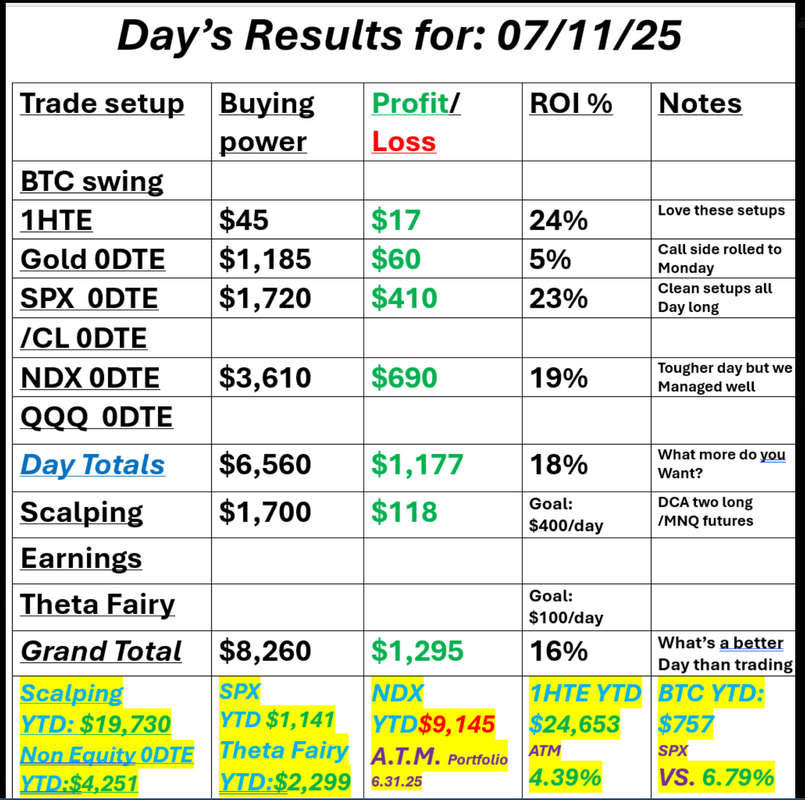

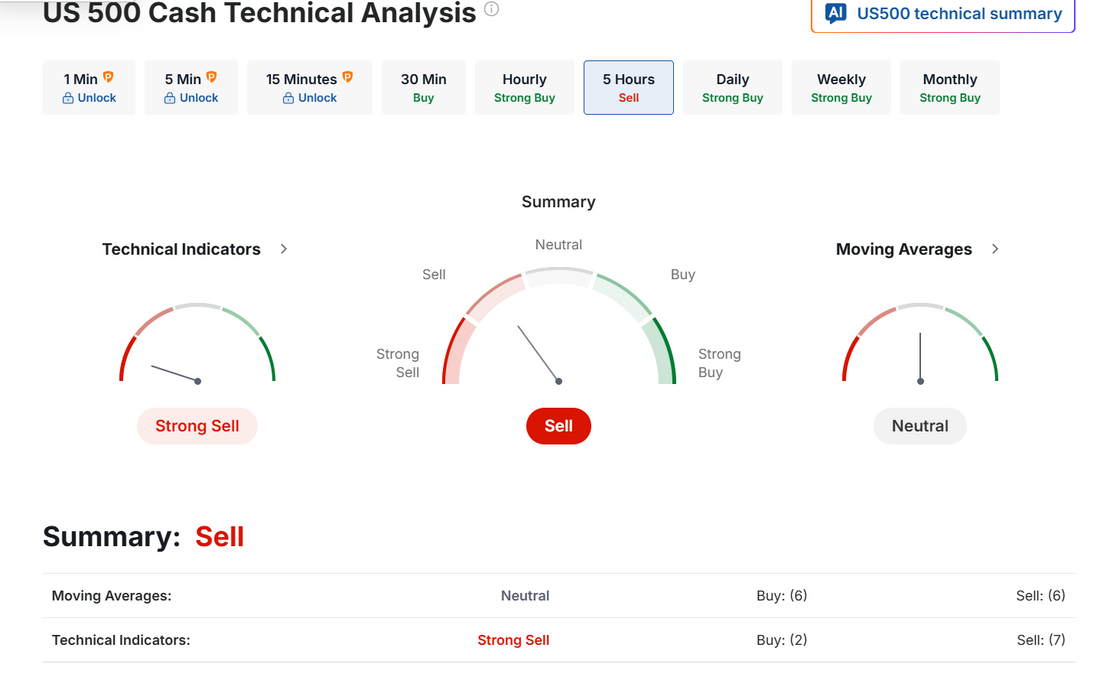

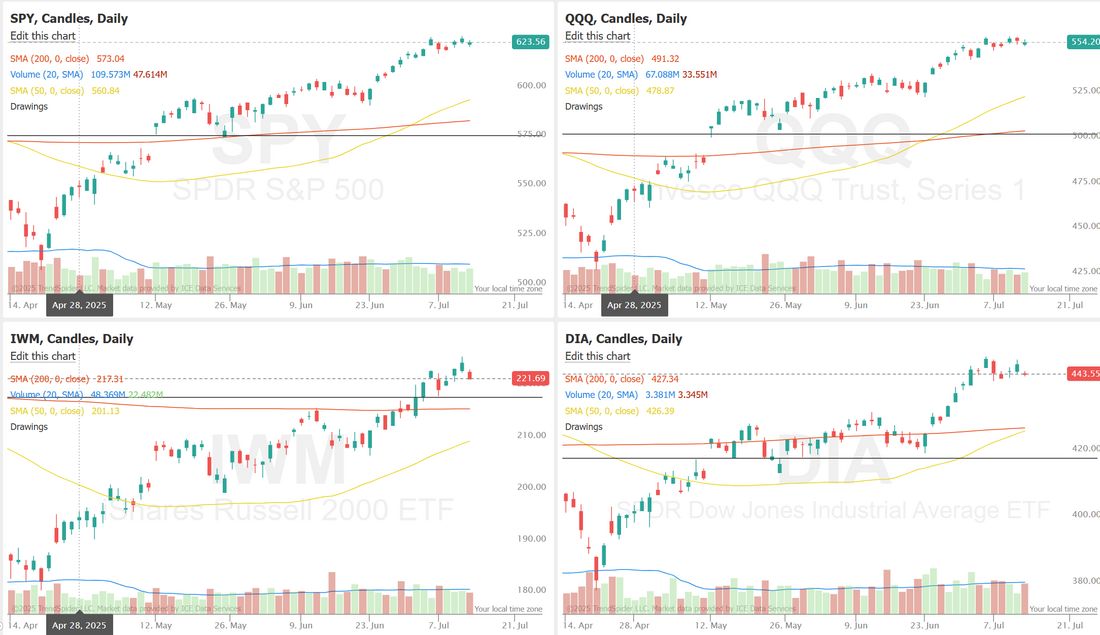

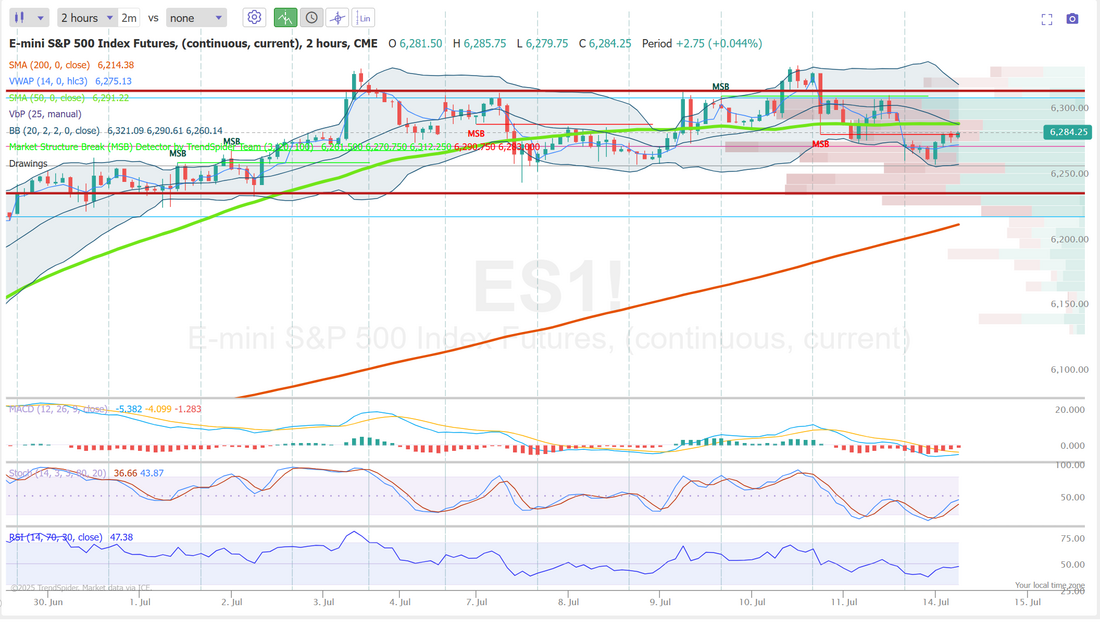

CPI and PPI weekMore inflation data and tariff news this week. We had an exceptional result from last week. Take a look at our day from Friday. We traded all day, right up to the close. September S&P 500 E-Mini futures (ESU25) are down -0.29%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.30% this morning, pointing to a lower open on Wall Street after U.S. President Donald Trump escalated his trade war. President Trump said in letters shared on his social media platform on Saturday that the U.S. will impose a 30% tariff on goods imported from both the European Union and Mexico beginning August 1st. Mr. Trump also said that if the EU or Mexico retaliated by increasing tariffs on the U.S., the U.S. would add that figure to the 30% rate. In response, European Commission President Ursula von der Leyen said on Saturday that the EU was prepared to retaliate to defend its interests. “We will take all necessary steps to safeguard EU interests, including the adoption of proportionate countermeasures if required,” she said. However, the EU said on Sunday it would extend its suspension of countermeasures to U.S. tariffs until early August and maintain efforts to reach a negotiated settlement. White House economic adviser Kevin Hassett said on Sunday that Trump had seen some trade deal offers and believes they need to be improved, adding that without that, he would move forward with the proposed tariffs on Mexico, the EU, and other countries. “Well, these tariffs are real if the President doesn’t get a deal that he thinks is good enough,” Hassett told ABC’s This Week program. “But you know, conversations are ongoing, and we’ll see where the dust settles.” Adding to the negative sentiment, Trump and his allies intensified their criticism of Federal Reserve Chair Jerome Powell’s handling of the costly renovation of the Fed’s headquarters. Some administration officials are working to build a case to remove Powell from the Fed’s Board of Governors. This week, investors look ahead to the release of key U.S. inflation data, comments from Fed officials, and the start of the second-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Albemarle (ALB) slid over -4% and was among the top percentage losers on the S&P 500 after UBS downgraded the stock to Sell from Neutral with a price target of $57. Also, airline stocks retreated, with American Airlines Group (AAL) falling more than -5% and United Airlines Holdings (UAL) dropping over -4%. In addition, Capricor Therapeutics (CAPR) plummeted about -33% after the U.S. Food and Drug Administration declined to approve the company’s cell therapy for a heart condition. On the bullish side, most members of the Magnificent Seven stocks advanced, with Alphabet (GOOGL) and Amazon.com (AMZN) rising more than +1%. “The stock market is looking lower due to President Trump’s more hawkish stance on tariffs. With the market overbought and very expensive, the market is getting ripe for some sort of a pullback,” said Matt Maley at Miller Tabak. Second-quarter corporate earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) set to release their earnings reports on Tuesday, followed by Bank of America (BAC), Morgan Stanley (MS), and Goldman Sachs (GS) on Wednesday. Netflix (NFLX), PepsiCo (PEP), Abbott Labs (ABT), Johnson & Johnson (JNJ), American Express (AXP), and 3M (MMM) are among other major names scheduled to deliver quarterly updates during the week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +2.8% increase in quarterly earnings for Q2 compared to the previous year, marking the smallest rise in two years. On the economic data front, the U.S. consumer inflation report for June will be the main highlight this week. The report will be closely scrutinized for any indications of whether tariffs are already driving up prices and what implications this could have for U.S. interest rates. Investors will also keep an eye on June wholesale inflation data, which will offer insight into pipeline inflationary pressures. Other noteworthy data releases include U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, the Empire State Manufacturing Index, the Export Price Index, the Import Price Index, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Building Permits (preliminary), Housing Starts, and the University of Michigan’s Consumer Sentiment Index (preliminary). Also, market participants will hear perspectives from a slew of Fed officials, including Waller, Bowman, Barr, Barkin, Collins, Logan, Williams, Kugler, Daly, and Cook, throughout the week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Meanwhile, RBC Capital Markets strategists pushed back their forecast for the Fed to resume easing to December from September, citing the need for more time to evaluate inflation and labor market conditions. U.S. rate futures have priced in a 93.3% chance of no rate change and a 6.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. The U.S. economic data slate is empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.423%, down -0.05%. Let's take a look at the market. We've got a slight sell signal to start us off this week. It's not very strong but I'll take it. We've been hoping for some bearish price action so hopefully we can get some this week. Are we rolling over? It's too early to tell. We can only hope! SPY ended the week nearly unchanged at $623.62 (-0.28%) as markets lacked a clear catalyst to drive momentum. A golden cross, highlighted by the Golden/Death Cross Candle Painter on July 1st, has kept the index hovering near its all-time high. However, with key inflation data set to be released next week, bulls will need to hold their ground to maintain momentum. With key tech earnings approaching, QQQ held steady and closed the week at $554.20 (-0.36%). QQQ’s golden cross, which occurred about a week ahead of the S&P 500, reflects stronger momentum in the tech sector. However, with QQQ trading higher above its 50-day and 200-day SMA support levels, there is more room for a pullback if earnings disappoint or market volatility increases. Small-caps were flat this week and underperformed their large-cap peers, with the IWM closing at $221.70 (-0.65%). Even so, the IWM has outperformed in recent weeks and may be setting up for a golden cross of it’s own. Since small-caps tend to benefit the most from lower rates, bullish momentum could continue if the market’s expectations for rate cuts by year-end hold up. Expected move for the week on SPX is only slightly better than 1%. That's to be expected. The market was completely flat last week and continues to be stuck in a tight consolidation zone. We really need a break to the downside to get any I.V. back in the market. My lean or bias today is slightly bullish. Futures were down and got hit pretty good Sunday night. We put on a long /MNQ scalp at that point and have covered it with an /NQ spread. It's hard to say if we get to green today on the indices but we've already recovered half of Sunday nights selloff. I'll likely start off my day with some bullish setups.  Trade docket: One quick mention here on our ATM portfolio. We continue to gain more and more buying power as our large Tesla position gets closer to unwinding. Managing BP can be as important as the trades you do. We've added several new positions to the portfolio today and hopefully can add several more later this week. For our trading room today: Gold 0DTE. Looking to unwind that trade today. We'll look to add our next tranche to our Copper trade. QTTB once again, we'll look at it and see if we want to book profits, adjust or hold. SPX 0DTE, LULU, JNJ earnings trade, NDX 0DTE, QQQ 0DTE. Let's take a look at intra-day levels on /ES. They haven't changed much, largely because the market didn't really move last week. 6317 continues to be resistance with 6239 working as support. I'm excited to do another training session today on all of the following:

I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |