|

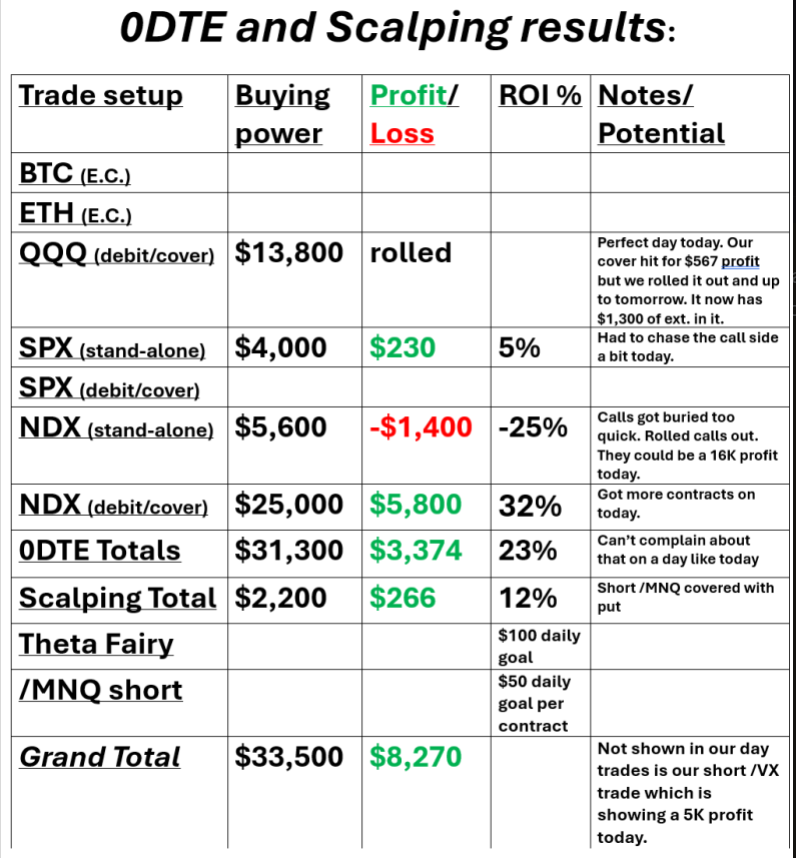

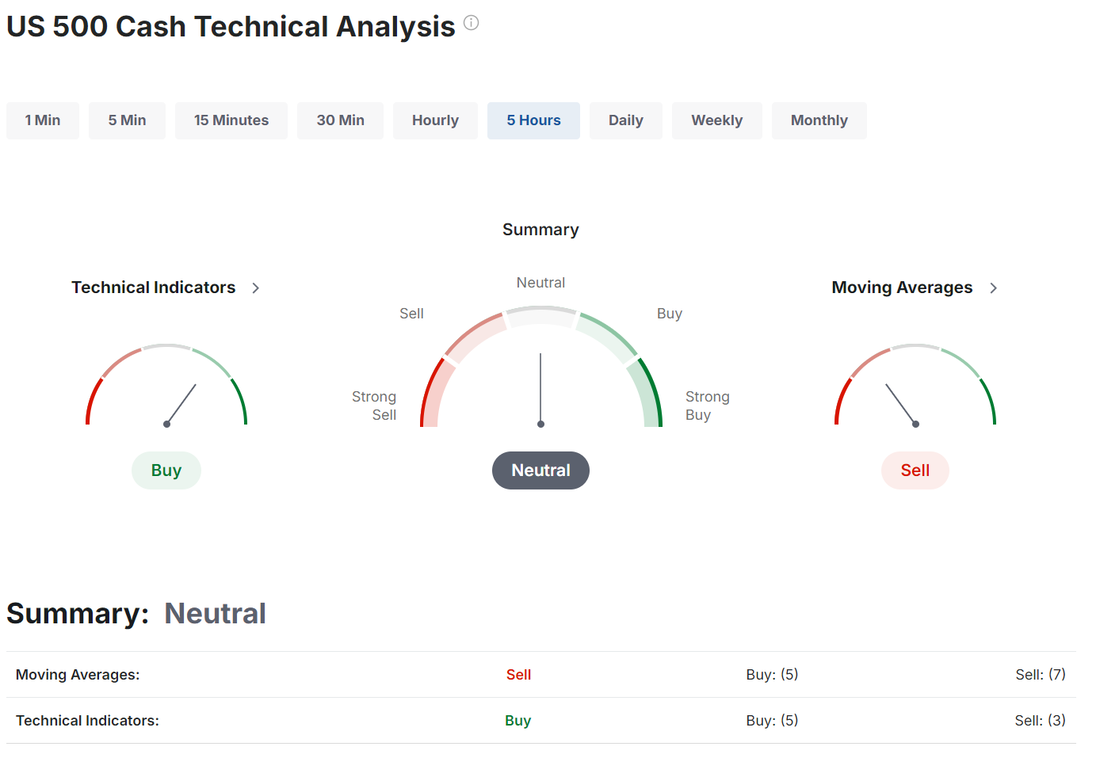

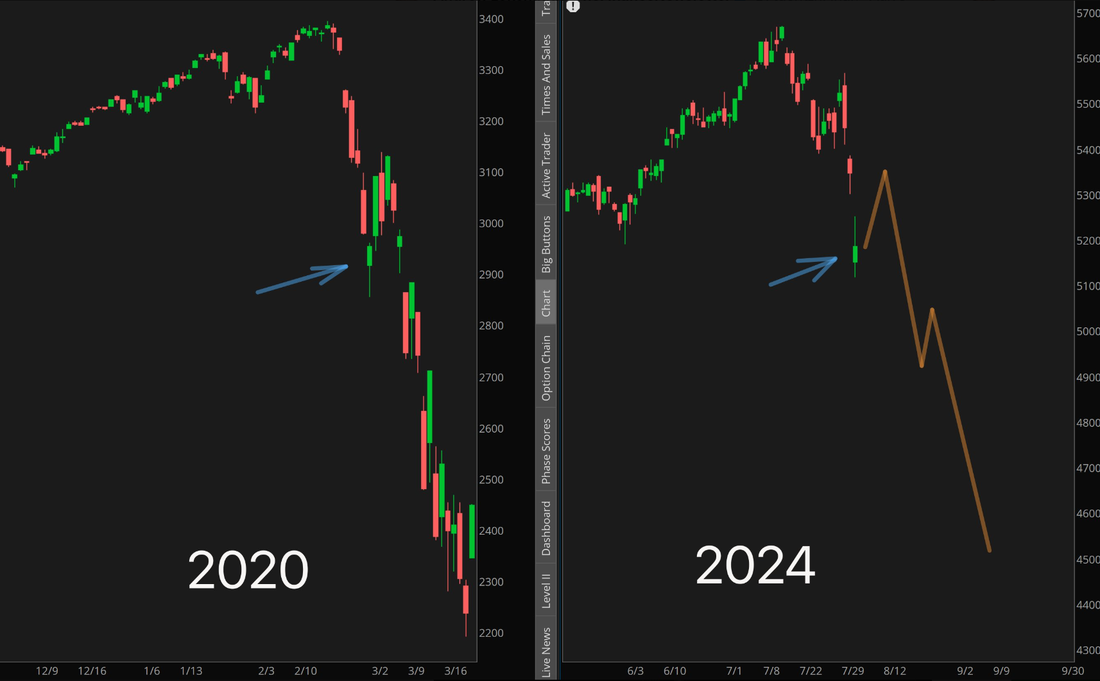

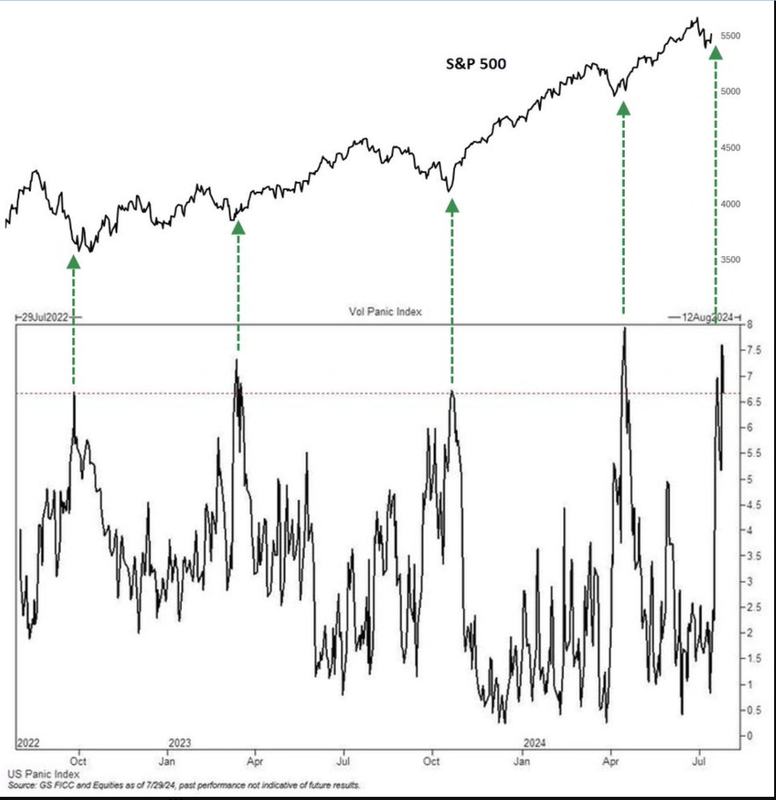

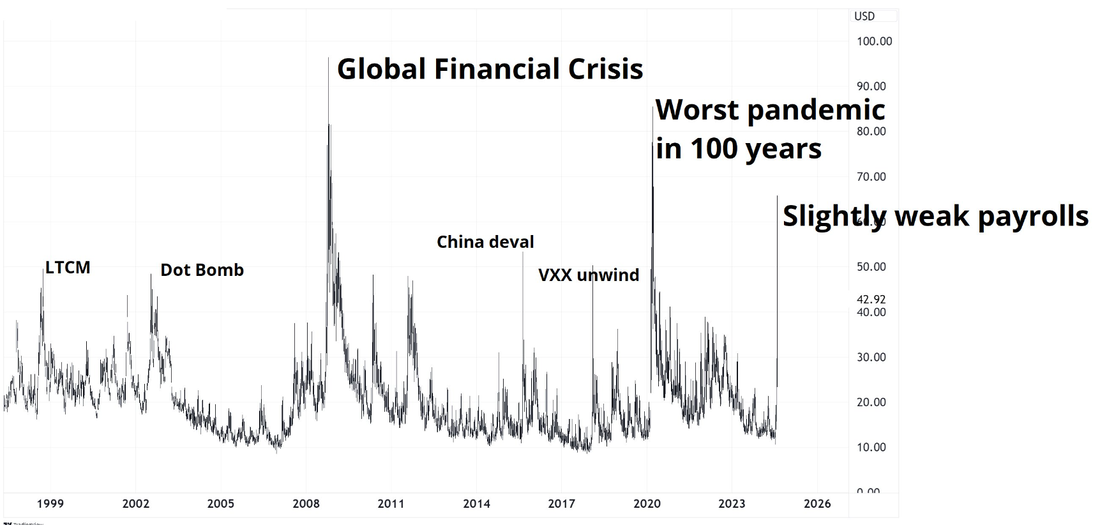

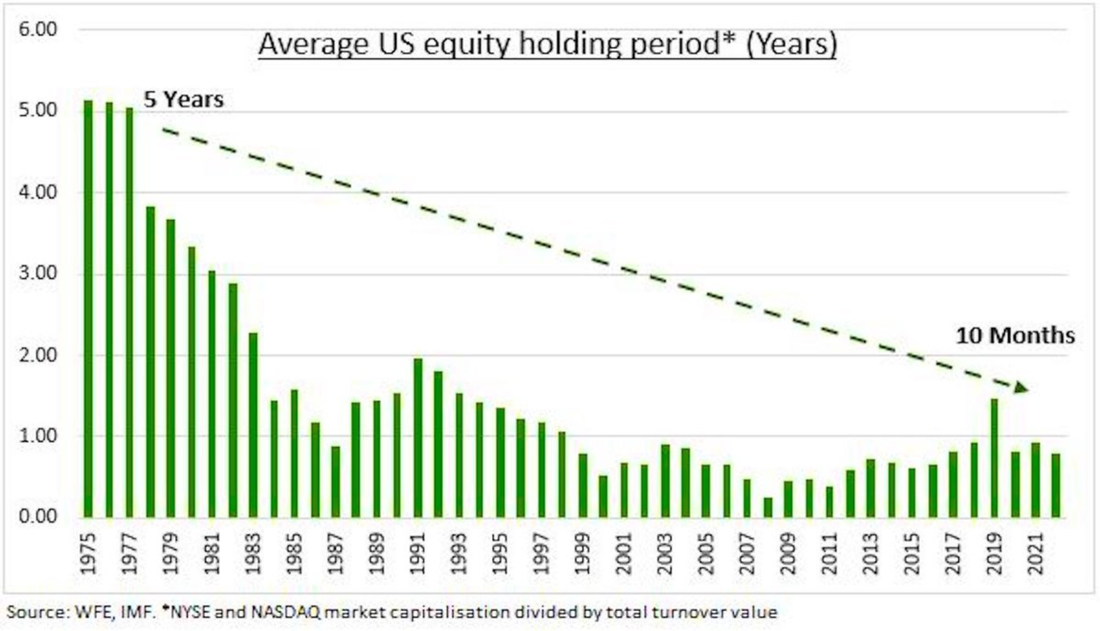

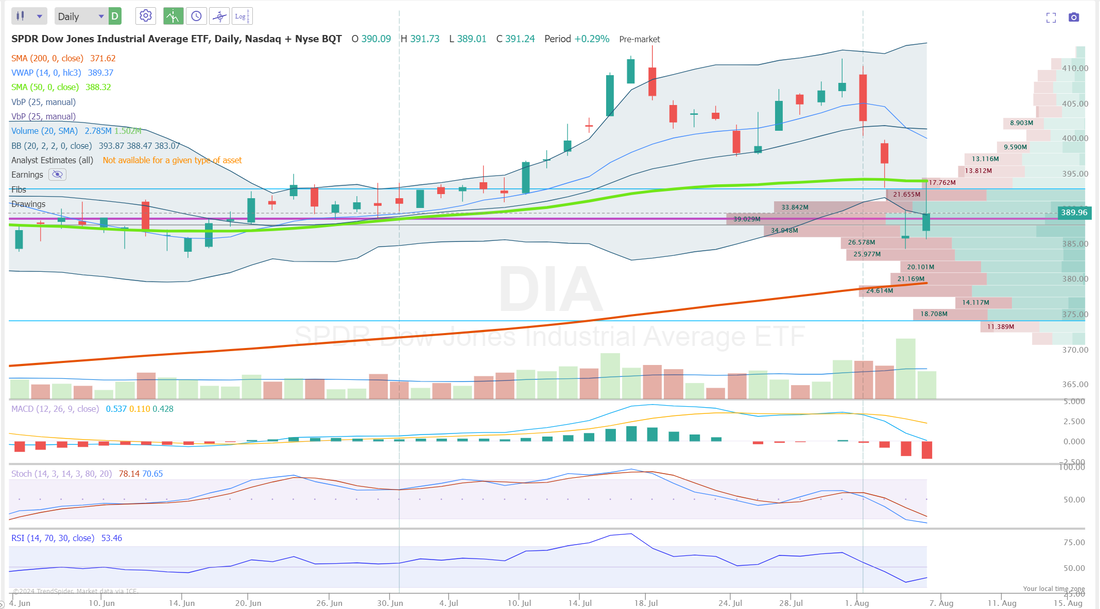

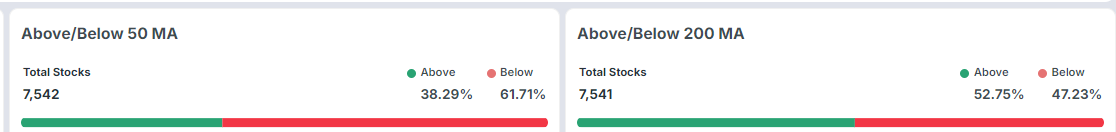

Welcome back traders! Yesterday was another solid day for us as we've stuck to our super focused approach that we took on mid last week. Every day we have members in the trading room asking, "what about this trade, what about this trade?" Nope. We've stuck to a very focused approach. Eskewed a lot of our normal weekly trades and wouldn't you know it, every day of this downturn has been nicely profitable for us. Last Fridays was huge. Scoring a $7,500 profit on one setup, which is nice, but we've done that before. That's not new. What was special was the $390 of total risk we took to garner that win. Yesterday we banked a 100% profit on our short VIX trade. Turning $5,600 into over $11,000. Our NDX stand alone 0DTE that we rolled to today has $16,000 of potential profit in it. Today could be a big one. Here's how our 0DTE trades went yesterday. With over $250,000 dollars of documented profits from our 0DTE trades, I'm just absolutely floored. I couldn't ask for any better results than this. Let's do our best to keep it going. Let's take a look at whats happening in the markets. In 2020 the stock market crashed 35% In 2008 the stock market crashed 55% In 1987 the stock market crashed 35% In 1973 the stock market crashed 50% In 1929 the stock market crashed 90% What's the take away? #1. Markets ALWAYS crash! They always have and they always will. It's how it works folks. People were asking, "what's wrong?" "what happened?" Nothing! It's how it works folks. This is why we ALWAYS have negative delta, bearish positions on! #2. Guess what happened after all those crashes? The market went on to hit a new all time high! That's also how it works! Takeaway: Don't get bogged down in all the daily movements. Just trade what you see and always have crash protection in place. It certainly served us well. Futures are up nicely as I type. Technicals are not quite back to bullish but they are trying. Does this mean we are out of the danger zone? Ah....let's not make that call quite yet. In bear markets we have huge one or two day short covering rallys. In bull markets we have one or two day selloffs. It doesn't neccessarily me a change of direction. Take a look at a few potential outcomes here. I'm not saying this is where we are going. Just be aware. The Goldman Panic Index is flashing panic. Past times were close to fairly major lows fwiw. It's not just jobs. The unwinding of the Yen carry trade has also done a lot of damage. You know what else is affecting the markets and adding to volatility? Apparently everyone is a day trader now! Long term "buy and hold" is becoming less and less of a thing. One last thing I'll add. US MANUFACTURING SECTOR HAS BEEN IN RECESSION FOR 22 MONTHS, THE LONGEST PERIOD SINCE 1990s We have to keep in mind, however, that manufacturing accounts for only 10% of US GDP. On the other hand, the services sector reflects ~70% of the US GDP Here's some key areas I'm looking at on the SPY, QQQ, IWM, DIA. SPY is not flashing a buy or sell signal today. My two key levels are the purple line on the downside which is the PoC (Point of control) 515.74 and the teal line up above which is the next big resistance level. We almost got there yesterday before selling off into the close. That's 533.61. Between here is just chop. QQQ has been beat up more than SPY. The one main bullish note you can make is that it has recaptured it's 200DMA (red line). That's no small feat. I'd like to see it break above it's PoC of 440.53. The next resistance is the blue line at 460. The QQQ's have a lot of damage to unwind. Holding above that 200DMA is key. IWM has given me flashbacks of Mister Toads wild ride at the local amusement park. What goes parabolic usually retraces and that's certainly been the case here. We went straight up and then straight down and guess what? We landed right back where we were for most of June and July. That purple line is the PoC. It's, as Happy Gilmore likes to say, "it's home". I expect less volatility with IWM now. DIA has has a very similar trajectory as IWM. Going near parabolic to the upside then summarily giving it all back. It too is now hovering just above its PoC and back to where it just hung out most of the last two months. We are sticking to our plan for our trade docket today. We do have some adjustments potentially to /ZC, /NG, CRM, DELL, DIA, DJT, F, IWM, LEVI. A new setup on NVDA. Continued scalping using the /MNQ. Four 0DTE's. SPX stand alone. QQQ bullish debt. NDX bearish debit. NDX stand alone. This should be plenty to keep us busy today. My bias today: Slightly bullish. In spite of the late day give back yesterday. The price action was mostly bullish and futures are up as I type. The markets trying to stabilize and rebound. Can it? Well...we'll know in about 7 hours! Tech, for the first time in a while, actually participated in the rebound yesterday. We still need a larger portion of stocks to be above their 50/200DMA's. Have a good day. We've got some monster potential today. That's all we can ask. Now it's up to us to make it happen.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |