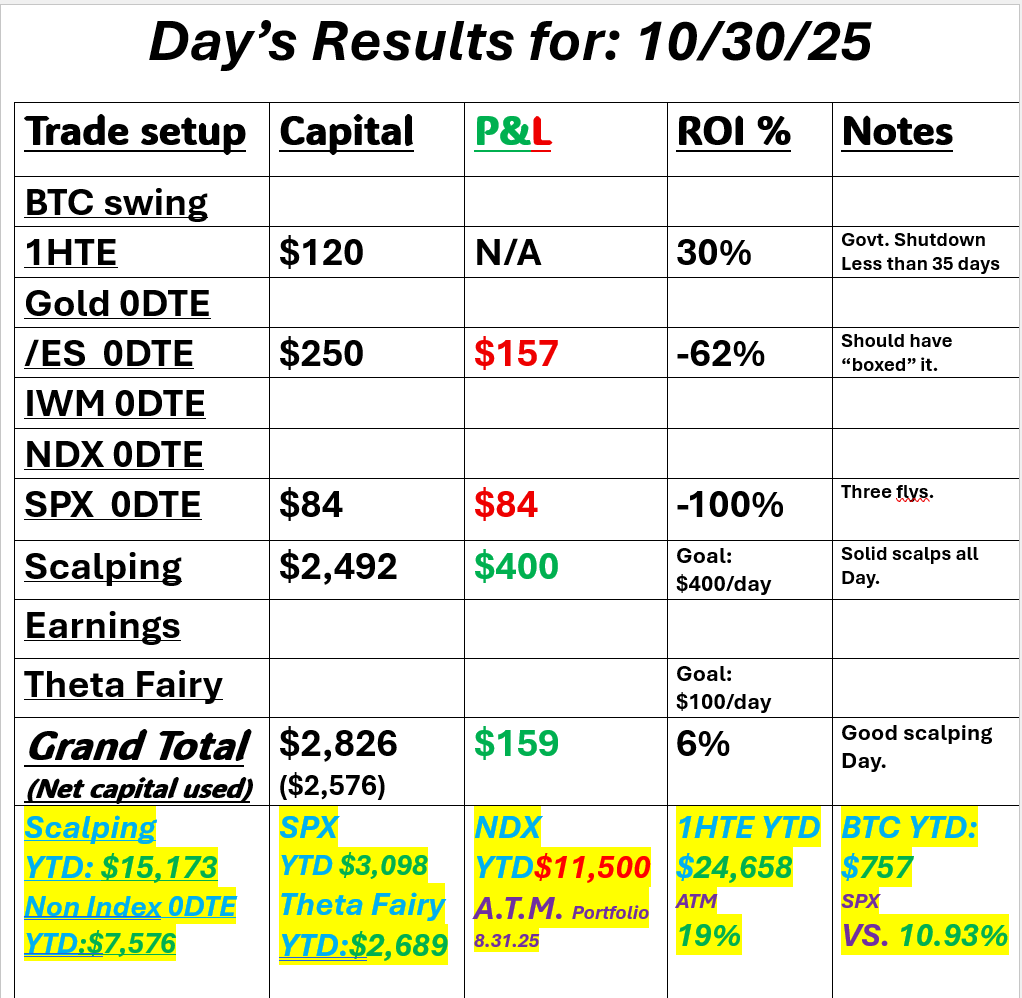

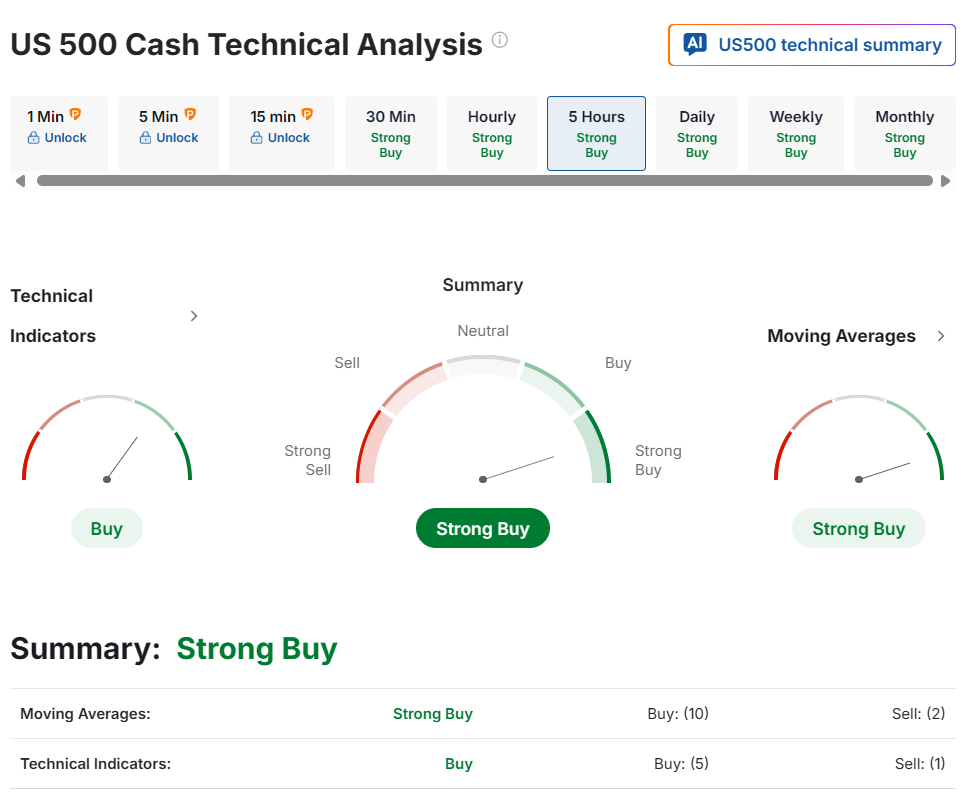

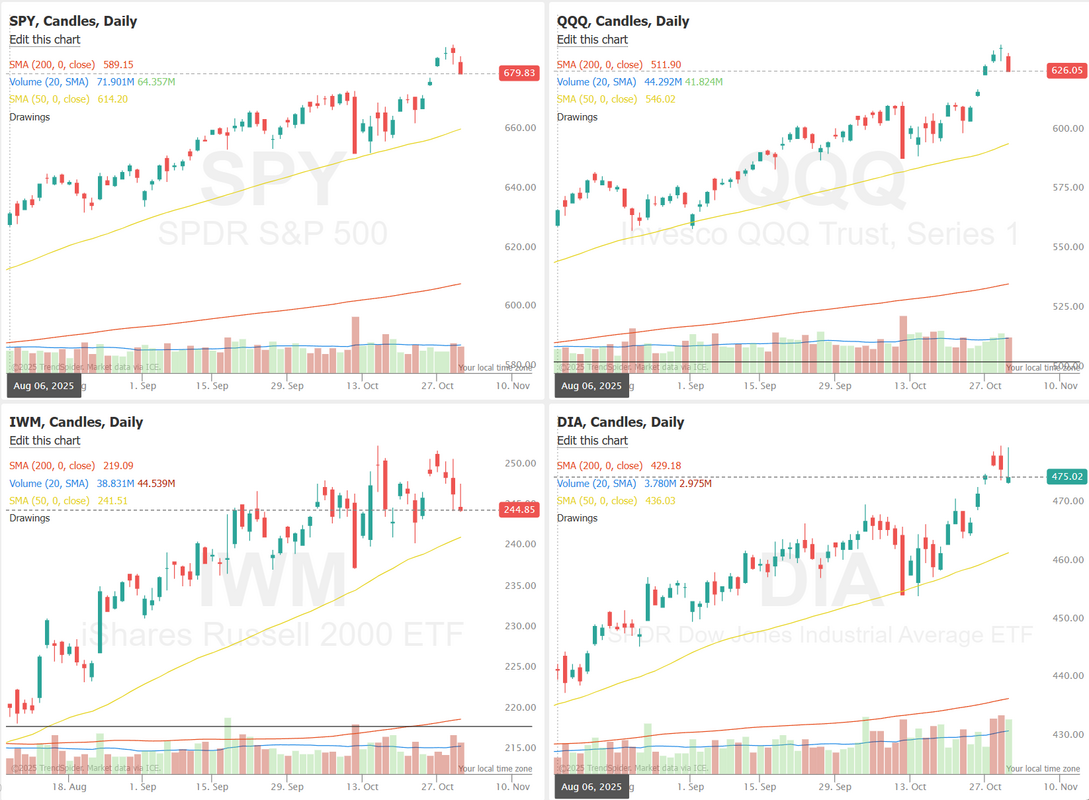

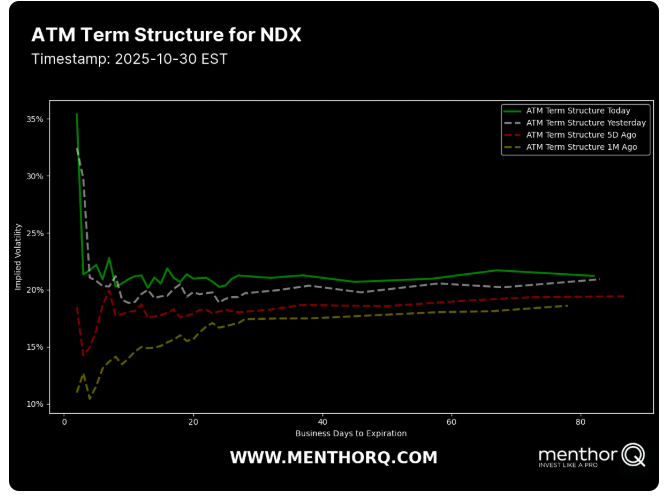

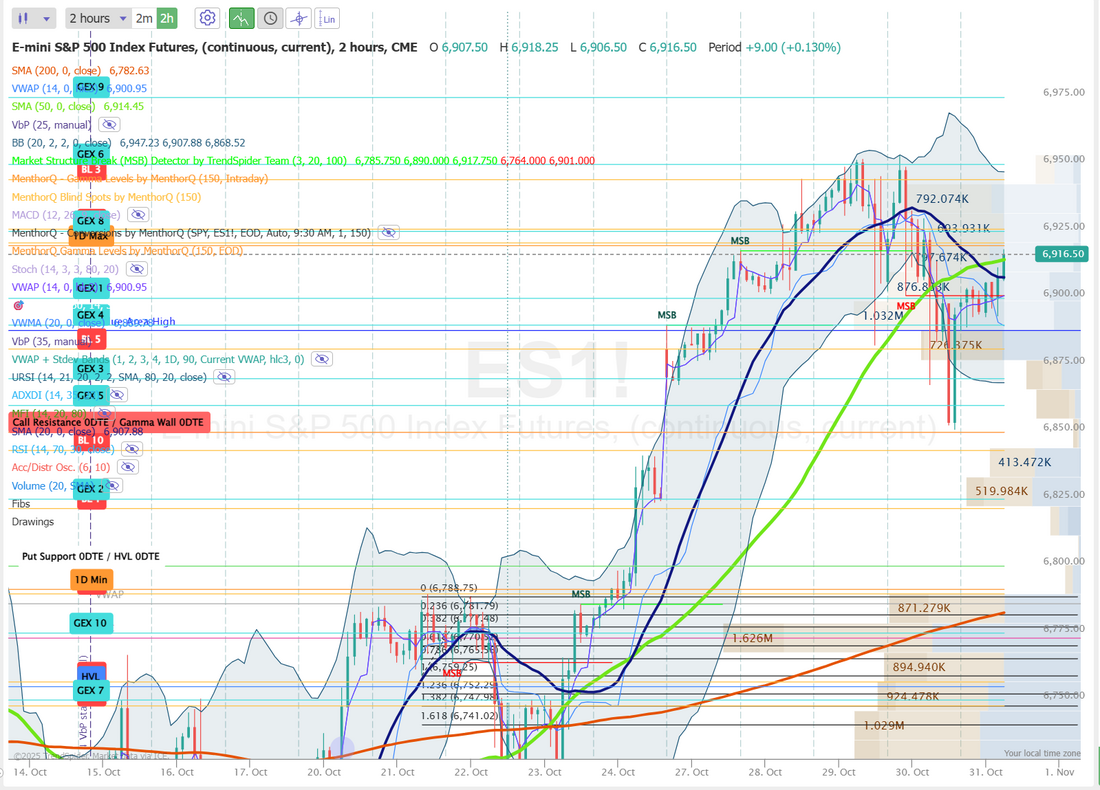

Happy HalloweenMy better half is out of town visiting her family in the pacific northwest for a few days but she'll be celebrating Halloween hard. I think she likes it more than Christmas. The market seems to like it as well. We are getting this morning what I thought we would get yesterday. I thought META, MSFT, GOOG earnings would pop us as well but they didn't pull through. Good trade news combined with solid AAPL/AMZN earnings are doing it today. We continue to see the duality of this market. Any hint of bad news tanks us. It's a tentative bull and yet, every dip gets bought. We had a small profit yesterday but excellent risk/reward. Here's a look at our day: Let's take a look at the market. With the strong futures this morning we are right back to bullish technicals. Just when the roll over looks like it's taking hold, we get another "buy the dip" morning. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +1.15% this morning as strong quarterly results and guidance from Amazon and Apple boosted sentiment. Amazon.com (AMZN) jumped over +12% in pre-market trading after the tech and online retailing giant posted the strongest growth rate in nearly three years in its cloud unit in the third quarter and issued solid Q4 revenue guidance. Also, Apple (AAPL) rose more than +1% in pre-market trading after the iPhone maker reported better-than-expected FQ4 results and provided an upbeat sales forecast for the holiday quarter. In yesterday’s trading session, Wall Street’s major indices ended in the red. Meta Platforms (META) plunged over -11% and was the top percentage loser on the Nasdaq 100 after the maker of Facebook and Instagram reported weaker-than-expected Q3 EPS and raised its full-year total expense forecast. Also, Microsoft (MSFT) fell nearly -3% after the technology behemoth reported FQ1 revenue growth in its Azure cloud-computing unit that failed to meet the highest expectations. In addition, Chipotle Mexican Grill (CMG) tumbled over -18% and was the top percentage loser on the S&P 500 after the burrito chain cut its full-year comparable restaurant sales guidance. On the bullish side, C.H. Robinson Worldwide (CHRW) soared more than +19% and was the top percentage gainer on the S&P 500 after the freight and logistics company posted better-than-expected Q3 adjusted EPS and raised its 2026 operating income guidance. Third-quarter corporate earnings season continues, and investors await reports today from notable companies such as Exxon Mobil (XOM), AbbVie (ABBV), Chevron (CVX), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also hear perspectives from Dallas Fed President Lorie Logan, Atlanta Fed President Raphael Bostic, and Cleveland Fed President Beth Hammack throughout the day. Meanwhile, the U.S. government shutdown has entered its 31st day, with no clear resolution in sight. In light of the government shutdown, the publication of the September core PCE price index, Personal Spending and Personal Income data, as well as the third-quarter Employment Cost Index, originally set for today, will be delayed. Still, the U.S. Chicago PMI will be released today. Economists forecast the October figure at 42.3, compared to the previous value of 40.6. The Congressional Budget Office stated earlier this week that the four-week government shutdown will trim real annualized GDP growth by 1 percentage point this quarter, with the impact intensifying the longer it continues. U.S. rate futures have priced in a 68.8% chance of a 25 basis point rate cut and a 31.2% chance of no rate change at the December FOMC meeting. Notably, a move in December was almost fully priced in before this week’s FOMC meeting. Fed Chair Jerome Powell on Wednesday threw some cold water on market expectations of another rate cut in December when he said, “A further reduction in the policy rate at our December meeting is not a foregone conclusion—far from it. Policy is not on a preset course.” “With uncertainty around Fed policy going forward and the ongoing government shutdown, there is the potential for volatility,” said Chris Fasciano at Commonwealth Financial Network. “But companies across a large swath of the economy continue to report solid earnings. On top of that, we’ve seen good news on trade policy, particularly with China. These should provide decent tailwinds for investors.” In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.111%, up +0.34%. The SPX option score remains elevated near recent highs, signaling that option market sentiment continues to lean constructive even as spot prices show a mild pullback from peak levels. This suggests traders are maintaining bullish or neutral positioning, potentially reflecting confidence in short-term support holding after a strong upward stretch. However, the slight dip in the score toward the end hints at waning momentum and some hedging activity as volatility expectations edge higher. In the near term, monitoring whether the score stabilizes above mid-range levels will be key, sustained strength could reinforce buying conviction, while further erosion may point to a shift toward consolidation or profit-taking behavior. The NDX ATM term structure shows a notable uptick in short-dated implied volatility, with front-end contracts rising sharply compared to both yesterday and last week. This suggests that near-term uncertainty has increased, likely reflecting upcoming catalysts such as earnings or macro data releases. Beyond the short end, the curve flattens around the 20–22% range, implying that longer-dated volatility remains anchored, with traders pricing the current spike as temporary rather than structural. The steep front-end slope signals that options markets are bracing for short-term swings, but the contained back end highlights confidence in medium-term stability if volatility events pass without major disruption. My lean or bias today is bullish. The "buy the dip" effect seems to be back in effect this morning. Let's take a look at the intra-day levels on /ES for our 0DTE setups. I feel like we have some pretty clear levels to work with today. 6919, 6925, 6944, 6950 are resistance with 6907, 6900, 6889, 6880 working as support. Let's see if we can finish off the week strong! See you all shortly in the live trading room. Enjoy the holiday and have a great weekend.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |