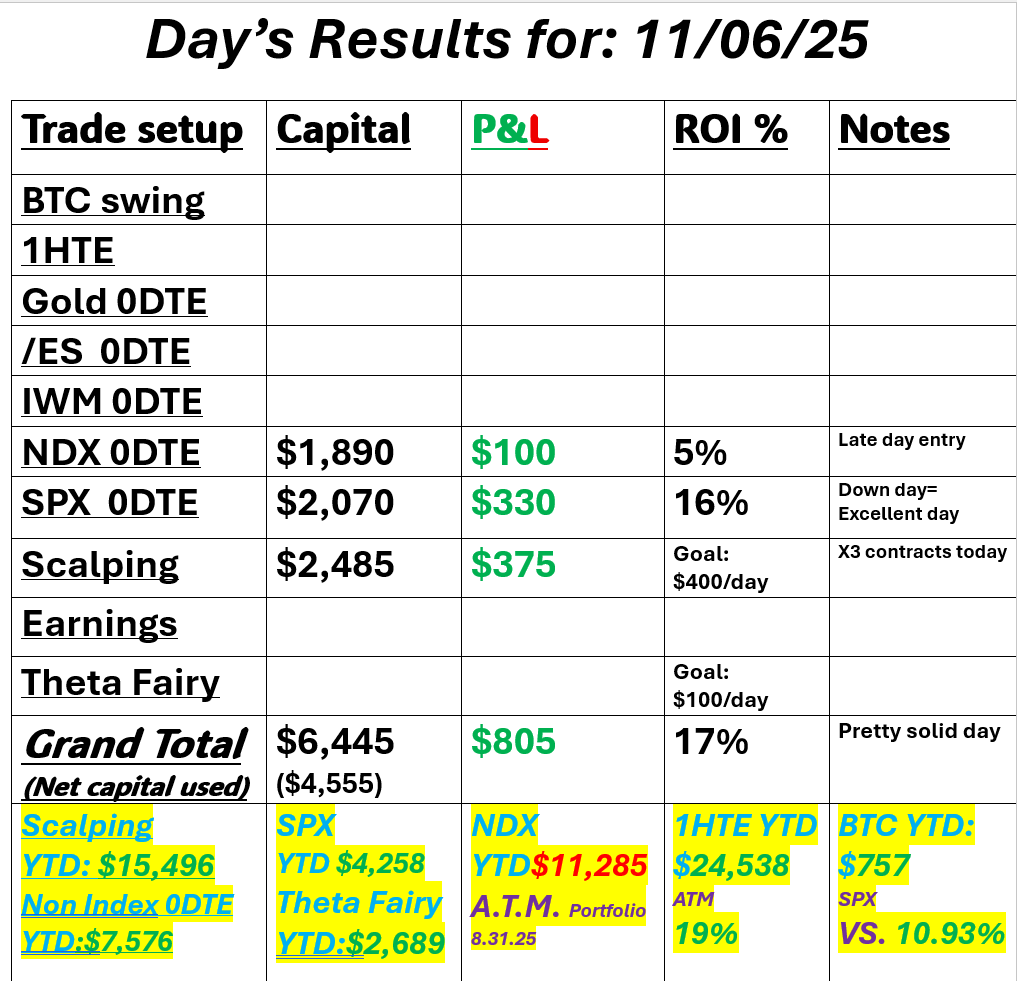

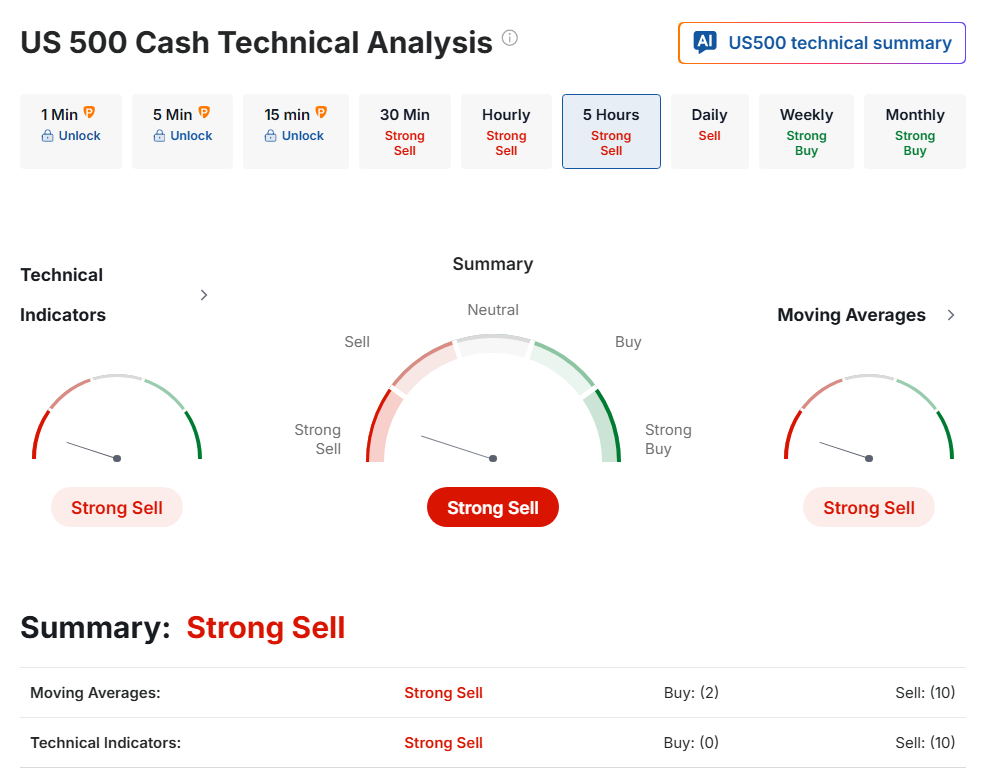

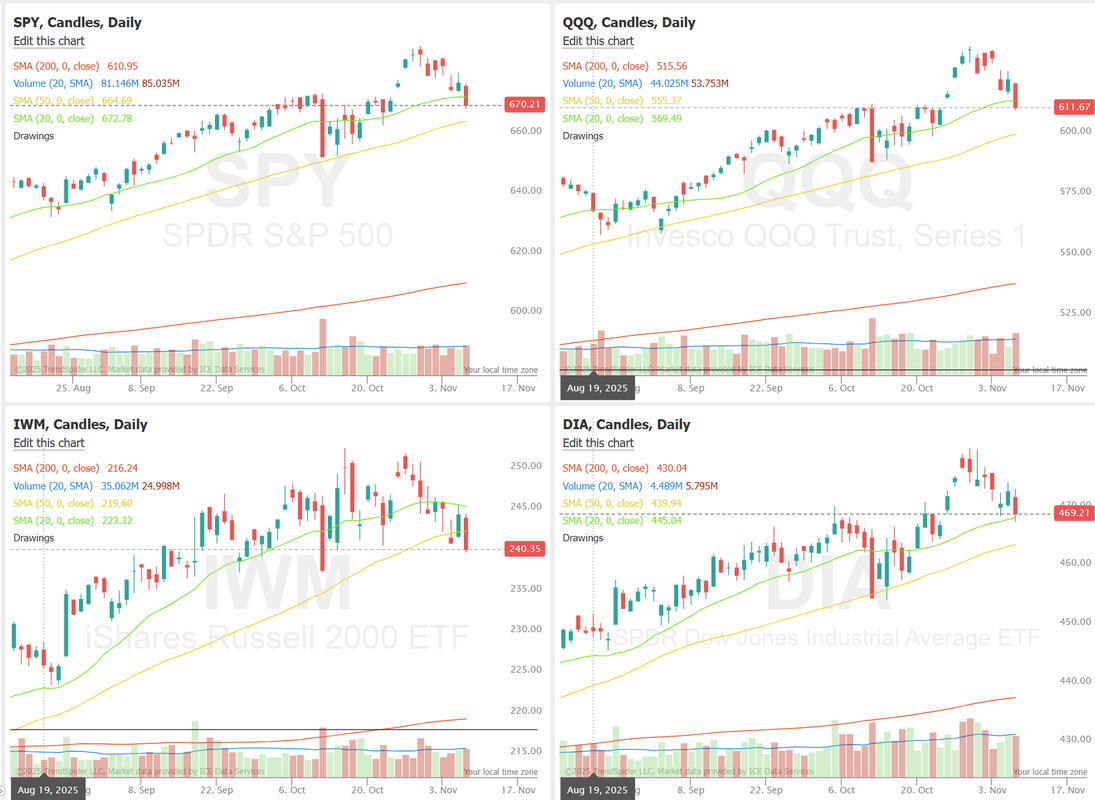

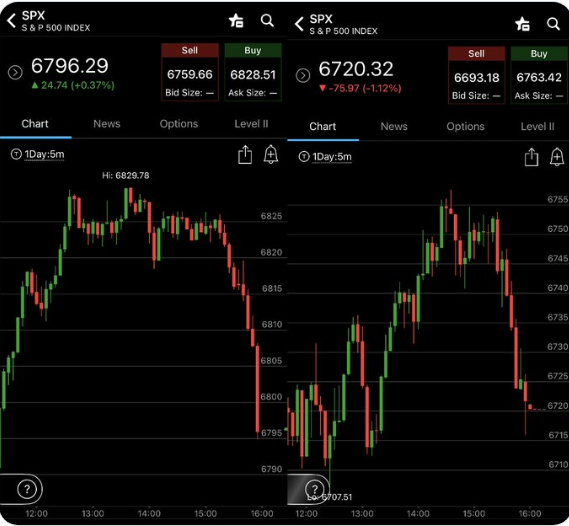

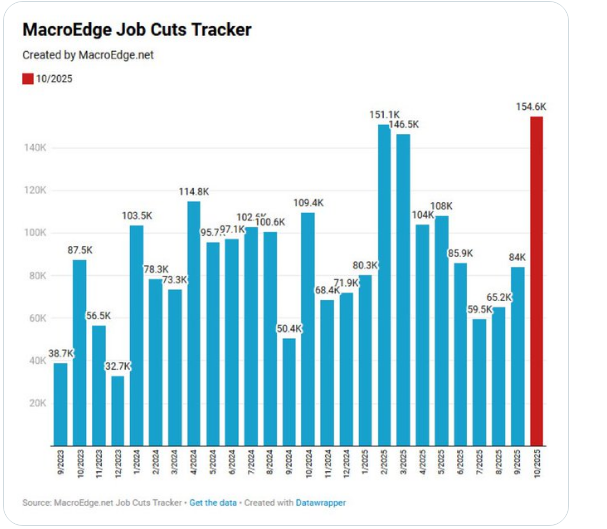

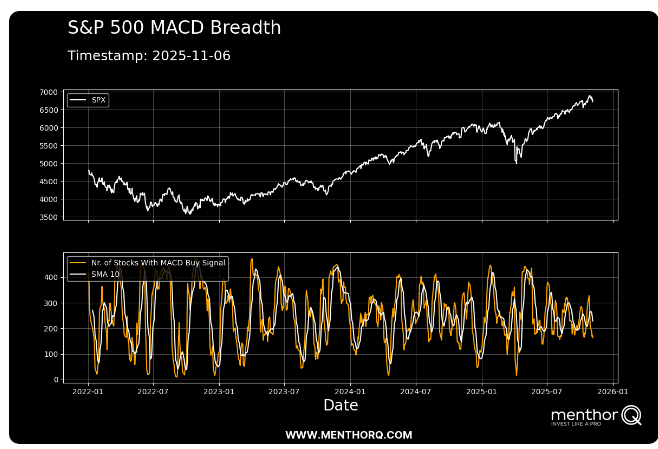

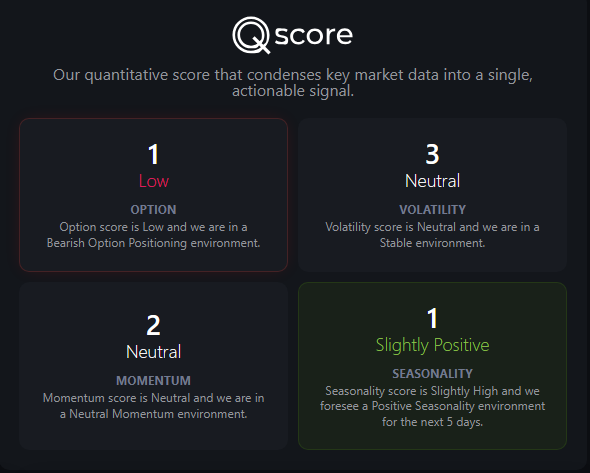

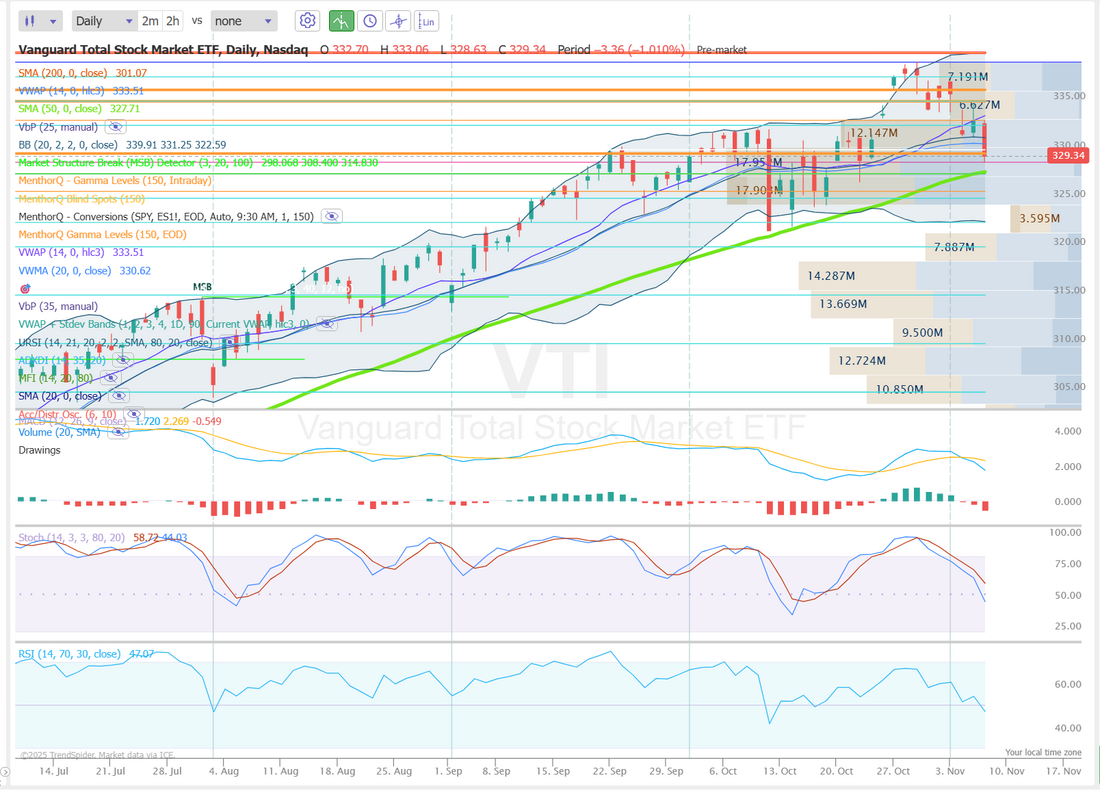

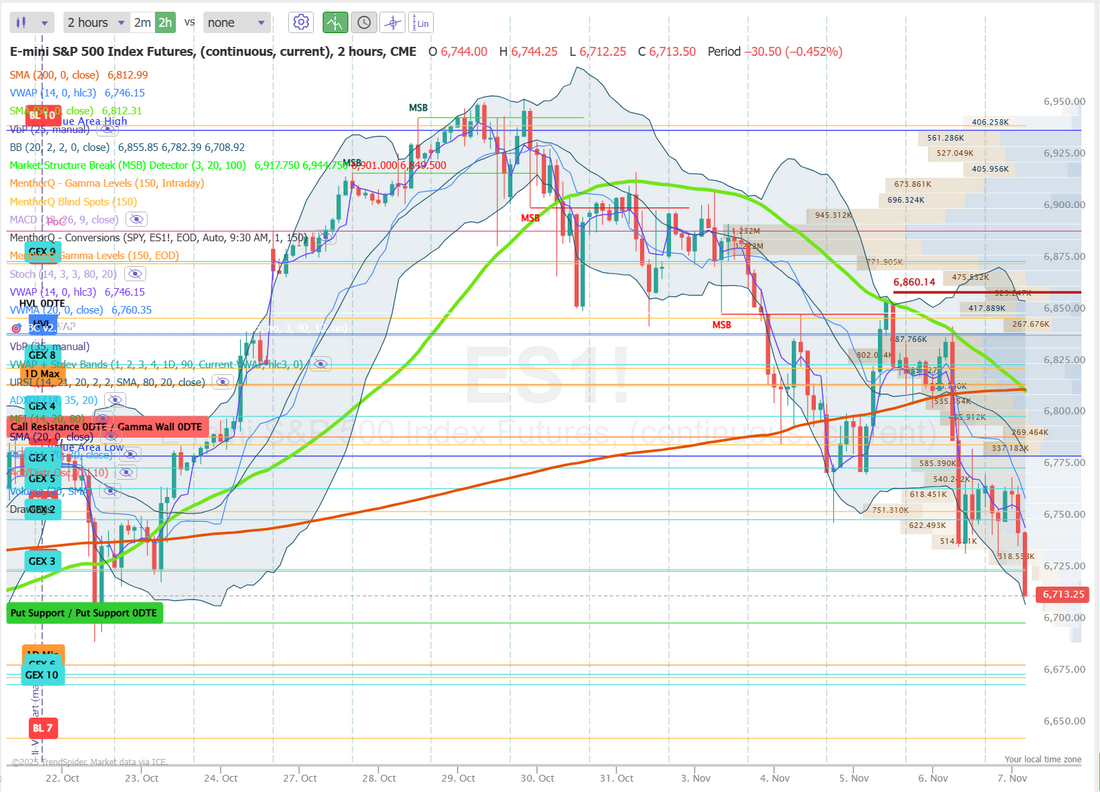

Goodbye 20DMA. Hello 50DMA!Well...as Phil Collins likes to say, it's another day in paradise. Have our rain dance prayers finally been answered? All we've ever asked for is a down trending market. Is that so big an ask? LOL. I don't know. After two strong, back to back years of gains the market looked tired at the start of 2025 and I thought, if there was any year that looked poised to go down, this was the year. Instead its just held it's ground. I dare so however, this current rollover looks like it could be the real deal. The market seems to be getting tired of A.I. and Quantum computing stocks with no revenues or earnings to speak of. We love them, of course, from the short side. Our ATM portfolio is poised to profit again today if the market keeps dropping. We had a stellar day yesterday. Everything hit for us. Take a look below: We had some excellent levels to work off yesterday. Today should be no different. There are some key support/resistance zones that have formed up. I'll touch on those in a moment. Let's look at the markets. Technicals are flashing sell. As I mentioned above, We blew through the 20DMA yesterday on the SPY and QQQ. The 50DMA looks like it's incoming. A break below that would be glorious. IWM as already done so. My lean or bias for today is bearish. Let's go bears! December S&P 500 E-Mini futures (ESZ25) are down -0.26%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.30% this morning, extending yesterday’s losses as investors remain concerned about weak labor market data and lofty tech valuations. Investors are now awaiting the release of the University of Michigan’s preliminary reading on U.S. consumer sentiment and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indices ended sharply lower. Most members of the Magnificent Seven stocks retreated, with Tesla (TSLA) and Nvidia (NVDA) dropping over -3%. Also, chip stocks slumped, with Advanced Micro Devices (AMD) sliding over -7% and Qualcomm (QCOM) falling more than -3%. In addition, DoorDash (DASH) plunged over -17% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the food-delivery company reported weaker-than-expected Q3 EPS and issued soft Q4 adjusted EBITDA guidance. On the bullish side, Datadog (DDOG) jumped more than +23% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the software maker posted upbeat Q3 results and raised its full-year guidance. Data from outplacement firm Challenger, Gray & Christmas released on Thursday showed that U.S. companies announced 153,074 job cuts in October, nearly three times higher than the same month last year and the highest for any October since 2003. Separately, Revelio Labs data showed that the U.S. shed 9,100 nonfarm jobs in October after adding 33,000 in the previous month. “We are sticking to our view that the Fed will deliver a follow-up 25 basis-point cut in December because restrictive Fed policy can worsen the already fragile employment backdrop,” said Elias Haddad at Brown Brothers Harriman & Co. Still, a slew of remarks from Fed officials on Thursday regarding inflation left traders uncertain about whether a December rate cut will materialize. Cleveland Fed President Beth Hammack said monetary policy needs to keep putting downward pressure on inflation, which she views as too high and a greater risk than labor market weakness. Also, Fed Governor Michael Barr said policymakers still have work to do in bringing down inflation to the central bank’s 2% target while ensuring the labor market is solid. In addition, Chicago Fed President Austan Goolsbee said a lack of official inflation data during the shutdown makes him cautious about cutting rates. Finally, St. Louis Fed President Alberto Musalem said the central bank needs to maintain downward pressure on inflation, warning that interest rates are nearing a level where that pressure could diminish. U.S. rate futures have priced in a 66.0% chance of a 25 basis point rate cut and a 34.0% chance of no rate change at the next FOMC meeting in December. Meanwhile, the longest government shutdown in U.S. history is now in its 38th day. U.S. officials have said they will reduce air traffic by 10% at 40 major airports starting today to ease pressure on air-traffic controllers who remain unpaid due to the shutdown. Economists noted that every week of the shutdown reduces quarterly annualized growth by 0.1 to 0.2 percentage points. Still, several lawmakers have expressed optimism that the shutdown could end this weekend. In light of the shutdown, the publication of October’s nonfarm payrolls report, average hourly earnings, and unemployment rate, originally set for today, will be delayed. Still, the University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists, on average, forecast that the preliminary November figure will stand at 53.0, compared to 53.6 in October. The Fed’s Consumer Credit report will also be released today. Economists expect the U.S. Consumer Credit to be $10.4 billion in September, compared to the previous figure of $0.4 billion. In addition, market participants will be looking toward speeches from Fed Vice Chair Philip Jefferson, New York Fed President John Williams, and Fed Governor Stephen Miran. On the earnings front, notable companies like Constellation Energy (CEG), KKR & Co. (KKR), Enbridge (ENB), and Duke Energy (DUK) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.106%, up +0.32%. The last two days the SPX dropped about 30 handles in 30 mins. This is a nice sign of weak hands. Markets can't hold going into the close. Everyone wants to be risk-off overnight. If you're worried about jobs numbers, you should be. Job cuts are skyrocketing. The S&P 500 MACD Breadth chart highlights a moderate cooling in short-term momentum as the number of stocks with active MACD buy signals has eased from recent peaks. While the SPX index remains in an uptrend, breadth readings show fewer constituents participating in the rally, suggesting a potential pause or minor consolidation phase ahead. Historically, similar dips in MACD breadth have preceded short-term pullbacks or sideways movement before trend resumption. In the near term, traders may watch whether breadth stabilizes or rebounds, as a renewed rise in MACD buy signals could confirm fresh upside participation across sectors. Gamma has flipped negative! Quant score in plummeting. Let's take a look at our intraday readings. We've got a textbook sell rating on the market right now. Rollover on Stoch, RSI, MACD. We just need a break below the 50DMA (green line) to really lock this bearish trend down. 6725, 6740, 6749, 6754, 6766 are resistance levels. 6711, 6700, 6680, 6674, 6660, 6644 are support. We had another great training session yesterday on Attribution analysis. Join us Monday for a training session on the Options smile skew. It should be another good one! I'll see you all shortly in the live trading room. Remember...there ain't no market like a down market. Let's go bears!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |