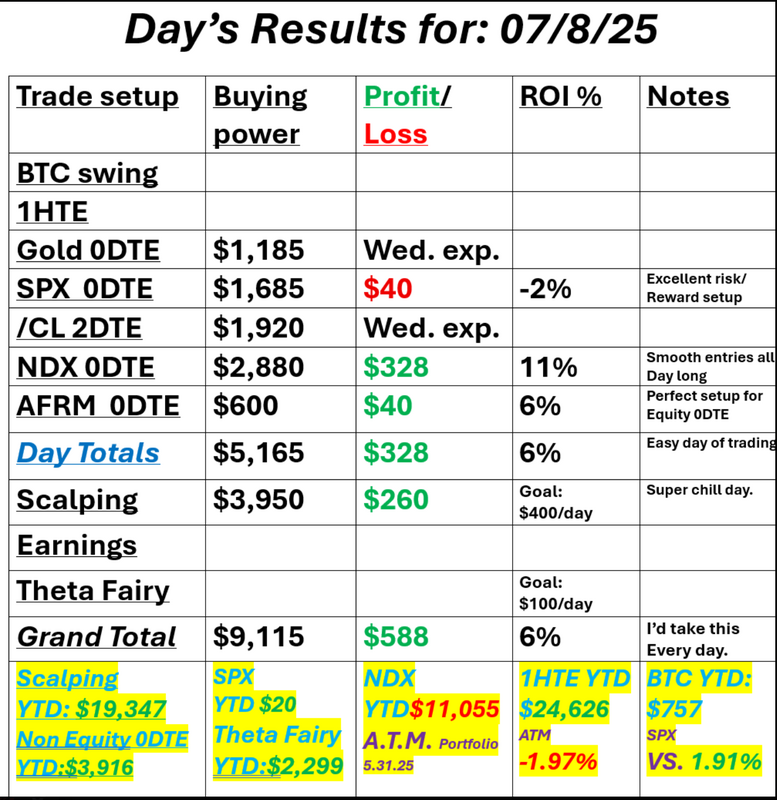

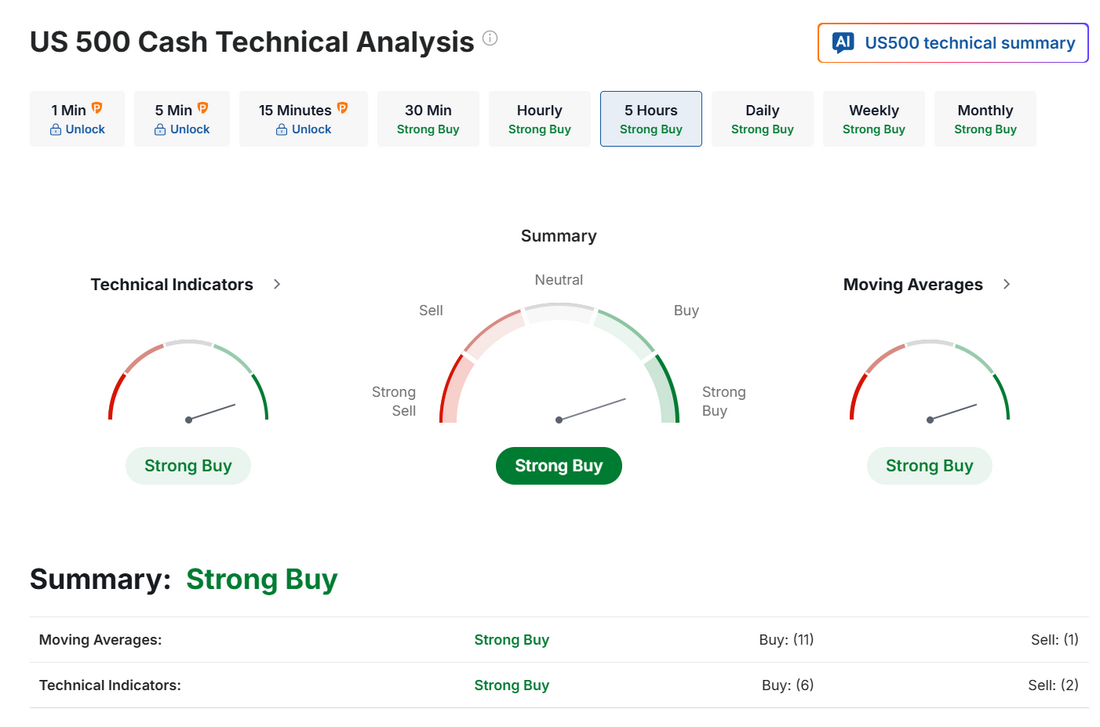

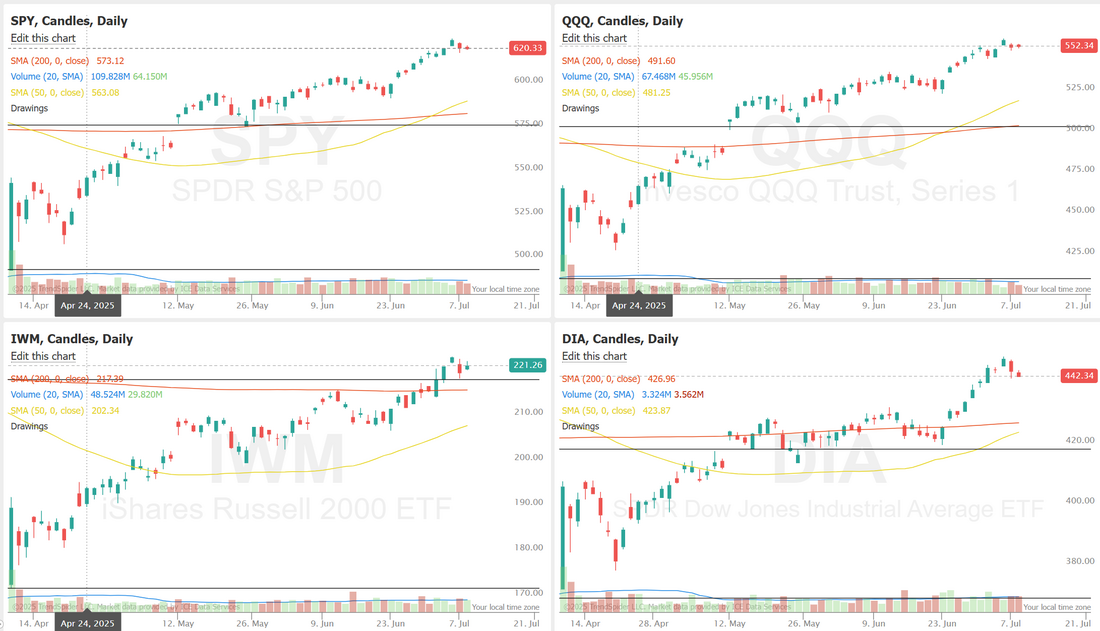

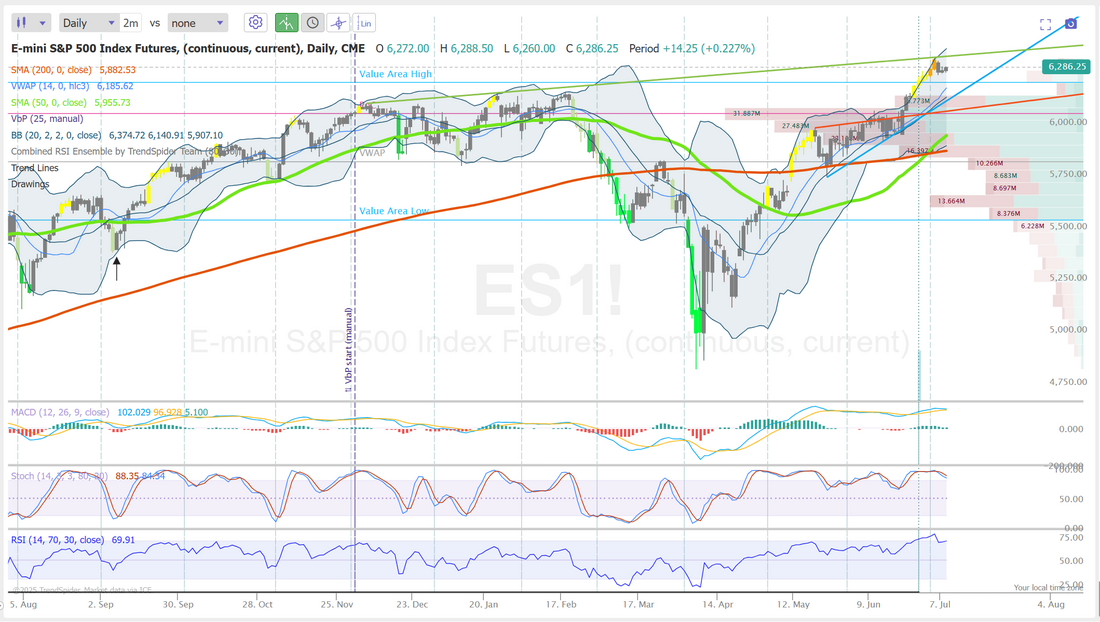

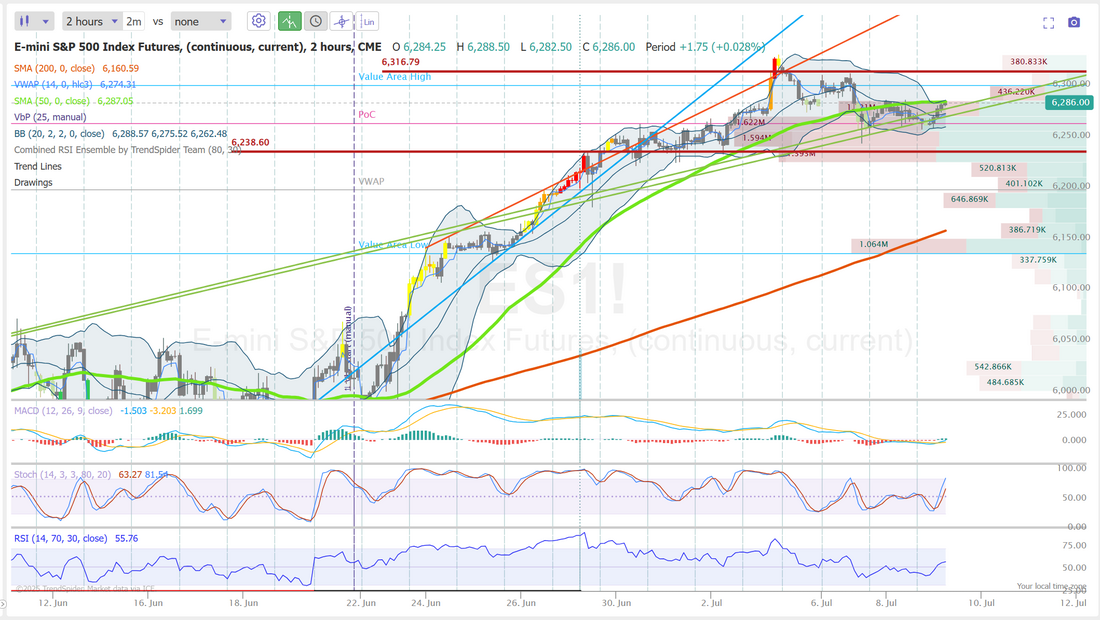

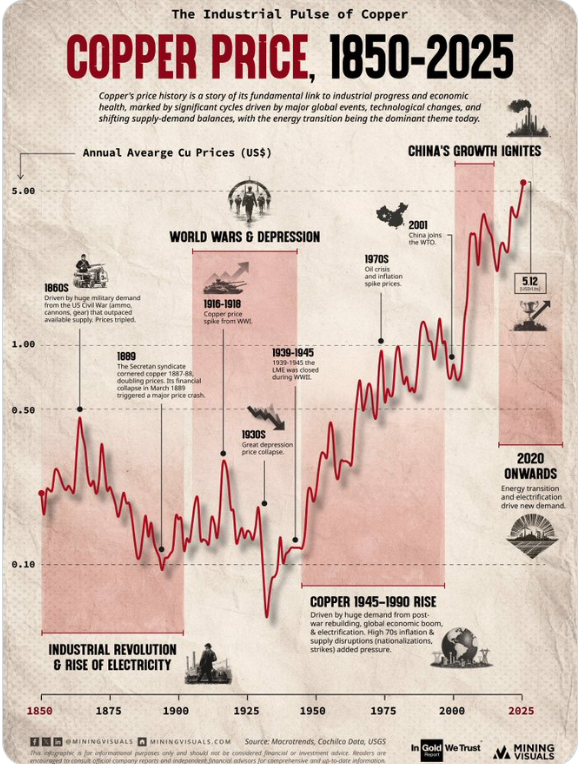

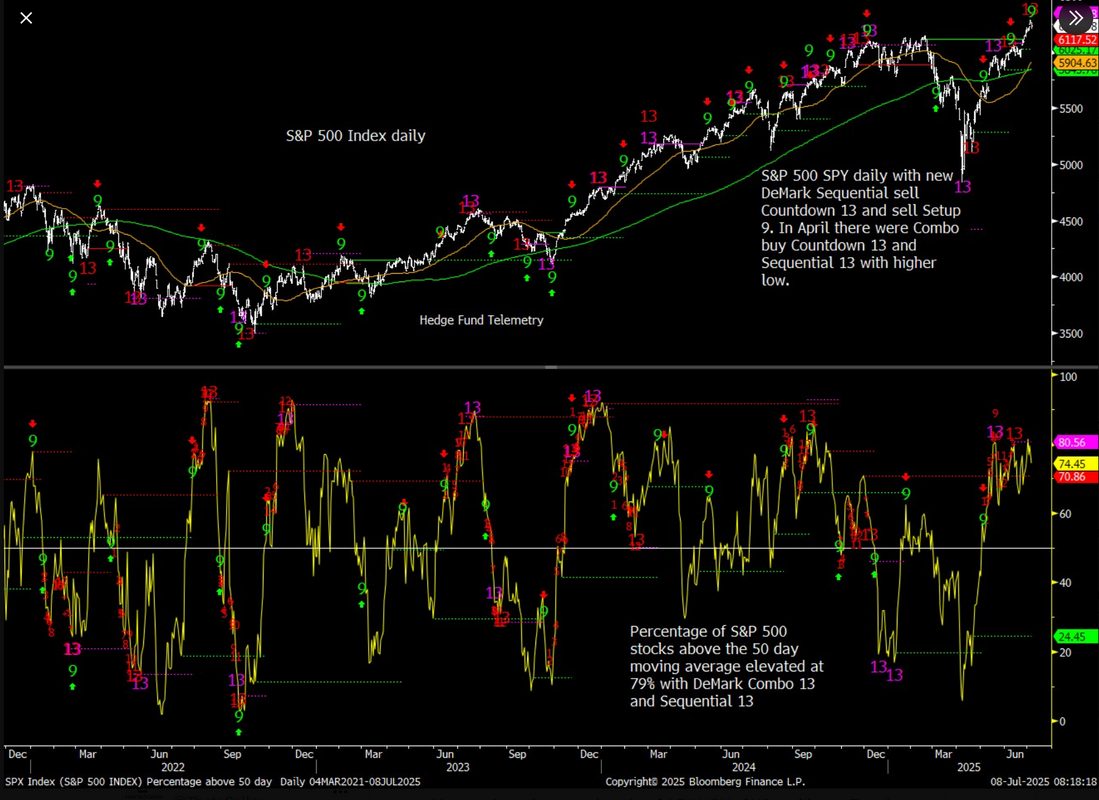

Smaller profit goal=More Consistency=More profit?Good morning traders! We had as close to a perfect day yesterday that we could possibly get. No, it wasn't our biggest profit day...by far. We have a daily profit goal of $1,000 dollars and we attempt to achieve that with 10-15K of capital. As amazing (or far fetched) as that sounds, there is rarely a day that the trades we build DON'T have that potential. Does it work everyday? Of course not, but the potential to make $1,000 a day is very real. Yesterday we made $588 profit. Much less than the $1,000 goal so why would I say it was a perfect day? The biggest our risk got yesterday with all our trades was approx. $200 dollars. It was a very easy day and the risk/reward was great. Our SPX lost $40 dollars but had over $500 profit potential and it was a trade that would have made money if the market went crazy...had a big move, shooting up or crashing down. I think these are perfect setups for this type of market. Have a position on that profits if a big move (either up or down) happens. This get's me to the title of today's blog. It only makes sense that if you lower your profit goals your consistency should increase. If your win rate increases your overall profit should increase as well. Yes! By lowering your profit goal you could actually find yourself making more. Would you give up the (very real) chance we have every day of making $1,000+ profit if you knew you could make $588 every day, guaranteed? I would. Here's a look at our day: King Copper in playLikely you heard Trump is looking to apply a 50% tariff on copper. Copper has retreated a bit this morning but it popped 10% yesterday and, I believe, it's created an interesting setup that creates some "edge" for a sharp trader. Be sure to tune into the zoom feed today as I discuss what that setup may look like. Let's take a look at the market. Technicals are still holding in buy mode. My lean or bias yesterday was neutral and that's exactly what we got. I'm leaning the same way today. We have oil inventory numbers and FOMC minutes but not much else to move the market. Some type of Tariff news seems likely which lately has been more negative then positive, albeit the market doesn't really seem to care that much anymore. The roll over hasn't taken shape...yet, but it does look like the bears are trying. September S&P 500 E-Mini futures (ESU25) are trending up +0.16% this morning as investors look past U.S. President Donald Trump’s latest tariff threats and await the Federal Reserve’s June meeting minutes. Just days after the U.S. started sending letters to trading partners announcing reciprocal tariffs under a new August 1st deadline, sector-specific duties have returned to the spotlight. President Trump on Tuesday announced a large 50% tariff on copper that could take effect by August 1st or earlier. Mr. Trump also proposed a tariff of up to 200% on pharmaceutical products but noted that companies would have up to a year and a half to prepare. He said that semiconductor tariffs are also under consideration. President Trump signaled that additional tariff details could be unveiled on Wednesday, with tariff letters possibly being sent to as many as seven countries this morning. “We will be releasing a minimum of 7 Countries having to do with trade, tomorrow morning, with an additional number of Countries being released in the afternoon,” Trump said on Truth Social late Tuesday. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Fair Isaac (FICO) slumped over -8% and was the top percentage loser on the S&P 500 after Federal Housing Finance Agency Director Bill Pulte announced on social media that Fannie Mae and Freddie Mac will permit lenders to use the VantageScore 4.0 credit scoring model. Also, Datadog (DDOG) slid more than -4% and was the top percentage loser on the Nasdaq 100 after Guggenheim downgraded the stock to Sell from Neutral with a $105 price target. In addition, solar stocks plunged after the White House said it would “rapidly eliminate the market distortions and costs imposed on taxpayers by so-called ‘green’ energy subsidies,” with Sunrun (RUN) tumbling over -11% and First Solar (FSLR) falling more than -6%. On the bullish side, chip stocks advanced, with Intel (INTC) climbing over +7% to lead gainers in the Nasdaq 100 and GlobalFoundries (GFS) rising more than +6%. Economic data released on Tuesday showed that U.S. consumer credit rose $5.10 billion in May, weaker than expectations of $10.40 billion. Today, market watchers will parse the Fed’s minutes from the June 17-18 meeting for any additional clues on potential interest rate cuts. While there have been recent signs of divisions leaning toward a more dovish stance, PMI and jobs data have indicated economic resilience, supporting the delay of interest rate cuts until later in the year. Meanwhile, U.S. rate futures have priced in a 95.3% probability of no rate change and a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting. On the economic data front, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final May figure to be -0.2% m/m, compared to +0.2% m/m in April. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.700M, compared to last week’s value of 3.845M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.394%, down -0.50%. Trade docket today: Copper! using /HG. Scalping continues with /MNQ, /NQ setup. /CL 0DTE, /GC 0DTE, QQQ 0DTE, SPX 0DTE, NDX 0DTE? QTTB? 1HTE BTC trades. With yesterday being a completely flat day my intra-day levels for /ES are the same. On the daily chart we are pretty neutral. The indicators as sooooo close to giving us a full blown sell signal, however, the bulls don't need to do much today to keep the bullish bias in place. On the 2hr. chart I continue to monitor 6316 as resistance and value area high and 6238 as support and PoC. It's tough to be anything but neutral until we break out of this consolidation range. 175 year history of Copper Is this really where you want to be long? Those with long only IRA's and 401K's are just asking to lose money. I look forward to seeing you all in the live trading room shortly. Let's see if we can put a copper trade together that we feel gives us an "edge".

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |