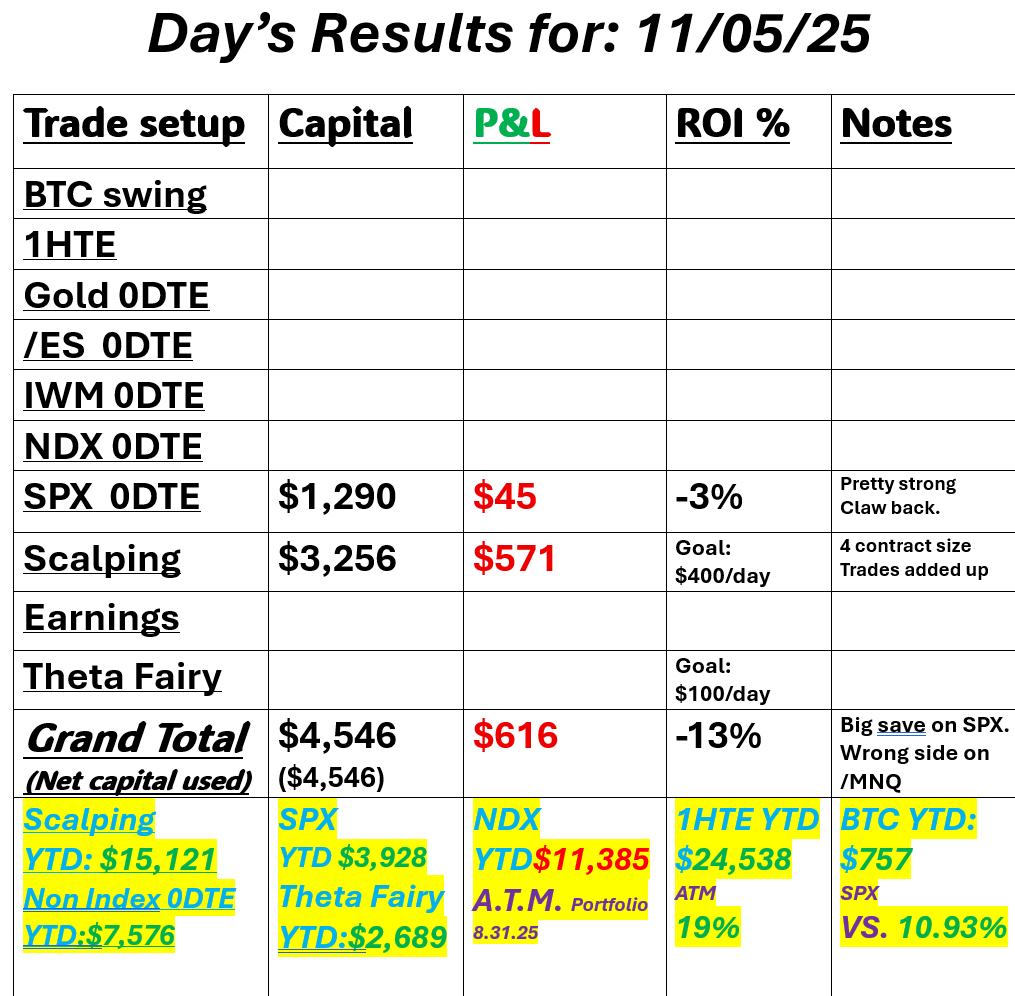

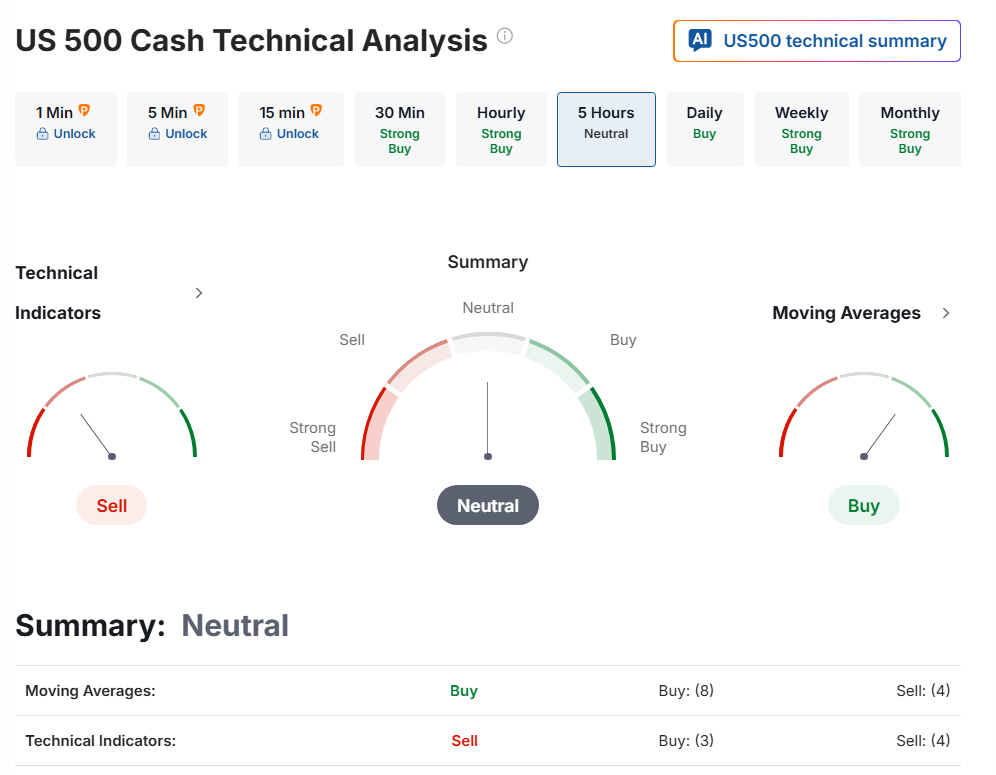

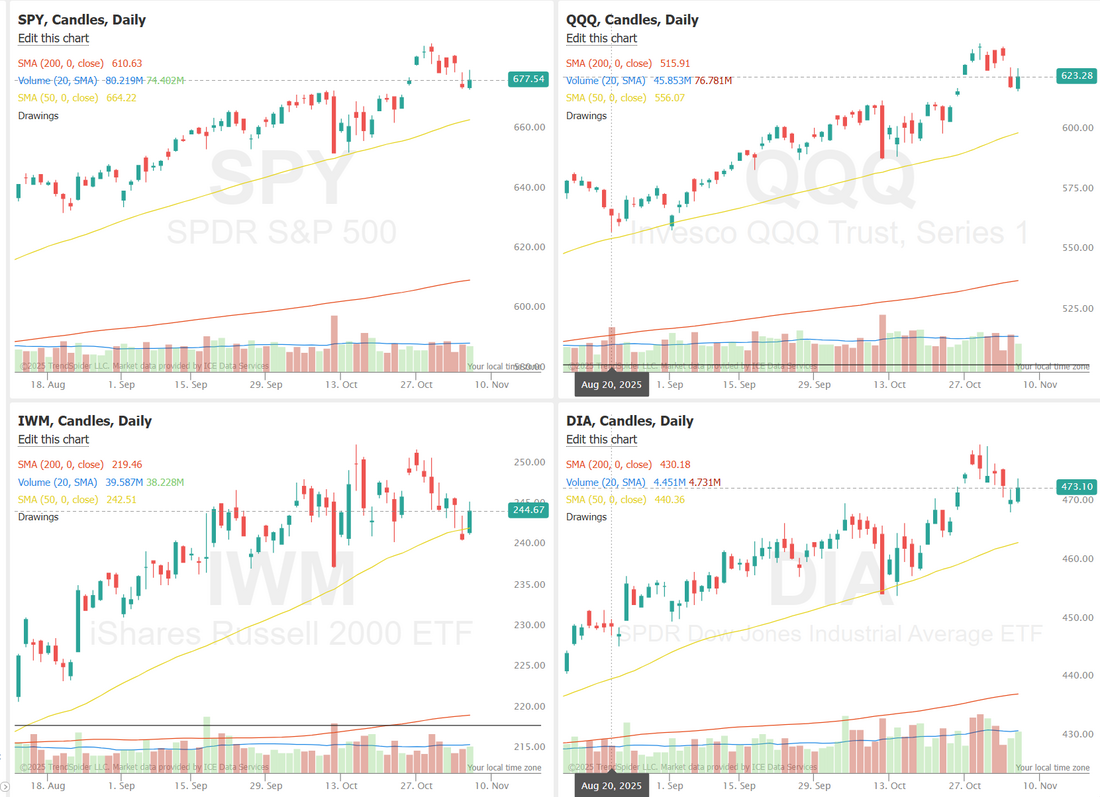

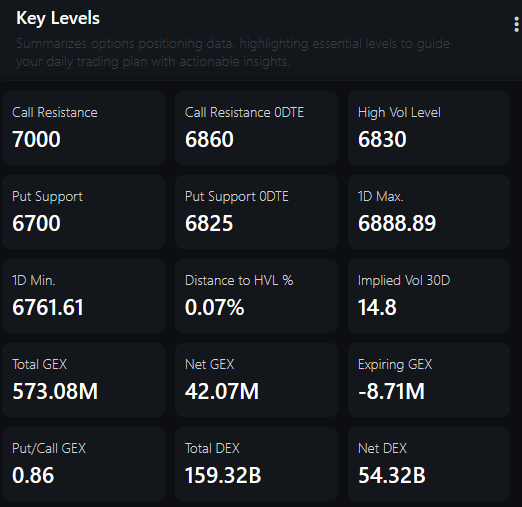

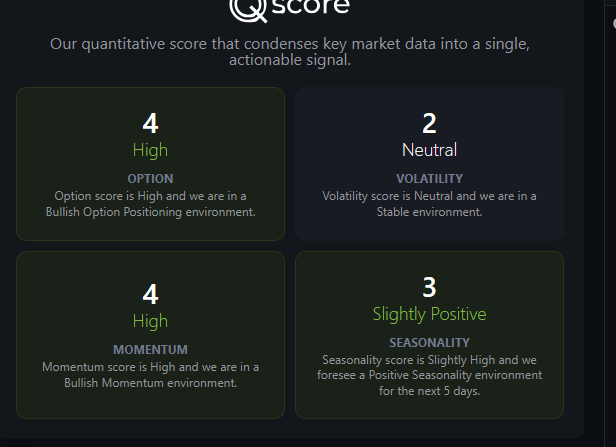

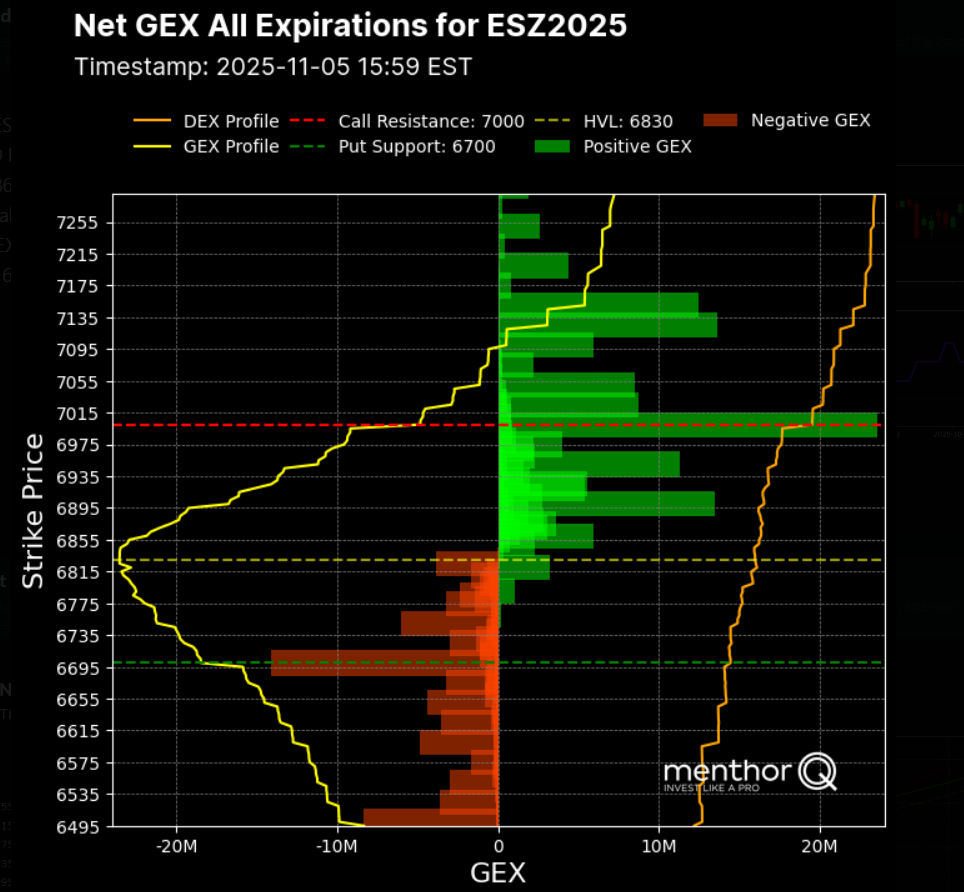

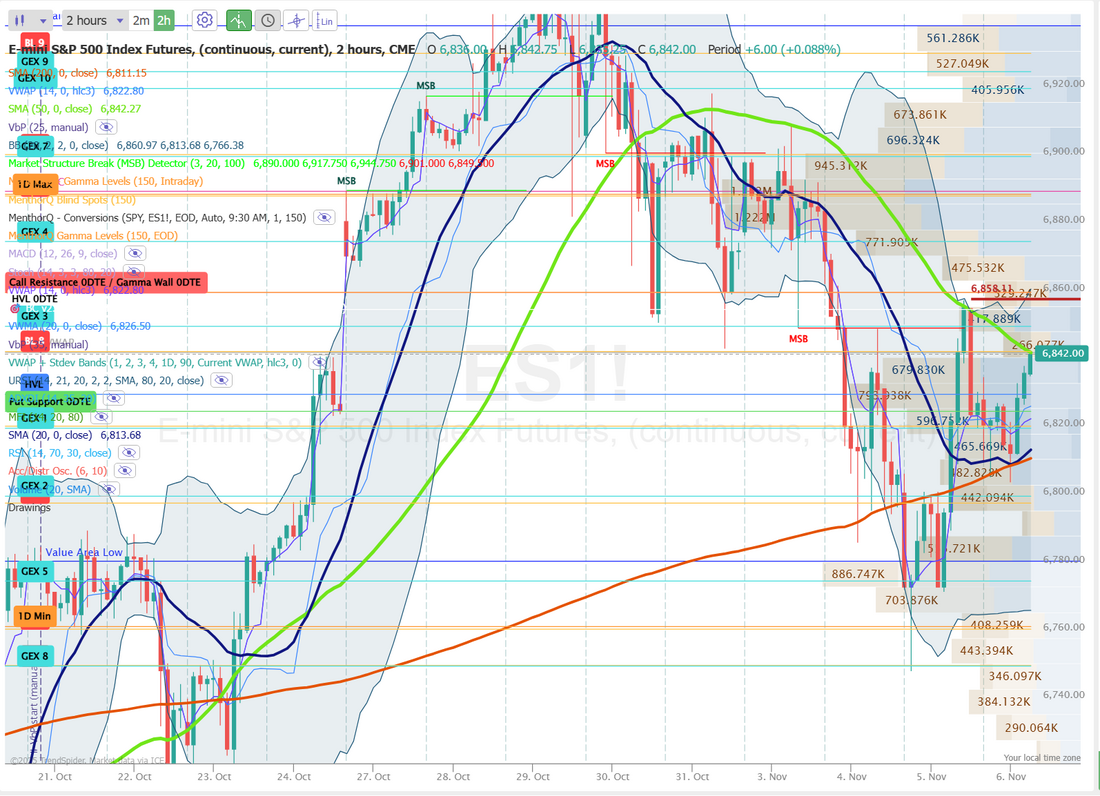

Big recovery=Big win?Lot's of lessons for me in yesterdays trading session. Both with our 0DTE SPX and Scalping the /MNQ futures. I got upside down on our SPX early in the day. Down about $1,000 dollars. I generally try to keep risk at no more than $500. We had an amazing reversal trade that almost brought us back to profits. It would have been almost $600 of profit IF, I would have abided by our level analysis and waited a bit longer to enter the retrace setup. I got a bit ahead of myself and our laid out gameplan. In scalping I went with 4 contracts which is a bit heavier than normal but the main issue was looking for the retrace a bit too early. It came. Again, I was just too anticipatory. I love the retrace trade. You can call me Scott "reversion to the mean" Stewart. The problem comes when it doesn't show up.. or shows up too late. A $45 dollar loss on SPX is hard to categorize as a win until you understand you were staring down a $1,000 loss. Today is a new day. Here's a look at my day. Let's take a look at the markets. Technicals are in a bit of a flux. Neutral rating to start today. That's always a tough one to read so I'll be a bit more patient to get started today. I would actually call yesterday a bearish day. Yes the IWM and DIA had a well deserved push higher after lots of negative days but the SPY and QQQ actually had a very bearish finish to the day, despite being up strong most of the day. December S&P 500 E-Mini futures (ESZ25) are up +0.16%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.20% this morning, pointing to a higher open on Wall Street as Treasury yields fell amid growing expectations for a Federal Reserve rate cut in December. Bond yields fell after data from outplacement firm Challenger, Gray & Christmas showed that U.S. companies announced the highest number of job cuts for any October in over two decades, prompting traders to increase wagers on a rate cut next month. Investors now await a slew of speeches from Federal Reserve officials for more clues on the interest rate outlook. Still, concerns over lofty tech valuations persisted, limiting gains in U.S. equity futures. Qualcomm (QCOM) fell over -2% in pre-market trading, becoming the latest chipmaker to issue upbeat guidance that nonetheless failed to impress investors. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. Chip stocks rallied, with Micron Technology (MU) climbing over +8% and Marvell Technology (MRVL) rising more than +6%. Also, Amgen (AMGN) surged over +7% and was the top percentage gainer on the Dow after the biotech giant posted upbeat Q3 results and raised its full-year guidance. In addition, Lumentum Holdings (LITE) jumped more than +23% after the company reported better-than-expected FQ1 results and issued strong FQ2 guidance. On the bearish side, Zimmer Biomet Holdings (ZBH) plunged over -15% and was the top percentage loser on the S&P 500 after the maker of knee and hip replacements posted weaker-than-expected Q3 sales. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 42K in October, stronger than expectations of 32K. Also, the U.S. ISM services index rose to 52.4 in October, stronger than expectations of 50.7. At the same time, the U.S. October S&P Global services PMI was revised lower to 54.8 from the preliminary reading of 55.2. Fed Governor Stephen Miran said on Wednesday that the ADP report showing an increase in employment at companies was “a welcome surprise,” though he reiterated that interest rates should be lower. U.S. rate futures have priced in a 67.3% probability of a 25 basis point rate cut and a 32.7% chance of no rate change at December’s monetary policy meeting. Third-quarter corporate earnings season rolls on, with notable companies like ConocoPhillips (COP), Airbnb (ABNB), Monster Beverage (MNST), Vistra Corp. (VST), Warner Bros Discovery (WBD), and Take-Two Interactive Software (TTWO) slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also hear perspectives from Fed Governors Christopher Waller and Michael Barr, along with New York Fed President John Williams, Cleveland Fed President Beth Hammack, and Philadelphia Fed President Anna Paulson, throughout the day. Meanwhile, the U.S. government shutdown has entered its 37th day. The shutdown has become the longest in U.S. history, surpassing the previous record on Tuesday night. In light of the shutdown, the publication of weekly jobless claims as well as preliminary third-quarter nonfarm productivity and unit labor costs data, originally set for today, will be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.139%, down -0.48%. The SPX Volatility Score chart indicates a cooling in short-term volatility after a brief spike in mid-October. While the index remains near its recent highs, the modest pullback in the volatility score suggests a more stable, range-bound environment as traders digest recent gains. Price action has shown resilience above the 6,700 zone, but fading volatility could mean tighter intraday swings and reduced momentum in the immediate term. If volatility picks up again, it may coincide with renewed market catalysts such as earnings or macro data releases, key short-term factors to watch as the SPX tests whether this consolidation becomes a pause before continuation or a shift toward rebalancing. We were too occupied with our SPX trade yesterday to get into our Attribution training. We'll hit it today. Come join us. I try to with hold a lean or bias on neutral rated mornings. It's just too much of a coin toss. Futures are trending higher and looking to open strong. Let's look at the setups for today's 0DTE SPX trade based off /ES futures levels. Quant score building momentum. GEX levels across all expirations. Intraday levels. 6842 (current level as I type) is key 50PMA on 2hr. chart. 6850 is also key (MSB- Market structure break level), 6860, 6875, 6890 are the remaining resistance levels for me today. Support starts at 6830, 6825, 6820, 6810, 6800. I look forward to seeing you all in the live trading room shortly. Yesterday was a great save. Let's see if we can just skip the "save" part today and go straight to profit.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |