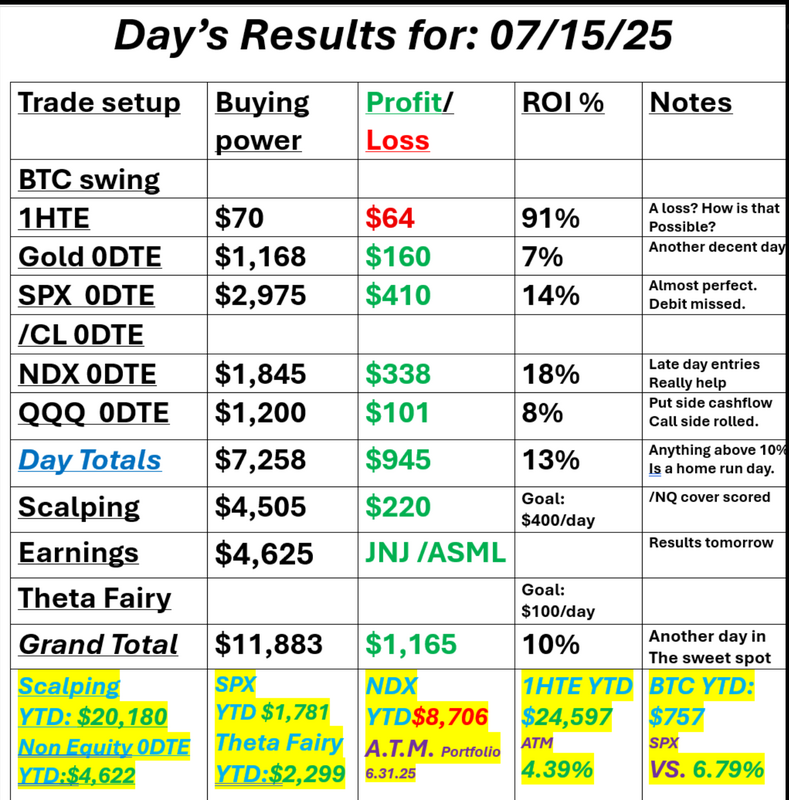

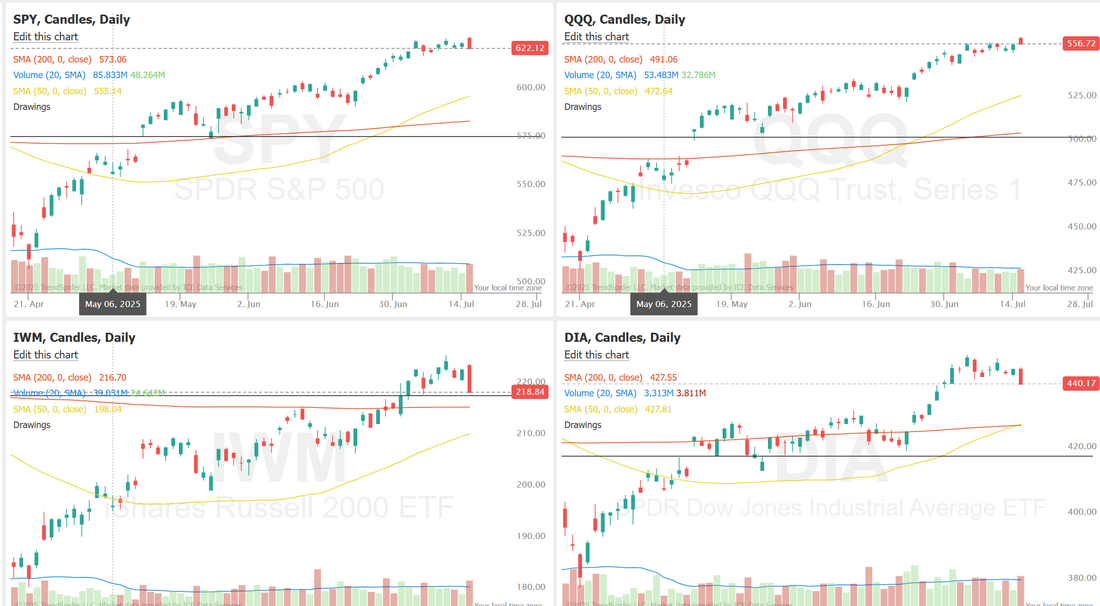

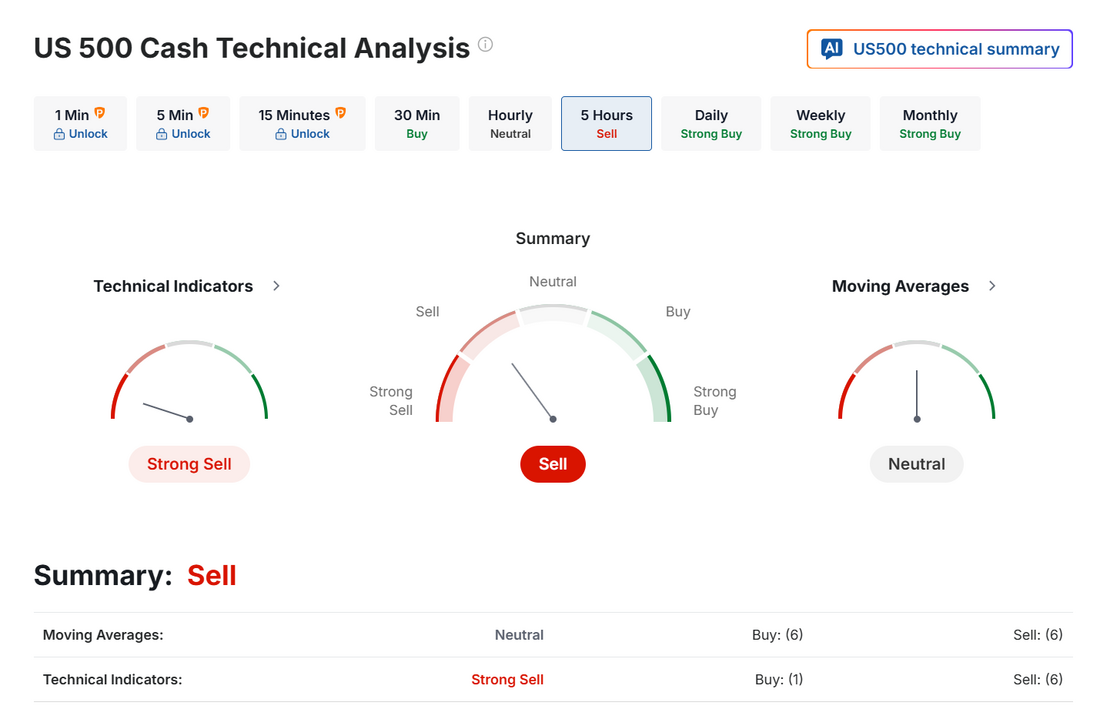

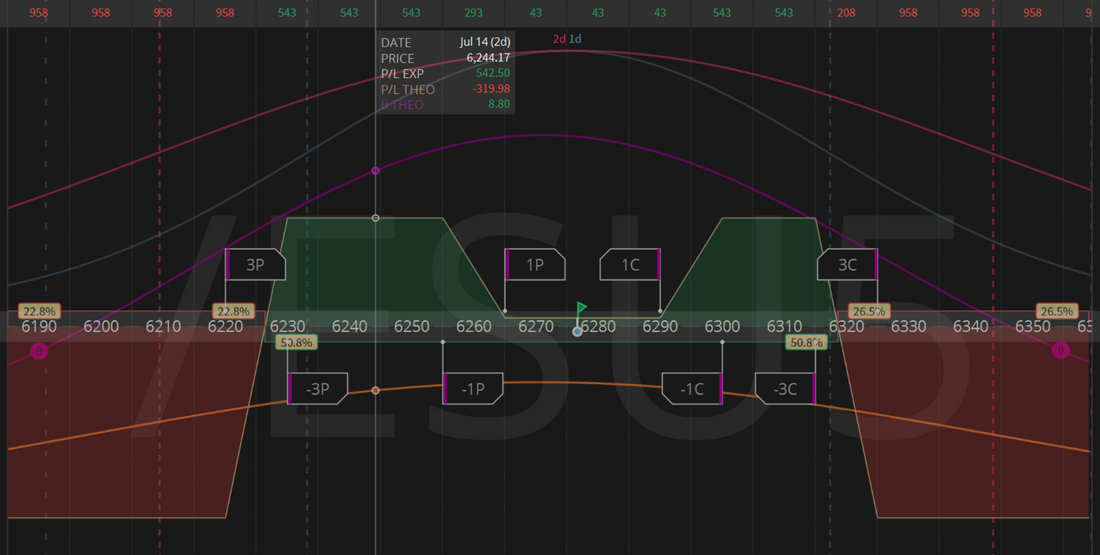

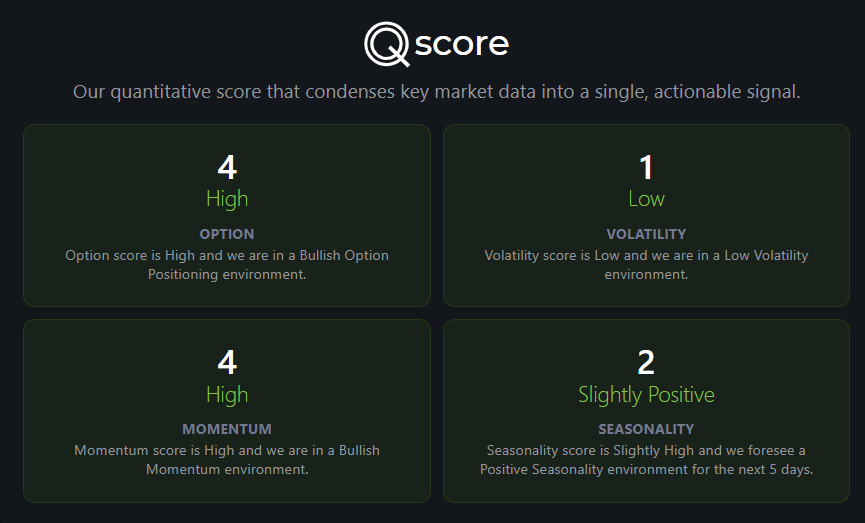

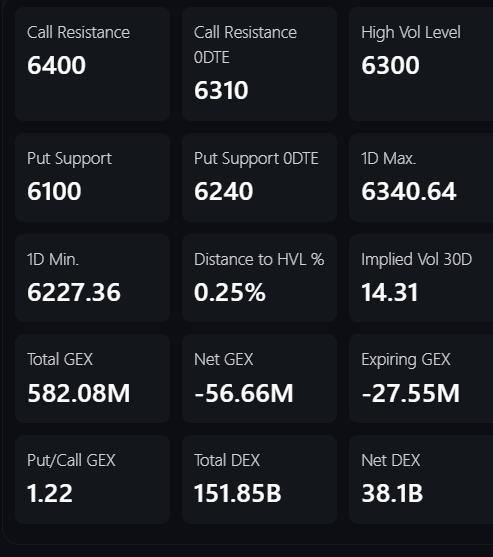

Do you use a "data driven approach"?I watched Powell's testimony yesterday and it was mentioned several times, by reporters and himself that he makes decisions and takes action based solely on data. They establish a mandate. What it is they want to achieve. Then they simply react to the data that comes in. This is how we should trade. We talk a lot about working to achieve stoic equanimity. That place where all emotion is removed from your trading. You're just reacting to the data. For us as day traders there are dozens of indicators, levels and order flow tools we use to attempt to accomplish this but some of the key ones are our support/resistance levels (levels are key to us...hence the name of this blog). We look at levels via support resistance, Fibonacci levels and GEX levels. I'll start including our GEX levels into our intra-day level analysis starting today. I've held off adding these because some traders get confused on GEX and DEX and how to use them. I'm going to be doing a training today on this in our live trading room. Join us if you can. Our results from yesterday were stellar. The profit noted in the QQQ is higher than actual as our put side finished slightly in the money but nevertheless, it was an excellent day for us. Let's take a look at the markets. Drawdown day! Two days ago the futures were down and my bias was bullish. Yesterday the futures were higher and my bias was bearish. I was right on both days. I don't need to be right. We can still make money if I'm wrong but, holy smokes!... it sure helps to be right! It makes it a lot easier. Is this the start of a roll over? Way too early to tell, if you ask me. No question we are "toppy" here though. Futures are starting us off with a slight sell signal this morning. We've yet to see PPI numbers and that could change everything. September S&P 500 E-Mini futures (ESU25) are trending down -0.09% this morning as investors digest the latest tariff headlines, while also awaiting crucial U.S. producer inflation data, quarterly reports from more big banks, and remarks from Federal Reserve officials. U.S. President Donald Trump signaled on Tuesday that tariffs on pharmaceuticals could be implemented by the end of the month, with similar measures on semiconductors possibly following. “Probably at the end of the month, and we’re going to start off with a low tariff and give the pharmaceutical companies a year or so to build, and then we’re going to make it a very high tariff,” he told reporters. Trump also stated that letters informing smaller countries of their U.S. tariff rates would be sent out soon, adding that his administration would likely impose a tariff of “a little over 10%” on those nations. In addition, the president predicted that he could finalize “two or three” trade agreements with countries before his so-called reciprocal tariffs take effect on August 1st, noting that a deal with India was among the most likely. In yesterday’s trading session, Wall Street’s major indexes closed mixed. State Street (STT) slumped over -7% and was the top percentage loser on the S&P 500 after Q2 results showed the company didn’t reduce expenses as much as analysts had expected and reported a decline in net interest income. Also, Wells Fargo (WFC) slid more than -5% after the San Francisco lender cut its full-year net interest income guidance. In addition, Newmont (NEM) dropped over -5% following the resignation of Chief Financial Officer Karyn Ovelmen. On the bullish side, Advanced Micro Devices (AMD) climbed more than +6%, and Nvidia (NVDA) rose over +4% to lead gainers in the Dow after the companies said they will resume some chip sales to China. The U.S. Bureau of Labor Statistics report released on Tuesday showed that consumer prices rose +0.3% m/m in June, in line with expectations. On an annual basis, headline inflation picked up to +2.7% in June from +2.4% in May, slightly stronger than expectations of +2.6%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +2.9% y/y in June, weaker than expectations of +0.3% m/m and +3.0% y/y. In addition, the Empire State manufacturing index unexpectedly rose to 5.50 in July, stronger than expectations of -8.30. “The big question for the inflation picture is tariffs. It’s taking some time for tariffs to show up in the data, but it’s highly likely that a tariff-driven inflation reckoning is coming,” said Skyler Weinand at Regan Capital. “The Fed will want to watch the next several inflation and jobs reports before it makes any moves on rates.” Richmond Fed President Tom Barkin said on Tuesday that the latest inflation data showed signs of building price pressures, and that more were on the way. Barkin added that it remains unclear how much of the tariffs companies could pass along to consumers, who may struggle to absorb additional price increases. Also, Boston Fed President Susan Collins said she still believes the central bank can afford to be patient when considering interest rate cuts. “Continued overall solid economic conditions enable the Fed to take the time to carefully assess the wide range of incoming data,” Collins said. Meanwhile, U.S. rate futures have priced in a 97.4% chance of no rate change and a 2.6% chance of a 25 basis point rate cut at July’s monetary policy meeting. After the latest inflation data, traders priced in lower odds that the Fed will cut rates more than once this year, with the chances of a September move now viewed as only slightly above 50%. Second-quarter corporate earnings season picks up steam, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC), Morgan Stanley (MS), and Goldman Sachs (GS) as well as notable companies like Johnson & Johnson (JNJ), Progressive (PGR), and United Airlines Holdings (UAL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. June PPI will stand at +0.2% m/m and +2.5% y/y, compared to the previous figures of +0.1% m/m and +2.6% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect June figures to be +0.2% m/m and +2.7% y/y, compared to May’s numbers of +0.1% m/m and +3.0% y/y. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists anticipate Industrial Production to rise +0.1% m/m and Manufacturing Production to be unchanged m/m in June, compared to the May figures of -0.2% m/m and +0.1% m/m, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.800M, compared to last week’s value of 7.070M. In addition, market participants will be looking toward speeches from Richmond Fed President Tom Barkin, Cleveland Fed President Beth Hammack, Fed Governor Michael Barr, and New York Fed President John Williams. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.478%, down -0.29%. My lean or bias right now is more neutral. PPI may change that and give us some directional bias. We have one of my favorite setups already on coming into this morning session. This is a trade that benefits from a decent sized move, either up or down but has no "valley of death" like so many of these setups have. I've got about $950 of buying power used for a max profit potential of around $500. We'll likely continue to add to this trade as the day progresses. As I mentioned, my bias is neutral to start off the day: Trade docket for today: /ES 0DTE, /MNQ scalp again, /GC 0DTE, ASML, JNJ, UAL, AA, GE earnings setups, 1HTE BTC IF I can get Kalshi to work (having issues there) QQQ 0DTE and SPX 0DTE. Also, never rule out a late day NDX entry. Let's take a look at the intra-day levels on /ES. 6300, 6311,6337 are resistance with 6262, 6242 working as support. The Q score (or quantitative score) still looks bullish. Key levels to watch today. I look forward to our training today on GEX and DEX. I'll see you all shortly, in the live trading room! If you want to use the quantitative data feed I use for GEX levels you can get a 20% discount now. click here.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |