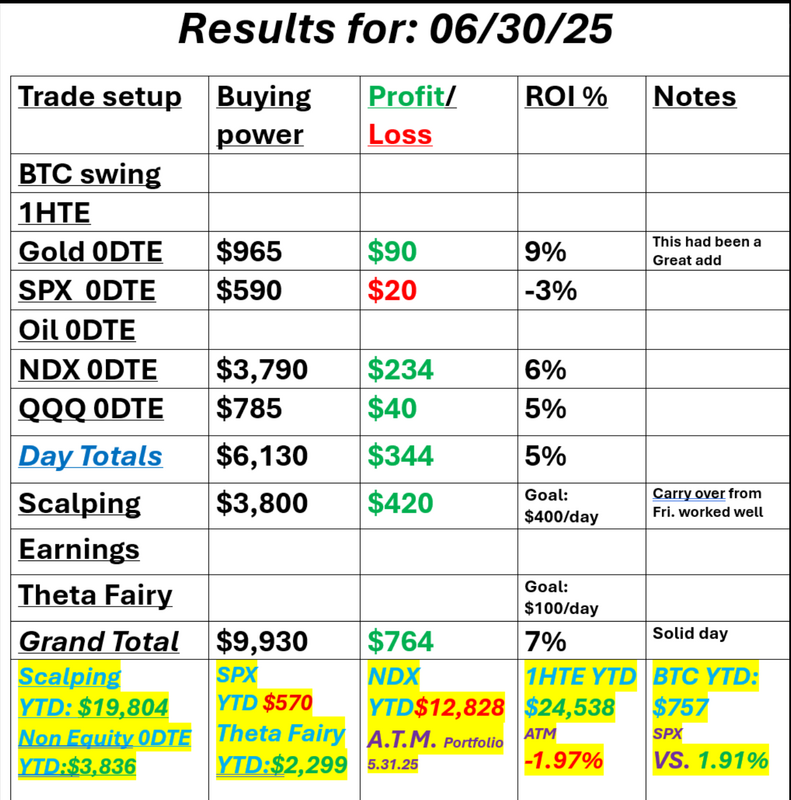

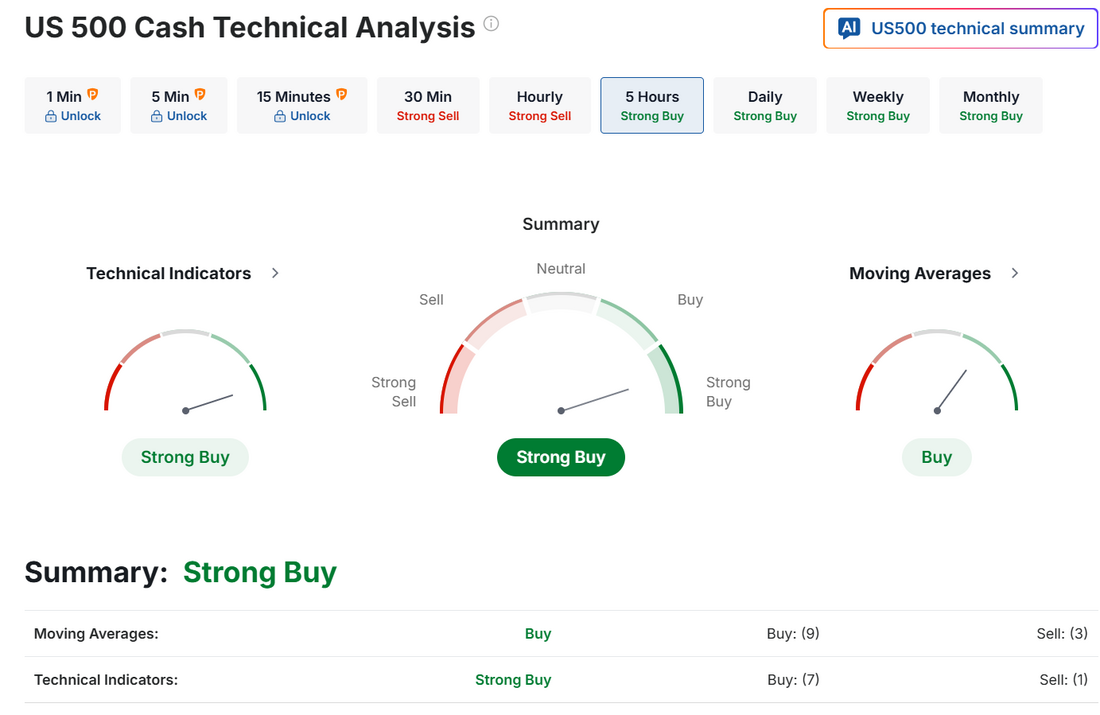

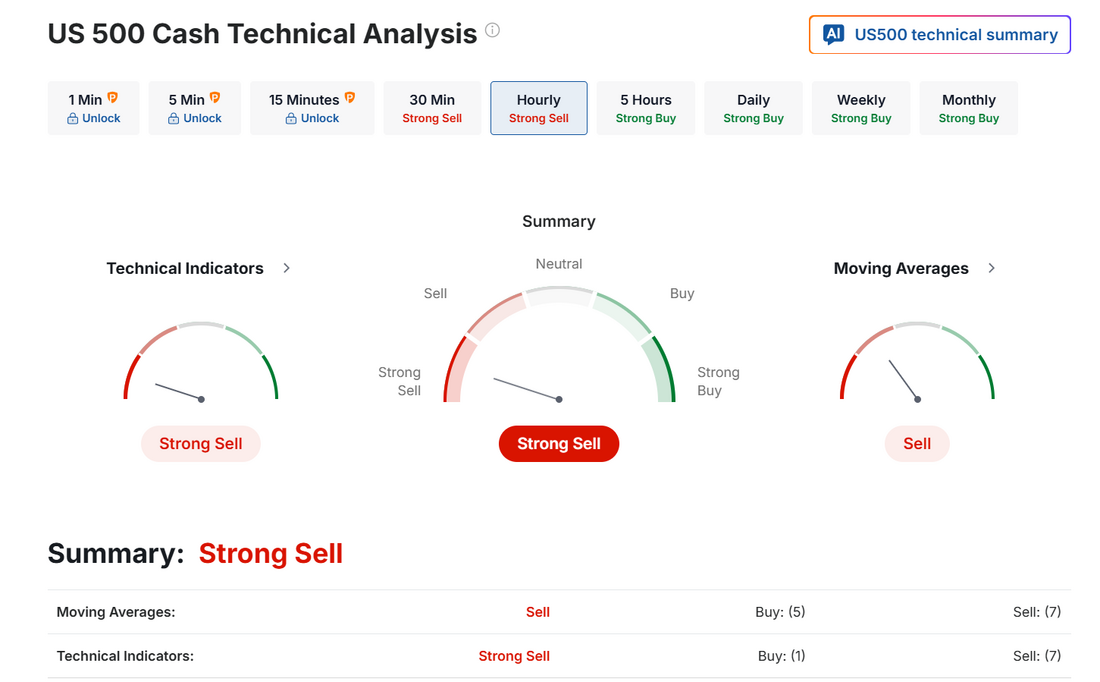

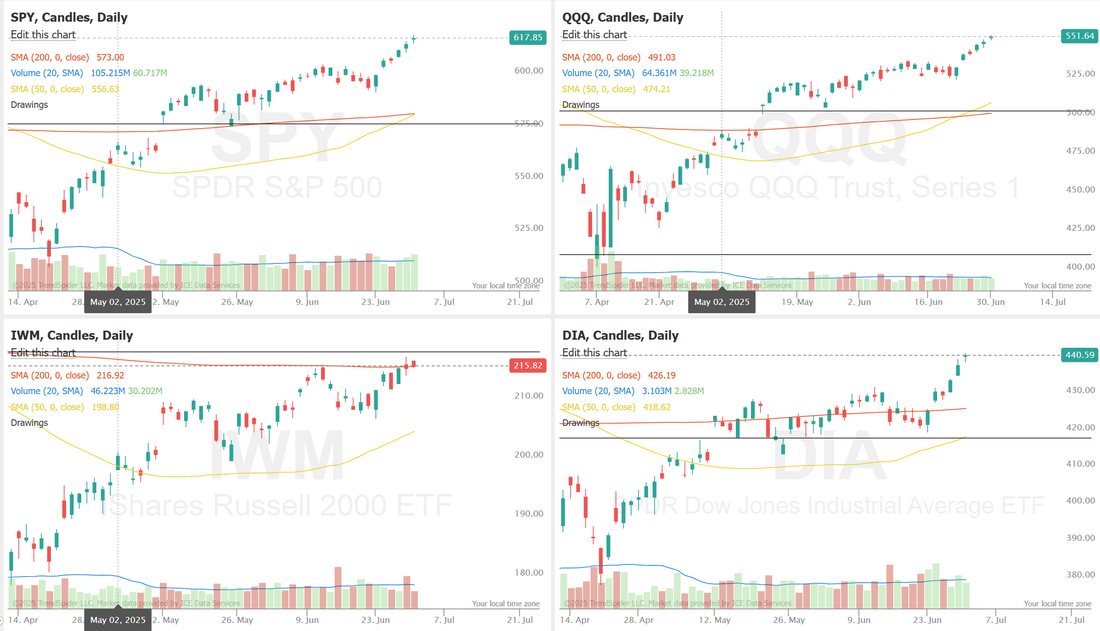

Are six days enough?After six days of upward movement, combined with multiple new ATH's I was looking for a bit of a pause yesterday and that's what we got. I'm looking for the same today. The market looks a bit tired here. Futures are selling off a bit, as I type. We had a really solid day yesterday. It could have been close to our $1,000+ daily profit goal if I would have pulled the unrealized profit on the SPX trade but all in all, I'm very happy with our day. See our results below: Let's take a look at the market. The 5 hr. technicals are still holding to a buy mode. The one hour however is flipping to sell. It today the day we get the retrace? Markets are sitting at potentially nose bleed levels. Stoch, RSI and Bollinger bands all show us very overstretched to the upside. My bias or lean today is for a retrace. I believe today is the day. Trade docket for today: We'll continue to work our Gold 1DTE. Book profits on /ZS. CVCO? GNE, KFS, ORCL, PGRE?, QQQ 0DTE, ATTB, SLP, SPX 0DTE, STZ earnings. September S&P 500 E-Mini futures (ESU25) are down -0.21%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.29% this morning, taking a breather after a recent rally, as investors monitor progress on U.S. trade talks and wrangling in Washington over President Donald Trump’s tax-and-spending bill. President Trump’s “big, beautiful bill” failed to pass the Senate on Monday. A final vote on the bill could come Tuesday, but first, Republicans will need to align on what the legislation would mean for Medicaid, tax cuts, green energy subsidies, and the widening budget deficit. The approaching end of tariff “pauses” also looms large, with countries scrambling to finalize deals with the U.S. President Trump on Monday voiced frustration over U.S.-Japan trade negotiations, and U.S. Treasury Secretary Scott Bessent cautioned that countries could be notified of sharply higher tariffs despite good-faith negotiations. Investor focus is also on the latest reading on U.S. job openings and manufacturing sector surveys, as well as remarks from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Hewlett Packard Enterprise (HPE) surged over +11% and was the top percentage gainer on the S&P 500 after the Justice Department settled a lawsuit challenging the company’s $14 billion acquisition of Juniper Networks. Also, bank stocks gained ground after the largest U.S. lenders all passed the Fed’s annual stress test, which could prompt the banks to return more capital to shareholders, with Goldman Sachs (GS) rising more than +2% to lead gainers in the Dow and JPMorgan Chase (JPM) advancing about +1%. In addition, Strategy (MSTR) climbed more than +5% and was the top percentage gainer on the Nasdaq 100 after the company purchased an additional 4,980 Bitcoins last week. On the bearish side, Fortive (FTV) slid over -3% after the company announced the retirement of President, CEO, and Director James Lico, and named Olumide Soroye as his successor. Economic data released on Monday showed that the U.S. Chicago PMI unexpectedly fell to 40.4 in June, weaker than expectations of 42.7. Atlanta Fed President Raphael Bostic said on Monday that tariff-related price increases may unfold gradually rather than as a one-time surge, potentially leading to more persistent upward pressure on inflation. Bostic said he penciled in one interest rate cut for this year and three in 2026. Meanwhile, U.S. rate futures have priced in a 78.8% chance of no rate change and a 21.2% chance of a 25 basis point rate cut at the next central bank meeting in July. Today, investors will focus on remarks from Fed Chair Jerome Powell, who is set to discuss monetary policy at the European Central Bank’s annual forum in Sintra, Portugal. Mr. Powell will speak on a panel alongside his counterparts from the Eurozone, Japan, and the U.K. On the economic data front, investors will monitor the U.S. JOLTs Job Openings figures for fresh insights into the health of the job market. Economists, on average, forecast that the May JOLTs Job Openings will come in at 7.320M, compared to the April figure of 7.391M. The U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI will also be closely watched today. Economists expect the June ISM Manufacturing PMI to be 48.8 and the S&P Global Manufacturing PMI to be 52.0, compared to the previous values of 48.5 and 52.0, respectively. U.S. Construction Spending data will be released today as well. Economists foresee this figure coming in at -0.2% m/m in May, compared to -0.4% m/m in April. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.196%, down -0.14%. Let's take a look at the /ES intra-day levels I'll be focusing on today. 6264 continues to act as resistance with 6195 working as both support and Value area high zone. (In volume profile analysis, the Value Area High (VAH) represents the highest price level within the range where 70% of the trading volume for a specific period has occurred. It's essentially the upper boundary of the "value area," which is the price range where the most trading activity takes place. ) We've got a busy day ahead of us. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |