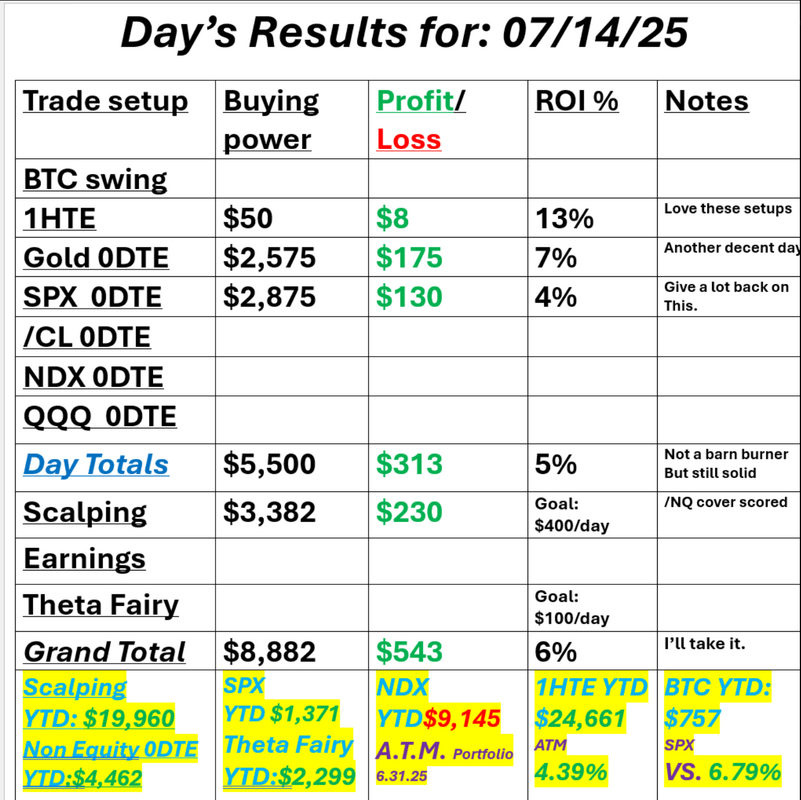

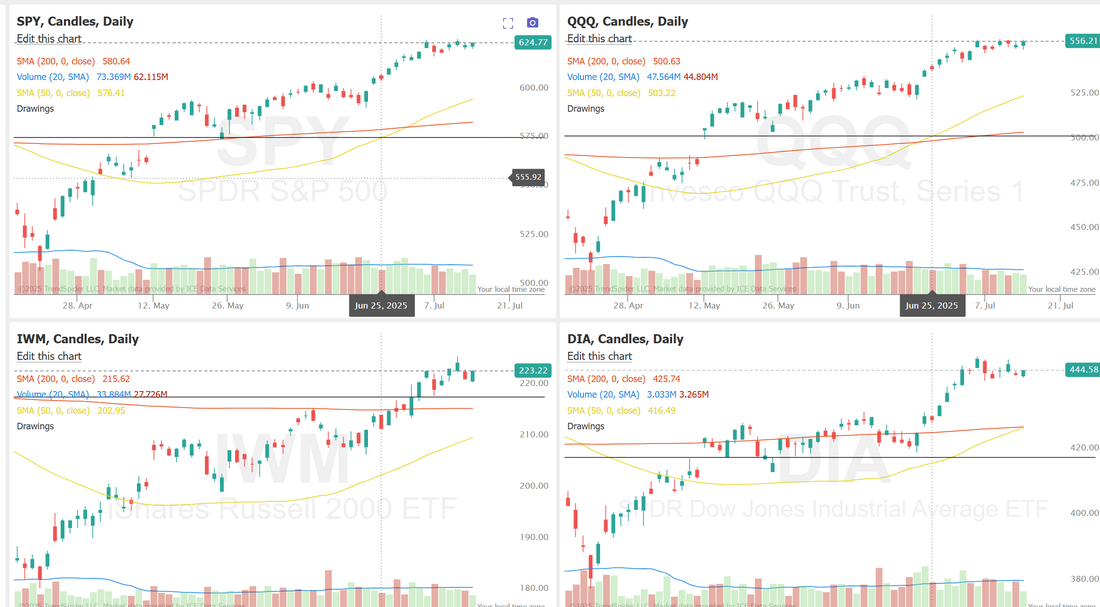

Take what you can getI was watching the futures before the open yesterday and just had a feeling it wasn't going to be an action filled day. Unfortunately I was right. I did have a bullish bias and we did get a little push up. I left some profit on the table on SPX but otherwise, we really got everything we could out of the day. Take a look at our day below: Let's take a look at the market this morning. We got a push up on the futures with the NVDA news. CPI is incoming. We are already short /MNQ in the scalping room. I'm looking for a retrace today from these highs. We just continue to tread water up here at the ATH zone. September S&P 500 E-Mini futures (ESU25) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.56% this morning as sentiment got a boost after Nvidia said it would restart sales of some AI chips to China, while investors awaited the release of key U.S. inflation data and earnings reports from some of the biggest U.S. banks. Nvidia (NVDA) gained over +5% in pre-market trading after the chip maker said it plans to resume sales of its H20 AI chip in China following assurances from Washington that export licenses would be granted. Other chip stocks also advanced in pre-market trading, with Advanced Micro Devices (AMD), Marvell Technology (MRVL), and Arm Holdings (ARM) up more than +2%. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Autodesk (ADSK) climbed over +5% and was among the top percentage gainers on the S&P 500 after the company said in a filing with the Securities and Exchange Commission that it is prioritizing organic growth with “targeted and tuck-in acquisitions,” signaling it has likely dropped its bid for PTC. Also, AppLovin (APP) surged more than +6% and was the top percentage gainer on the Nasdaq 100 after Citi reiterated that the stock remains a “Top Pick” heading into the company’s Q2 report on August 6th. In addition, Fastenal (FAST) rose over +4% after the company posted better-than-expected Q2 results. On the bearish side, Waters (WAT) tumbled more than -13% and was the top percentage loser on the S&P 500 after the company announced it was acquiring Becton Dickinson’s Biosciences & Diagnostic Solutions business in a Reverse Morris Trust transaction valued at $17.5 billion. Cleveland Fed President Beth Hammack said on Monday that she wants to see further declines in inflation before supporting an interest rate cut. “We’re not there yet on the inflation side of the mandate. I think it’s important that we wait and see how all the new policies that have been put forward are going to impact inflation,” she said in an interview with Fox Business Network. U.S. rate futures have priced in a 95.3% probability of no rate change and a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting. Meanwhile, the second-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C), slated to report their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will be closely scrutinized for any indications of whether tariffs are already driving up prices and what implications this could have for U.S. interest rates. Economists, on average, forecast that the U.S. June CPI will come in at +0.3% m/m and +2.6% y/y, compared to the previous numbers of +0.1% m/m and +2.4% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in June, compared to the May figures of +0.1% m/m and +2.8% y/y. “Inflation pressures have remained muted so far, but tariffs will eventually feed through pushing prints higher and creating some discomfort for the Fed,” said Seema Shah at Principal Asset Management. A survey conducted by 22V Research revealed that 42% of investors expect a “risk-on” market reaction to the CPI report, while 29% anticipate a “mixed” response and another 29% foresee a “risk-off” response. Moreover, the survey showed that 67% of investors believe the core CPI is on a Fed-friendly glide path. The Empire State Manufacturing Index will also be released today. Economists anticipate the Empire State manufacturing index to be -8.30 in July, compared to last month’s value of -16.00. In addition, market participants will parse comments today from Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Michael Barr, Richmond Fed President Tom Barkin, and Boston Fed President Susan Collins. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.418%, down -0.25%. Trade docket today: We are currently working a 1HTE on BTC. We've got a working put side entry on our Gold 0DTE. We'll Scale our QQQ 0DTE some more today. We have JNJ and ASML earnings trades. In scalping we are currently short, looking for a futures pullback today. We'll also work to get an SPX and hopefully an NDX 0DTE on as well. Let's take a look at my intra-day levels on /ES. Finally we have a change! 6356 is new resistance with 6300 now working as support. I look forward to seeing you all in the live trading room shortly. I'm hopefully we'll get some movement today that could yield up some good setups.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |