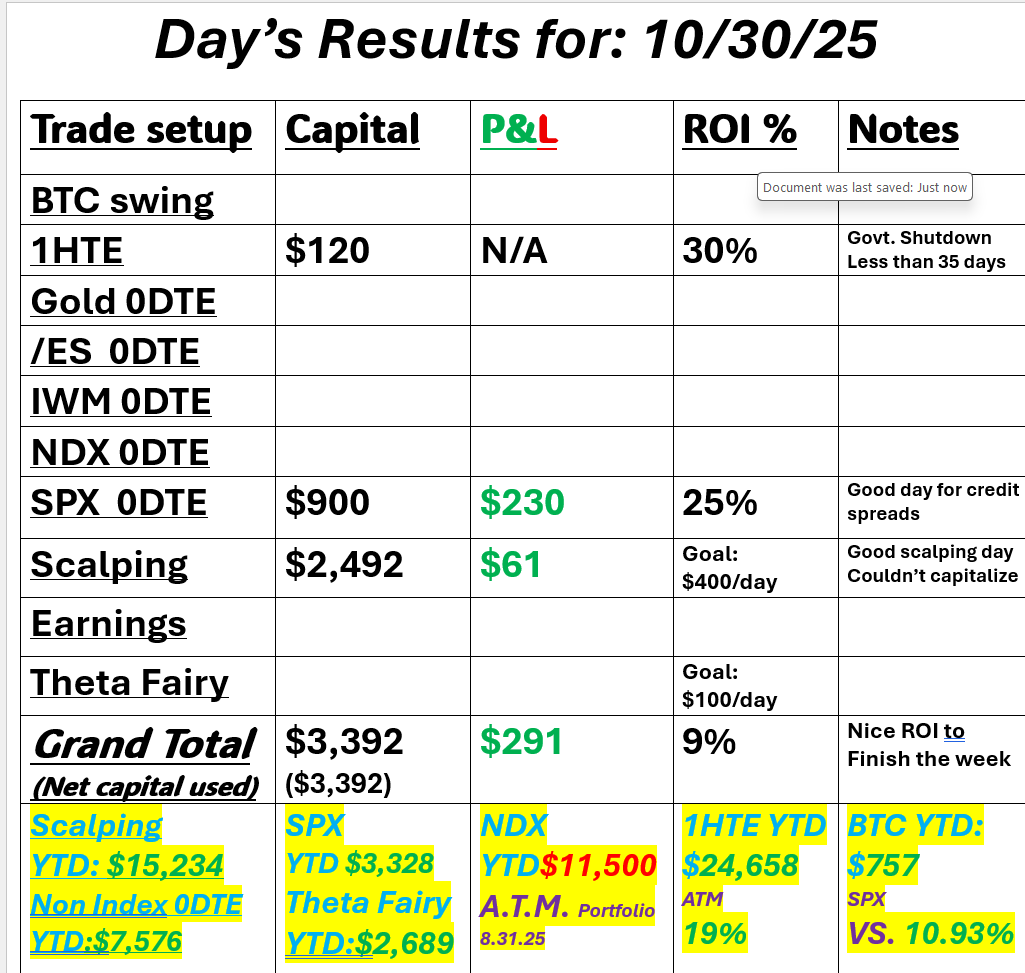

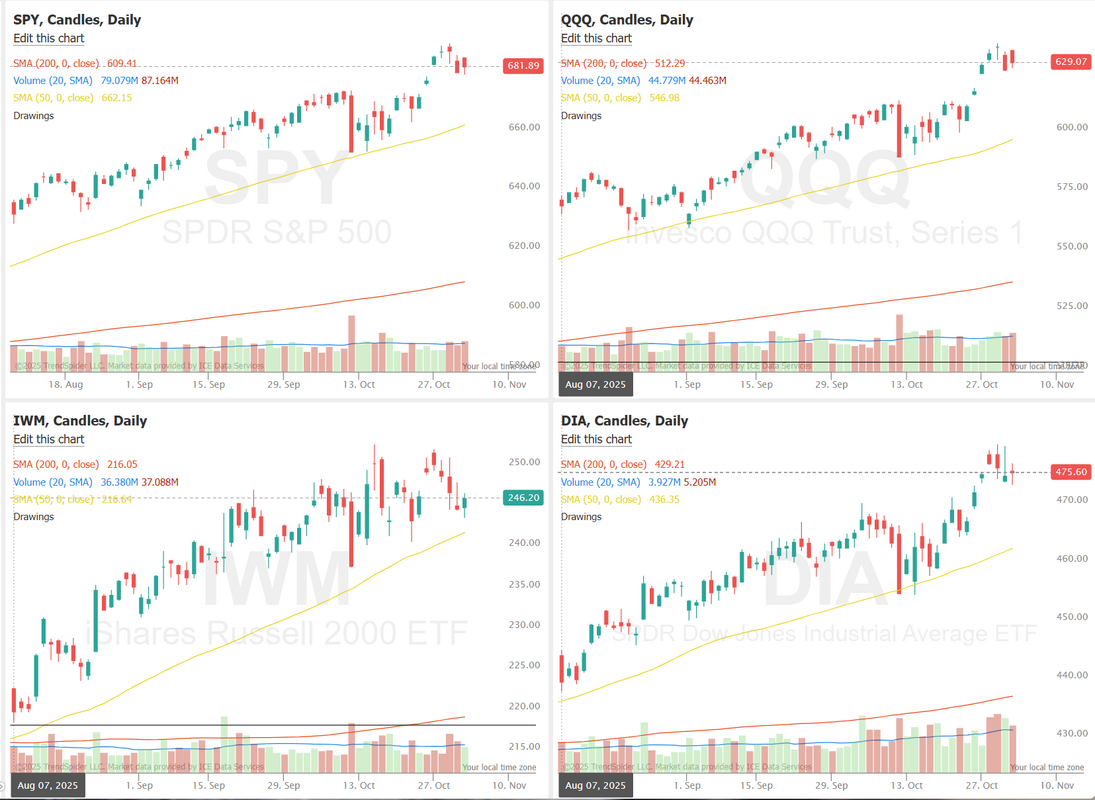

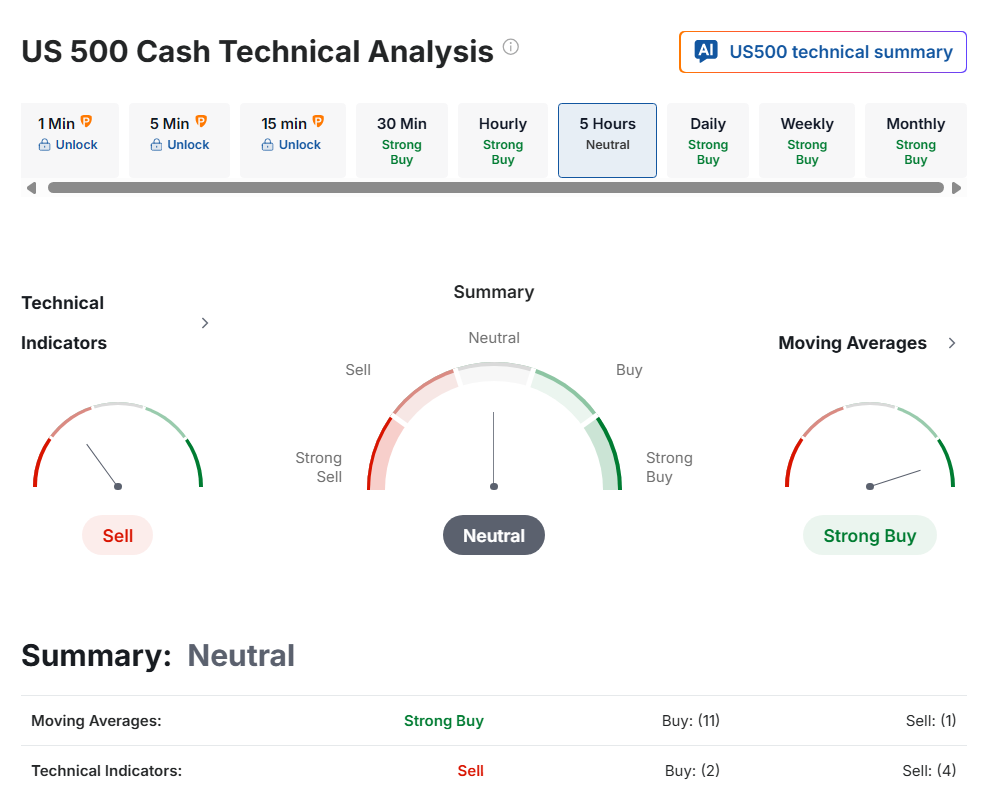

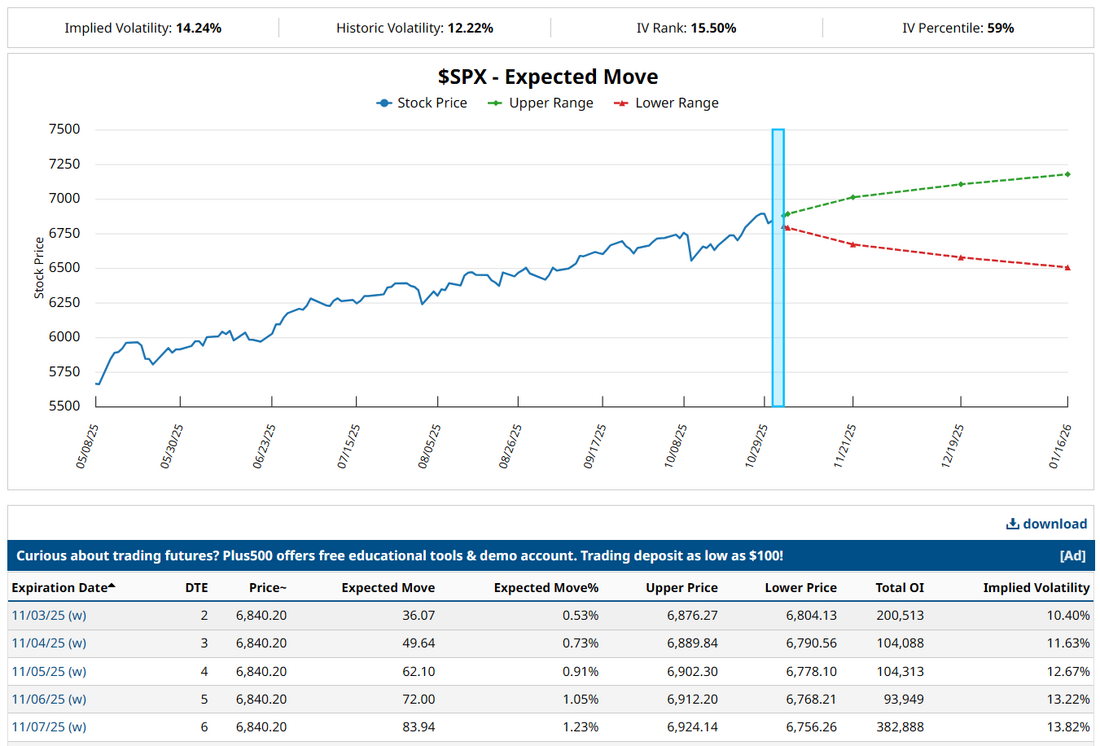

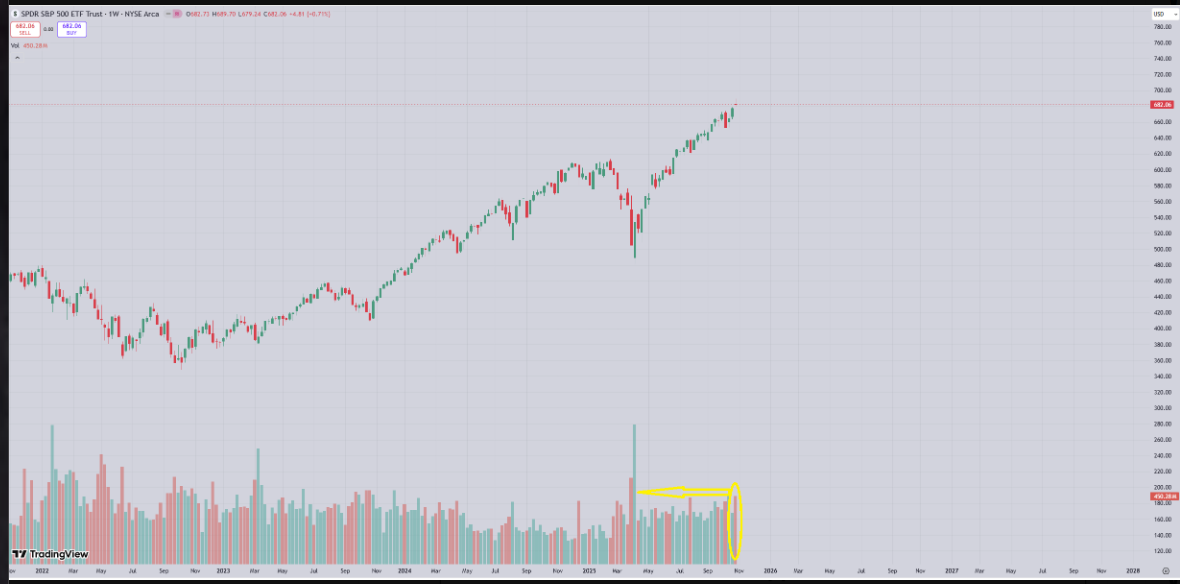

It's November folks!I can't even believe it! So crazy. Where did the summer go? I have to confess, I didn't get out and do all I wanted this year. Time is precious. We've got to make the most of it. I hope your weekend was grand. The wife is out of town so it was a lot of dog walks for me. Nice to get out of the house and away from the screens for a bit. We're back at it today with the start of a fresh month. Friday was strong (and easy) for us. Credits were juicy to start the day and we never needed to make any adjustments. Here's a look at our day. Let's look at the market. The daily chart doesn't really show the movement we got Friday. It was truly an up and down day. It should have been a perfect day for scalping but I couldn't get much working. Technicals are neutral to start the day. Futures are up across the board. I think this morning may be a "wait and see" day. My lean or bias, as I said is more wait and see. Futures are all green this morning but there's some decent resistance above current levels. I think it's best this morning to let the initial trend develop. December S&P 500 E-Mini futures (ESZ25) are up +0.42%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.57% this morning, pointing to further gains on Wall Street as strong tech earnings and easing U.S.-China trade tensions continued to buoy sentiment. Investor attention this week is on a new wave of corporate earnings reports, with key releases from data analytics software developer Palantir and chipmaker Advanced Micro Devices, alongside remarks from Federal Reserve officials and U.S. private-sector economic data. In Friday’s trading session, Wall Street’s major equity averages closed higher. Amazon.com (AMZN) surged over +9% and was the top percentage gainer on the Dow and Nasdaq 100 after the tech and online retailing giant posted upbeat Q3 results and issued solid Q4 revenue guidance. Also, Twilio (TWLO) soared more than +19% after the communications software provider reported better-than-expected Q3 results and gave above-consensus Q4 guidance. In addition, Brighthouse Financial (BHF) jumped over +24% after the Financial Times reported that Aquarian Holdings was in advanced talks to take the company private. On the bearish side, DexCom (DXCM) plunged more than -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after interim CEO Jake Leach said during the company’s Q3 earnings call that 2026 revenue growth could fall short of analysts’ expectations. Economic data released on Friday showed that the U.S. Chicago PMI rose to 43.8 in October, stronger than expectations of 42.3. Kansas City Fed President Jeff Schmid said on Friday that he voted against last Wednesday’s 25 basis point rate cut because he’s concerned that economic growth and investment could fuel upward pressure on inflation. “By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high,” Schmid said in a statement. Also, Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack said they would have preferred to keep interest rates unchanged. At the same time, Atlanta Fed President Raphael Bostic said he “eventually got behind” the decision to lower rates, noting that monetary policy remains “in restrictive territory” even after the cut. U.S. rate futures have priced in a 69.3% probability of a 25 basis point rate cut and a 30.7% chance of no rate change at the conclusion of the Fed’s December meeting. Third-quarter corporate earnings season continues in full flow, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Qualcomm (QCOM), Arm (ARM), Palantir (PLTR), Shopify (SHOP), Uber Technologies (UBER), Applovin (APP), McDonald’s (MCD), and Robinhood Markets (HOOD). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also parse comments from a slew of Fed officials, following Chair Jerome Powell’s warning last Wednesday against assuming another rate cut in December. Fed Vice Chair Philip Jefferson, Fed Governor Lisa Cook, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Michael Barr, New York Fed President John Williams, Cleveland Fed President Beth Hammack, Fed Governor Christopher Waller, Philadelphia Fed President Anna Paulson, St. Louis Fed President Alberto Musalem, and Fed Governor Stephen Miran are scheduled to speak this week. Their views of the economy and labor market will be scrutinized closely, as official data releases remain delayed due to the month-long government shutdown. The U.S. government shutdown has entered its 34th day. Democratic senators once again called on President Trump to personally step in to help end the government shutdown as the standoff entered a critical week, with the lapse on track to become the longest in history. If the shutdown continues, the publication of official U.S. economic data scheduled for this week, including the key U.S. jobs report for October, will be delayed. It would mark the second consecutive nonfarm payrolls report delayed due to the shutdown. This leaves investors focusing on private-sector data, with the ADP employment report being the highlight. The report will provide fresh insights into the health of the labor market. Other noteworthy private-sector data releases include the ISM survey on U.S. services sector activity and the University of Michigan’s preliminary Consumer Sentiment Index. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI data, set to be released in a couple of hours. Economists expect the October ISM manufacturing index to be 49.4 and the S&P Global manufacturing PMI to be 52.2, compared to the previous values of 49.1 and 52.0, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, down -0.34%. Looking at the expected move for the week. 1.23% for the week on SPX. Not high. Not low. Looks like a typical week of premium potential. S&P500. Ended last week with a gravestone doji on the highest volume since we bottomed out in April. This is typically a sign of a reversal coming, need to see follow through this week for confirmation. If you aren't familiar with the gravestone doji: A gravestone doji has a distinctive "inverted T" shape that shows a battle between buyers (bulls) and sellers (bears).

When a gravestone doji appears, it suggests a shift in market sentiment.

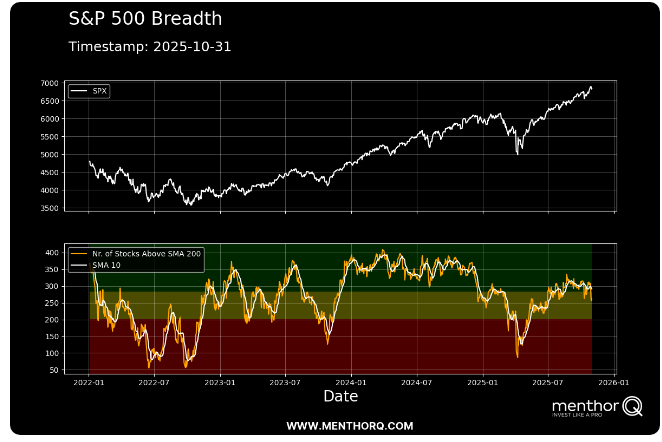

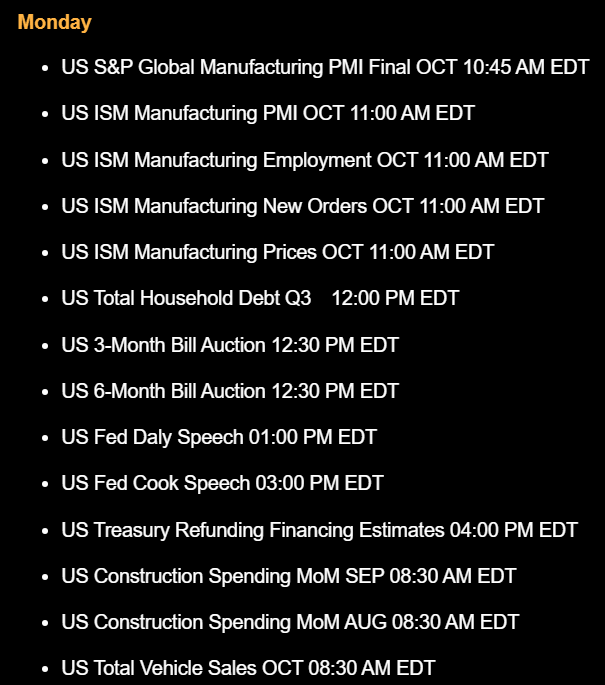

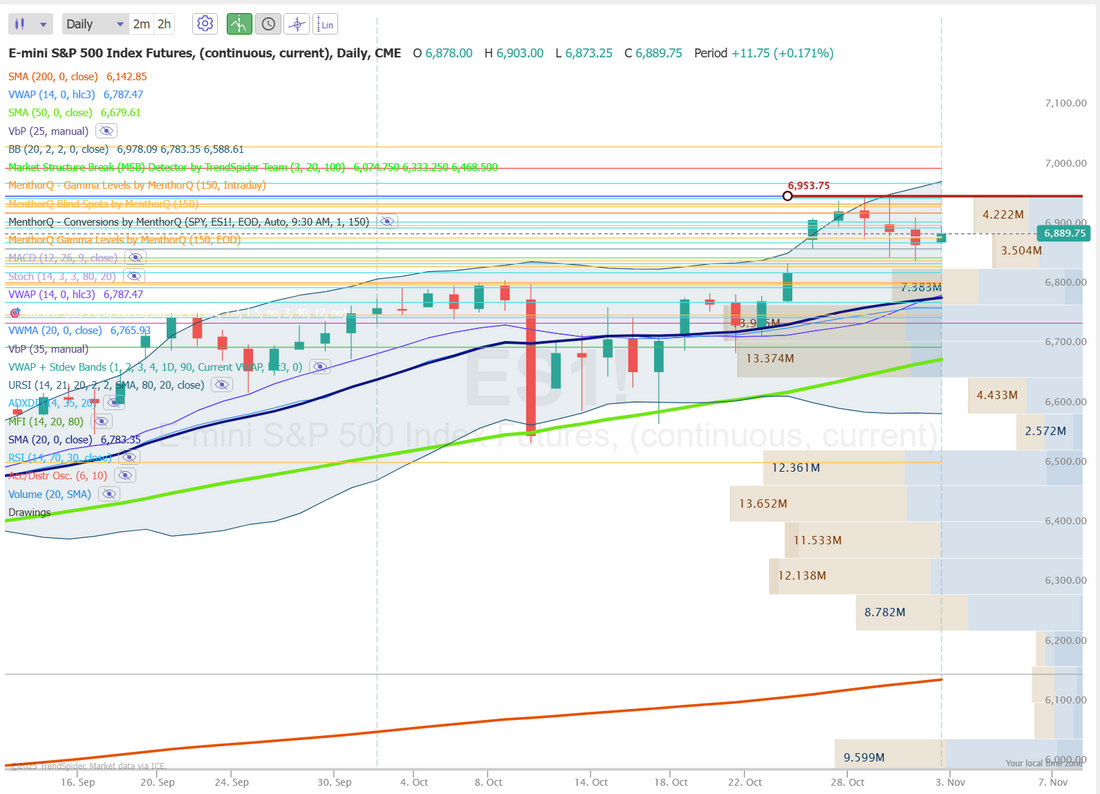

Today's training is a good one. We'll cover R and R-multiple calculations and talk about the different ways you can calculate ROI. Join us at 12:00 noon MDT in our live Zoom feed. The S&P 500 breadth chart shows that while the index continues to push toward new highs, market participation is narrowing, the number of stocks above their 200-day moving average has stalled around mid-range levels. This suggests that recent gains are being driven by a smaller group of large-cap names rather than broad-based strength. Short-term, breadth momentum (SMA 10) has flattened, hinting that the rally may be losing internal support unless participation improves. Traders may watch for whether breadth rebounds toward the upper green zone, a sign of renewed confirmation, or dips lower, which could signal near-term consolidation or rotation beneath the surface. Mondays key (planned) news catalysts. Let's look at some key intraday levels for us today on /ES for 0DTE trading. 6953 has been a brick wall for the last week. Bulls can't get a break above it. Intraday levels seem well formed. 6900, 6909, 6925, 6935, 6940 are resistance with 6888 the first step for bears. Then comes 6875, 6865, 6850, 6844 for support. I look forward to seeing you all in the live trading room today. Let's make it a great start to the week!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |