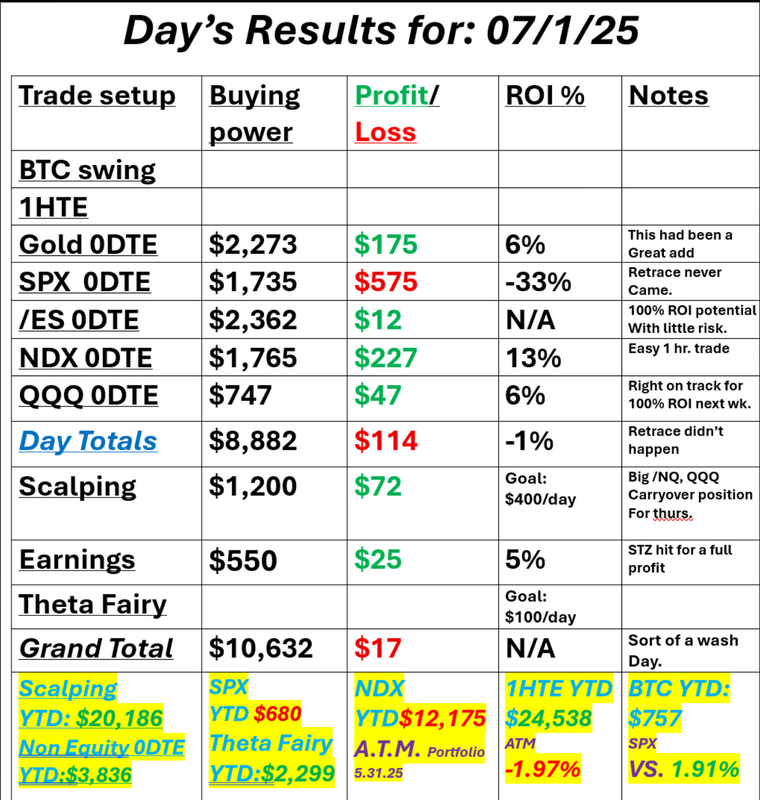

Happy independence day!Welcome back to a holiday shortened trading session today. The 4th of July holiday is a big thing to Americans and I can say, as an American who has lived in different countries and extensively traveled the entire globe, There is no more free place to live in the world. Do we have problems? Yes, and that will always be the case but I'm grateful for the freedoms we have. We had an "O.K." day yesterday. No, we didn't make any money but we had some great potential that just didn't hit. I was looking for a retrace yesterday and it just never came. Take a look at my day yesterday: We've got a shortened trading session today so we'll concentrate our focus to our scalps that we rolled from yesterday. We have a QQQ put position on that we'll turn into a debit spread to get some capital back and we have a big /NQ hedge against it. It these both hit we'll have a $1000+ profit day which is all we ask for. September S&P 500 E-Mini futures (ESU25) are up +0.03%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.08% this morning as investors sit on their hands ahead of the all-important U.S. payrolls report that will offer fresh insight into the labor market and the path of interest rates. Investors are also keeping an eye out for any updates on trade deals. Reuters reported that U.S. and India trade negotiators were working on Wednesday to secure a tariff-reducing deal ahead of the July 9th deadline, though disagreements over U.S. dairy and agriculture remained unsettled. Also, European Union trade chief Maros Sefcovic is set to meet with his counterparts today in Washington as the bloc scrambles to reach a deal before the July 9th deadline. U.S. President Donald Trump’s massive tax and spending bill remains in focus as well. The Republican-controlled U.S. House of Representatives on Thursday advanced President Trump’s tax bill, a procedural step that paves the way for potential passage of the legislation in a vote expected later in the day. Once the bill clears the House again, it will head to Trump’s desk, where he has long awaited the opportunity to sign it into law. The U.S. stock markets will close early at 1 p.m. Eastern Time today and remain closed on Friday for the Independence Day holiday. In yesterday’s trading session, Wall Street’s major indices closed mixed. Tesla (TSLA) advanced over +4% after the electric vehicle company reported better-than-feared Q2 deliveries. Also, chip stocks gained ground, with NXP Semiconductors N.V. (NXPI) and ON Semiconductor (ON) rising more than +4%. In addition, Nike (NKE) climbed over +4% and was the top percentage gainer on the Dow after President Trump said the U.S. reached a trade deal with Vietnam. On the bearish side, Centene (CNC) plummeted more than -40% and was the top percentage loser on the S&P 500 after the health insurer withdrew its full-year profit guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls unexpectedly fell -33K in June, weaker than expectations of +99K and the first decline in 2-1/4 years. “The ADP report increased the odds of a downside surprise in Thursday’s nonfarm payroll release,” said Jeff Roach at LPL Research. “Investor jitters could be a catalyst for a drop in yields [today] if the jobs report is weaker than expected. I expect a weaker-than-consensus report, increasing the odds the Fed cuts three times this year.” Traders increased bets on at least two rate cuts this year following the weak ADP data, with the first expected in September. Meanwhile, U.S. rate futures have priced in a 74.7% chance of no rate change and a 25.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that June Nonfarm Payrolls will come in at 111K, compared to the May figure of 139K. A survey conducted by 22V Research revealed that investors are paying closer attention to the key jobs report than usual this time and are anticipating a weaker print. Among the respondents, 44% expect the data to be “mixed/negligible,” 41% anticipate a “risk-off” reaction, and only 15% expect a “risk-on” response. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect June figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +3.9% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will creep up a tick to 4.3% in June from 4.2% in the prior month. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will be closely monitored today. Economists expect the June ISM services index to be 50.8 and the S&P Global services PMI to be 53.1, compared to the previous values of 49.9 and 53.7, respectively. U.S. Factory Orders data will come in today. Economists foresee the May figure jumping +8.1% m/m, compared to -3.7% m/m in April. U.S. Trade Balance data will be released today. Economists anticipate the trade deficit will widen to -$69.90B in May from -$61.60B in April. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 240K, compared to last week’s number of 236K. In addition, market participants will be looking toward a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.256%, down -0.79%. Trade docket today is concentrated today with just a half day. We'll work another QQQ 0DTE. We may have the potential for a take profit on GNE and PGCE. We'll put on a very small SPX 0DTE butterfly or something similar with little risk. Our big focus for today is our QQQ scalp with /NQ hedge. That trade alone could get us our $1,000+ profit goal today. Trading volume should be light today. We don't need levels or much technical guidance today with our focus and approach today. We will have a zoom live feed for the few hours we are trading today so I'll see you all there!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |