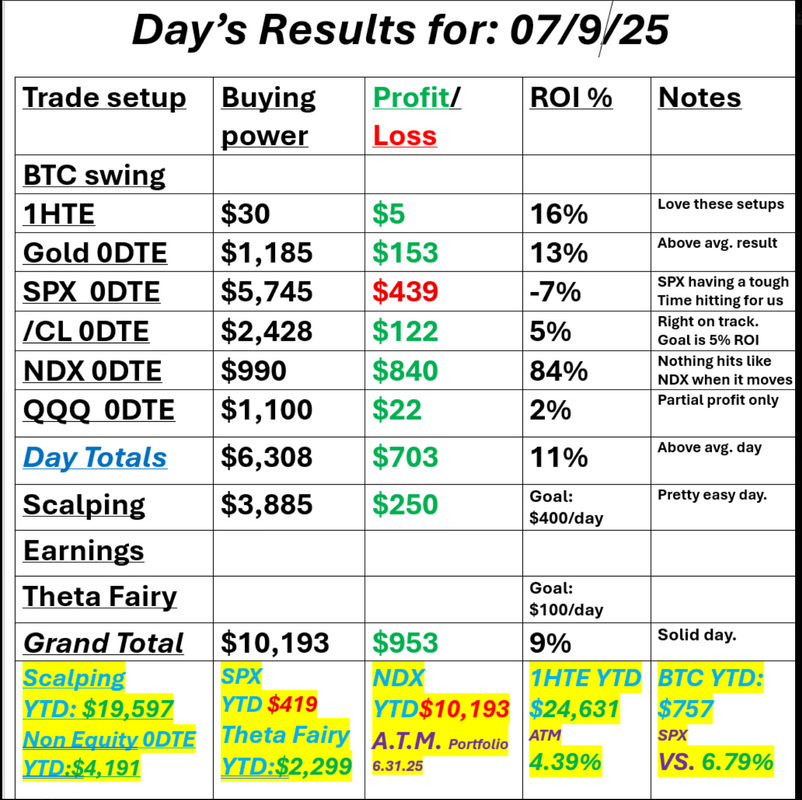

Copper is in play!If you traded with us yesterday we started our first entry into copper. It's a just a little 60% ROI potential trade! Crazy times for sure. We'll be working more positions into this trade over the next three weeks. Come join us! Our day yesterday was great. We still have trouble getting SPX into the green but our well diversified daily strategies continue to produce. See our results below: September S&P 500 E-Mini futures (ESU25) are down -0.12%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.09% this morning, pointing to a muted open on Wall Street amid uncertainty over U.S. President Donald Trump’s trade policies, while investors await U.S. jobless data and remarks from Federal Reserve officials. President Trump on Wednesday announced 50% tariffs on Brazilian goods, the highest rate announced so far, and confirmed via social media that 50% tariffs on copper products would take effect from August 1st. Trump also stated he would impose a 30% tariff on Algeria, Libya, Iraq, and Sri Lanka, along with 25% duties on goods from Brunei and Moldova, and a 20% rate on products from the Philippines. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. The Magnificent Seven stocks advanced, with Nvidia (NVDA) and Microsoft (MSFT) rising over +1%. Also, AES Corp. (AES) surged more than +19% and was the top percentage gainer on the S&P 500 after Bloomberg reported that the renewable power company was exploring options, including a possible sale, amid takeover interest. In addition, Boeing (BA) climbed over +3% and was the top percentage gainer on the Dow after delivering 60 aircraft in June, marking its highest monthly total in 18 months. On the bearish side, Aehr Test Systems (AEHR) plunged more than -12% after the company posted weaker-than-expected FQ4 revenue and said it wasn’t “reinstating specific guidance beyond what we have already stated” amid tariff-related uncertainty. Economic data released on Wednesday showed that U.S. Wholesale Inventories fell -0.3% m/m in May, in line with the preliminary reading. The minutes of the Federal Open Market Committee’s June 17-18 meeting, released Wednesday, showed that officials remained divided on how tariffs would impact inflation. “While a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation,” according to the FOMC minutes. Policymakers cited “considerable uncertainty” regarding the timing, magnitude, and duration of the tariffs’ possible impact on inflation. Still, most policymakers judged that “some reduction” in the Fed’s policy rate would probably be appropriate this year. Meanwhile, President Trump on Wednesday posted on social media that the Fed’s rate is “at least 3 points too high,” while repeating his demand for lower rates to ease the burden of servicing the national debt. “Optimism is growing that the Federal Reserve could begin cutting interest rates as early as September, particularly if upcoming data shows inflation is softening,” said Fawad Razaqzada at City Index. “But this is not a given as Trump’s policies could ramp up inflation in the coming months, which would lessen the need to loosen policy aggressively.” U.S. rate futures have priced in a 93.3% chance of no rate change and a 6.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 236K, compared to last week’s number of 233K. Also, market participants will parse comments today from St. Louis Fed President Alberto Musalem, Fed Governor Christopher Waller, and San Francisco Fed President Mary Daly. In addition, investors will monitor earnings reports from several notable companies, with Delta Air Lines (DAL), Conagra Brands (CAG), and Levi Strauss (LEVI) scheduled to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.349%, up +0.21%. My bias or lean yesterday was neutral. That was accurate for most of the day, until some bulls showed up late in the day. I'd look for more of the same today. We don't have a lot of upward catalysts. Trade docket today: /MNQ scalping, QQQ 0DTE, /GC 1DTE, /CL 1DTE, SPX 0DTE, NDX 0DTE, 1HTE BTC trades. Short and sweet blog today. All my levels are the same today as they were yesterday. No changes in our approach today vs. yesterday. See you all in the live trading room. Let's do it all again today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |