|

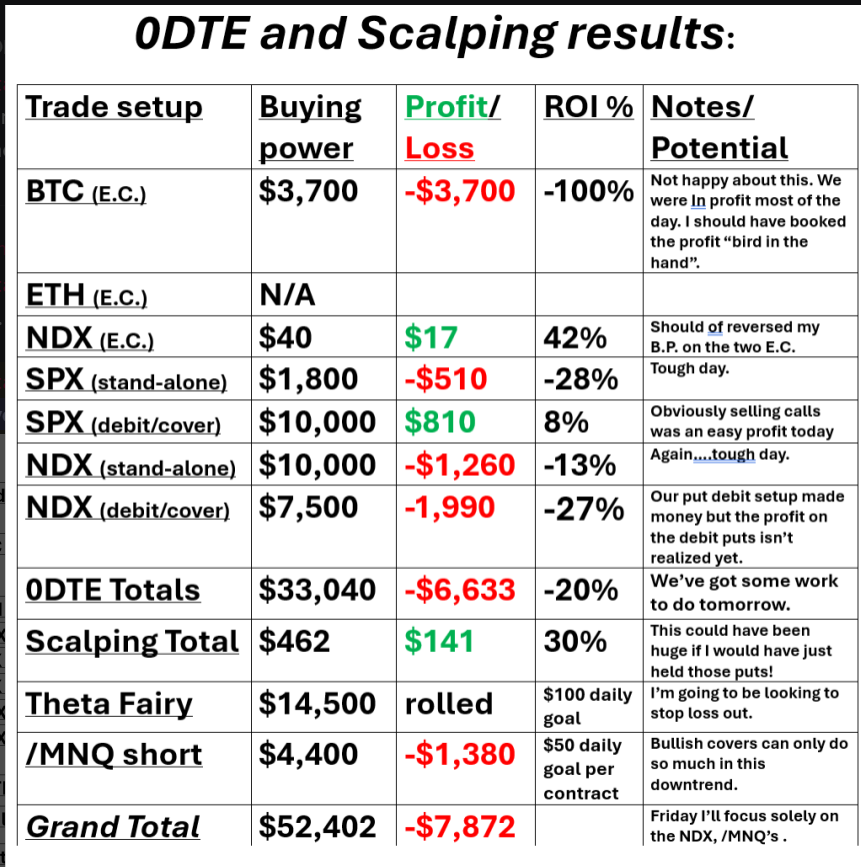

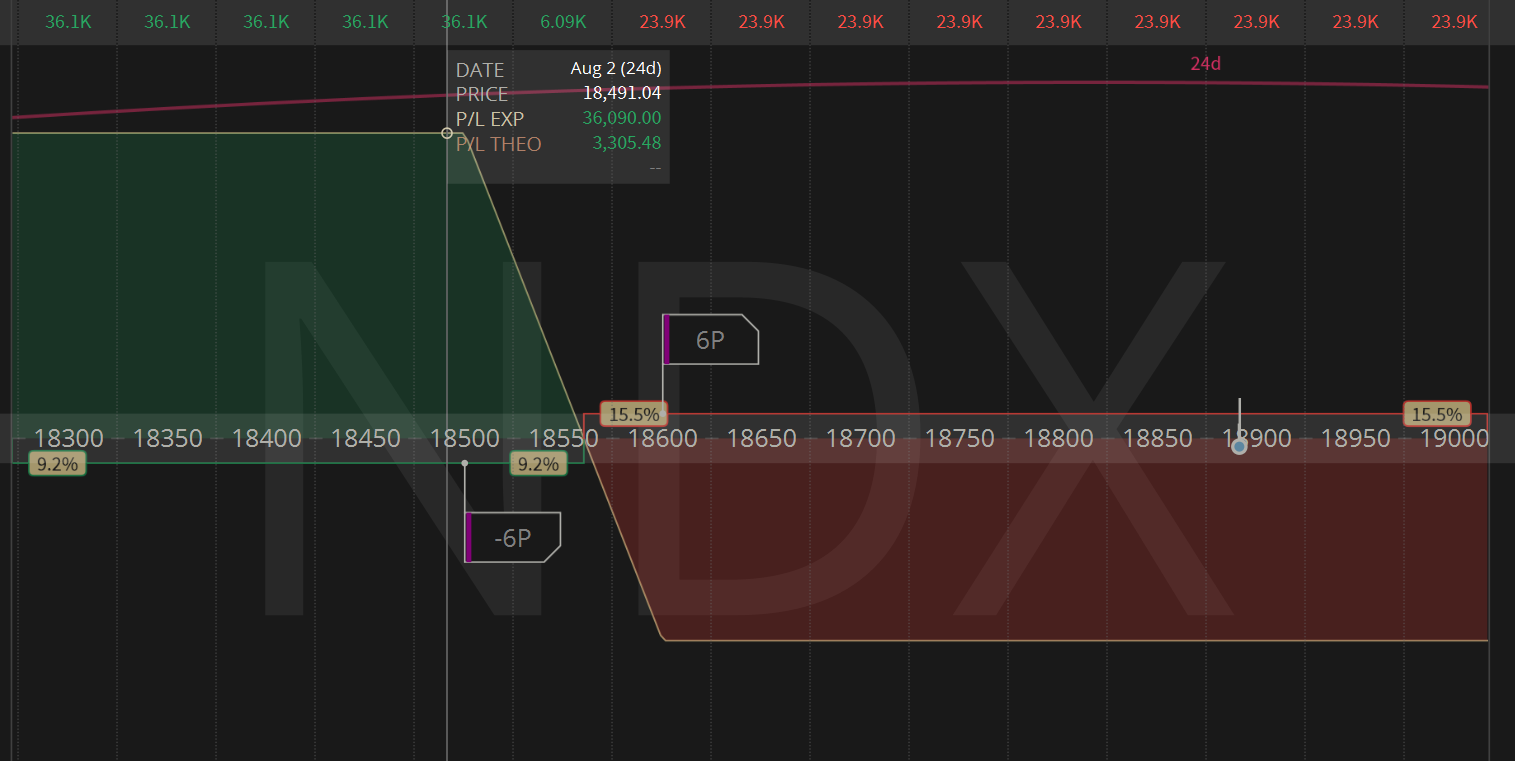

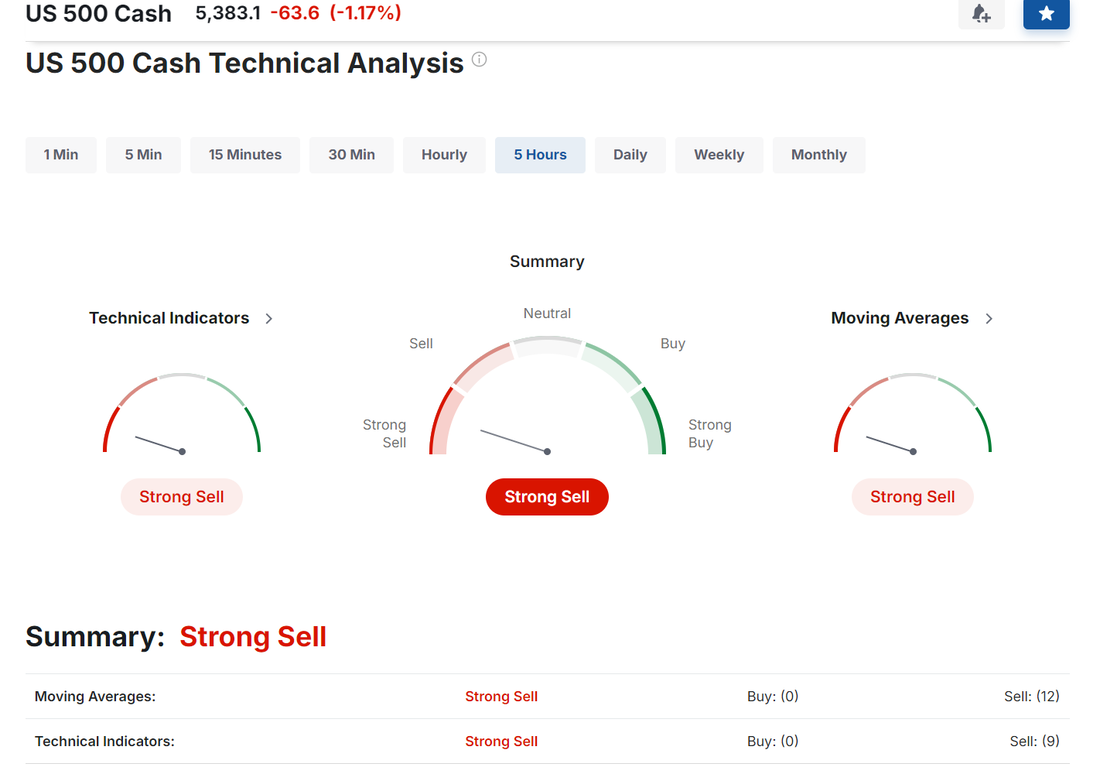

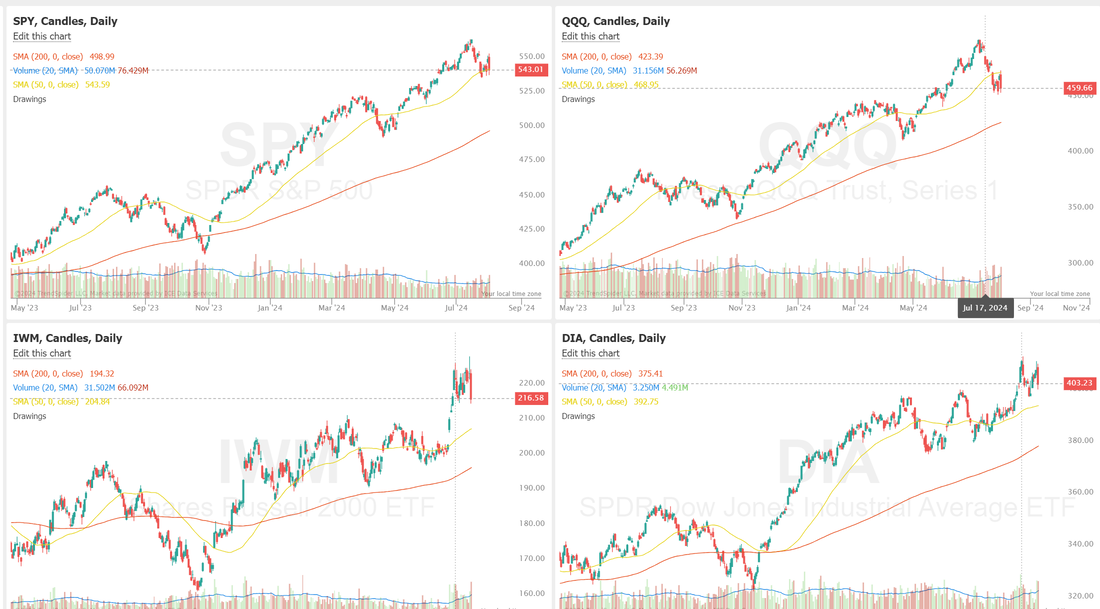

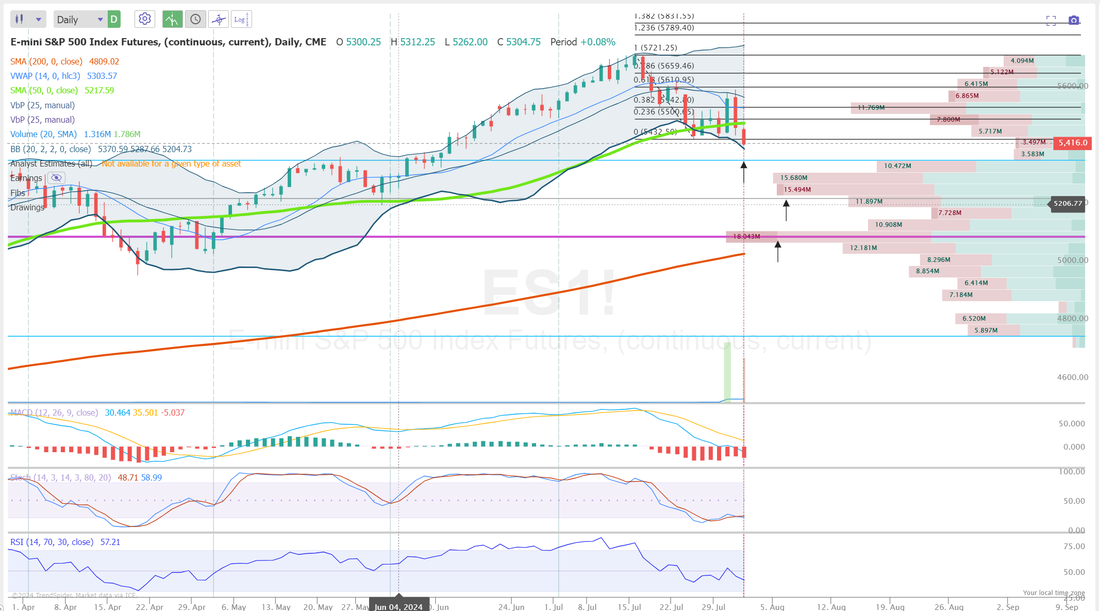

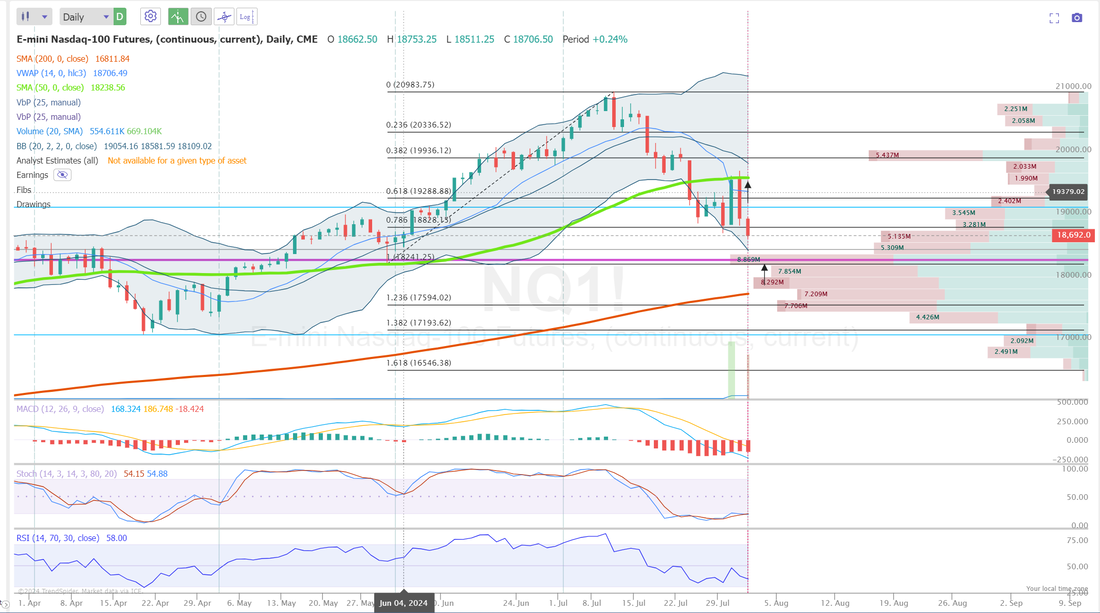

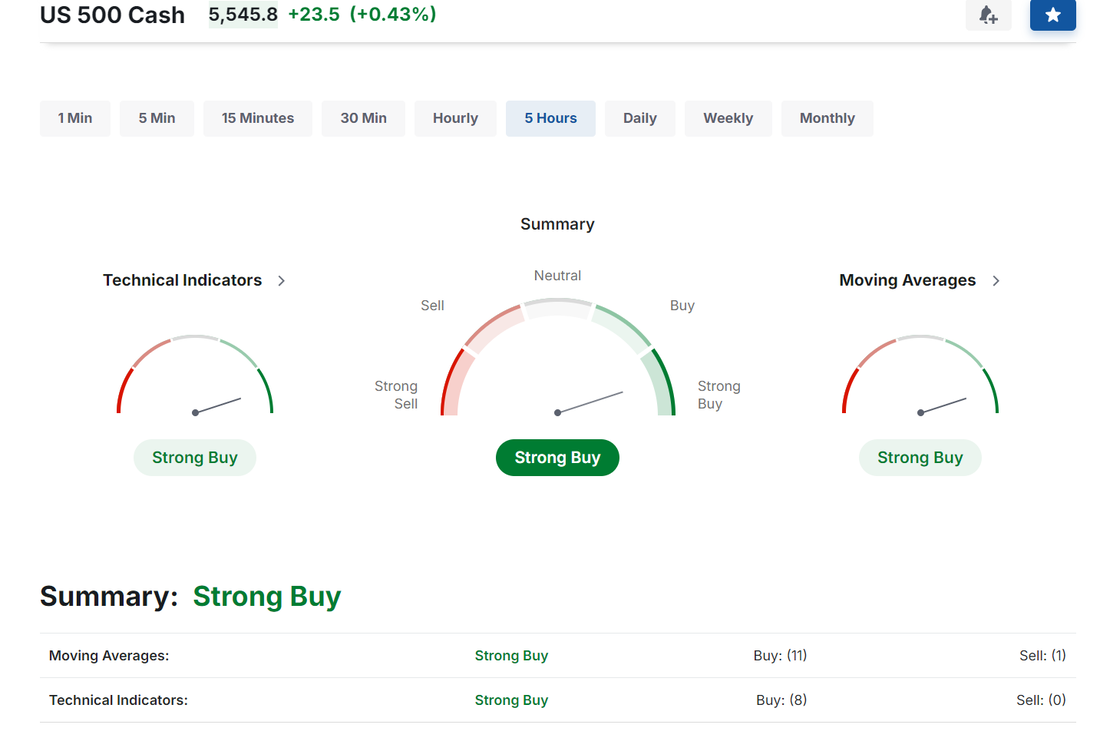

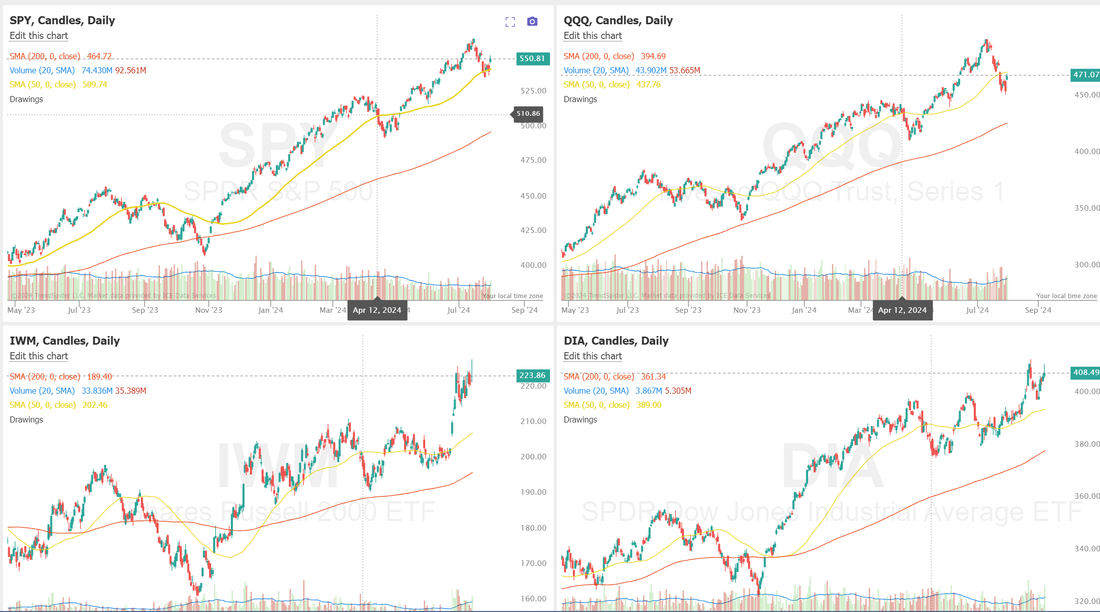

Good morning traders. I think it will be a good morning but, yesterday was a bad one. At least for me, For how happy I was with the profit we pulled Weds. on FOMC day, that's how depressed I was yesterday with my poor results. Here's a look at my days activity. Lots of trades we super close to profits but that doesn't count for much at the end of the day. Close doesn't pay the bills. I'll try to recoup today with focusing my trading efforts. /MNQ futures contracts for scalping (no options unless it's to cover the futures position) and Our NDX debit setup. Our NDX debit is our best shot at recouping the losses from yesterday. It's got $33,000 of profit potential in it and with futures down again this morning its already profitable but could get much better. This will be my focus today, along with scalping the /MNQ futures. What's happening to the market? Two things. Tech weakness. That continues today with poor earnings reception out of some big tech names. Also, Jobs. Jobs, jobs, jobs. Game of trades put out a wonderful analysis of this, which I shared with our trading community a couple days ago. It certainly looks spot on. Check it out and give them a follow. The put up good research. Let's take a look at the market internals. Technicals are bearish. No big surprise here. IWM and DIA have given up their recent parabolic gains but the SPY and QQQ, with all the damage they've taken, are still sitting close to or just above their 50DMA and are back to consolidation zones that we established in May. From a big picture perspective it looks pretty calm. From an intra-day perspective its a lot of volatility. Over the last week the sector rotation out of Tech and into "safer" sectors has accelerated. Let's take a look at a couple key levels in the indices that I'm watching. There are several key levels on the /ES. To the upside 5485 is key. That's the 50DMA. Bulls need to retake that to get any upward momentum. On the downside I have three levels I'm watching. 5359/5228/5094 (see arrows. PoC is 5094) /NQ has been weaker than the /ES. Two levels stick out to me. 19,633 on the upside (this is the 50DMA) and 18,318 on the downside. (this is PoC) Bitcoin continues to be tough to trade directionally here. 65,400 is right around the PoC and the 50DMA. We may wait for the next directional trend to start before trading it. September Nasdaq 100 E-Mini futures (NQU24) are trending down -1.81% this morning as fears of a U.S. slowdown and disappointing quarterly results from industry heavyweights such as Intel and Amazon weighed on sentiment, with the focus now shifting to the highly anticipated U.S. payrolls reading due later in the day. Amazon (AMZN) slumped over -9% in pre-market trading after the e-commerce and cloud giant reported weaker-than-expected Q2 revenue and issued disappointing Q3 guidance. Also, Intel (INTC) plummeted more than -21% in pre-market trading after the semiconductor giant reported downbeat Q2 results, provided below-consensus Q3 guidance, and said it would cut over 15% of its workforce as well as suspend its dividend starting in the fourth quarter. In yesterday’s trading session, Wall Street’s major indexes closed lower. Moderna (MRNA) plummeted over -21% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the biotech firm slashed its full-year net product sales guidance. Also, Western Digital (WDC) plunged more than -9% after the company provided below-consensus Q1 revenue guidance. In addition, Arm (ARM) slumped over -15% after the chip designer issued soft Q2 revenue guidance. On the bullish side, C.H. Robinson Worldwide (CHRW) climbed more than +14% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q2 adjusted EPS. Also, Meta Platforms (META) advanced over +4% and was the top percentage gainer on the Nasdaq 100 after the social media heavyweight posted upbeat Q2 results and issued a solid Q3 revenue forecast. Economic data on Thursday showed that the U.S. ISM manufacturing index unexpectedly fell to 46.8 in July, weaker than expectations of 48.8 and the steepest pace of contraction in 8 months. Also, U.S. Q2 nonfarm productivity advanced +2.3% q/q, stronger than expectations of +1.7% q/q, while U.S. Q2 unit labor costs rose +0.9% q/q, weaker than expectations of +1.8% q/q. In addition, U.S. construction spending unexpectedly fell -0.3% m/m in June, weaker than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose +14K to a nearly 1-year high of 249K, compared with the 236K expected. “The labor market has been flashing warning signals over the past several months,” said Chris Senyek at Wolfe Research. “History suggests Powell is walking a very fine line on potentially waiting too long to start cutting rates before it’s too late.” Meanwhile, U.S. rate futures have priced in a 100% probability of at least a 25 basis point rate cut at the next FOMC meeting in September. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Enbridge (ENB), and Church & Dwight (CHD) are set to report their quarterly figures today. Today, all eyes are focused on U.S. Nonfarm Payrolls data, set to be released in a couple of hours. Economists, on average, forecast that July Nonfarm Payrolls will come in at 176K, compared to last month’s figure of 206K. A survey conducted by 22V Research revealed that 42% of investors believe the market reaction to the jobs report will be “risk-off,” 36% said “negligible/mixed,” and only 22% anticipate “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect July’s figures to be +0.3% m/m and +3.7% y/y, compared to the previous numbers of +0.3% m/m and +3.9% y/y. U.S. Factory Orders data will come in today. Economists foresee this figure to stand at -2.7% m/m in June, compared to the previous number of -0.5% m/m. The U.S. Unemployment Rate will be reported today as well. Economists foresee this figure to remain steady at 4.1% in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.951%, down -0.61%. My bias today is bullish. It's not uncommon for a big algo move on FOMC days to get completely reversed the next day. Taken in context Wed. and Thurs. price action netted out to being not much of a move. The poor tech earnings this morning are tanking futures, once gain and that, along with yesterday certainly makes things look ugly. I believe that we may have a good chance to aborb the poor earnings today and get a bounce from the selloff we are currently seeing in the futures. I'm allready in one long /MNQ contract in scalping and may sell a 0DTE covered call on it today. My plan for today, once again: Focused effort today on our debit NDX position. I don't want 7 trades to keep track of today. be quicker to take both profits and losses on it as the day progresses. I'll use the /NQ futures again to work the put covers so I have more flexibility and time, should I need it.

My biggest focus and advice for today to myself and all of you? Don't revenge trade today! Let's be patient with entries and quick with exits.

0 Comments

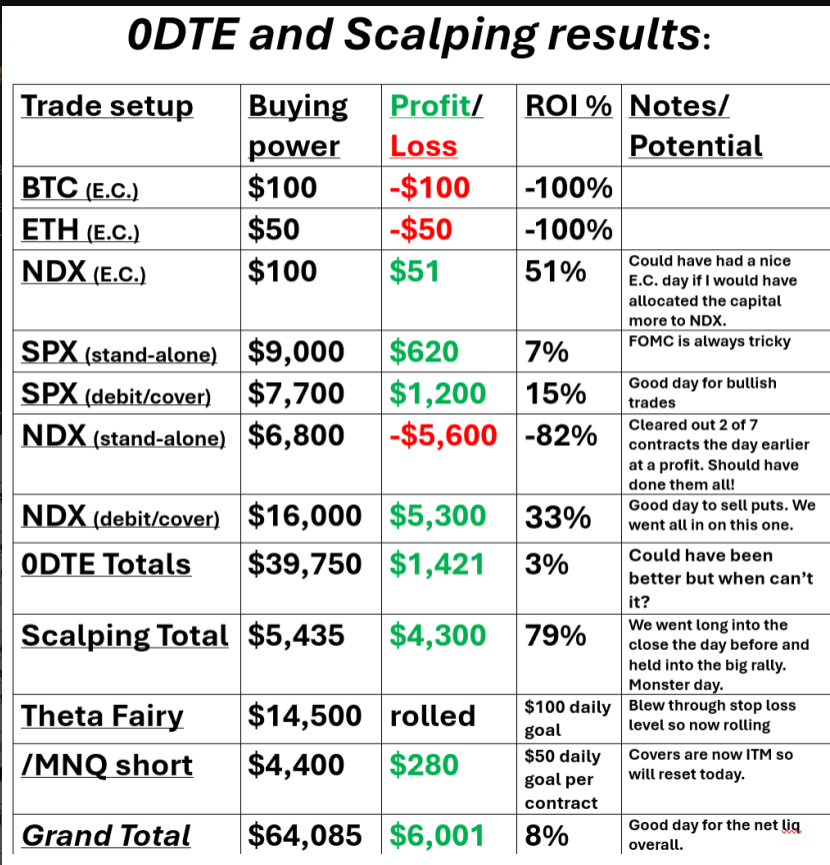

Welcome back! FOMC has come and gone and it didn't disappoint. I'm getting a late start so todays blog will be short. Here's a look at our results from yesterday. September Nasdaq 100 E-Mini futures (NQU24) are up +0.36% this morning as strong quarterly results from Meta Platforms and dovish comments from Federal Reserve Chair Jerome Powell boosted sentiment, while investors awaited a new round of U.S. economic data and earnings reports. Meta Platforms (META) climbed over +6% in pre-market trading after the company reported stronger-than-expected Q2 results and issued solid Q3 revenue guidance. As widely expected, yesterday the Federal Reserve kept the federal funds rate in a range of 5.25% to 5.50%, a level it has held since last July. At the same time, policymakers made several changes to the language of a statement issued after their two-day meeting. The committee altered its language to state it is “attentive to the risks to both sides of its dual mandate,” moving away from previous wording that concentrated solely on inflation risks. The Fed also adjusted its language to note that price pressures remain “somewhat” elevated and to acknowledge “some further progress” toward its inflation goal, a change from “modest further progress” in the previous statement. In addition, Fed Chair Jerome Powell stated at his post-monetary policy decision press conference that a rate cut “could be on the table as soon as September” if inflation continues to move toward the central bank’s 2% target. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-week highs and the blue-chip Dow posting a 1-1/2 week high. Nvidia (NVDA) surged over +12% and was the top percentage gainer on the Nasdaq 100 after Morgan Stanley named the chip giant a top U.S. chip stock pick following the stock’s recent selloff. Also, Advanced Micro Devices (AMD) gained more than +4% after the semiconductor company reported stronger-than-expected Q2 results, offered a solid Q3 revenue forecast, and boosted its full-year guidance for artificial intelligence chip sales. In addition, Match Group (MTCH) climbed over +13% after the company reported better-than-expected Q2 revenue and announced plans to cut about 6% of its staff. On the bearish side, Humana (HUM) plunged more than -10% and was the top percentage loser on the S&P 500 after the health insurer cut its full-year GAAP EPS guidance and warned of higher hospital admissions. The ADP National Employment report on Wednesday showed private payrolls rose by 122K jobs in July, significantly lower than the consensus figure of 147K. Also, the U.S. employment cost index, a key gauge of U.S. labor costs, rose +0.9% q/q in the second quarter, weaker than expectations of +1.0% q/q. In addition, the U.S. July Chicago PMI fell to 45.3, a smaller decline than expectations of 44.8. Finally, U.S. pending home sales rose +4.8% m/m in June, stronger than expectations of +1.4% m/m and the biggest increase in 6 months. Second-quarter corporate earnings season continues in full flow, with investors awaiting new reports today from notable companies such as Amazon (AMZN), Apple (AAPL), Intel (INTC), Block (SQ), DoorDash (DASH), Cigna (CI), ConocoPhillips (COP), Roblox (RBLX), and DraftKings (DKNG). On the economic data front, all eyes are focused on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the July ISM Manufacturing PMI will arrive at 48.8, compared to last month’s figure of 48.5. Also, investors will likely focus on the U.S. S&P Global Manufacturing PMI, which stood at 51.6 in June. Economists foresee the July figure to be 49.5. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q2 Unit Labor Costs to be at +1.8% q/q and Q2 Nonfarm Productivity to stand at +1.7% q/q, compared to the first-quarter numbers of +4.0% q/q and +0.2% q/q, respectively. U.S. Construction Spending data will be reported today. Economists foresee this figure to stand at +0.2% m/m in June, compared to the previous number of -0.1% m/m. U.S. Initial Jobless Claims data will come in today as well. Economists estimate this figure to be 236K, compared to last week’s value of 235K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.055%, down -1.22%. Market technicals are bullish Most indices have easily cleared their respective 50DMA's save for the QQQ's which look to do so today. Trade docket for today: /ES, /MCL, /MNQ, /ZN, CRM, CVNA, DJT, EBAY, IWM, META, MGM, MRK, NVDA, QCOM, QQQ. 0DTE's (I'll be using futures today for our covers and going a little heaver on position size. This will allow me greater control if we need adjustments outside of the cash market time frame). No scalping for me today and tomorrow. I'll be in and out too much to monitor but I'll be running the zoom feed for you all. My bias today: I'm not sure! I don't really have one. Clearly yesterday was bullish. Technicals are bullish and futures are up as I type. I wouldn't be surprised if we took a breather and consolidated today. I certainly wouldn't be surprised if the bullish trend continued and I wouldn't be surprised if we gave back a bit of those monster gains from yesterday. I'll just remain neutral and patient and trade what I see today. Intra-day levels: /ES; 5595* (key level. this was a heavy resistance yesterday)/5606/5631* (key level. high of the day yesterday) to the upside. 5558/5533/5508* (key level. PoC) to the downside. /NQ; Two key levels for me today. 19,724 is resistance and high of the day yesterday. 19487 is support and weakness could come below that. Bitcoin: BTC fell apart late in the day yesterday and ruined my crypto 0DTE's. I'm watching 63,949 level of support (red line) If we can hold that for a few hours into the trading day that my be my signal for a bullish entry on the 0DTE. I hope you all have a great day today. Premium is down a tad today after that monster rally but it's still good. Let's make it happen.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |