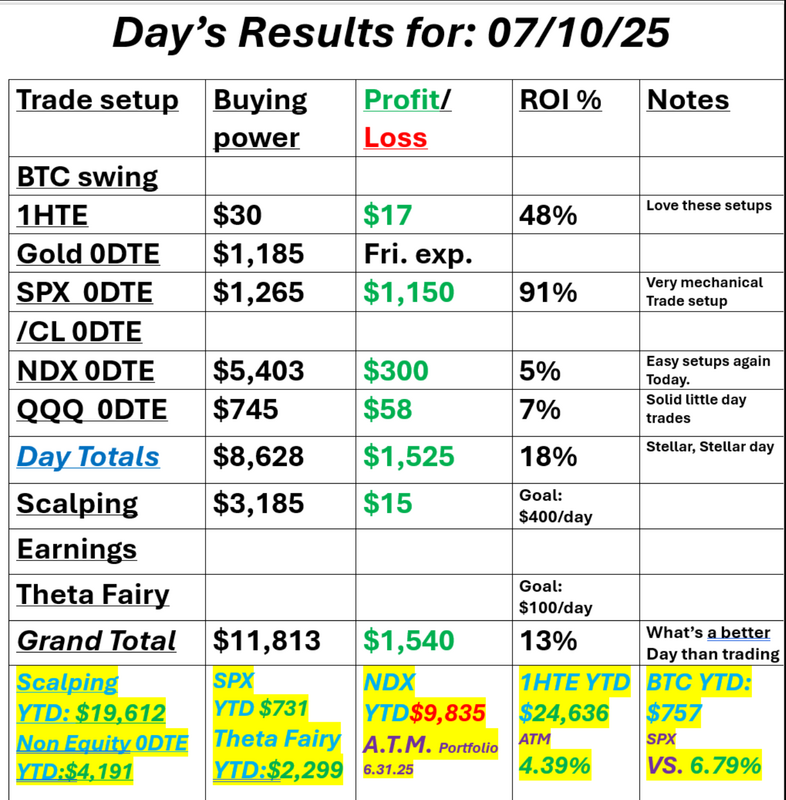

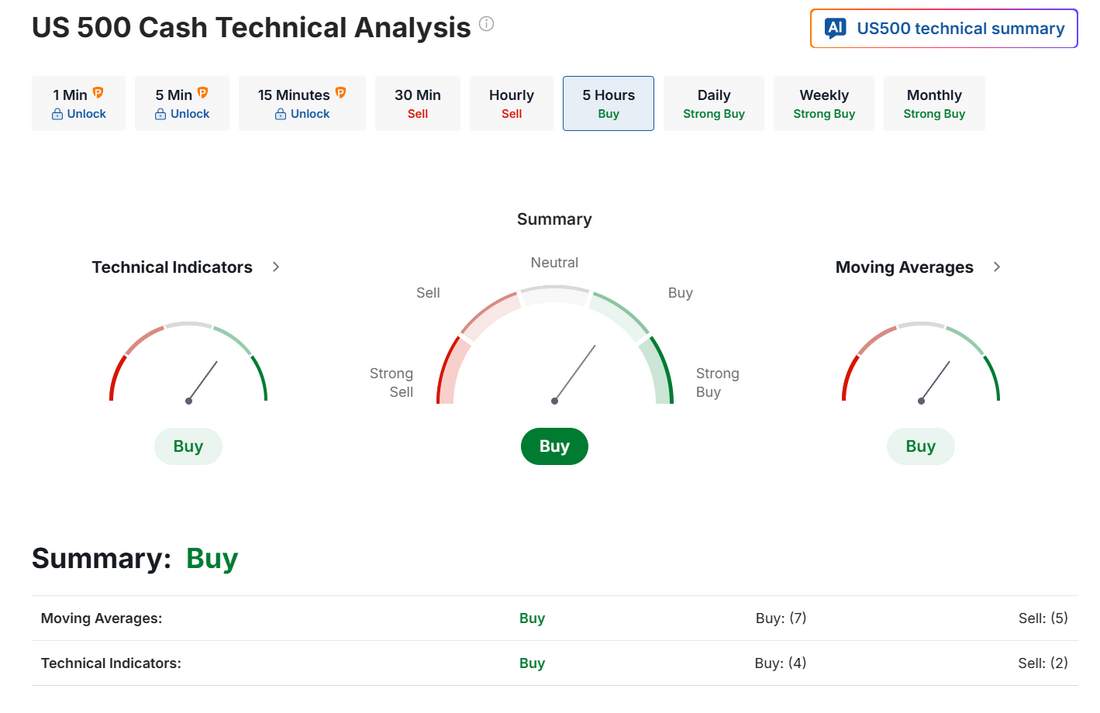

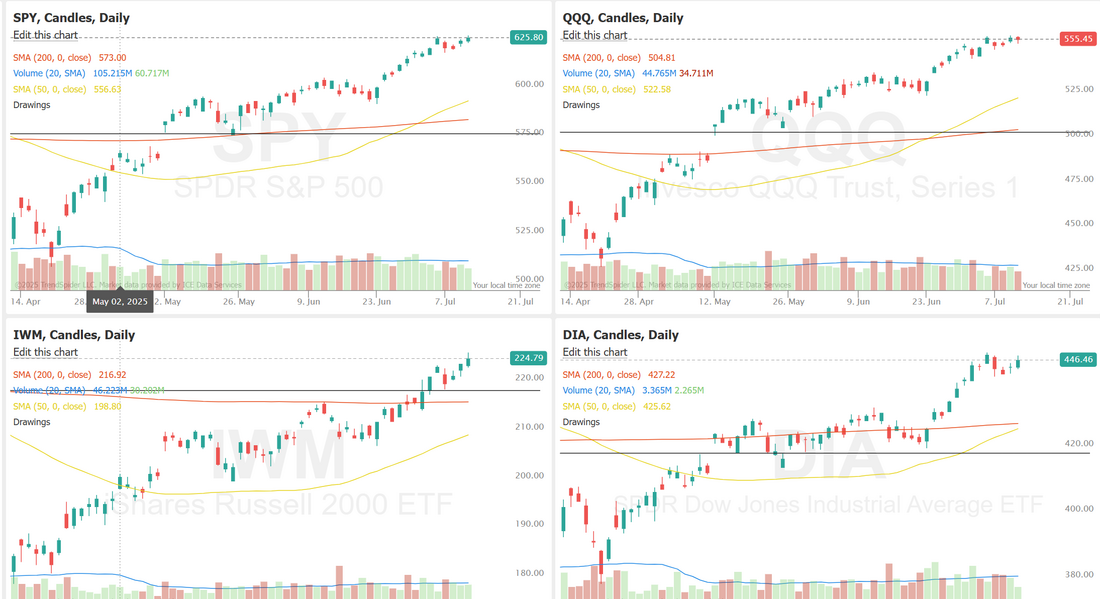

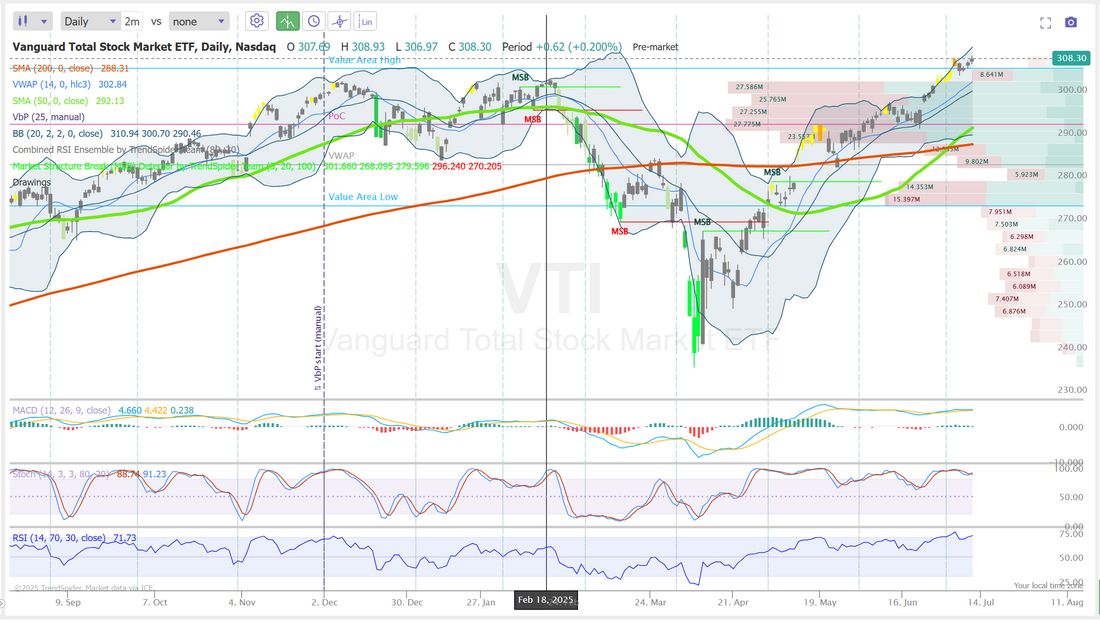

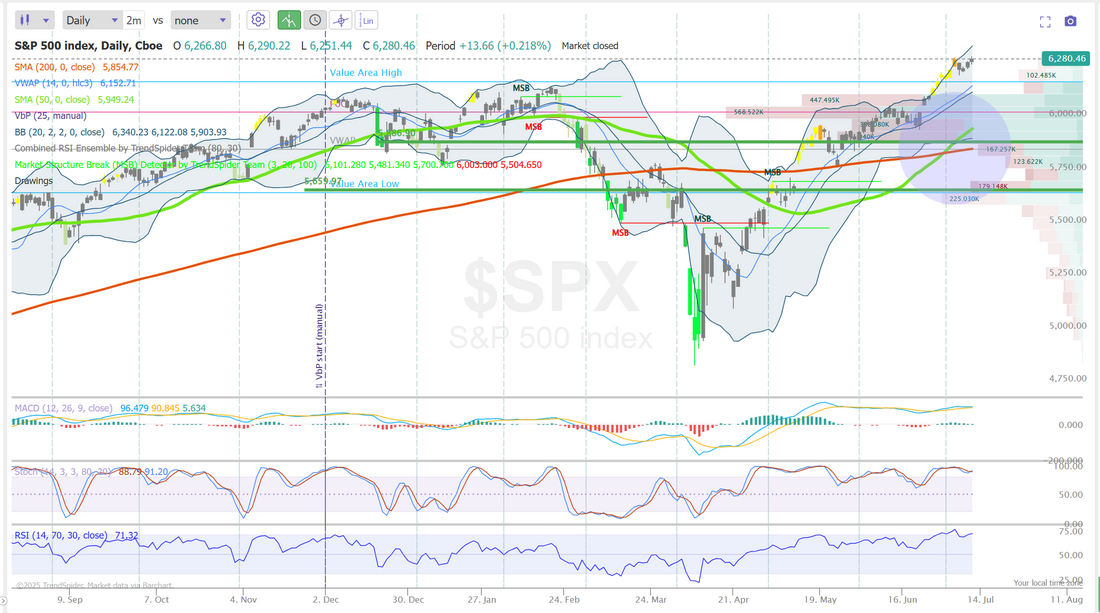

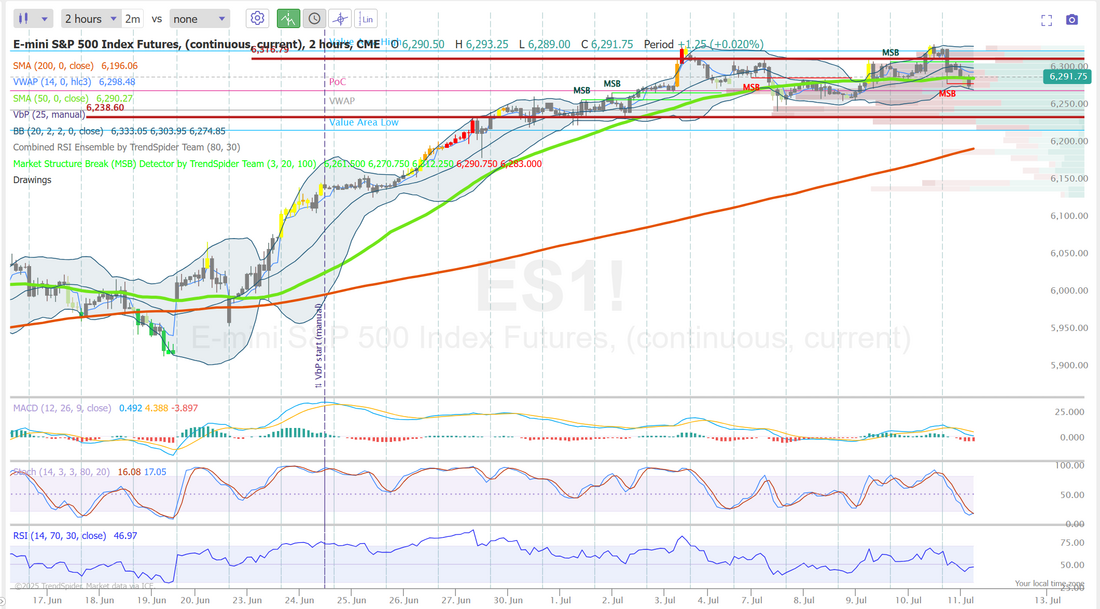

Are you a full-time professional trader?We had a good discussion yesterday in our live trading room about what level of effort we put into our trading. One thing we've learned in life is that those that treat something as a hobby are less proficient than those that treat it as a profession. Those that look at it as "part-time" do worse than those that view it as "full-time" work. The key here is that it's all about how you view it, not how much money you have or how much time you can devote. Many will say, "I only have a tiny amount of capital" or "I have a full time job and little time to commit to trading". None of this precludes us from viewing ourselves and conducting ourselves in a professional manner. We all need to decide, each day, how much effort we are willing to give to something. Trading is one of the most rewarding things I've done in my life but it take commitment. I've spent time living in Hawaii, getting up at 3:00 A.M. every day to start my trading. I've traded from hospital beds. I've annoyed my family to no ends continually pulling the family car over on road trips to "make just one more trade". I get up at 4:00 A.M. every day to do my research. I'm keenly aware that I'm not the smartest person in the room. I'm keenly aware that there are many traders much better versed than I. I succeed because of effort...not skill or I.Q. Each night, as we go to bed we need to look ourselves in the mirror and ask if we did everything we could to be successful. It's hard...but it's worth it. Put in the work. Trading IS work. We had a really nice day yesterday. Here's a look at our results. September S&P 500 E-Mini futures (ESU25) are trending down -0.62% this morning as sentiment took a hit after U.S. President Donald Trump ratcheted up trade tensions yet again. Late Thursday, President Trump announced a 35% tariff on Canadian imports, set to take effect on August 1st. However, the White House said goods complying with the U.S.-Mexico-Canada Agreement would continue to be exempt. Also, Mr. Trump said the European Union could receive a letter on tariff rates by Friday, casting doubt on the progress of trade negotiations between Washington and the bloc. In addition, Trump said he plans to raise blanket levies to 15%-20% on most trading partners that have not yet been given proposed tariff rates. “We’re just going to say all of the remaining countries are going to pay, whether it’s 20% or 15%,” he told NBC News. The International Monetary Fund said Thursday it is keeping a close watch on the latest U.S. tariff announcements, cautioning that global economic uncertainty remains high. It called on countries to engage constructively to maintain a stable trade environment. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 notching a new all-time high. Delta Air Lines (DAL) surged about +12% and was among the top percentage gainers on the S&P 500 after the carrier posted better-than-expected Q2 results and reinstated its 2025 profit guidance. Also, Advanced Micro Devices (AMD) rose more than +4% after HSBC upgraded the stock to Buy from Hold with a $200 price target. In addition, MP Materials (MP) jumped over +50% after announcing a public-private partnership with the U.S. Department of Defense aimed at speeding up the build-out of the nation’s rare earth magnet supply chain. On the bearish side, Helen of Troy (HELE) plummeted more than -22% after the company behind brands including Hydro Flask and Braun Thermometers posted downbeat FQ1 results. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell -5K to an 8-week low of 227K, compared with the 236K expected. St. Louis Fed President Alberto Musalem said on Thursday that while he sees upside risks to inflation, it is still too early to determine whether tariffs will have a persistent impact on prices. “It’s going to take time for the tariffs to settle. There’s a scenario where we could be in Q4 this year, or Q1 or Q2 of next year, where tariffs are still working themselves into the economy,” he said. At the same time, San Francisco Fed President Mary Daly said she continues to see two interest rate cuts as likely this year and believes there is a higher likelihood that the inflationary impact of tariffs may be more subdued than expected. “There’s zero chance we’ll have tariff clarity by Aug. 1, which makes a July rate cut impossible,” said Tom Essaye of The Sevens Report. “The practical impact of this consistently delayed tariff policy is to reduce the chances of a September rate cut, which could leave rates higher for longer and increase the chances of an economic slowdown.” Meanwhile, U.S. rate futures have priced in a 93.3% probability of no rate change and a 6.7% chance of a 25 basis point rate cut at the next central bank meeting in July. The U.S. economic data slate is empty on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.389%, up +0.73%. Let's take a look at the markets this morning. We are holding on to an every so slight, buy signal....still. We keep hitting new ATH's but we also seem to be running out of gas...if that makes sense. We keep waiting for a new catalyst that will relaunch the bullish move or cause a reversal. The VTI is just stuck here. No real buy or sell signals...yet. We've recently triggered a Golden cross in the indices. This is about as bullish a signal as we can get. Do the bulls still have enough buying power to keep the push going? Trade docket for today: QTTB. We've been quietly cash flowing this position with covered calls for a while now. Yesterday it came alive. That may present an interesting opportunity today to either take profit or possibly add more. /MNQ scalp. I've added to our long position this morning on the dip. We'll keep working this all day today. Gold 0DTE. We started this yesterday and set aside more buying power to continue to work it today. SPX 0DTE. Possibly a NDX 0DTE later in the day and 1HTE on Bitcoin. Let's take a look at the intra-day levels I'll be using today for our /ES setup. We have an interesting start to today. Futures are down this morning on tariff concerns (stop me if you've heard this before) but the structure shows some support and technicals on the 2 hr. chart are looking to rebound. Could we build back some upside movement this morning? That's the way I'm setup right now with our scalping trade. We find ourselves smack dab in the middle of my trading range this morning with 6317 still working as my resistance level an 6238 my support. I think we may have a decent shot at getting some movement today so I'll continue to hold my long scalp until we see what trend develops. My lean or bias today is slightly bullish. I think we have a decent chance to rebound off the lows of the futures market this morning. I'll see you all in the live trading room shortly! We've had an amazing week so far. Let's try to not screw it up today! LOL

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |