|

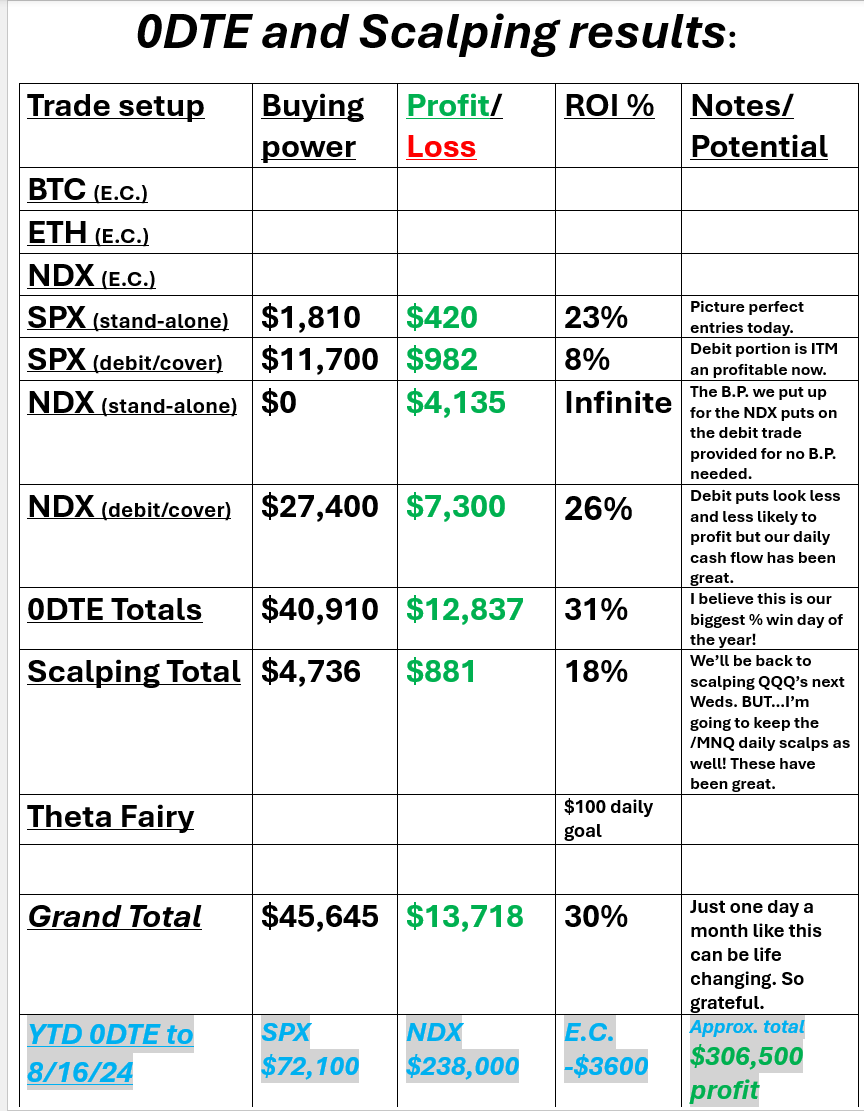

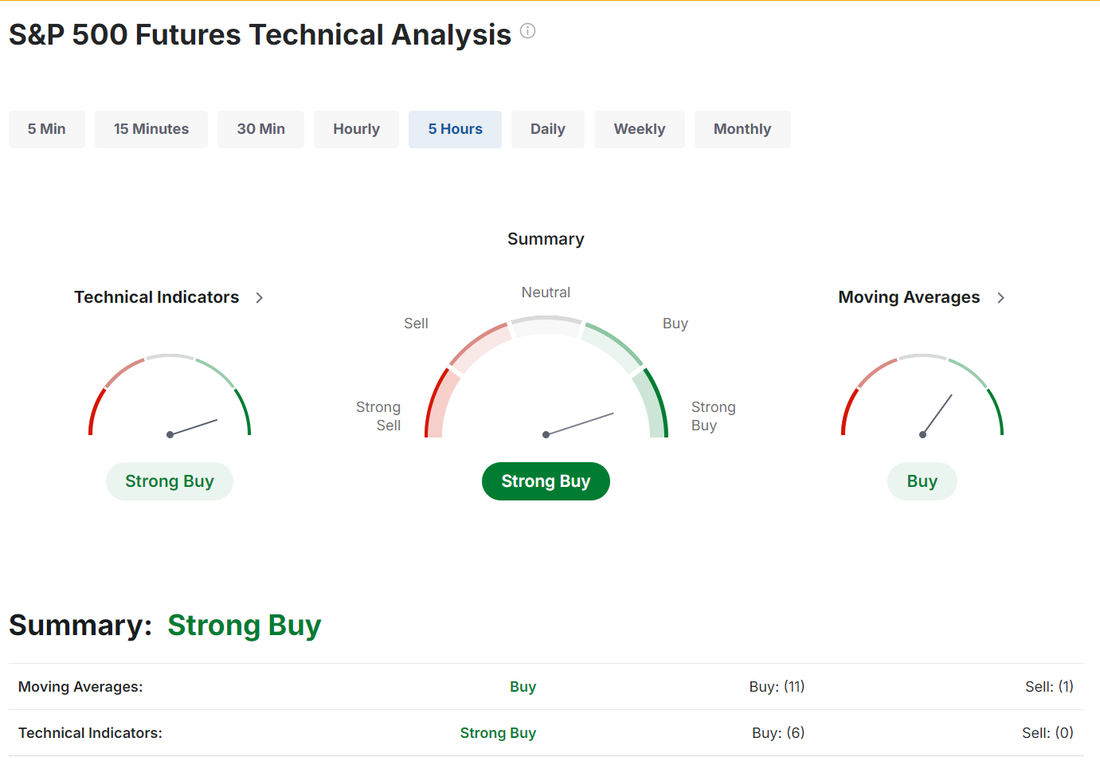

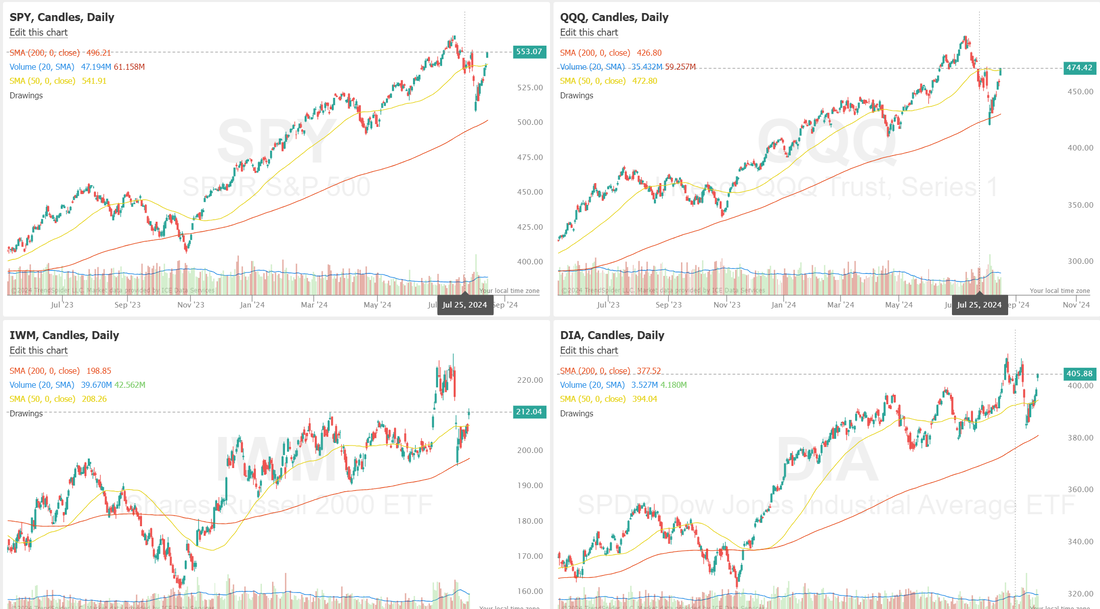

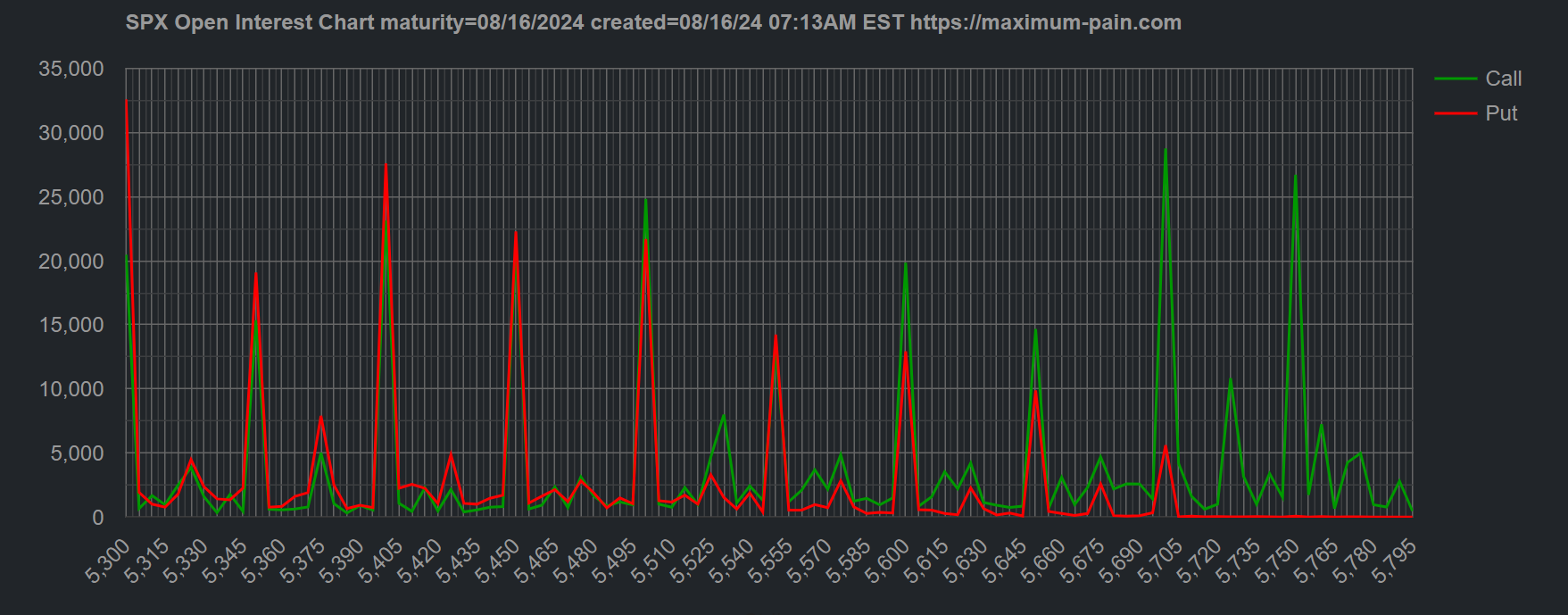

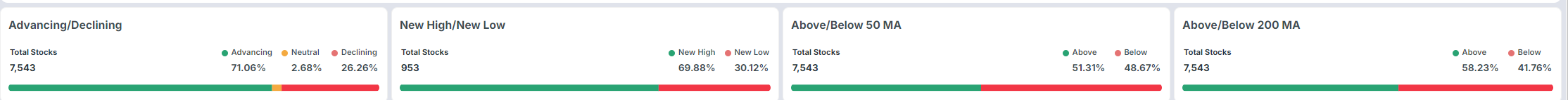

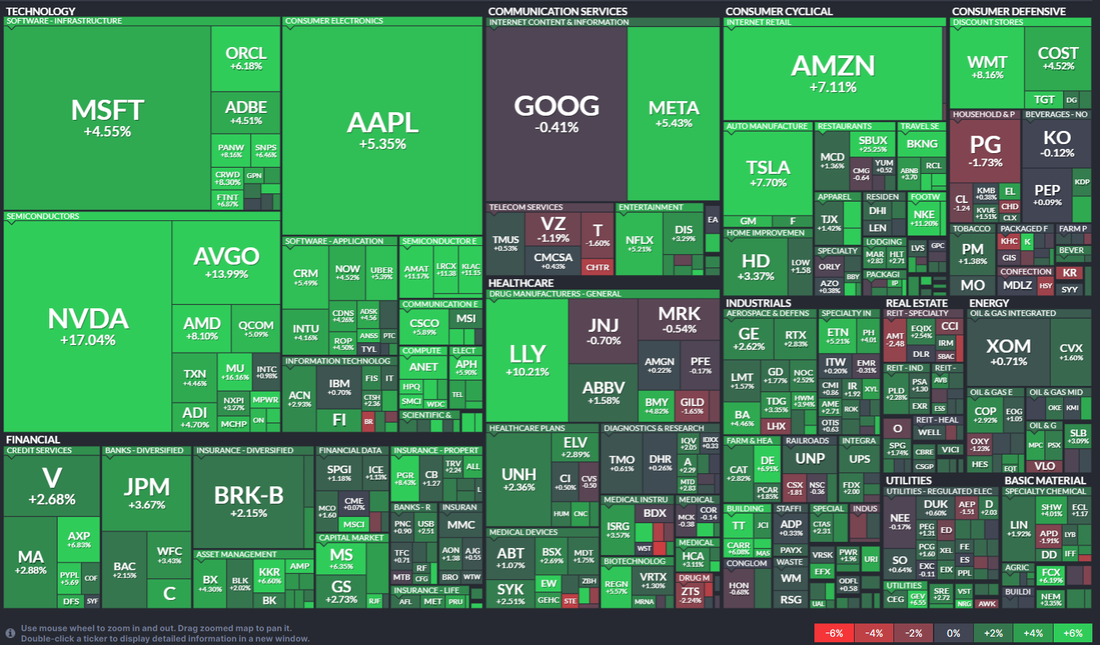

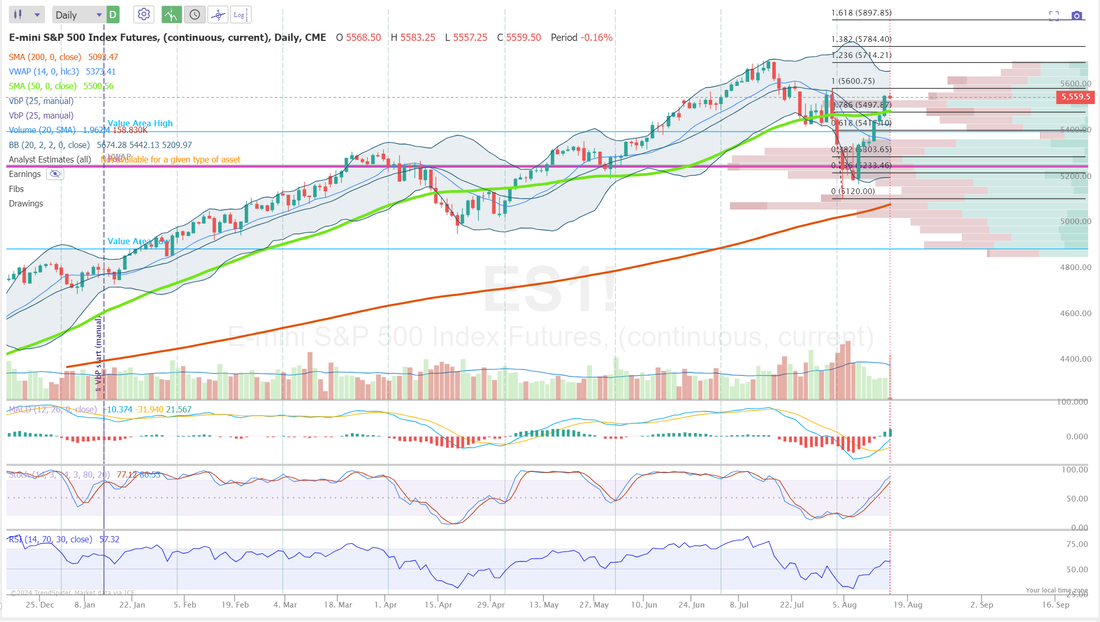

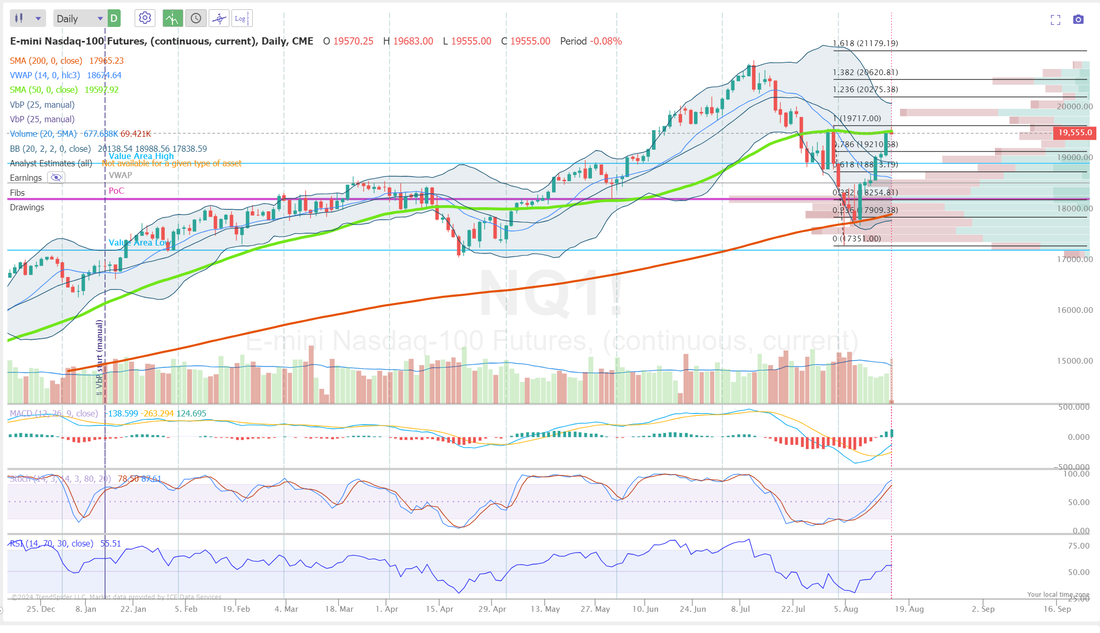

Weclome to Friday traders! The last trading day of the week. Our focus on Fridays is #1. Book any open profits. #2. De-risk the account. #3. Bring our buying power back in so we can be ready to do it all over again next week. Yesterday wasn't good for us...it was stellar. Just stellar. I believe it was the highest percentage gain we've had all year. We've had days where the dollar profit was greater but not the percentage gain. 31% in a day might be a record for us. It also pushes us up over $300,000 dollars in documented profits on our 0DTE's for the year. These can be life changing results but...sadly they are not enough. I just had a new member in our trading room cancel his membership. Sometimes people are looking for something other than just making money. I'm going to write up some thoughts on that in our trading room today. Hopefully it can help each of you set goals with your trading that better align with what you really want out of life. Never the less...I simply couldn't be happier with our results. NOTE: No live zoom feeds until next Weds. I'm out visiting the in-laws in Washington. Let's take a look at the markets. The buy signals continue to hold. We've blasted up above the key levels of the 50DMA on all the indices we trade. One of our trading members asked yesterday about premium skew and where the most activity is. Here's a snapshot of the largest open interest levels currently. Most of our internal metrics look healthly This week has been a good, solid one for the bulls. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 notching 2-week highs. Ulta Beauty (ULTA) surged over +11% and was the top percentage gainer on the S&P 500 after a 13F filing revealed that Warren Buffett’s Berkshire Hathaway purchased approximately 690,000 shares of the company, valued at around $266 million, during the second quarter. Also, Cisco Systems (CSCO) climbed more than +6% and was the top percentage gainer on the Dow after the company posted upbeat Q4 results, provided solid Q1 guidance, and announced plans to cut its global workforce by about 7%. In addition, Walmart (WMT) gained over +6% after the retail giant reported stronger-than-expected Q2 results and raised its FY25 guidance. On the bearish side, Dillard’s (DDS) plunged more than -10% after reporting weaker-than-expected Q2 results. Economic data on Thursday showed that U.S. retail sales climbed +1.0% m/m in July, stronger than expectations of +0.4% m/m and the biggest increase in 1-1/2 years, while U.S. core retail sales, which exclude motor vehicles and parts, rose +0.4% m/m in July, beating the +0.1% m/m consensus. Also, the U.S. August Philadelphia Fed manufacturing index fell to a 7-month low of -7.0, weaker than expectations of 5.4. In addition, U.S. industrial production slumped -0.6% m/m in July, weaker than expectations of -0.3% m/m, while U.S. July manufacturing production fell -0.3% m/m, weaker than expectations of -0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -7K to a 5-week low of 227K, less than the 236K consensus. “We’re back to an environment where good news is good news and bad news is bad news,” said Bret Kenwell at eToro. “Investors and consumers want inflation to go lower - but not at the expense of the economy. [Thursday’s] stronger-than-expected retail sales figure quiets some of the fears the U.S. may be slipping into a recession.” Atlanta Fed President Raphael Bostic told the Financial Times in an interview released on Thursday that he is open to an interest rate cut in September, noting that the Fed cannot “afford to be late” in easing monetary policy. “I’m open to something happening in terms of us moving before the fourth quarter,” Bostic told the newspaper. Also, St. Louis Fed President Alberto Musalem stated that he believes the time is approaching when it will be appropriate for the central bank to lower interest rates. “From my perspective, the risk to both sides of the mandate seems more balanced. Accordingly, the time may be nearing when an adjustment to a moderately restrictive policy may be appropriate as we approach future meetings,” Musalem said. Meanwhile, U.S. rate futures have priced in a 72.5% chance of a 25 basis point rate cut and a 27.5% probability of a 50 basis point rate cut at the next FOMC meeting in September. Today, all eyes are focused on the preliminary reading of the U.S. Michigan Consumer Sentiment Index, set to be released in a couple of hours. Economists, on average, forecast that the Michigan consumer sentiment index will come in at 66.7 in August, compared to last month’s value of 66.4. The U.S. Building Permits (preliminary) and Housing Starts data for July will also be reported today. Economists forecast Building Permits to be 1.430M and Housing Starts to be 1.340M, compared to the previous numbers of 1.454M and 1.353M, respectively. In addition, market participants will be anticipating a speech from Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.913%, down -0.54%. My bias today is slightly bearish. We've had a big run this week. Probably time to pause or give a little back. Trade docket for today could be busy. Many of these positions expire today and may do so on their own. We still list them. /MNQ scalping, /MCL, /NG, /ZC, /ZN, AMAT, BABA, DELL, F, GLD, IWM, META, NVDA, ORCL, PLTR, PYPL, SHOP, UPST, WYNN, 0DTE's. Let's take a look at a couple key levels for our 0DTE's today. /ES; The /ES is a little more healthy than the /NQ. Solidly above the 50DMA. 5600 is first upside target with 5716 the next. 5497 is the first downside target and corresponds to the 50DMA. 5426 would be the next target is we can break below the 50DMA. /NQ: That green line is key. 50DMA. 19589. Bulls need to continue to push through that level to maintain momentum. Above that is 19700 which is also heavy resistance. 19204 is first downside target then all the way down to 18985. There appears to be more downside than upside today. Let's have a great finish to a great week today! I hope you all have a great weekend.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |