|

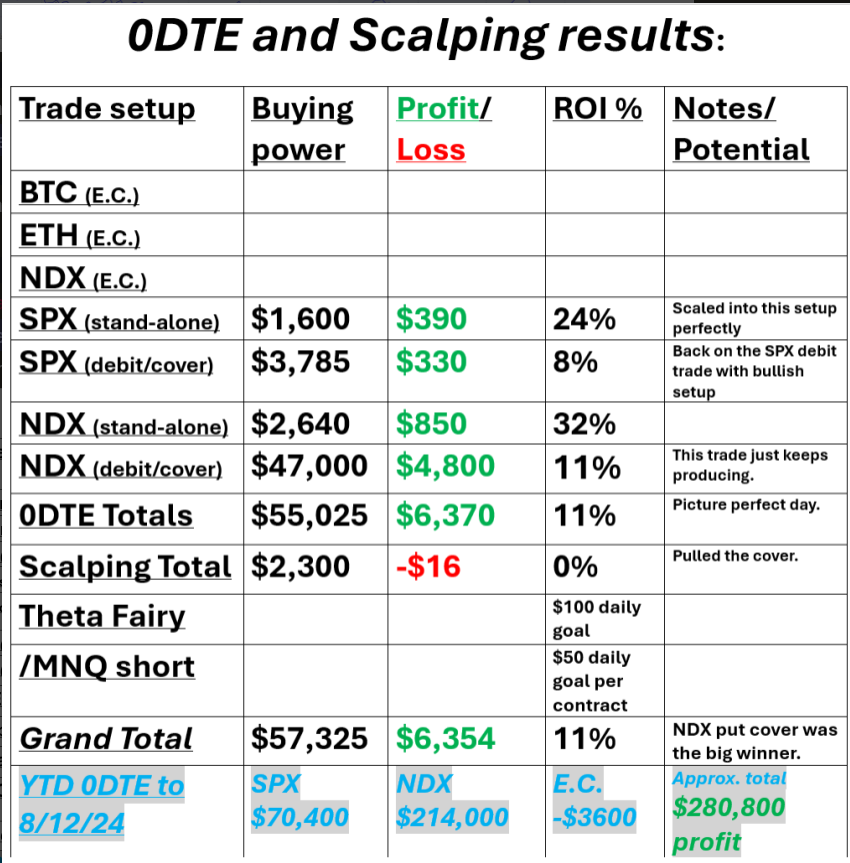

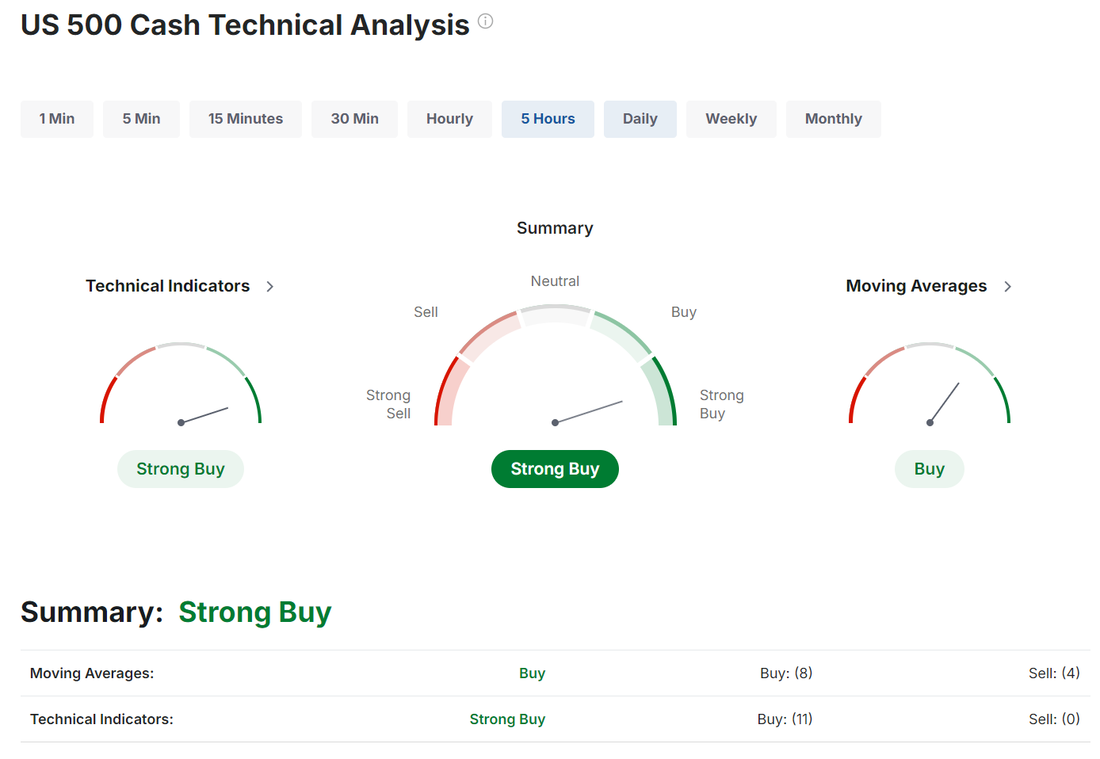

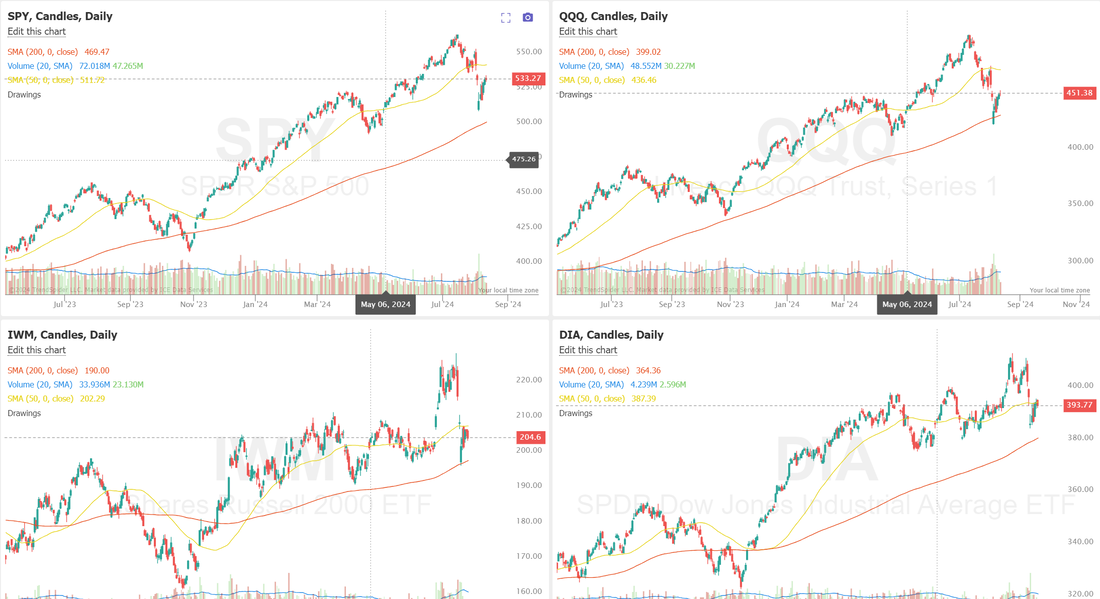

Welcome back traders. We had a near, picture perfect day yesterday. In the trading room we talked about how some days, whatever you do it doesn't work and somedays everything just flows. Take a look at our results below. We continue to grow our profits on our 0DTE setups. We'll need the help of the NDX debit setup to get us over the $300,000 profit mark. We should know more on that after PPI and CPI this week. Let's take a look at the markets. Buy mode just holding on. We continue to be stuck in major consolidation zones. Yesterdays price action didn't really alter that. September S&P 500 E-Mini futures (ESU24) are trending up +0.11% this morning as investors awaited crucial U.S. producer inflation data, comments from a Federal Reserve official, and an earnings report from home improvement chain Home Depot. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. KeyCorp (KEY) climbed over +9% and was the top percentage gainer on the S&P 500 after Scotiabank announced plans to buy a 14.9% pre-forma stake for a minority investment of about $2.8 billion through the issuance of common shares at a price of $17.17 per share. Also, Monday.com (MNDY) advanced more than +14% after the company posted upbeat Q2 results and raised its full-year revenue guidance. In addition, Starbucks (SBUX) gained over +2% after the Wall Street Journal reported that activist investor Starboard Value had built a stake in the coffee giant. On the bearish side, B. Riley Financial (RILY) plummeted nearly -52% after the company suspended its quarterly dividend and said it expects a Q2 loss between $435 million and $475 million. “This skittish sentiment will likely persist until investors see more evidence that the economy isn’t slowing into a recession and indications from the Fed that it will act aggressively, if necessary,” said Jason Draho at UBS Global Wealth Management. Meanwhile, U.S. rate futures have priced in a 50.5% probability of a 25 basis point rate cut and a 49.5% chance of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, home improvement chain Home Depot (HD) is set to report its Q2 earnings results today. Today, all eyes are focused on the U.S. Producer Price Index, set to be released in a couple of hours. Economists, on average, forecast that the U.S. July PPI will stand at +0.2% m/m and +2.3% y/y, compared to the previous figures of +0.2% m/m and +2.6% y/y. The U.S. Core PPI will also be closely watched today. Economists expect July’s figures to be +0.2% m/m and +2.7% y/y, compared to the previous numbers of +0.4% m/m and +3.0% y/y. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.920%, up +0.26%. No lean or bias for me today. PPI should be the catalyst and we also have FED Bostic speaking. Trade docket for today: NU and XP earnings setups. CCL, FSLR, META additions to current setups. /MNQ scalp, 0DTES. We have skipped the E.C. 0DTE's this past week as the edge just wasn't there but they look more enticing now. I'd imagine we'll be back on them next week. As mentioned, I think PPI an Bostic speaking should be our two potentially market moving catalysts for today so let's look at a coupld key levels in the /ES and /NQ. /ES; On the upside we have 5403. This is the current resistance. Above that we have the 200 period M.A. (red line) on the 2hr. chart. Support is at 5359 and then down to 5332 (green line) which is the 50 period M.A. A breakout above or below these levels could get us back to moving more directionally. /NQ: 18829 is the first resistance level with 18948 being the next (red line) as the 200 period M.A. 18627 is the first support and 18536 takes us down to the PoC (purple line). Again, a break out above of below these levels could initiate some directional movement. Use the converter to easily convert futures to SPY/QQQ or SPX/NDX: Now we just await the PPI numbers. Have a great day folks. Let's see if we can keep the momentum going.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |