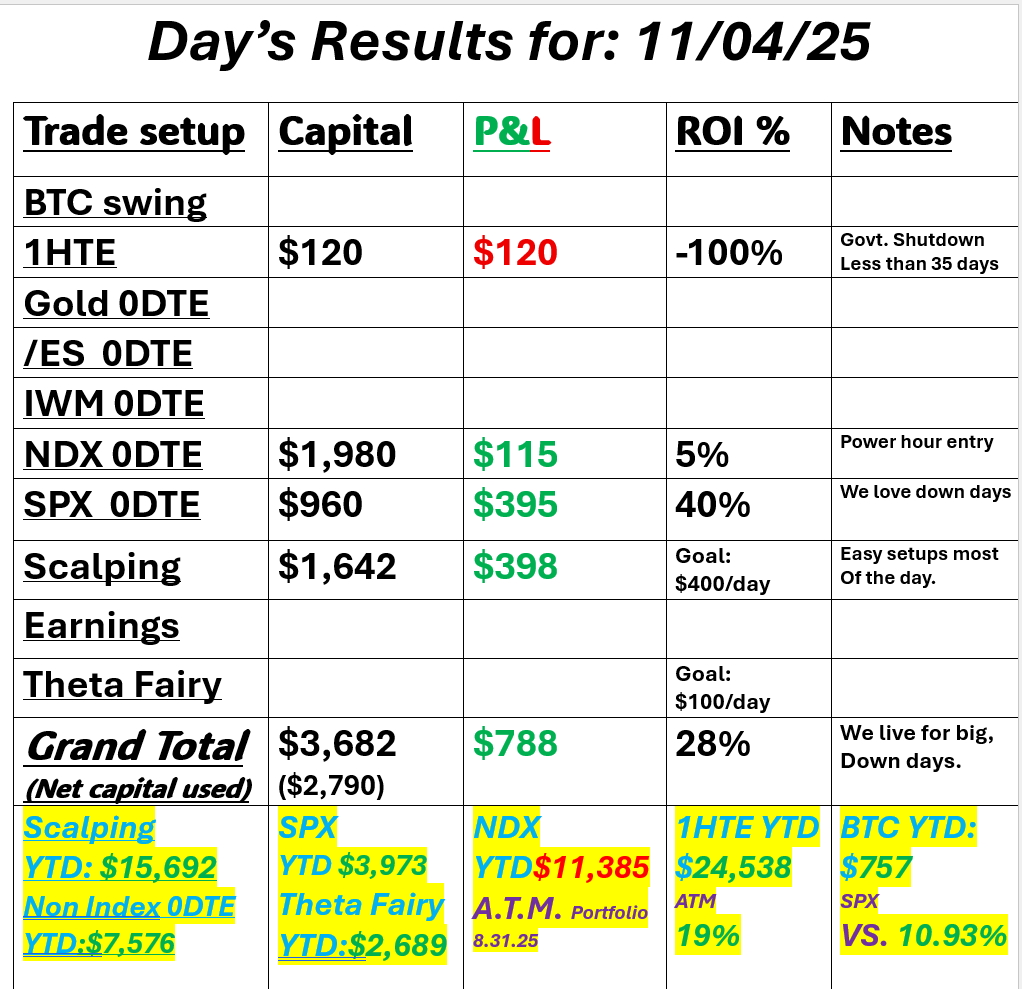

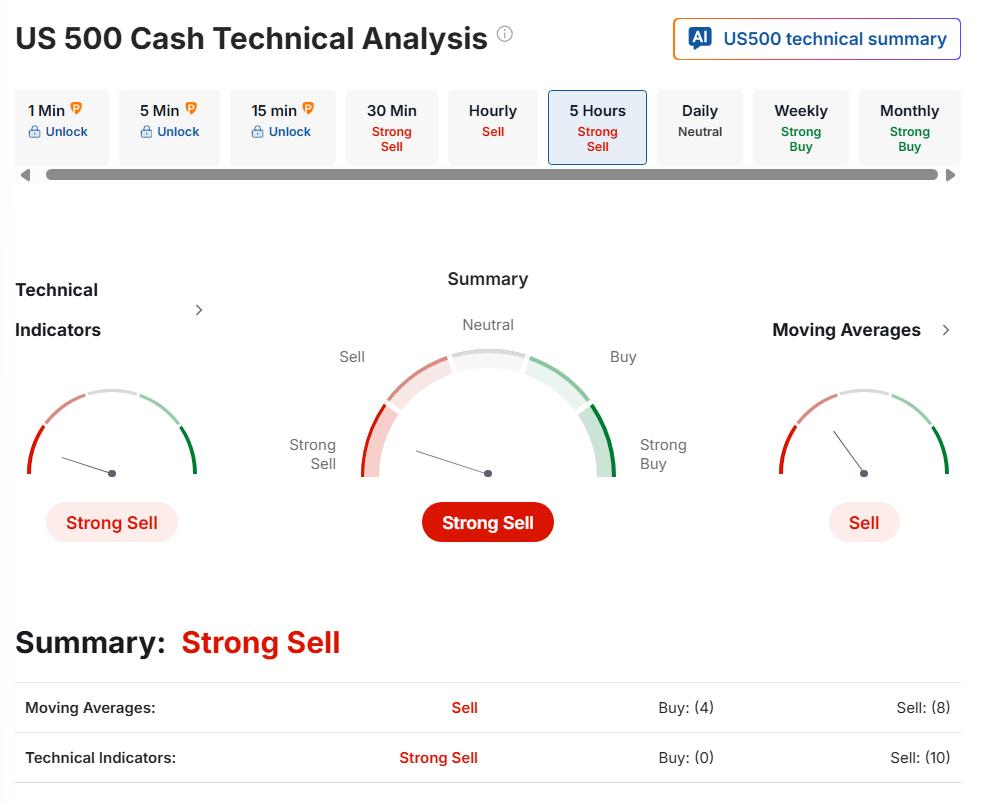

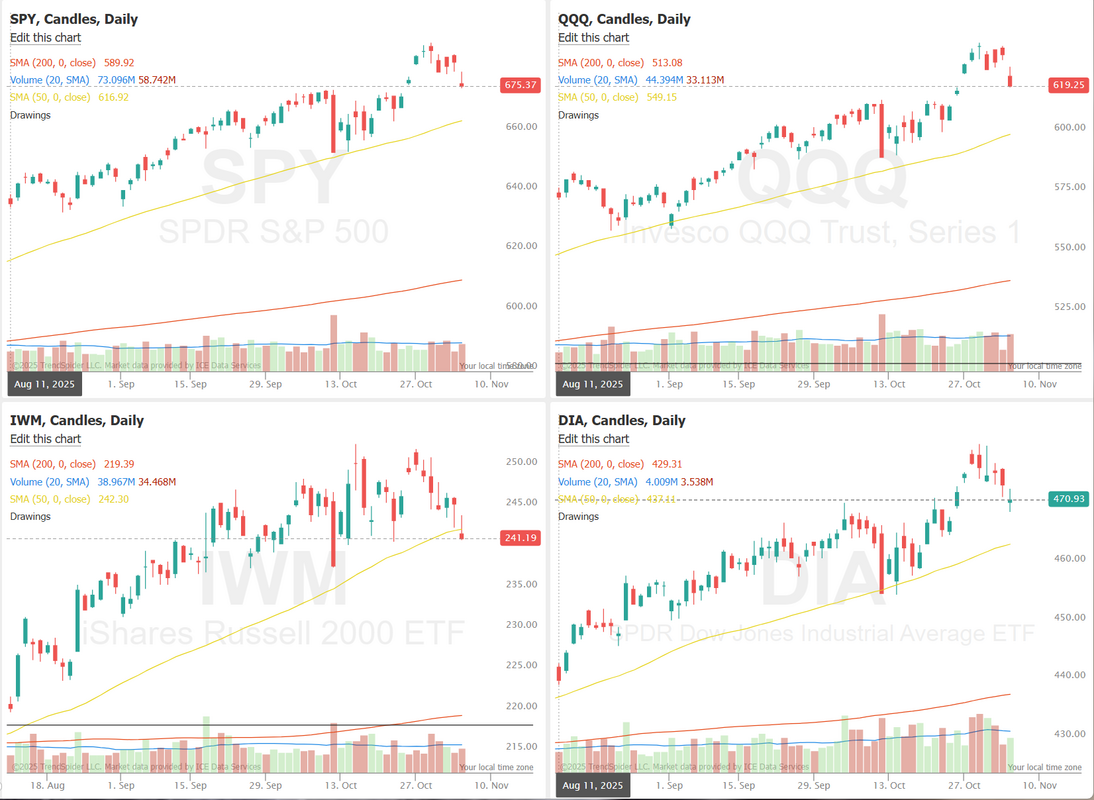

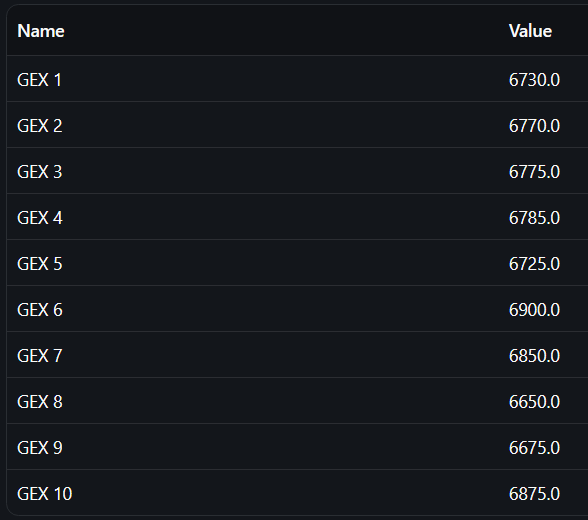

Down market = Up profitsYesterday was everything we (I) ask for as traders. I've talked endlessly about how I love big down days. Let me expand on why I think they are the best trading environment. #1. Movement. As traders we just want movement. Nice clean (not erratic) moves. This is obviously the best situation for our scalping efforts. It also lends itself to the use of debit trades. Those give us a bit better leverage than credit setups. #2. Down trends. Markets usually have bigger moves down than up. It also pumps I.V. into the options premium, making credit trades better risk/reward. In short, downward trending days give us the best chance to use all our tools. Scalping, Debit and credit trades. Here's a look at our day yesterday. Let's take a look at the markets. Sell mode it still engaged this morning although, futures are trying to fight back as I type. Do I see an actual bearish trend? Maybe on the IWM and DIA but SPY and QQQ have really just made a round trip from where they broke out to the upside a couple weeks ago. December Nasdaq 100 E-Mini futures (NQZ25) are trending down -0.57% this morning as investors digested weak earnings from notable tech players such as Advanced Micro Devices and Super Micro Computer, while concerns over lofty tech valuations continued to weigh on sentiment. Advanced Micro Devices (AMD) slid over -4% in pre-market trading after the chipmaker’s Q4 revenue guidance failed to impress investors. Also, Super Micro Computer (SMCI) plunged more than -9% in pre-market trading after the server maker posted weaker-than-expected FQ1 results and gave a disappointing FQ2 adjusted EPS forecast. Investors now await the U.S. ADP employment report and a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s major indexes closed sharply lower. The Magnificent Seven stocks retreated, with Tesla (TSLA) sliding over -5% and Nvidia (NVDA) falling nearly -4%. Also, chip stocks slumped, with Micron Technology (MU) dropping over -7% and Intel (INTC) falling more than -6%. In addition, Palantir Technologies (PLTR) sank over -7% amid valuation concerns, despite the data analytics company reporting upbeat Q3 results and raising its full-year revenue guidance. On the bullish side, Expeditors International of Washington (EXPD) climbed more than +10% and was the top percentage gainer on the S&P 500 after the company posted better-than-expected Q3 results. “This reinforces our thinking that the stock market is ripe for some sort of material pullback over the near-term, no matter where it’s going over the intermediate/longer-term,” said Matt Maley at Miller Tabak. On the trade front, China’s Customs Tariff Commission of the State Council announced on Wednesday that it will extend the suspension of a 24% tariff on some U.S. goods for another year while keeping a 10% duty in place, as part of the trade truce agreed at last month’s Trump-Xi summit. The commission also stated that it would lift tariffs of up to 15% on certain U.S. agricultural products. In addition, China will remove export controls against 15 U.S. entities and extend the suspension of such measures for another year for 16 others. The measures are set to take effect on November 10th. Third-quarter corporate earnings season continues, and investors await new reports from prominent companies today, including McDonald’s (MCD), Applovin (APP), Qualcomm (QCOM), Arm (ARM), Robinhood Markets (HOOD), McKesson (MCK), and DoorDash (DASH). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. The report will provide fresh insights into the health of the labor market. Economists, on average, forecast that the October ADP Nonfarm Employment Change will stand at 32K, compared to the September figure of -32K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the October ISM services index to be 50.7 and the S&P Global services PMI to be 55.2, compared to the previous values of 50.0 and 54.2, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -2.5 million barrels, compared to last week’s value of -6.9 million barrels. Meanwhile, the U.S. government shutdown has entered its 36th day, becoming the longest in history. On Tuesday, the Senate failed for the 14th time to pass a bill that would have reopened the government through November 21st. Still, lawmakers from both parties have hinted at the emerging outlines of a deal to end the shutdown, potentially as soon as this week. The Supreme Court is set to hear arguments later today in the case against President Trump’s use of the International Emergency Economic Powers Act to impose sweeping tariffs. The court will hear arguments from three lawyers, one representing the Trump administration and two representing the small businesses and states contesting the legality of the tariffs. U.S. rate futures have priced in a 69.9% chance of a 25 basis point rate cut and a 30.1% chance of no rate change at the December FOMC meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, down -0.05%. My lean or bias today: Not sure. Futures have been on a wild ride overnight. Absolutely tanking and then fighting back only to slip again and now fighting back...again. Every sell this year has been bought up. Technicals are bearish. Futures are red (although coming back) and yet I have a feeling today will be an up day. Todays training will be on Attribution analysis. This should be another good one. Tune in live at 12:00 noon MT. The SPX option score chart shows a short-term softening in sentiment following the recent push to local highs near 6,900, as the option score dropped sharply from 5 to 1, hinting at a cooling of bullish positioning in the derivatives market. This pullback aligns with the minor retracement seen in spot prices after a strong multi-week rally. The data suggests that option flows have turned more cautious, possibly reflecting traders hedging recent gains or anticipating short-term consolidation. If the option score stabilizes and rebounds, it could indicate renewed demand for upside exposure, but for now, the momentum appears to favor a pause or mild correction as markets digest recent strength. Intraday Gamma Levels 0DTE for SPX on 2025-11-05Spot Price used: Last Intraday Price (not provided explicitly, analysis based on levels) Date: 2025-11-05 Primary LevelsCall Resistance:

Let's take a look at the chart for intraday levels on /ES. 6800 is the first BIG resistance level. It's a big phycological level as well as the 200 period M.A. on the 2hr. chart 6821, 6825, 6839, 6850 (another big level). Support levels start at 6781. Bears need to get below this level to continue any downside bias. 6775, 6765, 6759 are the next levels. I'll see you all in the live trading room shortly. Let's see if the bulls can take hold today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |