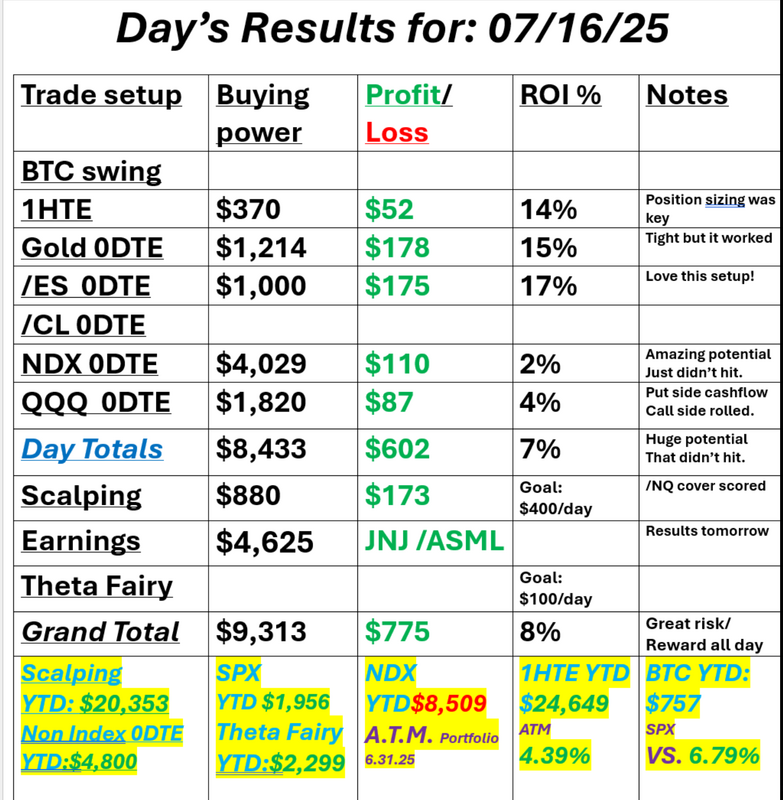

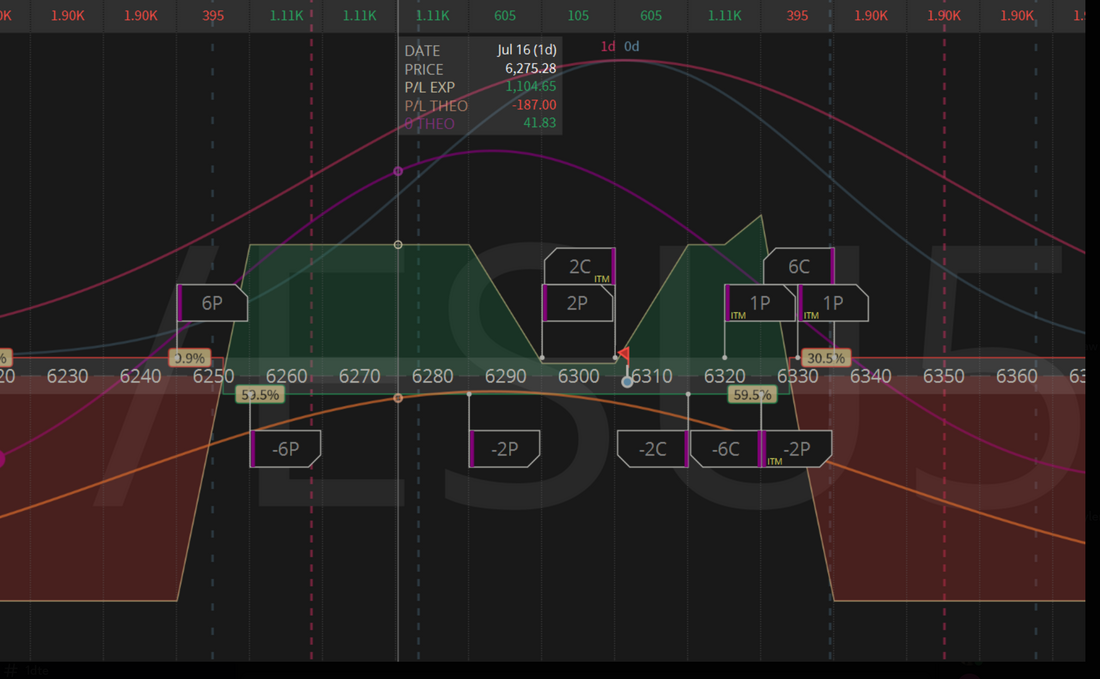

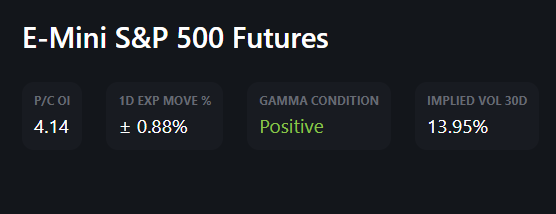

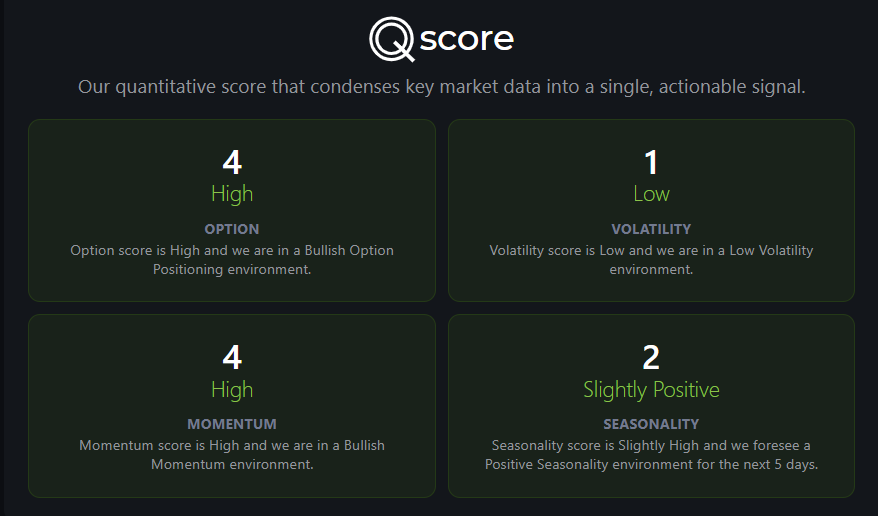

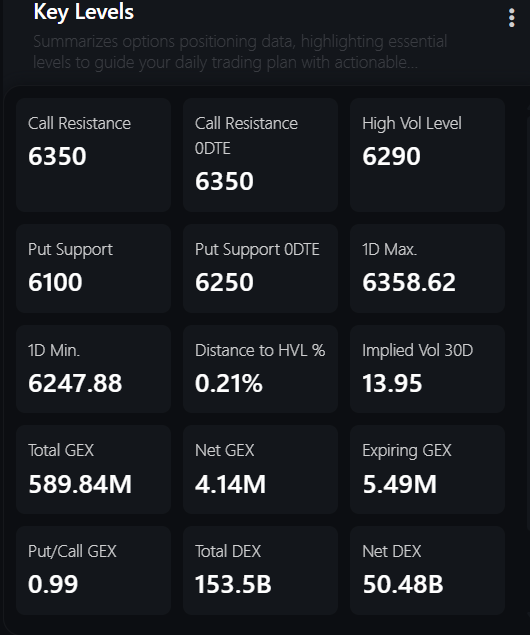

Every dollar countsWe have a daily income goal of $1,000 dollars profit. We also follow the idea of Gestalt which means you use a diversified approach with multiple setups, knowing the likelihood that some will not work. As our day get started we see trades come in with $24 profit, $60 profit, etc. It seems meaningless but at the end of the day, it all adds up. That has been our case for the last few days. No real big home runs. Just plucking away and at the end of the day it adds up. Here's a look at our results from yesterday. Our /ES trade was an easy winner for us yesterday. We have a similar setup going into today. See below: I'm pretty proud of this setup...if I do say so. Market's today are no different then they've been for weeks. Take a look at the /ES. This is a 2hr. chart going back to the start of the month. We've been stuck in a consolidation zone between 6342 and 6251. At some point we'll break out but who knows when? We are coming into the morning session with positive gamma. The Quant score keeps us in bullish mode It seems more and more likely we are primed for a retrace. Key levels for /ES. eptember S&P 500 E-Mini futures (ESU25) are up +0.05%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.13% this morning, pointing to a muted open on Wall Street after yesterday’s volatile session, with attention now turning to U.S. retail sales data and an earnings report from streaming giant Netflix. U.S. President Donald Trump said in an interview aired on Real America’s Voice on Wednesday that the U.S. is very close to finalizing a trade deal with India, while a deal with Europe is also possible, though it is too early to determine whether an agreement can be reached with Canada. Earlier on Wednesday, President Trump stated that he would send letters to over 150 countries informing them of tariff rates, with the imposed levies potentially set at 10% or 15%. “We’ll have well over 150 countries that we’re just going to send a notice of payment out, and the notice of payment is going to say what the tariff” rate will be, Trump told reporters. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Global Payments (GPN) climbed over +6% and was the top percentage gainer on the S&P 500 after the Financial Times reported that activist hedge fund Elliott Management had built a “sizeable” stake in the payments processing company. Also, Johnson & Johnson (JNJ) advanced more than +6% and was the top percentage gainer on the Dow after the drug and medical device maker posted better-than-expected Q2 results and raised its full-year guidance. In addition, Arm Holdings (ARM) rose over +4% and was the top percentage gainer on the Nasdaq 100 after BNP Paribas Exane upgraded the stock to Outperform from Neutral with a $210 price target. On the bearish side, ASML Holding N.V. (ASML) slid more than -8% and was the top percentage loser on the Nasdaq 100 after the Dutch supplier of chip-making equipment said it could no longer guarantee growth in 2026 due to rising uncertainty stemming from President Trump’s tariffs. Economic data released on Wednesday showed that the U.S. producer price index for final demand came in at unchanged m/m and +2.3% y/y in June, weaker than expectations of +0.2% m/m and +2.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, was unchanged m/m and rose +2.6% y/y in June, weaker than expectations of +0.2% m/m and +2.7% y/y. In addition, U.S. June industrial production rose +0.3% m/m, stronger than expectations of +0.1% m/m, while manufacturing production rose +0.1% m/m, stronger than expectations of no change m/m. “Disinflation remains, but the Fed will be undeterred in keeping rates steady until September. As long as the labor market remains strong and resilient, rates aren’t likely to move meaningfully lower, and that’s a good thing,” said Jamie Cox at Harris Financial Group. New York Fed President John Williams said on Wednesday that he anticipates tariffs will have a bigger impact on inflation in the coming months, making the Fed’s current restrictive stance “entirely appropriate.” Meanwhile, the Fed said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity “increased slightly” between late May and early July. “That represented an improvement over the previous report, in which half of districts reported at least slight declines in activity,” according to the Beige Book. Still, the report said that “uncertainty remained elevated, contributing to ongoing caution by businesses.” The report also said that all 12 regions of the country saw price increases, with businesses facing “modest to pronounced input cost pressures related to tariffs.” U.S. rate futures have priced in a 97.4% chance of no rate change and a 2.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Second-quarter corporate earnings season is gathering pace, and investors look forward to new reports from prominent companies today, including Netflix (NFLX), GE Aerospace (GE), Abbott Labs (ABT), and PepsiCo (PEP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.1% m/m rise in June following a -0.9% m/m decline in May. Investors will also focus on U.S. Core Retail Sales data, which came in at -0.3% m/m in May. Economists expect the June figure to be +0.3% m/m. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists foresee the Philly Fed manufacturing index standing at -1.2 in July, compared to last month’s value of -4.0. U.S. Export and Import Price Indexes will come in today. Economists anticipate the export price index to be unchanged m/m and the import price index to rise +0.3% m/m in June, compared to the previous figures of -0.9% m/m and unchanged m/m, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 233K, compared to last week’s number of 227K. In addition, market participants will be anticipating speeches from Fed Governors Adriana Kugler, Lisa Cook, and Christopher Waller, along with San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.469%, up +0.34%. My lean or bias today is neutral again. Most of our technicals are still leaning bullish with positive gamma as well but the market is looking tired. Unless we get a catalyst today it may be more of the same. Trade docket today: I'll continue to use the /MNQ for scalping . We already have the bulk of our /ES 0DTE working. /GC 0DTE is already started and may need more work. ASML could be ready for a take profit. JNJ? NFLX earnings. LULU, QQQ 0DTE, SPX 0DTE?, NDX 0DTE. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |