience, supporting the delay of interest rate cuts until later in the year. In addition, market participants will hear perspectives from Fed Governor Christopher Waller, San Francisco Fed President Mary Daly, and St. Louis Fed President Alberto Musalem throughout the week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.353%, up +0.86%. The SPY hit another all-time high this week, closing at $624.97 (+1.67%) with zero signs of bearish momentum. Zooming out and looking at the quarterly chart, we see a massive Q2 2025 candle with the SPY bouncing off its 2021 resistance, which is now acting as support. With the MACD continuing to push and a new quarterly candle gap, bulls remain in full control. Even as tech heavyweights like Tesla and Meta stumbled, QQQ surged to fresh all-time highs, closing at $555.75 (+5.50%). The quarterly 8/21 EMA cloud, which has been green for more than a decade, once again acted as a springboard, with Q2’s brief dip into the cloud quickly bought up. With no clear resistance overhead, traders are watching for potential resistance levels to form as this momentum plays out. Small-caps roared higher this week, with the IWM closing at $223.08 (+5.35%) as the Russell 2000 continues to defend its 2022 lows. With rate cut bets fueling rotation and the quarterly MACD flirting with a bullish cross, traders are eyeing a potential breakout to all-time highs that could finally bring small-caps in line with their large-cap counterparts. Expected moves for the week are still stuck around the 1% range for SPX. We need some more I.V. to get back to better risk/reward ratios. NDX is not much better. Trade docket for today is busy. /MNQ scalping. Gold 0DTE, Oil 2DTE, QQQ 0DTE, SPX 0DTE, Two new pairs trades with GOGO, MGNI short and EHAB and ADMA long. BITO 4DTE and 1HTE BTC trades. The Russell 2000 index has gone 913 trading days without hitting an all-time high, the longest streak in 14 years. This also marks the 3rd-longest stretch in history. The index is currently trading ~10% below its November 2021 peak. While the Nasdaq 100 and S&P 500 have reached multiple record highs in 2025, small caps continue to lag. Year-to-date, the Russell 2000 is flat, significantly underperforming the S&P 500 and Nasdaq, which are up 5.9% and 7.8%, respectively. Meanwhile, 46% of companies in the index are currently unprofitable, near the highest share on record. Small caps are getting smaller. I look forward to seeing you all in the live trading room shortly! We've got a lot to work on today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |