|

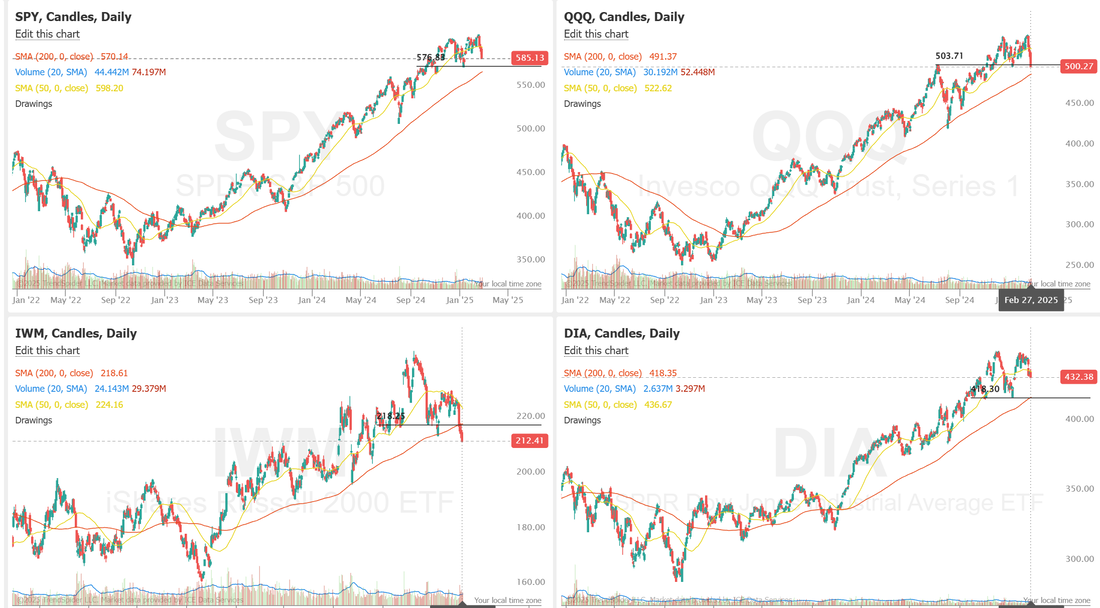

Welcome to Friday! The "Gateway to the weekend" LOL. It's been an o.k. week for us but I really let a golden opportunty slip through my fingers yesterday. We were sitting on a nice profit on both our NDX and SPX 0DTE's and then came "Tariff talk", which seems to be the main boogey man right now (along with inflation) in the market. While some of our trading members had already locked in their gains, I was caught flat footed and needed to roll. PCE is out shortly and I'm sure that will be the main catalyst today allthough we do have Trump meeting with Zelenskiy today. They will hold a joint press conference at 13:00 ET. That could be a market mover as well. Here's a look at what we did get logged yesterday. One nice enhancement we've worked on over the last two weeks are our earnings trades. Instead of exiting them the next day we hold for a few more days and work them. We are only two weeks in so data is light but so far it's been a very positive expierience. Moving from 1-3% returns to closer to 8-10% profits. Let's take a look at this crazy market. We came into yesterdays session with a neutral technical rating. This have proven to be very difficult days to trade. It's a sign the market is searching. Then came the "tariff talk" and down we went. We are opening today with a bearish lean. For the last three days I've been looking for a bounce. It's not been pure "hopeium". The bulls have given it a go each day but simply didn't have enough strength to keep the push higher going. It's pretty clear, if you look at the charts that the bearishness is starting to take hold. All the major indices are now below their 50DMA and the IWM looks particularly ugly, down below its 200DMA. Bitcoin has been ugly as well. One of the best "big picture" tools I use to judge market health is the VTI. Its the "whole" market. Every technical you can look at is bearish but... we are back to a long term trend support line. Today should be critical. March S&P 500 E-Mini futures (ESH25) are trending up +0.38% this morning, staging a partial rebound from the prior session’s losses, while investors brace for the release of the Federal Reserve’s first-line inflation gauge. In yesterday’s trading session, Wall Street’s major indices closed in the red. Teleflex (TFX) plummeted over -21% and was the top percentage loser on the S&P 500 after the company provided a downbeat full-year adjusted EPS forecast. Also, Nvidia (NVDA) slumped more than -8% and was the top percentage loser on the Dow after the chipmaker’s good-but-not-great quarterly results disappointed investors. In addition, Salesforce (CRM) fell over -4% after reporting weaker-than-expected Q4 revenue and issuing below-consensus FY26 revenue guidance. On the bullish side, Invitation Homes (INVH) climbed more than +5% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q4 revenue. The U.S. Bureau of Economic Analysis, in its second estimate of Q4 GDP growth, said on Thursday that the economy grew at an unrevised +2.3% annualized rate. Also, U.S. January durable goods orders advanced +3.1% m/m, stronger than expectations of +2.0% m/m, while core durable goods orders, which exclude transportation, were unchanged m/m, weaker than expectations of +0.2% m/m. In addition, U.S. pending home sales fell -4.6% m/m in January, weaker than expectations of -0.9% m/m and the biggest decline in 9 months. Finally, the number of Americans filing for initial jobless claims in the past week rose +22K to a 2-1/2 month high of 242K, compared with the 222K expected. “Investors want lower rates from the Fed, but they don’t want to get there by seeing a notable deterioration in the underlying economy,” said Bret Kenwell at eToro. “At the very least, if the economy is going to slow, investors will want to see inflation slow down too.” Cleveland Fed President Beth Hammack stated on Thursday that interest rates are not “meaningfully restrictive” and should remain unchanged for some time as policymakers await clear evidence that inflation is moving toward their 2% target. “A patient approach will allow us time to monitor the trajectories for the labor market and inflation and how the economy in general is performing in the current rate environment,” Hammack said. Also, Philadelphia Fed President Patrick Harker said, “The policy rate remains restrictive enough to continue putting downward pressure on inflation over the longer term, as we need it to, while not negatively impacting the rest of the economy.” In addition, Kansas City Fed President Jeffrey Schmid said that the central bank could have to balance inflation risks against growth concerns. “While the risks to inflation appear to be to the upside, discussions with contacts in my district, as well as some recent data, suggest that elevated uncertainty might weigh on growth,” he noted. Meanwhile, U.S. rate futures have priced in a 94.5% chance of no rate change and a 5.5% chance of a 25 basis point rate cut at the March meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.6% y/y in January, compared to the previous figures of +0.2% m/m and +2.8% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate January Personal Spending to be +0.2% m/m and Personal Income to be +0.4% m/m, compared to December’s figures of +0.7% m/m and +0.4% m/m, respectively. The U.S. Chicago PMI will be reported today. Economists expect this figure to come in at 40.5 in February, compared to the previous value of 39.5. U.S. Wholesale Inventories data will be released today as well. Economists foresee the preliminary January figure standing at +0.1% m/m, compared to the previous figure of -0.5% m/m. In addition, market participants will be anticipating a speech from Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.249%, down -0.89%. U.S. credit card debit hit's a record. This is "No bueno" for future economic outlook. Freddie Mac (Housing) delinquency rates are now HIGHER THAN 2008 and 2008 was UGLY! Housing is the #1 driver of our economy. As housing goes, so goes the economy. My bias or lean today is...slightly bullish...again. I've been beating this drum (wrongly) for three days now. Yes, the economic data I'm looking at doesn't look great but...we are working on seven straight days down. RSI and Stocastic are looking very stretched to the oversold downside. The two variables are PCE data and the press conference. If those go smoothly I think we trade higher. /MNQ (/NQ) scalping. /NG?, BITO, DIA, FSLR, SPY/QQQ, 0DTE's, RIOT, /GC? Let's take a look at our intra-day levels for trading today. Our levels were pretty spot on yesterday. /ES: 6017 is now resistance with 5859 the new support. If we lose this support level today I think we get some decent downside potential. /NQ: Same situation closer to support than resistance. 21,071 is resistance with 20,538 working as support. If we break this support level it could be "look out below". BTC: Bitcoin's weakness continues. 87,121 is now resistance with support at 78,498. We may be able to work a couple smaller 1HTE's today. Last weeks Friday left a sour taste in our mouths. Let's see if we can go into the weekend a bit happier today!

See you all in the live trading room shortly

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |