|

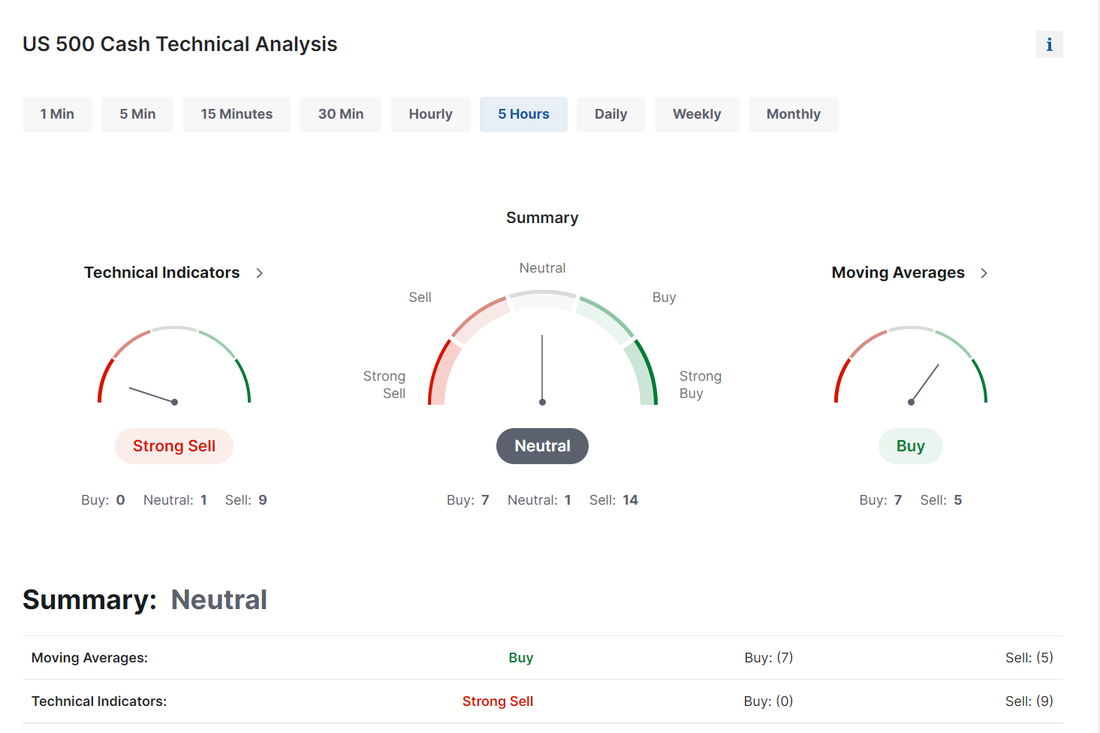

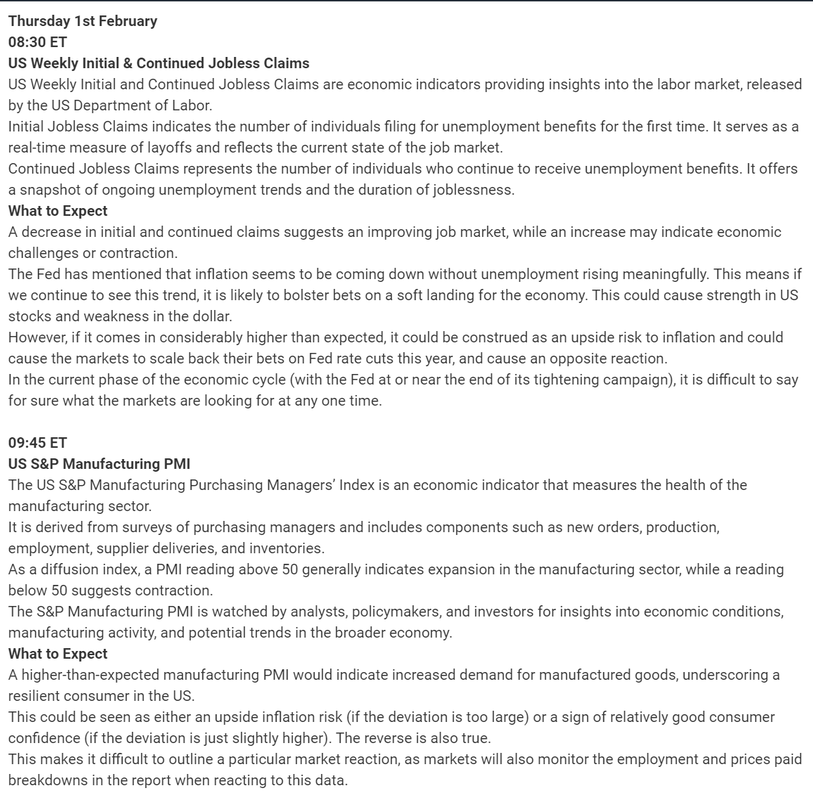

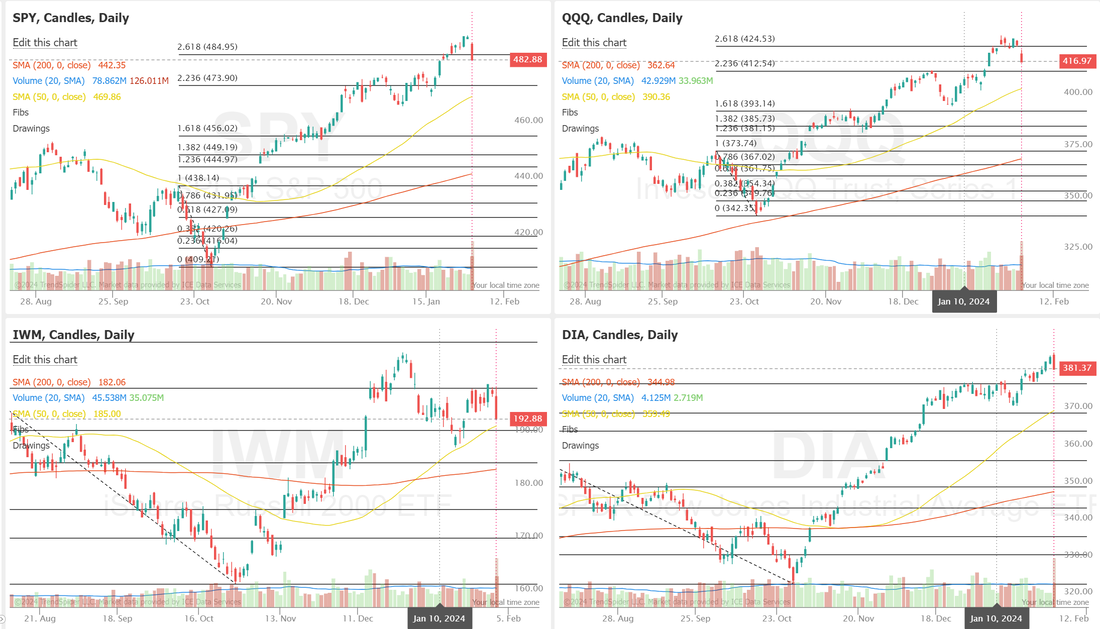

We had an amazing day yesterday! FOMC day never dissapoints with opportunity. A day that many traders eskew is one of our very favorite days to trade. My net liq was up almost $6,000 dollars and could have been more but, that's how it goes. We never catch the exact tops or bottoms. We have more opportunity today with AAPL, META and AMZN reporting ATC. Yesterdays sell off was enough to finally turn our technicals to neutral, if only slightly. If we get a moderate rebound today (futures are up as I type this) we could easily swing back into buy signals. Our bullish QQQ and VTI trades have enough protection in them that both made money yesterday even with the downturn. Neutral rated days can be very difficult to trade. The market abhors a vacumn and seeks directional bias. I would imagine that will be sorted out in the next couple days. Jobless claims and PMI are the scheduled news catalysts for today: Trades that are on our docket for today: AAPL, META, AMZN, DAL?, DIAm GLD, GOOG, IWM?, PFE, QQQ?, RUT?, SBUX, SHOP, SPX/NDX 0DTE's. While it was a big down day yesterday, it was the Techs that pulled us down. We are getting a little bit of a mixed bag with the DIA showing amazing strength. The IWM volatile but going no where fast and the SPY and QQQ bullish but looking more likely to roll over. /ES futures broke down through our "chop zone". Stopped exactly at our bottom fib line and as I type this they are trying to get back into the "chop zone". Once we get through AAPL, META and AMZN earnings we'll have a much clearer picture. Intra day levels for me on /ES: 4897/4902/4922/4934 to the upside. 4887/4866* (key level. yesterdays low)/4837/4824 to the downside. Intra day levels for me on /NQ: 17388/17425/17478/17542 to the upside. 17331/17286/17217/17168 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |