|

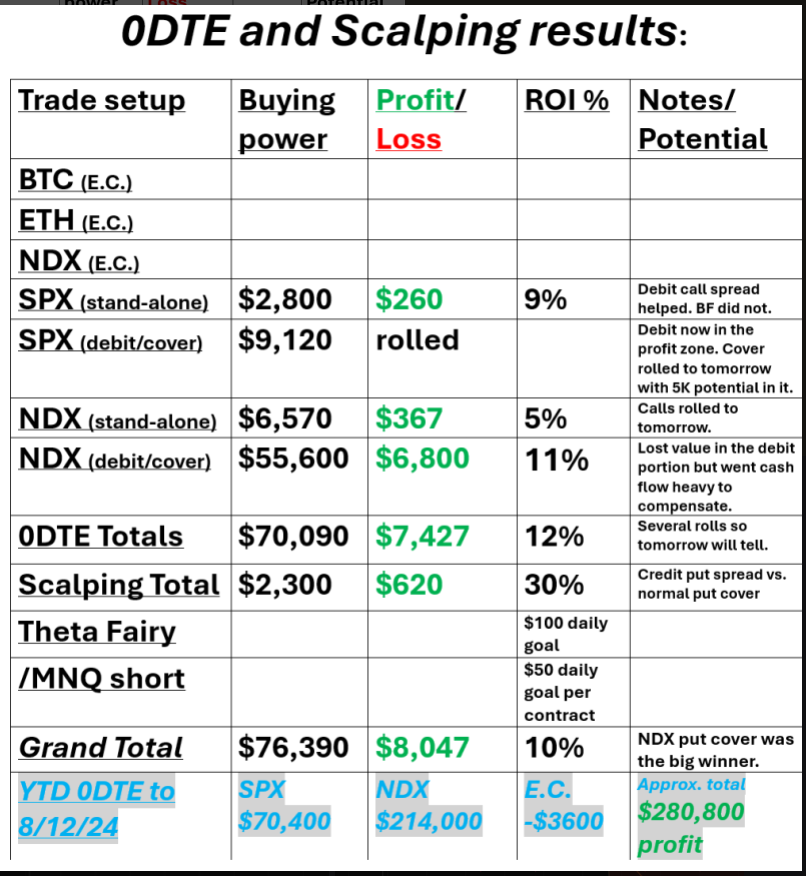

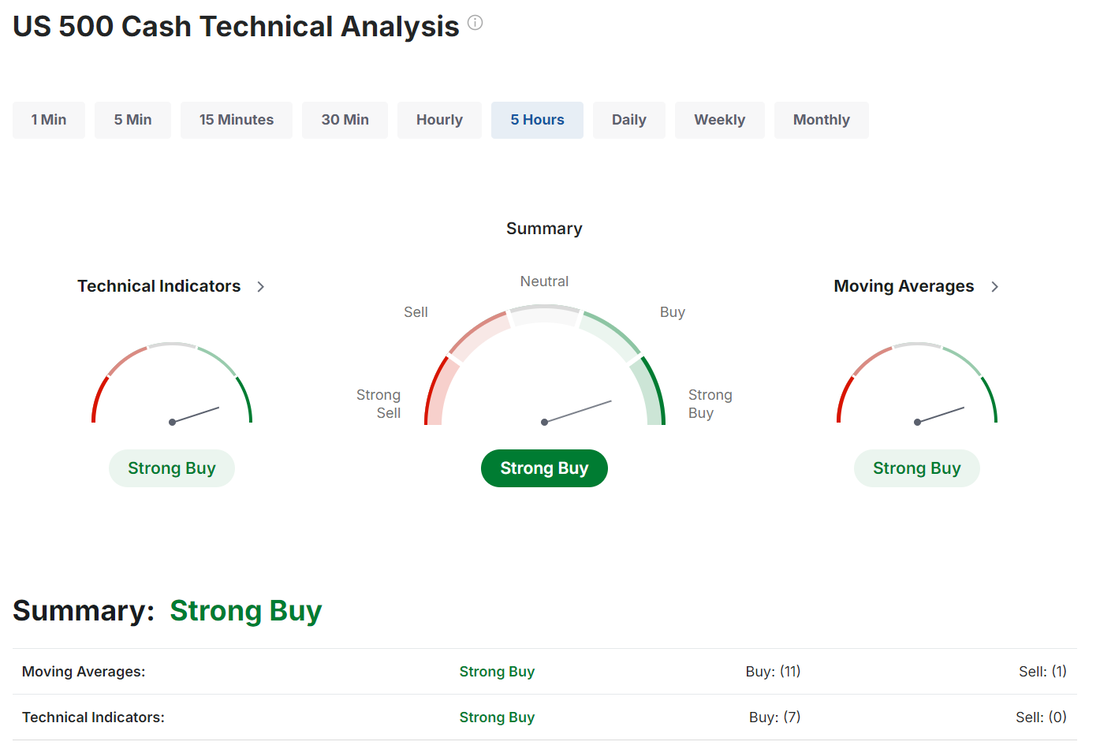

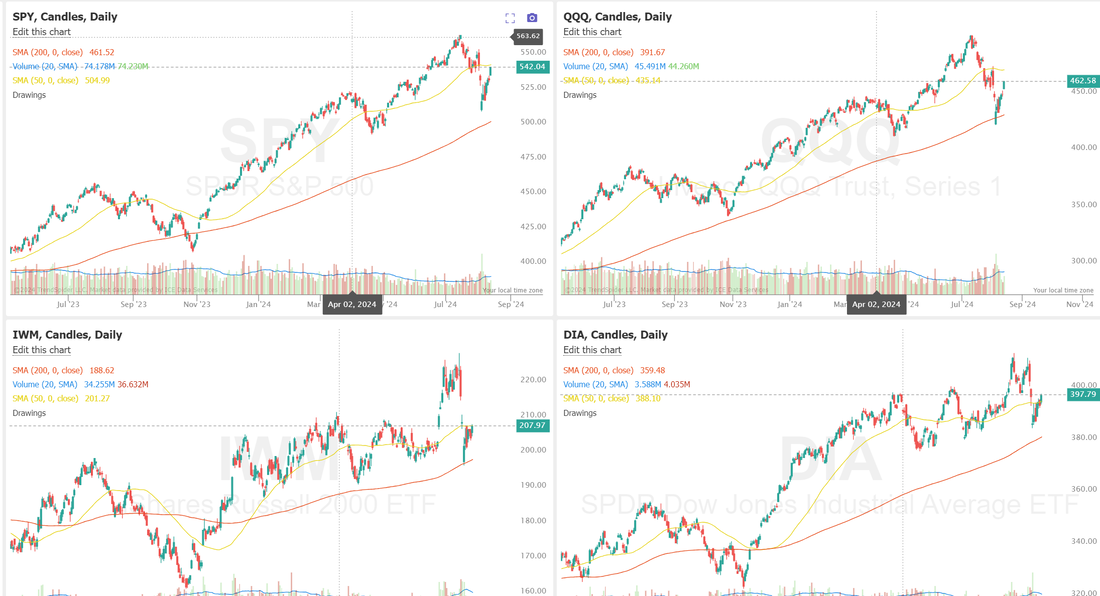

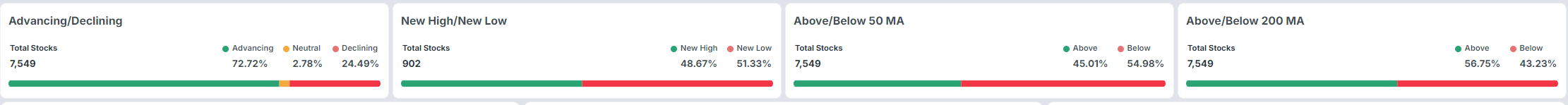

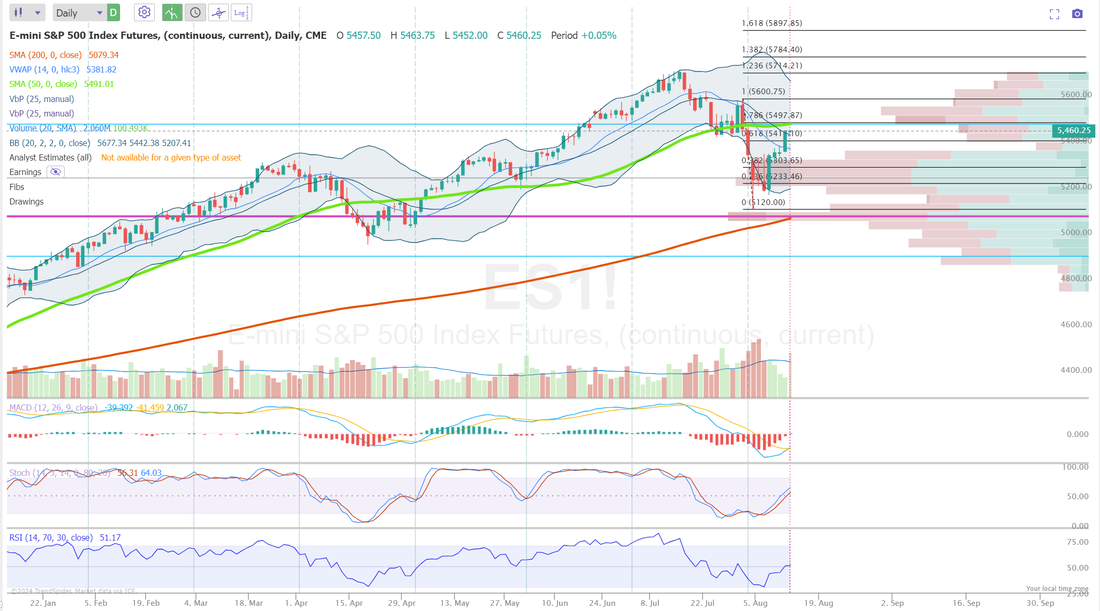

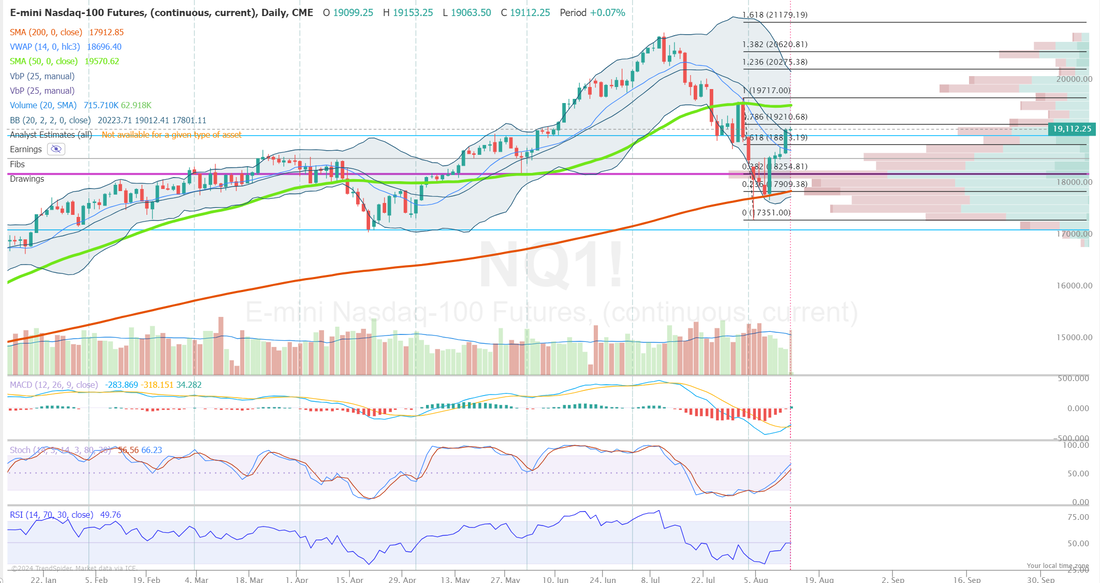

Welcome to Weds. and CPI day for those of you that celebrate it! Yesterday we got PPI and the market loved the soft numbers. We broke through some critical resistance. Today could give us a definitive directional change. The main (only?) question today is, does CPI confirm the soft PPI numbers or contradict? It should be the driver for today. We had a decent day yesterday. Our SPX debit call cover and NDX stand alone 0DTES have positions we've rolled to today so we'll really see the results of our full effort yesterday in todays closing numbers. Here's how our trades went yesterday. The big push up hurt our NDX put debit spread but that is as of yet, unrealized as a gain or loss. We've got 12 more days to work that setup. Let's take a look at the markets. We finally have some movement off of strong consolidation zones. Buy mode was achieved. From a technical perspective we broke through some key levels of resistance. However, you can see that it's just brought us back to the next resistance levels. The market certainly looks much more healthy. What led us down (tech) is also what's leading us back up. This past week has been strong across all sectors. The QQQ's are pricing in a 1.3% potential move today. CPI is a big market driver. September S&P 500 E-Mini futures (ESU24) are up +0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.09% this morning as market participants held back from making any big bets ahead of the release of the U.S. consumer inflation report. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-1/2 week highs and the blue-chip Dow posting a 1-week high. Starbucks (SBUX) soared over +24% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after naming Chipotle Mexican Grill’s Brian Niccol as its next CEO effective September 9th, succeeding Laxman Narasimhan, who is stepping down as CEO effective immediately. Also, chip stocks gained ground, with Nvidia (NVDA) advancing more than +6% and Intel (INTC) rising over +5% to lead gainers in the Dow. In addition, Dell Technologies (DELL) climbed more than +4% after Barclays upgraded the stock to Equal Weight from Underweight. On the bearish side, Chipotle Mexican Grill (CMG) slumped over -7% and was the top percentage loser on the S&P 500 after CEO Brian Niccol departed the company to take up the role of CEO at Starbucks. Economic data on Tuesday showed the U.S. July producer price index for final demand rose +0.1% m/m and +2.2% y/y, better than expectations of +0.2% m/m and +2.3% y/y. Also, the U.S. core PPI, which excludes food and energy prices, increased +2.4% y/y in July, less than the +2.7% y/y consensus and cooling from the +3.0% y/y pace in June. “Muted PPI is more good data,” said Paul Ashworth at Capital Economics. “It is nevertheless consistent with the Fed’s preferred core PCE prices measure increasing at a below 2% annualized pace.” Atlanta Fed President Raphael Bostic stated Tuesday that he is seeking “a little more data” before endorsing a reduction in interest rates. “We want to be absolutely sure,” Bostic said. “It would be really bad if we started cutting rates and then had to turn around and raise them again.” Meanwhile, U.S. rate futures have priced in a 49.5% chance of a 25 basis point rate cut and a 50.5% chance of a 50 basis point rate cut at the next central bank meeting in September. On the earnings front, notable companies like Cisco Systems (CSCO), Cardinal Health (CAH), and Brinker International (EAT) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. consumer inflation report, set to be released in a couple of hours. Economists, on average, forecast that the U.S. July CPI will arrive at +0.2% m/m and +3.0% y/y, compared to the previous numbers of -0.1% m/m and +3.0% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the Core CPI to be +0.2% m/m and +3.2% y/y in July, compared to the previous figures of +0.1% m/m and +3.3% y/y. A survey conducted by 22V Research revealed that 52% of investors anticipate the market reaction to the consumer inflation report will be “risk-on.” U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.900M, compared to last week’s value of -3.728M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.855%, down -0.05%. No bias or lean for me today. I'm sure our price action will be data driven off the CPI result. However the data is percieved by the market, I think we have a good chance for a trend day. Trade with the trade today, that's my goal. Let's look at the new, key levels for me today. /ES; /NQ: Some key levels for me today: 19601 to the upside is the first big target. This is the 50DMA. 18546 is the first downside target with 18249 the next level down. Again...lots of potential movement lined up for today. Trade docket for today: DDD?, CSCO, /MCL, /MNQ scalping, /NG, CRM?, DELL, DJT, FSLR, IWM?, NVDA?, UPST, NU, XP, 0DTE's. Have a great day folks. CPI is out shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |