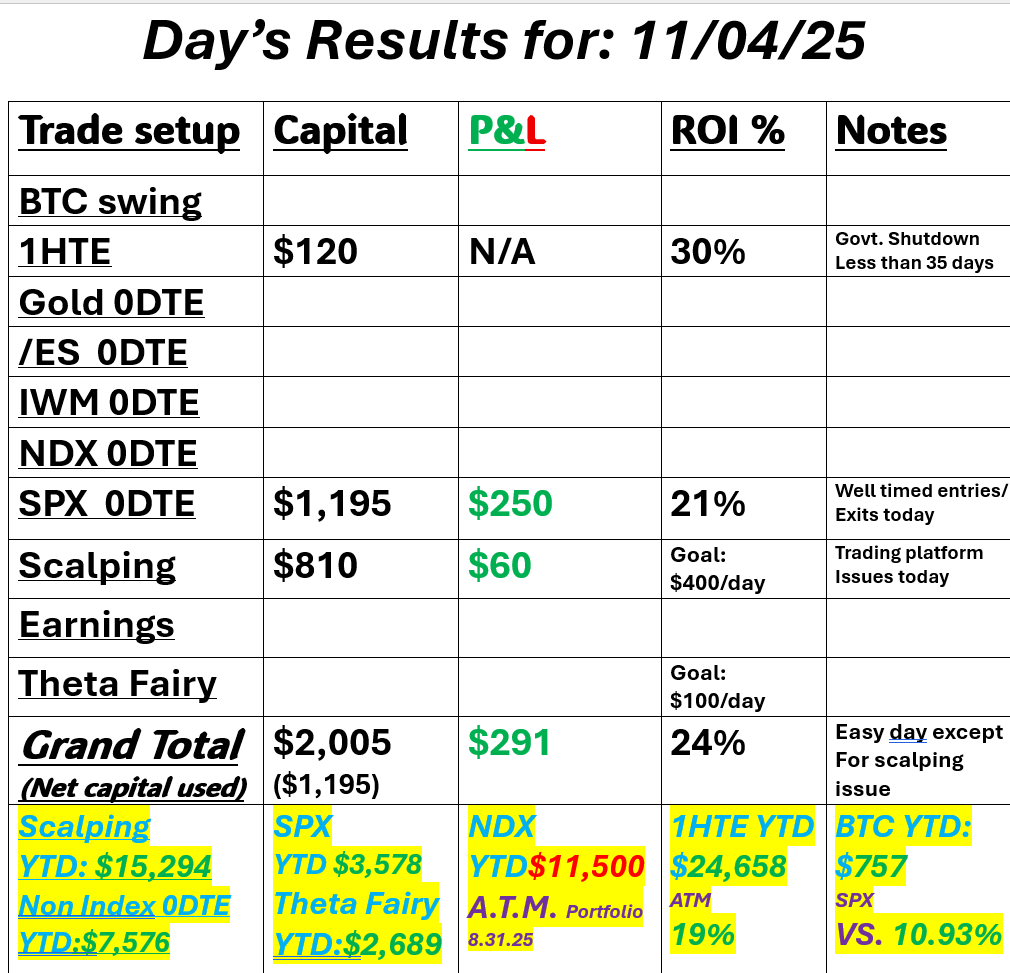

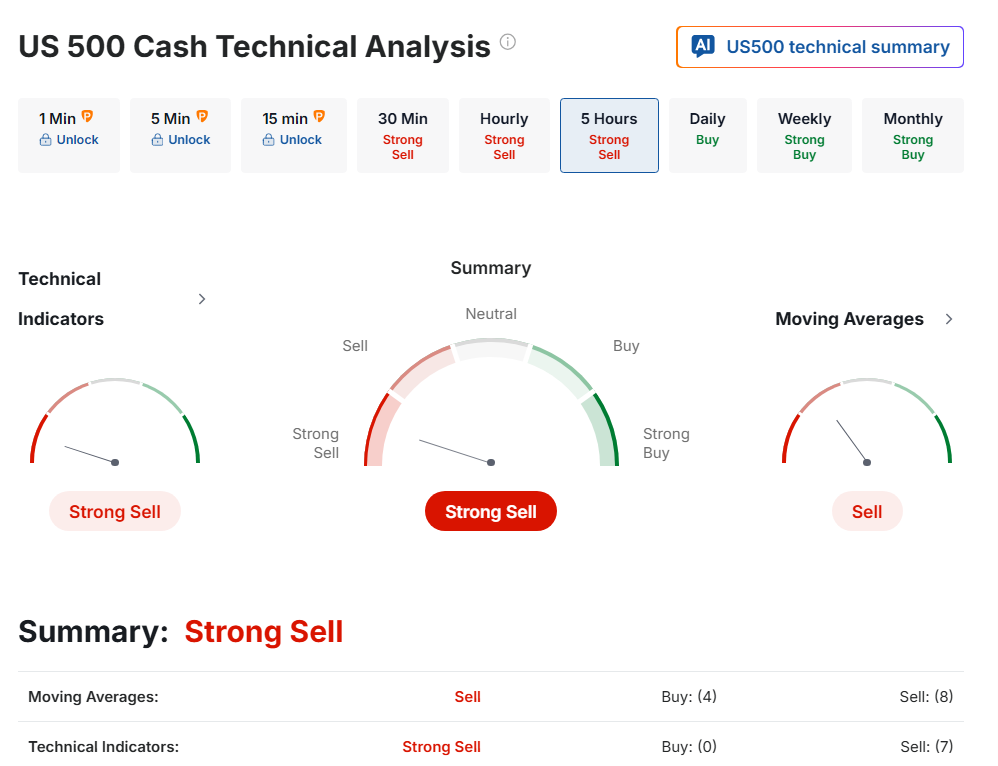

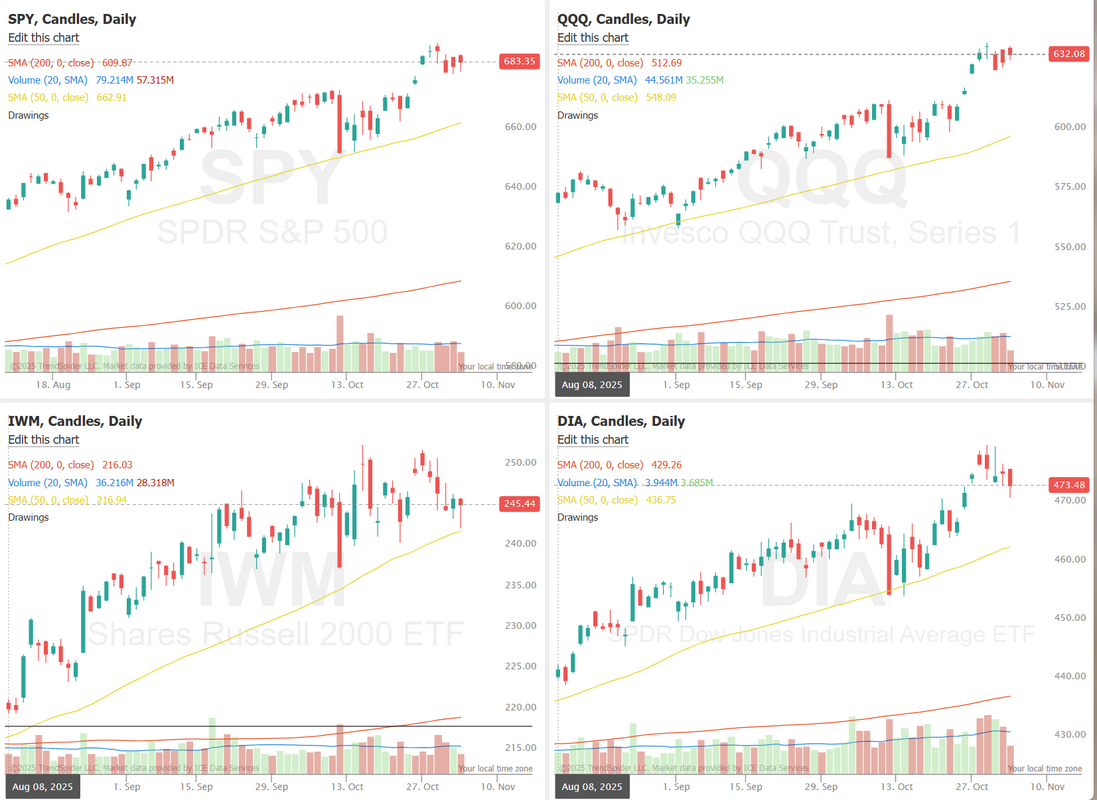

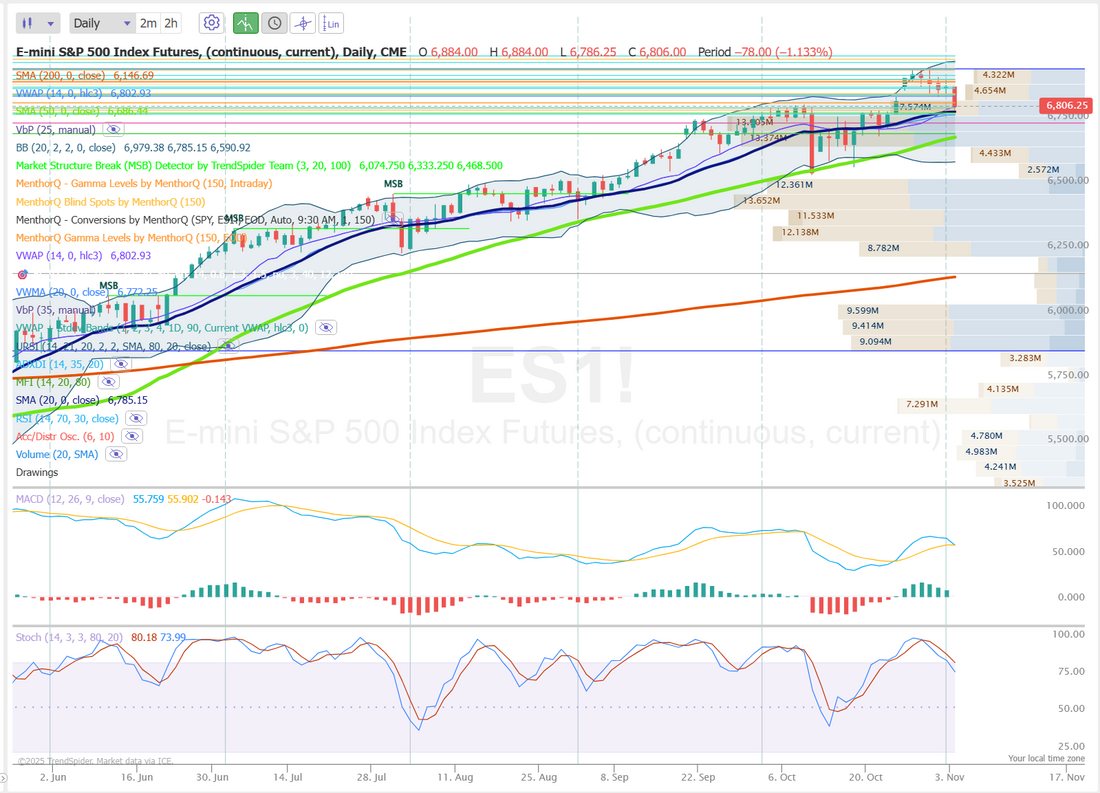

Buy the dip today?We've got a nice selloff in the the futures this morning. You know me. I love down days. Better movement and better premium to work with. The question is, are you going to buy the dip? That's been what's worked all year. I'm still cautiously optimistic we can get a "real" rollover and change of direction going. Call me a bearish optimist! We had a solid day yesterday even though my scalping interface was messed up in the morning. Tastys active V2 platform seems to not work as often as it does function properly. Here's a look at our day. Let's take a look at the markets. We start the day with a sell signal. Futures are down as I type. We've had a lot of these weak days followed by small retraces to the downside, only to be bought up and take us even higher. We all know at some point the "buy the dip" will stop working and the "sell the rip" will take over. We just don't know when. Today maybe? We've got some nice sell side action going right now in the futures. We'll see. That's why we show up every day. The S&P 500 momentum score remains elevated near its upper range, signaling sustained strength in short-term price action after weeks of consistent upside. Despite a few pauses, the index continues to hold above key recent support levels, with momentum readings steady at the maximum score of 5, a sign that trend-following strategies may still find underlying resilience in the current structure. However, the tight clustering near recent highs suggests some consolidation could unfold as markets digest prior gains. In the short term, traders may watch for whether the index can maintain this elevated momentum or begin to cool if profit-taking increases, particularly ahead of key macro events and earnings updates. December S&P 500 E-Mini futures (ESZ25) are down -1.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.31% this morning as quarterly results from AI bellwether Palantir failed to impress investors and Wall Street executives cautioned about a potential correction due to sky-high valuations. Palantir Technologies (PLTR) slumped over -7% in pre-market trading amid valuation concerns, despite the company reporting upbeat Q3 results and raising its full-year revenue guidance. Morgan Stanley’s Ted Pick and Goldman Sachs’ David Solomon were among Wall Street executives at a Hong Kong summit who cautioned that markets might be facing a significant pullback, while noting that pullbacks are a normal part of market cycles. Also, Mike Gitlin, president and chief executive officer of Capital Group, which manages about $3 trillion in assets, said that corporate earnings remain strong but “what’s challenging are valuations.” Also weighing on sentiment were mixed remarks from Federal Reserve officials. Chicago Fed President Austan Goolsbee said on Monday, “I’m not decided going into the December meeting. I am nervous about the inflation side of the ledger, where you’ve seen inflation above the target for four and a half years, and it’s trending the wrong way.” Also, Fed Governor Lisa Cook said she views the risk of further labor market weakness as outweighing the risk of rising inflation, though she refrained from explicitly supporting another rate cut next month. In addition, San Francisco Fed President Mary Daly said policymakers should “keep an open mind” about the possibility of a rate cut in December. By contrast, Fed Governor Stephen Miran said monetary policy remains restrictive and that he will continue to push for larger interest rate cuts. “The Fed is too restrictive, neutral is quite a ways below where current policy is,” Miran said. Investors now await a fresh batch of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. IDEXX Laboratories (IDXX) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the veterinary medicine company posted upbeat Q3 results and raised its full-year guidance. Also, Amazon.com (AMZN) climbed +4% and was the top percentage gainer on the Dow after the tech giant’s cloud unit signed a $38 billion agreement to provide OpenAI with Nvidia GPUs. In addition, Kenvue (KVUE) jumped over +12% after Kimberly-Clark agreed to acquire the Tylenol maker for about $40 billion. On the bearish side, Charter Communications (CHTR) slid more than -4% and was the top percentage loser on the Nasdaq 100 after KeyBanc and Bernstein downgraded the stock. Economic data released on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to 48.7 in October, weaker than expectations of 49.4. At the same time, the U.S. October S&P Global manufacturing PMI was revised higher to 52.5, stronger than expectations of 52.2. “With U.S. data softening and Fed officials keeping policy optionality alive, investors are reassessing positioning rather than chasing risk,” said Billy Leung, an investment strategist at Global X Management. U.S. rate futures have priced in a 72.1% chance of a 25 basis point rate cut and a 27.9% chance of no rate change at the next FOMC meeting in December. Third-quarter corporate earnings season rolls on, with investors awaiting fresh reports from high-profile companies today, including Advanced Micro Devices (AMD), Shopify (SHOP), Uber Technologies (UBER), Arista Networks (ANET), Amgen (AMGN), Pfizer (PFE), and Spotify (SPOT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also focus on a speech from Fed Vice Chair for Supervision Michelle Bowman. Meanwhile, the U.S. government shutdown has entered its 35th day, with bipartisan negotiations reportedly gaining momentum and making progress. The government shutdown is set to become the longest in history, surpassing the 35-day shutdown that occurred during President Trump’s first term in 2018-2019. In light of the shutdown, the publication of September JOLTs job openings, factory orders, and trade data, originally set for today, will be delayed. Goldman Sachs analysts said in a note that the current U.S. government shutdown appears poised to have the most significant economic impact of any shutdown on record. “Not only is it likely to run longer than the 35-day partial shutdown in 2018-2019, it is much broader than prior lengthy shutdowns, which affected only a few agencies,” the analysts said. They noted that a prolonged shutdown could more heavily impact federal spending and investment and might also spill over into private-sector activity. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.091%, down -0.39%. We had a really solid training session yesterday on the R-multiple. Tomorrow we'll discuss attribution analysis. Come join us on our live zoom feed. My lean or bias today is bearish. I'm "optimistic" we can finally get something working to the downside. Let's look at our intraday levels. This morning's futures have created some new levels. On the daily chart, we are close to a full-on sell signal. The 20-day moving average at 6782 could come into play. If we lose the 50DMA at 6686, the next target would be the 50DMA. 6820, 6845, 6851, 6864 are resistance levels. 6799, 6794 (200 PMA on 2hr. chart), 6776, 6767 are support levels. I look forward to seeing you all in the live trading room shortly. We've got exactly what we want to start the day; #1. Movement. #2. Movement to the downside. So let's see what we can do with it!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |