|

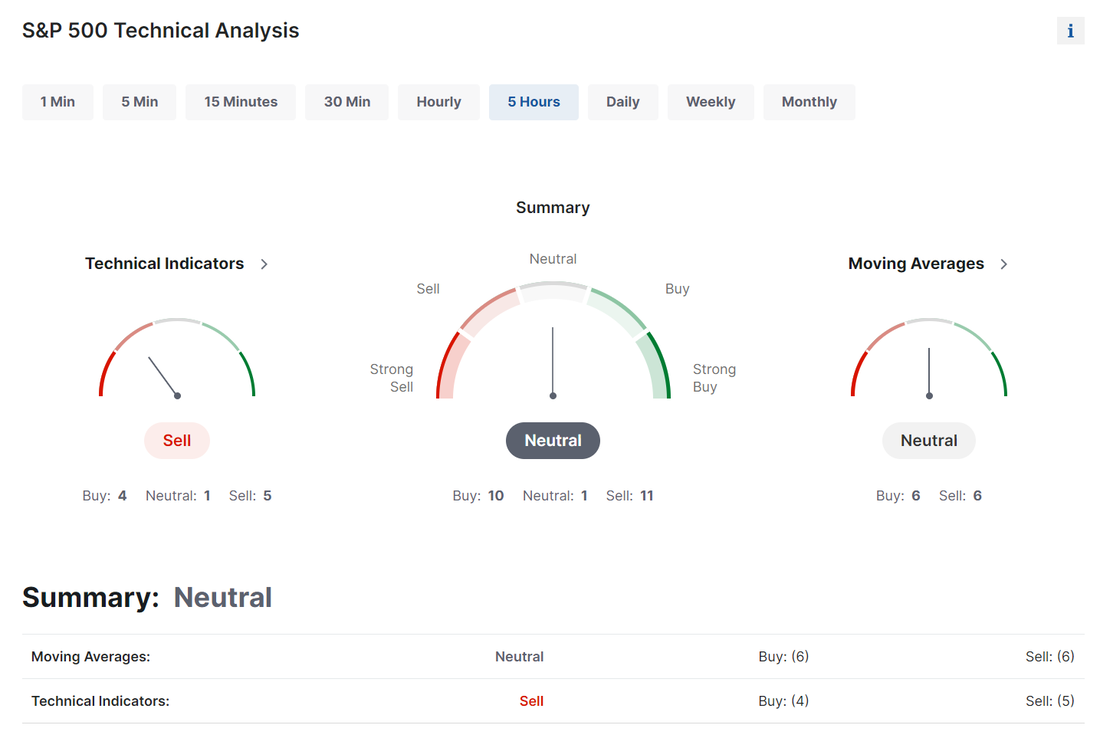

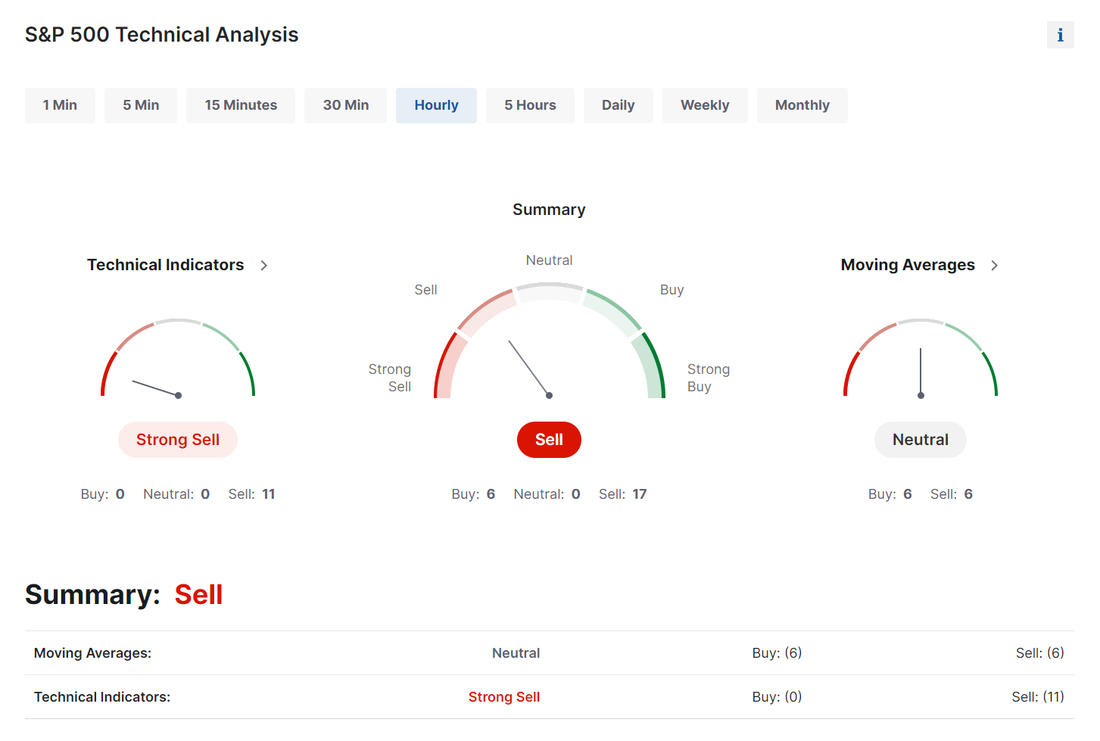

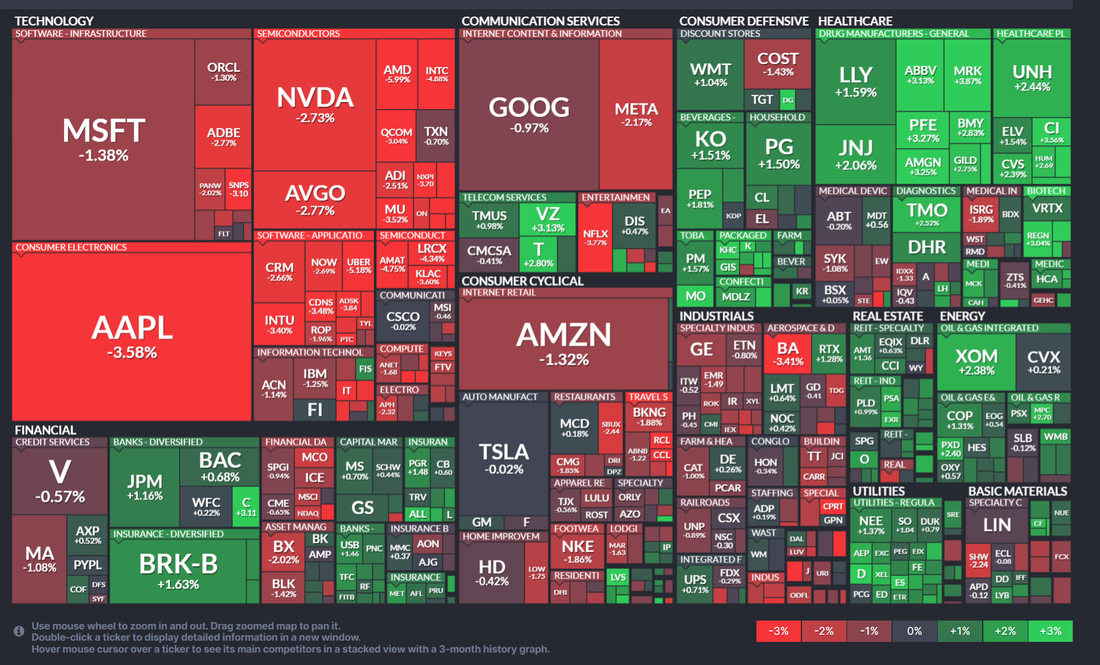

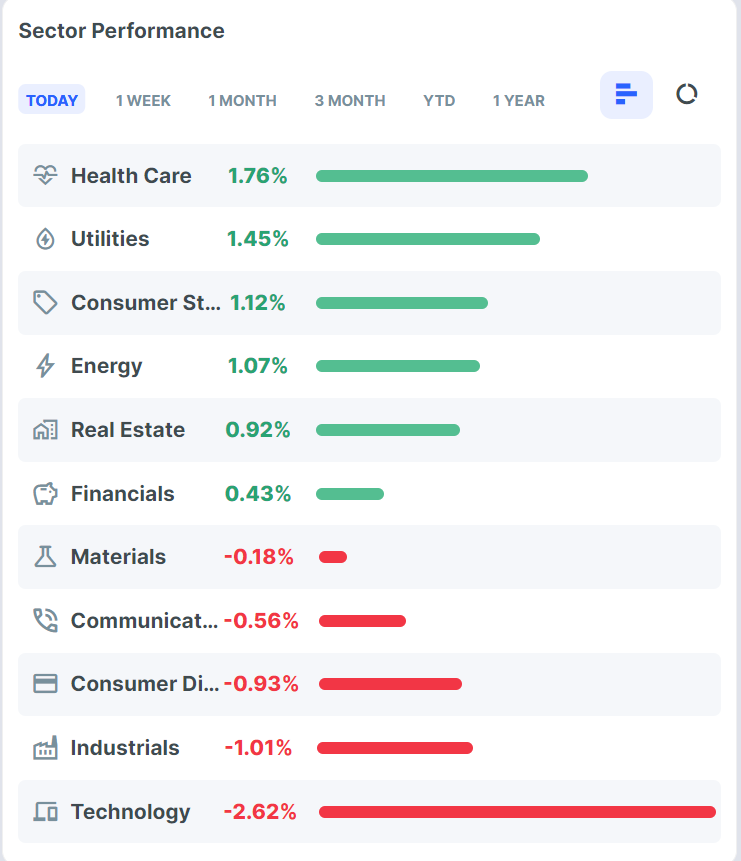

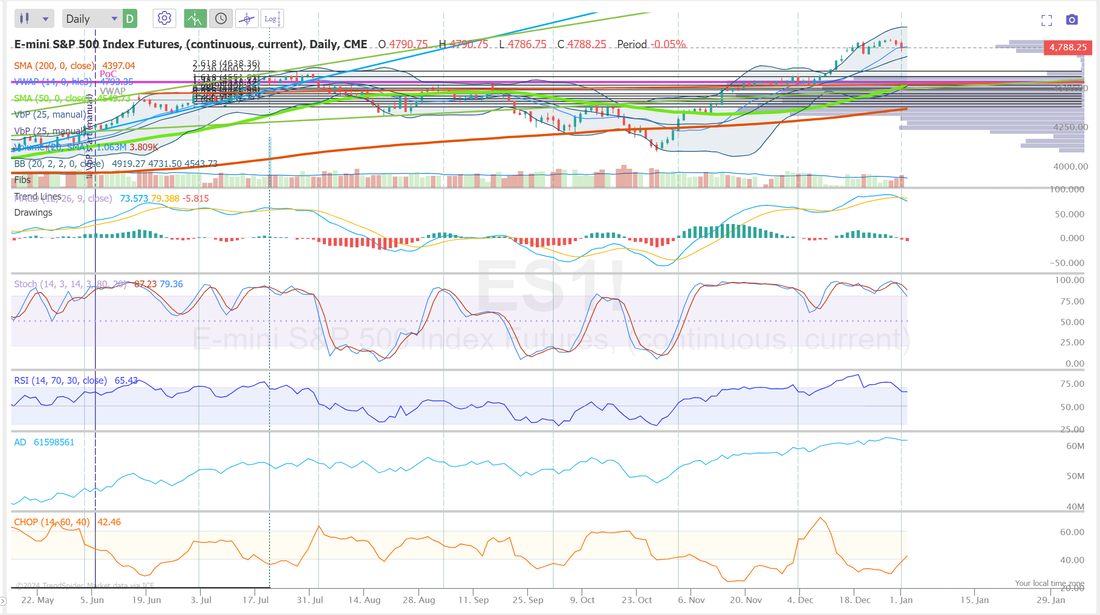

2024 started off with a bang for us. We didn't cash flow a bunch but our RUT trade is looking better and better...building extrinsic and finally moving in the right direction. We scored another full profit capture on our NDX 0DTE. Our Gold, Oil and DIA ladders all look good. Our new weekly credit strangles look solid as well. With todays drawdown following Fridays weakness we haven't acomplished much in terms of directional change. We did get a technical move to the "dreaded neutral" rating. These days can be tough ones to get a bead on any substantive directional bias. Once again (just like Friday) The sellers were able to hold going into the close. The hourly looks much more bearish. Price action was mixed with Techs getting hit and health care strong. Lots of economic news catalysts out today. Could be a key day for market direction Markets starting to look much more vunerable now with ADX, RSI, STOC and MACD all rolling over with sell signals. Intra day levels for me today: The key demarcation line for me is 4790 on /ES. Above could start a bullish move. Below, a bearish one. 4805/4815/4828/4843 to the upside. 4779/4765/4756/4744 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |