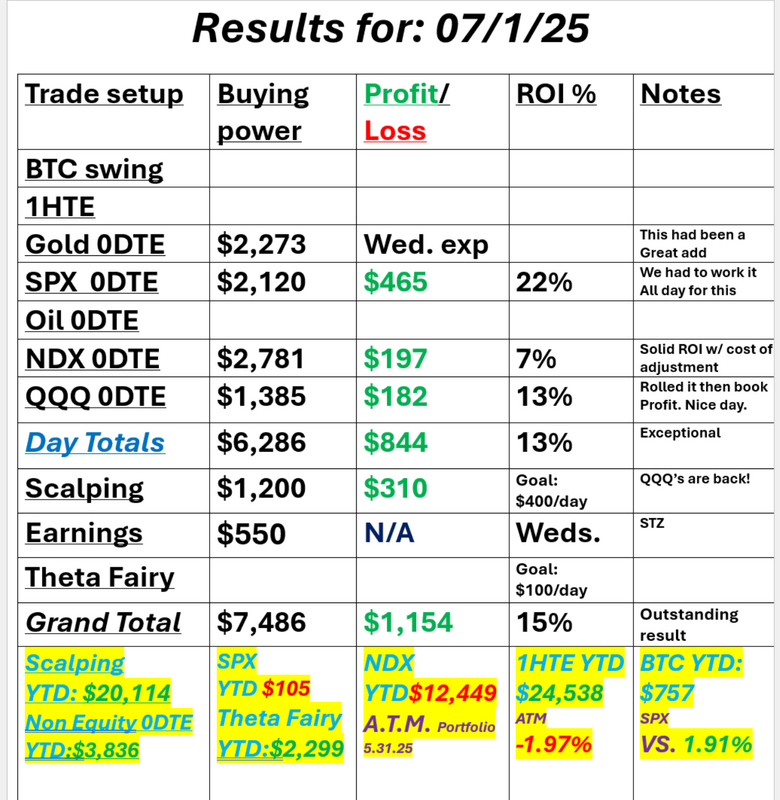

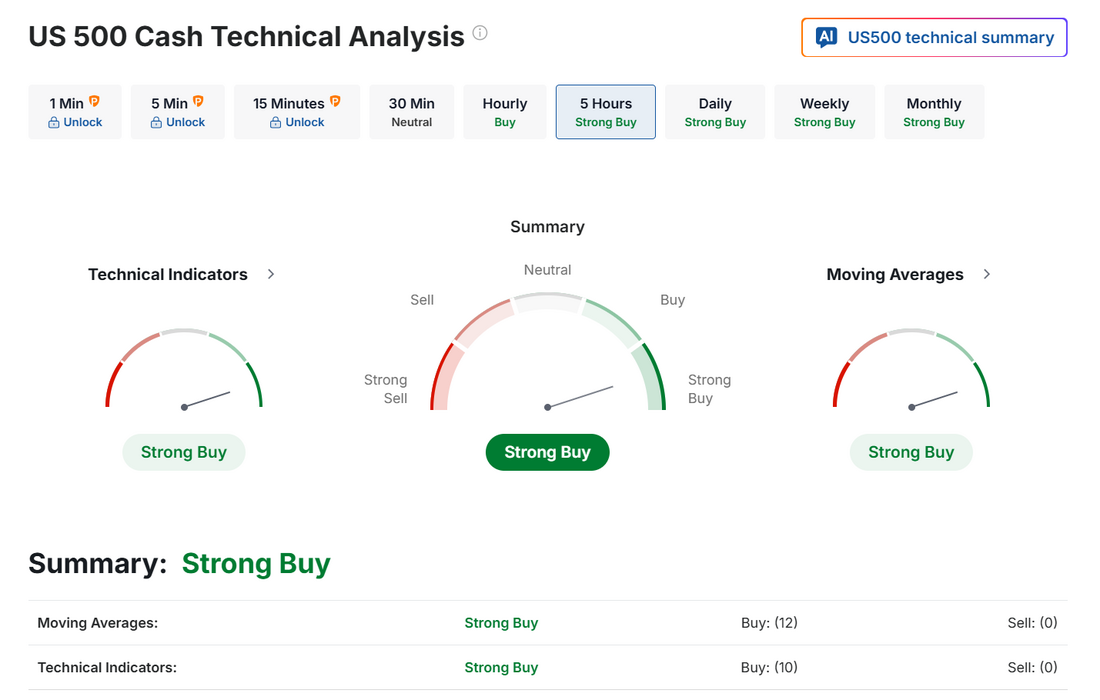

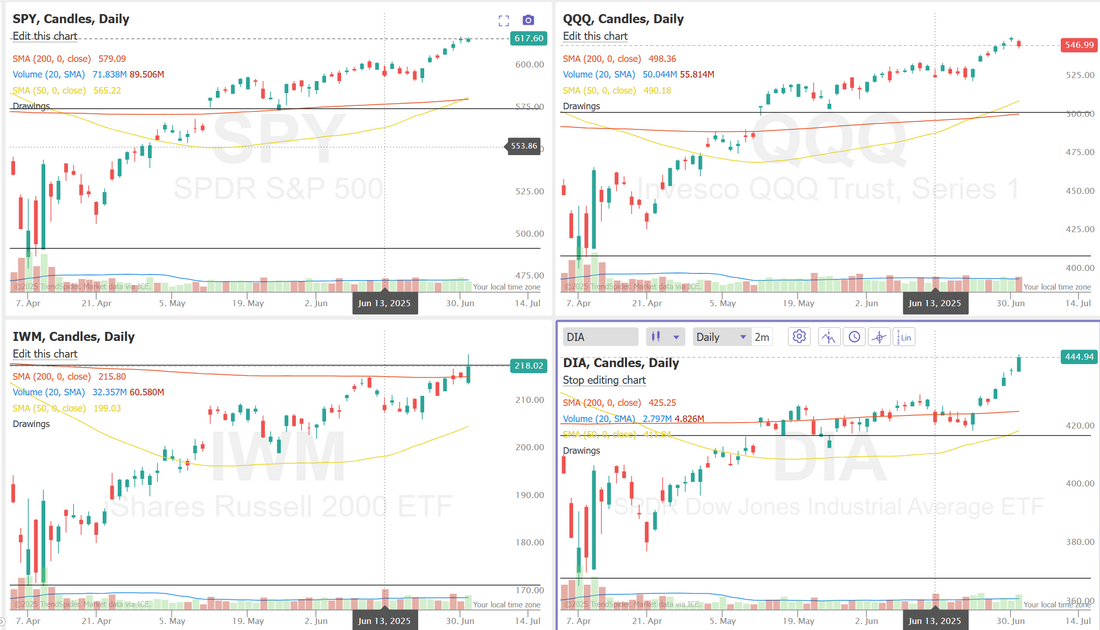

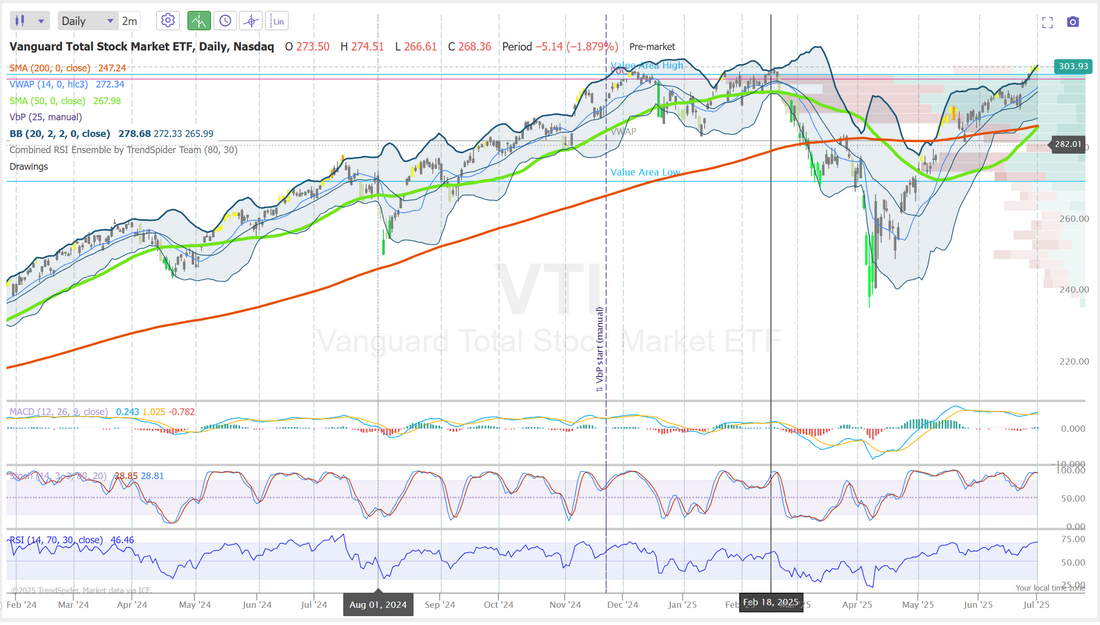

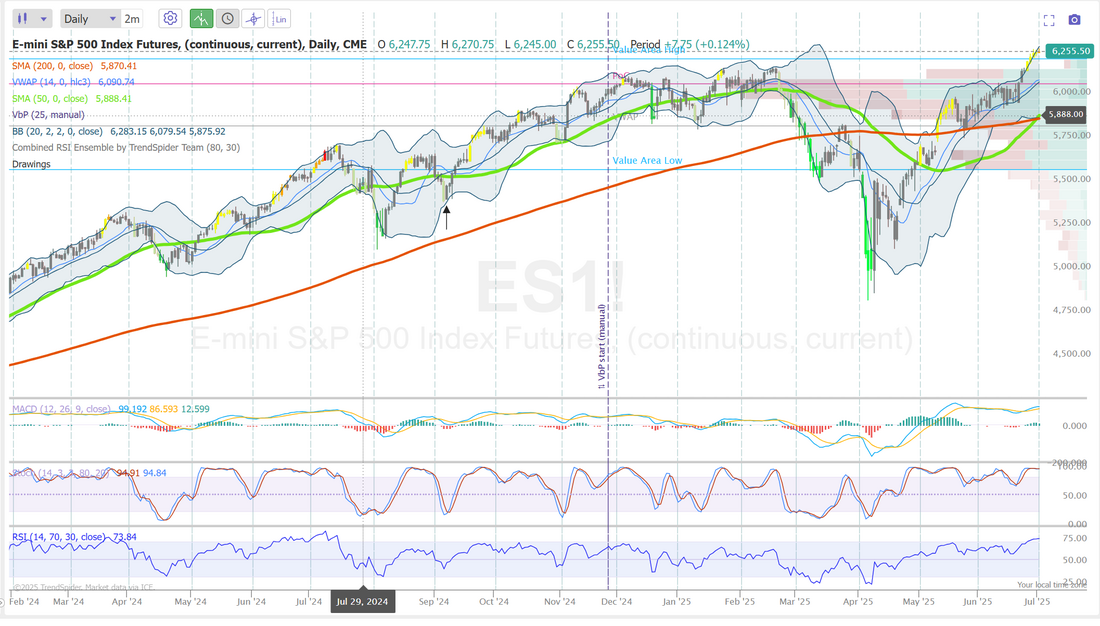

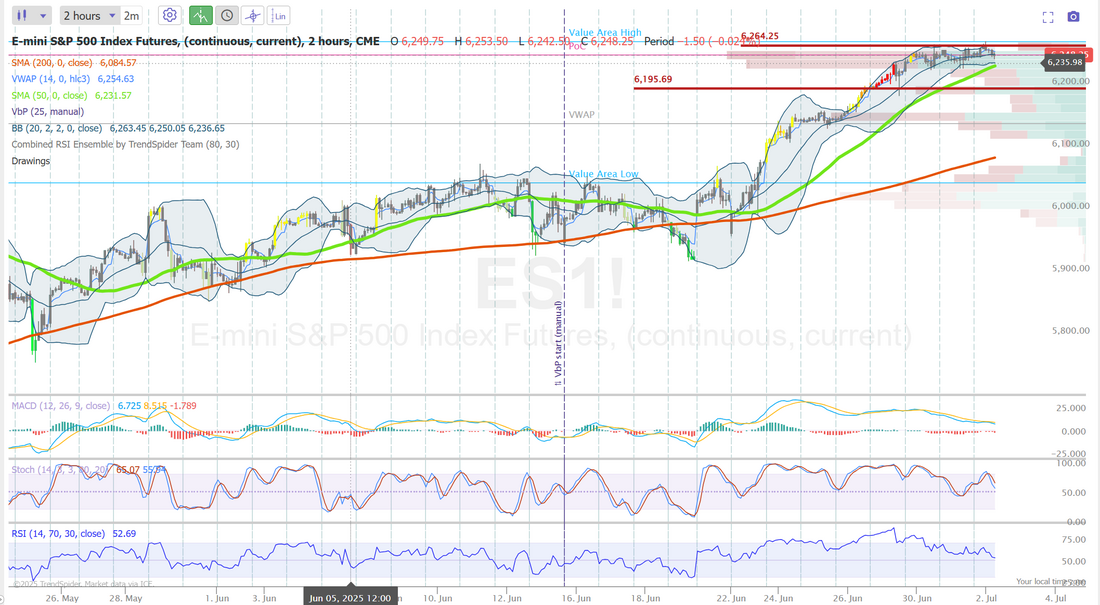

The power of zero-based thinkingAs traders we fight a dual-fold battle. We try to build winning trades, using math and statistics but we also battle ourselves. The mental side of trading can be a bigger impediment to success then getting the trades right! The great Brian Tracy designed zero based thinking after zero based accounting. It's a great way to look at how you make decisions. As traders we use it to understand that A: The market has no memory. It doesn't remember what you did in the past. It doesn't remember what trades you've made or lost money on. Each day is a new, fresh day. B: As traders, every entry we make is new and fresh. C: It's our job as traders to distinguish that. It doesn't matter if you've lost money on an initial setup. You're next entry is a new entry. It has no knowledge of your recent loss. It stands on it's own merits. This rears it's head in trading all the time. A good example is in our scalping room. We had a good day yesterday, making a nice profit and never really dipped into the red however, there are many days where we start out $300 dollars in the hole. We work and scalp all day and eventually end up with a nice profit. One of our trading members will inevitably say, "I didn't make money. I lost $300 dollars!" Of course what happened is they gave up after getting down initially. Giving up rarely provides you a positive result. Look at each trade as a new, stand alone trade. It either makes sense or it doesn't. We had an excellent day yesterday with most everything we touched working. See our results below: Let's take a look at the market. Buy mode is still holding! Markets sure look bullish. They also look tired. September S&P 500 E-Mini futures (ESU25) are trending up +0.14% this morning as investors await the U.S. ADP employment report and monitor developments in trade talks ahead of President Donald Trump’s July 9th deadline. As the U.S. continues talks with major trading partners, President Trump has increased pressure on Japan and reiterated that he won’t extend his tariff deadline. Trump threatened to raise tariffs on Japan to “30%, 35% or whatever the number is that we determine, because we also have a very big trade deficit with Japan” — well above the 24% tariff rate he announced on April 2nd. Reuters reported that the Trump administration plans to prioritize securing trade deals with countries such as India before Japan in the days leading up to the July 9th deadline. Trump’s tax-and-spending bill narrowly passed the Senate on Tuesday after Vice President JD Vance’s tie-breaking vote. House lawmakers are heading back to Washington from a holiday week, with a vote expected later today on the Senate version of the bill. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Tesla (TSLA) slumped over -5% as President Trump threatened to withdraw subsidies from Elon Musk’s companies and review the billionaire’s immigration status after Musk slammed Trump’s tax bill as “utterly insane and destructive.” Also, chip stocks lost ground, with Advanced Micro Devices (AMD) sliding more than -4% and Broadcom (AVGO) falling over -3%. In addition, AeroVironment (AVAV) plunged more than -11% after the defense tech firm announced plans to raise up to $1.35 billion through public offerings of stock and convertible debt. On the bullish side, U.S.-based casino operators climbed after Macau posted a rise in June gambling revenue, with Las Vegas Sands (LVS) and Wynn Resorts Ltd. (WYNN) gaining over +8%. A Labor Department report released on Tuesday showed that U.S. JOLTs job openings unexpectedly rose to a 6-month high of 7.769M in May, stronger than expectations of 7.320M. Also, the U.S. June ISM manufacturing index rose to 49.0, stronger than expectations of 48.8. In addition, the U.S. June S&P Global manufacturing PMI was revised upward to 52.9, beating the consensus of 52.0. At the same time, U.S. construction spending fell -0.3% m/m in May, weaker than expectations of -0.2% m/m. “As long as the labor market remains solid, the US economy can continue to chug ahead, while helping reduce the risk of stagflation. It would also buy the Fed more breathing room when it comes to interest rates,” said Bret Kenwell at eToro. Speaking Tuesday at the European Central Bank’s annual Forum on Central Banking in Sintra, Portugal, Fed Chair Jerome Powell reiterated that the U.S. central bank likely would have lowered rates further this year if not for Trump’s expanded use of tariffs. Powell said he anticipates the impact of tariffs will show up in inflation data over the coming months, while acknowledging that uncertainties persist. Still, when asked whether July was too soon for a rate cut, the Fed chief did not dismiss the possibility. “I wouldn’t take any meeting off the table or put it directly on the table. It’s going to depend on how the data evolve,” he said. Meanwhile, U.S. rate futures have priced in an 80.9% probability of no rate change and a 19.1% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Today, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the June ADP Nonfarm Employment Change will stand at 99K, compared to the May figure of 37K. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -3.500M, compared to last week’s value of -5.836M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.281%, up +0.63%. Let's take a look at three daily charts. VTI is first. Bullish? For sure. Overstretched to the upside? I believe so. We don't have sell signals...yet in the indicators but they are primed to start rolling over. When? No one knows but it WILL happen. Markets don't move is straight lines. They ebb and flow. The /ES is the same. It really looks like it could use a retrace. /NQ : We actually have a sell signal in the Nasdaq. Don't get too excited though. That was largely due to Tesla's selloff yesterday. Apparently Trump is going to deport Elon now! My lean or bias today is the same as yesterday. I'm looking for a flat to down day. It's been a nice, long run up but I think it's time for a pause or possible retrace. We've already put our money where MY mouth is. We have a bearish QQQ trade and a bearish /ES 0DTE for today that we started yesterday. My intra-day levels today are the same as yesterday. /ES resistance is still at 6264 is heavy resistance with 6195 working as support. Trade docket: We've got a lot of potential 0DTE's today. Our Gold trade looks good going into the open. We'll work another QQQ 0DTE. We have an /ES 0DTE working as well. We will likely get an SPX and NDX 0DTE as well. LULU cash flow. STZ earnings. It should be another good day for us. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |